Summary

In Q3 2025, the global crypto market demonstrated steady recovery amid volatility. According to CoinGecko, total market capitalization rose by 16.4%, reaching $4 trillion, while average daily trading volume rebounded to $155 billion, up 43.8% quarter over quarter. AI, RWA, and on-chain derivatives emerged as leading sectors. Institutional inflows and regulatory progress continued to strengthen market structure, signaling a more mature and sustainable ecosystem. Meanwhile, MEXC achieved remarkable performance across new listings, trading activity, and ecosystem expansion, further solidifying its position as a key driver of industry growth.

New Listings

In Q3, MEXC listed a total of 680 new tokens, representing a 17% quarter-over-quarter growth. Compared to Q2, MEXC’s new token trading participants increased by 16% quarter-over-quarter, while trading volume surged dramatically by 97%. These impressive figures fully demonstrate MEXC’s robust performance across key metrics in Q3, highlighting the platform’s leading advantages in user engagement and market activity.

Spot Market Recap: 2,933% Average Gains Amid Narrative Rotation

In Q3, the spot market demonstrated strong performance, with the top 10 highest-volume new tokens recording an average peak gain of 2,933%—a 158% quarter-over-quarter increase.

During the quarter, leading narratives rotated across Memes, AI+Web3, Perpetual DEXs, and stablecoins. The Perpetual DEX sector was led by $ASTER’s 712% gain, underscoring sustained interest in DeFi derivatives. In the AI infrastructure category, $C achieved a 2,100% gain and $AIA a 532% gain, yielding a sector average exceeding 1,300%. Among the top 10 highest-trading-volume new spot tokens, the standout individual performer was $STBL, a stablecoin protocol with a 12,125% return. MEXC’s rapid listings and zero-fee support enabled users to easily capture high-frequency trading opportunities.

