MEXC IEO hits a maximum ROI of 6,647% and 94% of new assets remain profitable to date

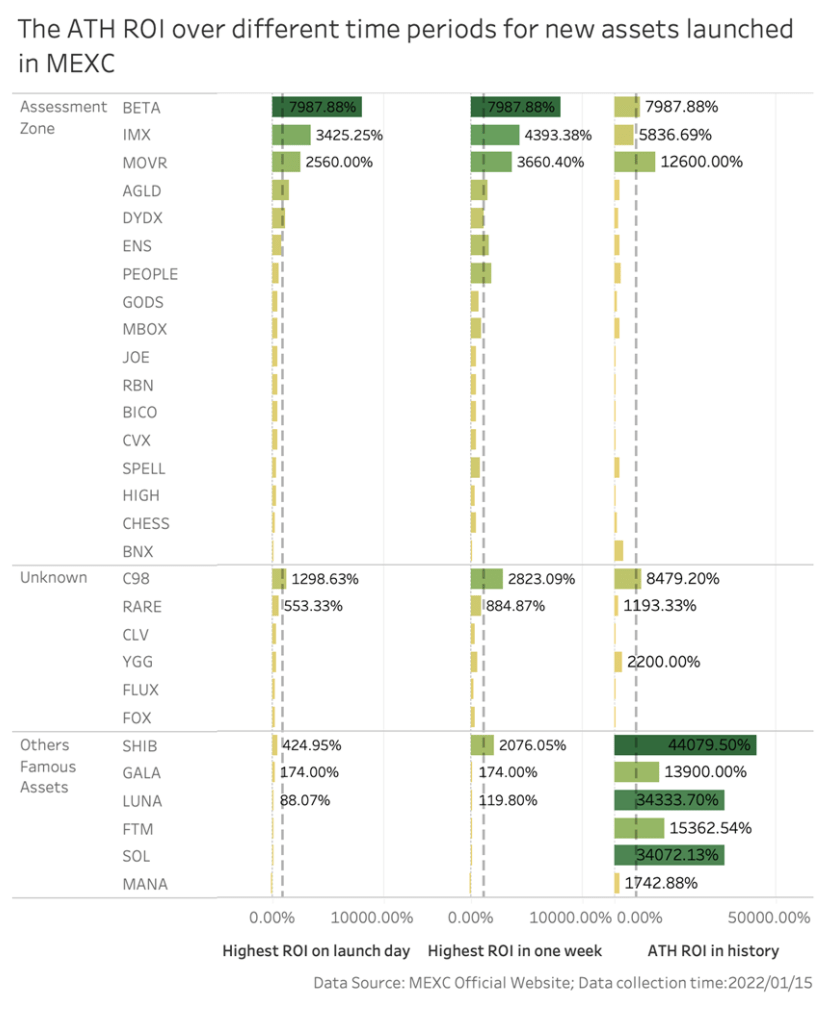

To be more fair, this article will consider 6 more recent popular assets based on the new assets launched by 2 or more exchanges in the second half of 2021. According to statistics, the maximum yield (the increase of the highest price on the day compared with the opening price) of recent 29 high-quality new assets has reached 874.07% on the day of launch. Among them, the assets of MEXC Assessment Zone launched in the second half of 2021 are particularly outstanding. The highest yield of BETA, IMX and MOVR were all exceeded 2,500% on the day of launch. Especially BETA, which has reached 7,987.88%, an increase of nearly 80 times on the launch day. In addition, AGLD, DYDX, ENS, C98, RARE, GODS and MBOX also performed very well on the launch day, with the highest yield exceeding 500%.

In 2019, when the exchange’s IPO was booming, new assets often reached record high prices on the day it launched, then fell all the way down. But this does not often happen among the high-quality assets in the scope of this observation. Instead, over longer time periods, these assets have shown the ability to sustain growth.

During one week observation period, the maximum yield of 29 assets (the increase of the highest price in one week from the opening price) can reach 1,205.97%, which is 38% higher than the maximum yield on the day of the launch. Among them, the highest yield of 18 assets within one week of launch is higher than the highest yield of launch day. SOL, SHIB, PEOPLE, SPELL, C98, ENS and CHESS are all increased by more than 100%. In particular, SOL, which has increased by 781%, is the one with the largest increase within a week among all assets. The remaining 11 assets have higher yields on the day of launch, such as HIGH, BICO, DYDX, AGLD, CLV, etc.

