In the fast-paced world of cryptocurrencies, innovations are quickly shifting the traditional boundaries of investment. In this context, exchanges, as the main players in the market, are always striving to enhance the capital efficiency of their users by offering new products. MEXC Exchange The launch of the “Margin Futures Yield” feature on September 30, 2025, is one such innovation that has attracted significant attention. This feature allows futures traders to earn 5% to 15% annual returns (APR) on their collateralized assets (margin).

This new product represents a significant paradigm shift in leveraged trading. In the past, the capital locked as collateral in futures accounts was an inactive asset that only served as a safety net. However, now, MEXC Exchange transforms it into a dynamic income source with this feature. This approach changes the traditional trading model from a purely speculative activity to a strategy with the potential for dual income generation. However, as observed with any major financial innovation, these new opportunities come with a set of challenges and hidden risks. In this article, we will comprehensively analyze this feature, from its advantages and technical details to inherent risks and platform issues, and finally, compare it with similar products in the market, providing practical guidance for users.

1. Fundamental concepts in simple language: from futures to APR

For a complete understanding of the new feature MEXC ExchangeIt is necessary to first familiarize ourselves with the basic concepts of the futures trading world. Futures and margin trading are two powerful tools that traders use to profit from market fluctuations, but due to their complex nature, they come with significant risks.

1.1 What are futures contracts?

Futures trading, or futures contracts, are tools that allow traders to predict and analyze the future price of an asset (such as Bitcoin). Unlike spot trading where ownership of the asset is transferred immediately, in futures, the trader speculates on the price movement without actually owning the underlying asset. This type of trading enables profit from two-sided markets; meaning the trader can profit from both price increases (long position) and price decreases (short position).

The fundamental nature of futures trading is built on prediction and speculation. This nature transforms leverage into a very powerful but equally risky tool. The smallest mistake in price prediction can lead to significant losses due to leverage, and ultimately result in liquidation (loss of the entire margin).

1.2 Margin and Leverage: The Key to Leveraged Trading

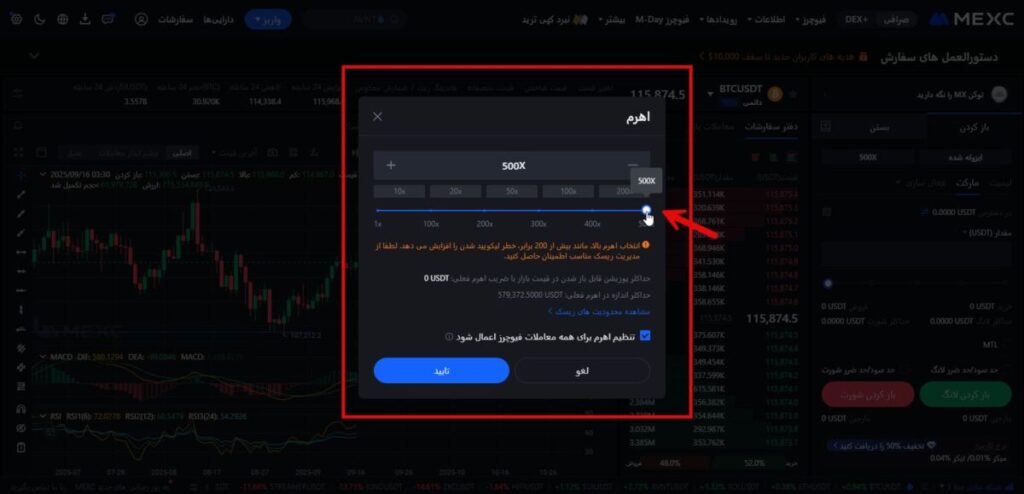

In cryptocurrency trading, margin refers to the collateral or minimum capital that a trader must have in their account to open larger positions relative to their initial capital using leverage. In fact, leverage (Leverage) is the ratio of borrowed funds from the exchange to the initial capital, which gives the trader the ability to buy multiple times their capital. For example, MEXC’s 200x leverage means that with an investment of $1,000, a position worth $200,000 can be opened. For some currency pairs, the option to use leverage up to 500 is equally available on the MEXC exchange.

Margin is not just collateral, but serves as a security buffer for the exchange. The exchange holds this collateral to cover its losses if the price moves against the trade. If the value of the collateral decreases to a certain level due to trading losses (maintenance margin), the exchange issues a “margin call” and asks the trader to deposit more funds to keep the position open. If the trader fails to provide this amount, the exchange automatically closes their position and withdraws their collateral assets to cover the loss, a process known asliquidation‘.

2.APR in the world of cryptocurrencies

APR or (Annual Percentage Rate) is a key metric in the financial and cryptocurrency world that indicates the annual return or cost rate. The important thing about APR is that it is calculated based on “simple interest” and does not take into account the earnings from reinvesting previous profits. In contrast, APY or (Annual Percentage Yield) includes “compound interest” and provides a more accurate picture of capital growth over time.

MEXC’s use of the term APR instead of APY is an important point. This choice makes calculations simpler and clearer for users, as the profit is calculated only based on the principal amount. However, this indicates that the actual final yield may be slightly lower than those exchanges that consider compound interest. This technical nuance highlights the importance of paying attention to details when investing.

