Crypto exchange MEXC’s Q1 2025 report on trading fraud reveals a sharp uptick in coordinated fraudulent trading activity. The data shows a 200% quarter-over-quarter increase in detected fraud attempts, with the bulk of activity concentrated in India, Indonesia, and the CIS region. This surge highlights evolving risks in fast-growing markets and underscores the need for enhanced risk management and user education.

According to MEXC’s data, the platform identified 80,057 syndicated fraud attempts in Q1 2025 — doubling the volume from the previous quarter. These cases include coordinated wash trading, market manipulation by syndicates, and automated bot networks engaging in unfair trading behavior. Over 3,000 separate fraud syndicates were uncovered.

Two parallel factors may have contributed to the increase in fraudulent activity: a proactive listing strategy that includes emerging market tokens, as well as low-fee structures that attract both retail and institutional users. However, these features have also made the platform a magnet for bad actors seeking high-liquidity venues with low execution costs.

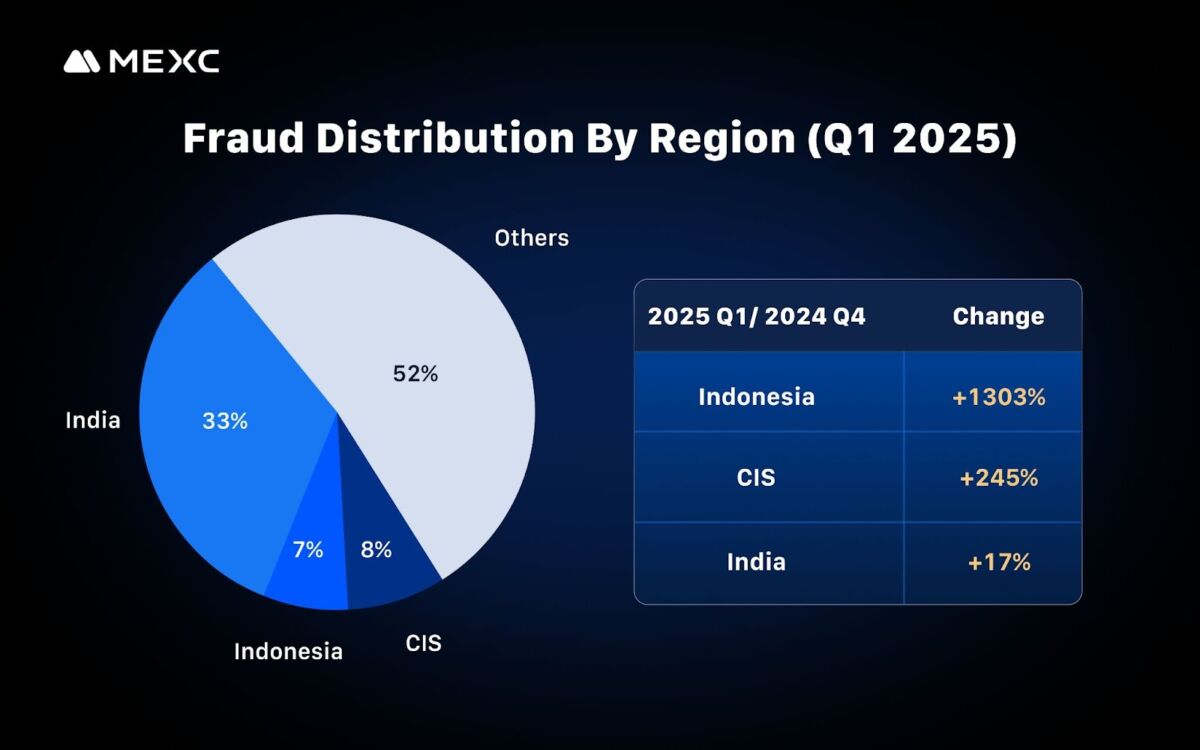

India led the surge in fraud, with nearly 27,000 flagged accounts, followed by Indonesia (5,603) and the CIS region (6,404). In percentage terms, Indonesia saw the most dramatic increase, with a 1,303% rise in suspicious activity versus Q4 2024, while the CIS region saw a 245% rise.