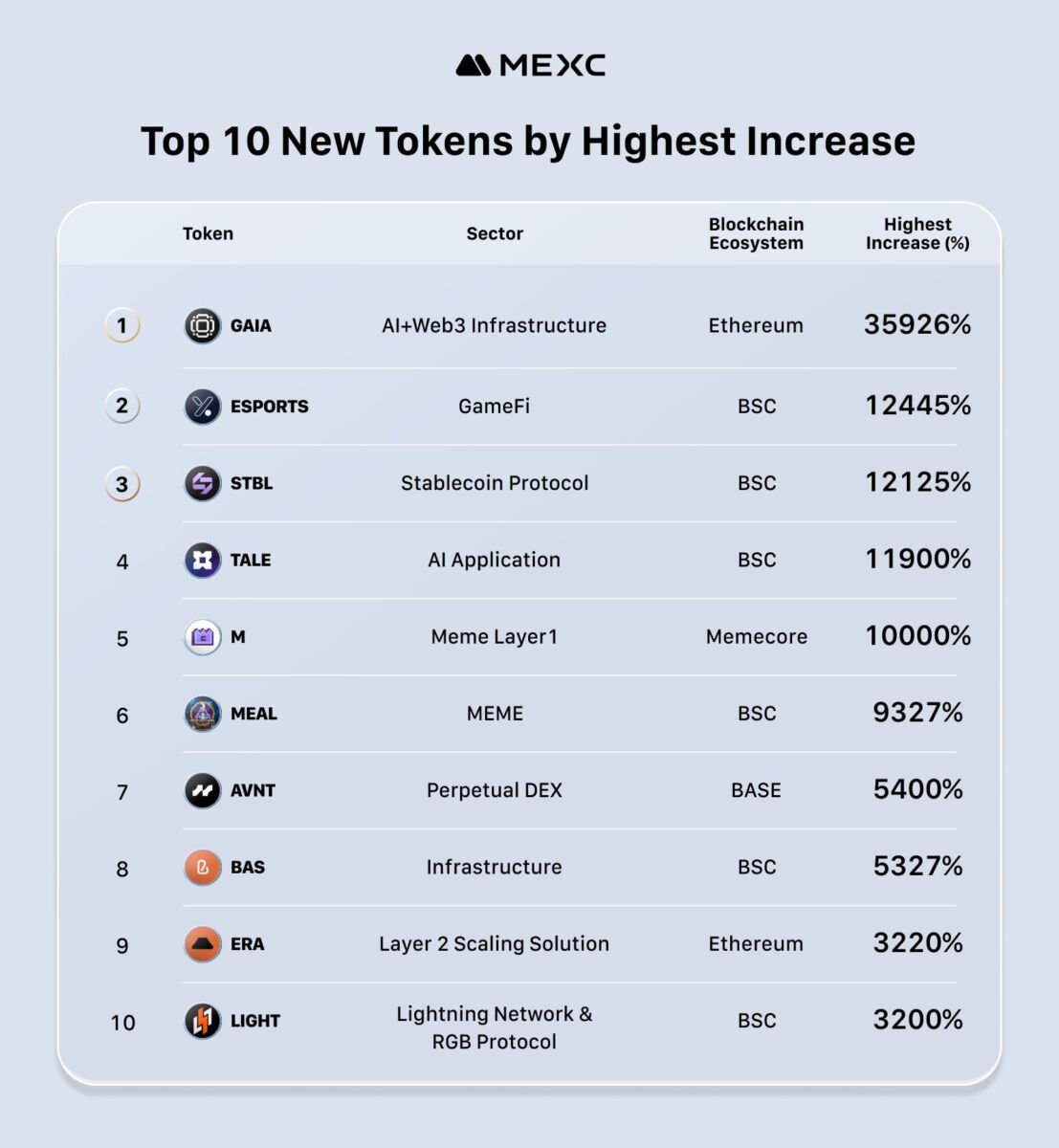

Top Gainers: 10,887% Q3 Surge Led by BSC Dominance

In Q3, the top 10 tokens by highest gain recorded an average peak increase of 10,887%—a 195% quarter-over-quarter rise from Q2—fully demonstrating MEXC’s precise ability to capture high-potential tokens. The BSC ecosystem emerged as the clear winner, accounting for 60% (6 tokens) and excelling across multiple sectors including stablecoin, AI, DeFi, GameFi, and meme: $STBL (12,125%), $TALE (11,900%), $BAS (5,327%), $LIGHT (3,200%), $ESPORTS (12,445%), and $MEAL (9,327%), with an average gain of 9,054%. The ETH ecosystem held 20% (2 tokens), focusing on advanced infrastructure narratives, exemplified by $GAIA (35,926%) and $ERA (3,220%), which highlight the mainnet’s capacity to support high-quality technical frameworks. The Base ecosystem contributed through a single token, $AVNT (5,400%), representing 10% and underscoring the emerging vitality of L2 Perp DEXs.

Ecosystem Development

Backing Ethena’s Stablecoin Infrastructure

MEXC Ventures made a second strategic investment of $30 million in ENA, Ethena’s governance token. This brings MEXC’s total commitment to the Ethena ecosystem to $66 million, underscoring the exchange’s strategic focus on building foundational liquidity layers and advancing a more decentralized economy.

Ethena’s synthetic dollar is purpose-built for DeFi, offering an alternative to traditional stablecoin issuers while creating a comprehensive ecosystem for decentralized finance. To accelerate adoption, MEXC introduced zero-fee USDe trading pairs and launched high-yield staking programs with $1M in rewards, making the token accessible to both retail and institutional users. This investment underscores our commitment to infrastructure projects that bridge DeFi innovation with mainstream utility, positioning stablecoins as critical infrastructure for the industry’s next growth cycle.

MEXC CSR Program

- A total of 8 CSR events were held across Vietnam, UAE, Nigeria, the Philippines, India, and Australia. Event highlights, including photos, videos, and PR coverage from offline activities, were shared through MEXC official channels and partnered media outlets.

- Most activities focused on Education and Empowerment, with a total participation of over 1,600 people.

- 725 participants joined the MEXC Foundation: Blockchain Certificate Quiz, among which 334 successfully passed and received an official digital certificate issued by the MEXC Foundation.

In Q3, the MEXC Foundation hosted 8 CSR events across Vietnam, the UAE, Nigeria, the Philippines, India, and Australia, focusing on education and empowerment. These offline activities engaged over 1,600 participants through interactions, sessions, and workshops, with highlights—photos, videos, and PR coverage—shared via MEXC’s official channels and partner media to boost global interest in blockchain and sustainability.

Notably, the Blockchain Certificate Quiz attracted 725 participants, with 334 earning official digital certificates. This initiative sharpened skills and reinforced MEXC’s role in blockchain education, enabling more people to join the blockchain ecosystem.