3. Why is MEXC’s futures margin yield attractive?

The new capability of MEXC exchange، is not just a regular tool; it directly addresses the basic needs of traders: optimizing capital efficiency in volatile market conditions.

3.1 Revolution in capital efficiency

In the traditional model, the trader’s capital was locked in the futures account and generated no yield. This capital remained waiting for market fluctuations to profit from trading positions. However, with the new capability MEXC Exchange, this idle asset turns into a steady income stream. MEXC exchange intelligently utilizes users’ locked assets to generate profits and returns part of it to the traders.

This MEXC approach is part of a larger trend in the crypto industry. Major exchanges like Binance and Bybit are also offering similar products in partnership with platforms like Ethena that allow users to earn income from their margins. This movement represents a shift in the competition among exchanges from «lower fees» و “higher leverage” towards “higher user capital efficiency” .

3.2 Technical features

The capability of MEXC futures margin yield is based on the “multi-asset margin” system of this exchange, which provides numerous benefits for traders. This system allows users to use various tokens such as Bitcoin (BTC) and Ethereum (ETH) directly as margin. This eliminates the need to convert assets to stablecoins like Tether (USDT) or USDC, thus removing costs and losses from sudden price fluctuations.

In addition, the automated risk management mechanism of this system automatically offsets the profits and losses of various positions, increasing the account’s resistance to market fluctuations and reducing the risk of the entire account being liquidated at once. Additionally, MEXC has implemented a tiered collateral rate system that applies to widely used assets like Bitcoin and Ethereum. This system offers a higher collateral rate for smaller asset volumes, and as the volume increases, the rate gradually decreases to establish a balance between efficiency and risk management.

3.3 Smooth user experience

Simplicity and efficiency are important principles that MEXC has focused on in delivering this product. The system operates automatically and reduces the need for manual margin management. This feature allows users to focus on their trading strategies instead of constantly worrying about margin management.

4. The other side of the coin: hidden and obvious risks

While MEXC’s new capability offers attractive opportunities, traders must be fully aware of the inherent and hidden risks of this tool.

4.1 Inherent risks of futures trading

Leveraged trading is inherently very risky, and the addition of margin yield capability does not eliminate these risks.

Liquidation risk: The primary danger in futures trading is liquidation. In the event of a severe and sudden market move against the position, the trader may lose their entire margin (collateral).

Leverage impact: Leverage not only multiplies the potential profit but also significantly increases the loss. Even a small fluctuation in the market, with high leverage, can lead to the loss of a significant portion of capital.

Call Margin: When the value of collateral decreases to a specified level, the exchange warns the trader to deposit more funds into the account. Ignoring this warning may lead to liquidation.

5. Comparison of Margin Returns on Leading Exchanges

| Futures Leverage | Return Rate | Type of Return | Similar Capability | Exchange |

| Up to 500 times | 5% to 15% | APR | Futures Margin Return | MEXC |

| Up to 125 times | About 8% | APY | Return through USDe | Binance |

| Different | 5% | APY | Return on Cash Balance | Quantfury |

| Up to 10 times (on specific accounts) | Up to 90% of profit | Different Model | Trading with Funded Capital | Kraken |

6. Smart Risk Management: The Key to Successful Leveraged Trading

Entering the world of leveraged trading without a full and responsible understanding of the risks is like playing with fire. For success, the trader must have a comprehensive risk management strategy.

6.1 Risk Management Guide for Futures Margin Returns

| Type of Risk | Proposed Solutions |

| Liquidation Risk | Using low and reasonable leverage, especially for novice traders, and setting a stop-loss limit to automatically close positions if losses exceed the allowable limit. |

| Margin Call Risk | Always maintaining enough capital as a safe margin in the futures account and transferring profits to the spot wallet. |

| Market Volatility Risk | Continuous education, technical and fundamental analysis, and emotion control (fear and greed). |

6.2 Key Recommendations

Risk management in futures trading is an essential necessity for preserving capital. One of the most important risk management tools is determining stop-loss and take-profit levels, which automatically closes the trade at a predetermined level and prevents further losses. In addition, the logical and cautious use of leverage, especially for novice traders, is of high importance.

Ultimately, success in these markets heavily relies on continuous education and analysis. Traders should always seek a deeper understanding of the market and avoid emotional decision-making based on their greed or fear.

Final conclusion: Is this feature suitable for you?

The ‘Futures Margin Return’ feature is an attractive and smart innovation that significantly increases capital efficiency and can help traders generate income from their assets in various market conditions. This feature represents a shift in exchanges towards providing tools to enhance the capital efficiency of users.

However, this opportunity comes with significant risks that, if ignored, can lead to heavy financial losses. These risks include the inherent dangers of leveraged trading such as liquidation and margin calls. Therefore, this powerful tool is considered an exceptional opportunity for traders who possess adequate knowledge, precise strategies, and a thorough understanding of the risks. For beginners, entering this field without training and risk management can be very dangerous. The final recommendation is to thoroughly research before using this feature and to enter with capital that you can afford to lose.

Disclaimer: The information provided in this article is not considered investment advice and should not be regarded as a basis for financial decision-making. Investing in cryptocurrencies comes with high market risk. Please trade with caution. MEXC exchange does not assume any responsibility for potential losses.

Join MEXC and Get up to $10,000 Bonus!

Sign Up