The surge in fraud across these regions reflects a broader structural issue: rapid user growth in these markets has often outpaced financial education and platform literacy. According to a report released by the National Centre for Financial Education in February 2025, only 27% of Indian adults meet basic financial literacy standards — far below the global average of 42%. Among millennials, the gap is more striking: while many express high confidence in their financial knowledge, just 19% demonstrate adequate understanding. This mismatch not only exposes individuals to greater fraud risk, but also undermines sustainable wealth creation and long-term trust in the ecosystem.

Many new users are onboarded via viral campaigns or third-party influencers. Still, not all investment advice circulating online is credible. Malicious actors often masquerade as financial experts or influencers, leaving their followers susceptible to coordinated manipulation efforts disguised as investment strategies. In some cases, entire communities are targeted via Telegram channels and YouTube videos promoting “pump groups” or “secret token launches.” In markets with large retail user bases and relatively low levels of financial literacy, these dynamics make users more vulnerable to syndicate recruitment and easier to manipulate.

In Indonesia and parts of the CIS region, low per-capita income and volatile local currencies have fueled demand for high-risk, high-reward token speculation. Research presented at the International Conference on Information Management and Technology found that most cryptocurrency investors in Indonesia are risk-lovers, primarily driven by profit-seeking motives. This suggests a willingness to engage in high-risk investments with the expectation of substantial returns. This has led to the rise of informal social trading circles. While many of these groups are formed organically, some have been exploited by coordinated actors spreading misleading or manipulative narratives under the guise of financial advice.

In response to these risks, MEXC is applying real-time detection mechanisms, prioritizing surveillance of small-cap assets, and strengthening risk-monitoring tools that flag anomalous behavior. The platform operates a multi-layered risk control framework that combines automated detection, human review, and regional escalation procedures. Accounts exhibiting suspicious activity — including abnormal order patterns — are temporarily reviewed or restricted under global AML guidelines and internal protocols aligned with FATF recommendations. The measure allows protecting the broader user base from illicit behavior that threatens trust and fairness in trading.

“While 2021 was marked by DeFi exploits, 2025 is increasingly characterized by socially engineered market manipulation,” said Tracy Jin, COO of MEXC. “We’ve observed a growing number of so-called ‘educational’ trading groups that appear to be coordinated efforts to mislead users. This trend highlights the importance of user education and proactive protection, especially for younger investors who may be more susceptible to persuasive but harmful narratives.”

To improve transparency and raise awareness about fair trading, MEXC plans to release an updated version of its Risk Control Guidelines, accompanied by user education in affected regions and dedicated appeal procedures. The exchange also plans to launch a series of educational initiatives, including the MEXC Guardian Safe Trading campaign and the MEXC Guardian Fund to offer financial protection for retail users impacted by fraud.

This isn’t the first time MEXC has raised red flags over market abuse. In March, the exchange reported a similar spike in manipulative activity, particularly involving users from the CIS region and Vietnam, further illustrating the cyclical and regional nature of fraud trends in crypto markets.

About MEXC

Founded in 2018, MEXC is committed to being “Your Easiest Way to Crypto.” Serving over 40 million users across 170+ countries, MEXC is known for its broad selection of trending tokens, everyday airdrop opportunities, and low trading fees. Our user-friendly platform is designed to support both new traders and experienced investors, offering secure and efficient access to digital assets. MEXC prioritizes simplicity and innovation, making crypto trading more accessible and rewarding.

For more information, visit: MEXC Website|X|Telegram|How to Sign Up on MEXC

For media inquiries, please contact MEXC PR Manager Lucia Hu: lucia.hu@mexc.com

Join MEXC and Get up to $10,000 Bonus!

Sign Up