If the observation period ends on January 15, 2022, then this trend of continuous development is more obvious, the maximum yield of 29 assets (the increase of the highest price from the opening price) will further increase to 6852.22%. Compared with the maximum yield within a week and the maximum yield of launch day, it has increased by 468% and 684% respectively. Among them, the historical highest yields of SOL, LUNA, FTM, SHIB, GALA and BNX have increased by more than 2000% compared with the highest yield on the launch day. It is worth noting that the historical highest yields of SHIB, GALA, LUNA, FTM, SOL and MOVR have all exceeded 10,000%, that is, the highest yield have all increased by more than 100 times. Especially the highest yields of SHIB, LUNA and SOL are more than 300 times so far.

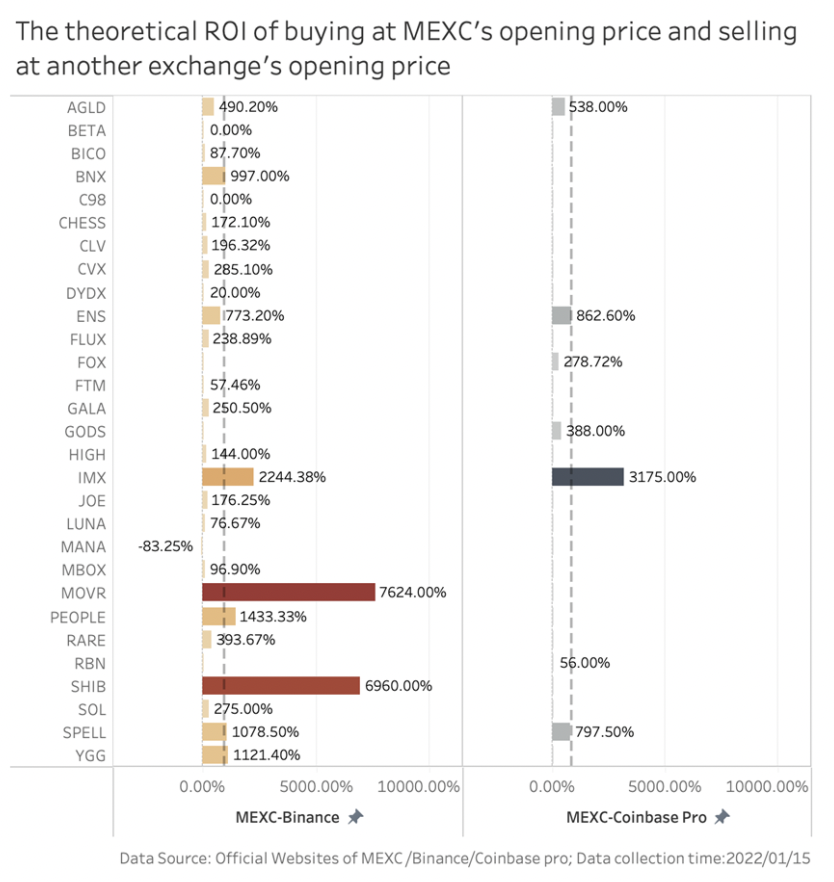

The market awareness and recognition of the asset remains relatively low when IEO. At this time, the opening price on MEXC tends to be lower. Over time, the opening prices on Binance and Coinbase Pro tend to increase as the market awareness and acceptance of the asset develop. As far as the same asset is concerned, MEXC may bring investors a higher maximum yield due to the fast launch date,according to statistics.

Among the 29 high-quality assets, MEXC’s historical maximum yield reached 6852%, while Binance is about 2804%. Coinbase Pro, which has a longer launch interval, is only 270%. For example, the opening price of AGLD in MEXC is about $0.5, and the highest yield is about 1540%;the opening price on Binance is $2.95, the highest yield fell to 84.24%; the opening price on Coinbase Pro is $3.19, the highest yield fell to 63.64%. Other assets met the similar situaiton,the highest returns of the same asset among difference exchanges can reach a gap of several times or even dozens of times.

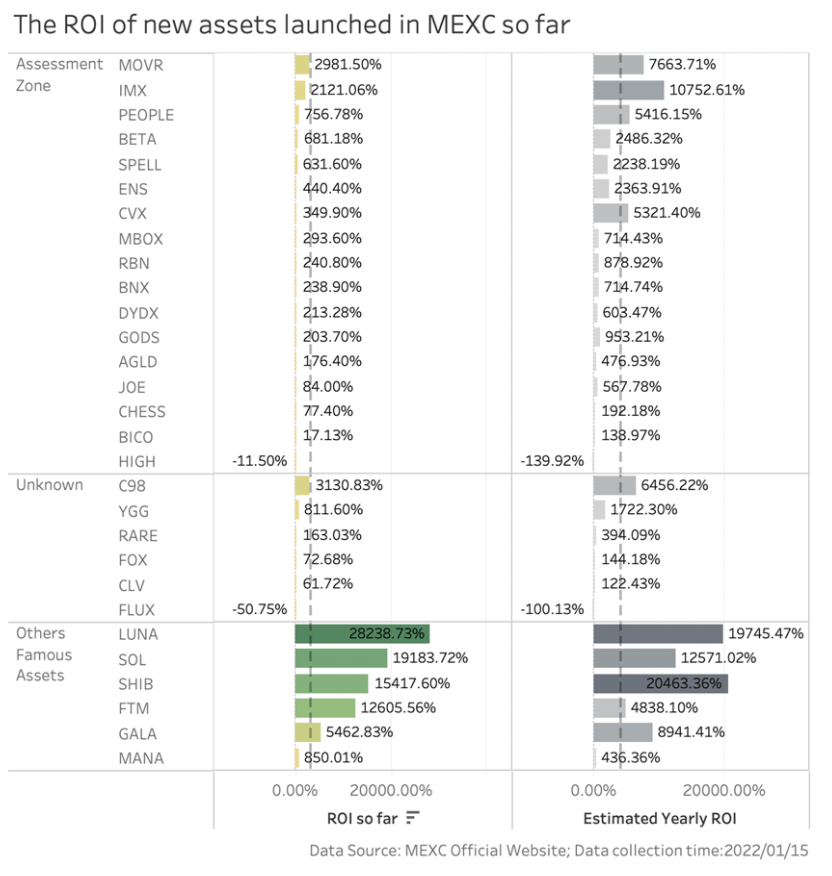

Even considering the overall returns of these high-quality assets, it can be found that there are only a few tokens fell below the initial offering price, the risk of investors participating in IEO has decreased. According to statistics, the overall average yield of 29 assets is about 3291%, so far. Among them, only HIGH and FLUX are currently below the initial offering price, the other 27 assets are all higher than the opening price. Especially , the overall yeild for LUNA, SOL, SHIB, and FTM is above 10,000%.That is, if you buy on MEXC with the opening price, you can get more than 100 times of the income theoretically. Among the high-quality assets newly launched this year, the overall yields of MOVR, IMX, and C98 are all exceeded 2,000%. That is, if you buy on MEXC with the opening price, you can get more than 20 times of the income theoretically. In addition, the overall yields of PEOPLE, BETA, SPELL and YGG are also above 500%.

The highest ROI up to 1,000% with selling while trading opening

The gap in launch time inevitably creates a gap in theoretical maximum return. This provides early investors with the possibility of double profit, thus to get profit through arbitrage among different exchanges. This is also the potential profit that investors can achieve by taking advantage of the listing gap among different exchanges.

The 29 assets within this observation scope are prioritized listing on MEXC. Assuming that investors buy at the opening price when launches on MEXC, then they choose to sell at the opening price on the day Binance lists, the average return for investors will reach at 965.74%. Especially, the yields of MOVR and SHIB are particularly high, reaching 7624% and 6960% respectively. Assuming that investors buy on dips after MEXC listed, then choose to sell at the opening price on the day Coinbase Pro launches, the average yield will drop to 870.83%. Among them, the yield of IMX is higher, which can reach 3,175%. It is worth noting that this larger arbitrage space may come with the cost of a longer listing time gap. For example, MOVR’s listing interval is 73 days, and IMX’s listing interval is 50 days, both are higher than the 40-day average. This actually has higher requirements for investors’ investment strategies, and requires investors to be able to “ambush” early in the assets launched on MEXC.

Another scenario for investors is to buy with the opening price when MEXC launches and then sell at the highest price on the day Binance or Coinbase Pro launches. If investors choose to sell on Binance, the average return can reach at 7392.97%;If investors choose to sell on Coinbase Pro, the average return can reach at 1266.12%. Among them, SHIB, SOL, LUNA, FTM, GALA, C98, BETA, MOVR, IMX and other assets can obtain high returns of 3500%-44000% in this way.

If a more complex trading strategy is adopted, the actual profit brought to investors by listing gap between exchanges may be even higher. For example, investors can choose to buy at the opening price on MEXC and sell at a higher price after listing on Binance and Coinbase Pro; or directly benefit from the good news of listing on different exchanges and wait for a better price in MEXC; or to adopt a combination of the above strategies.

Start your crypto trading journey with MEXC Exchange

Join MEXC and Start Trading Today!