Strategic Partnership Development (Story & Solana)

MEXC’s partnership with Story Network (IP) featured a $1M prize pool campaign that attracted over 220,000 participants and generated 1.59B USDT in combined trading volume, comprising 490M USDT in spot and 1.1B USDT in futures. Key incentives including zero-fee trading on IP pairs, high-yield staking options, and structured trading tasks drove strong market response across both spot and futures markets.

In Q3, amid surging demand for RWA and a growing number of institutions filing applications for a spot SOL ETF, these supportive developments fueled both demand and price growth for SOL. To further support the growth of the Solana ecosystem, MEXC launched the Solana Eco Month campaign with a $1M prize pool. The campaign attracted over 128,000 participants worldwide and generated over $400M in combined trading volume, reflecting strong user interest in the Solana ecosystem and continued trust in the MEXC platform.

Product & Innovation

In Q3, MEXC demonstrated exceptional product innovation across multiple dimensions, reflecting MEXC’s strategic focus on democratizing financial access, optimizing capital efficiency, and creating sustainable value for users through simplified yet sophisticated trading solutions.

Airdrop+ Campaigns

Both the number of Airdrop+ activities and total prize pools saw substantial growth. A total of 272 Airdrop+ campaigns were launched, representing a 86% quarter-over-quarter increase. The total prize pool exceeded 16.6M USDT, up 50% QoQ. New users received approximately 60 USDT per person in rewards.

By significantly increasing the number of events and reward volumes, Airdrop+ has established a regular reward mechanism that enables users to earn substantial returns through simple participation.

Launchpad

MEXC Launchpad hosted 11 events with over 127K participants, raising 31.3M USD. New users achieved returns up to 1093%, showcasing strong platform momentum.

MEXC pursued a premium listing strategy, combining trending tokens with blue-chip discount campaigns—offering ETH (90% off), PUMP (40% off), and WLFI (60% off) to new users.

Key highlights: • PUMP: Sold out in minutes with 10,075 participants; new users gained up to 183.3%, averaging 70% across all users • WLFI: Delivered 220% returns within one hour of launch • ETH: New users achieved up to 1,093% returns at 90% discount; existing users earned 21%

This low-risk participation model successfully meets demand for affordable blue-chip access while driving strong market engagement.

MEXC AI

MEXC launched three major AI trading tools, providing users with intelligent trading assistance to help overcome market pain points. Among them, AI Select List intelligently recommends high-potential tokens, making it easy for users to solve token selection challenges; AI News Radar captures real-time social media trends, whale on-chain activities, and other key signals to prevent users from missing sudden market shifts; MEXC-AI is a conversational AI bot that offers macro analysis and micro action recommendations, such as interpreting token price fluctuations and providing strategy suggestions. Over the past month, MEXC AI recorded an average of 44,400 daily active users, serving a total of 758,272 users and delivering 2,248,385 responses — a strong testament to its growing engagement and service efficiency.

Stock Futures

MEXC’s innovative Stock Futures have achieved remarkable success, with 24-hour trading volume peaking at 81.4M USDT. As of September 30th, MEXC offers 21 US stocks with up to 5x leverage, powered by advanced technology delivering near-zero slippage and millisecond execution. On launch day, major pairs like TSLA and NVDA showed exceptional liquidity, with 0.1% depth exceeding 300,000 USDT.

The platform significantly simplifies user experience—traders can use their MEXC account and USDT to access US stocks without complex verification. MEXC synchronizes with US market hours and implements smart risk controls during off-hours, restricting order placement while allowing cancellations and margin adjustments. These innovations make US stock investment more accessible and secure, seamlessly bridging traditional and crypto finance.

Multi-Asset Margin

MEXC’s Multi-Asset Shared Margin Pool allows users to combine 14 supported tokens (including BTC, ETH, SOL, DOGE, USDT) into unified collateral for contract trading.

Key benefits include: • Enhanced Capital Efficiency: Use crypto directly as margin without conversion, eliminating fees and maximizing asset utilization • Superior Risk Hedging: Automatic cross-position P&L offsetting reduces isolated liquidation risks • Seamless Operations: Automated margin management eliminates manual intervention and improves market responsiveness

The tiered collateral rate structure (100% for stablecoins, 97.5%–85% for BTC/ETH based on position size) optimizes capital flexibility while maintaining risk control.

Security & Infrastructure

In Q3, MEXC continued to strengthen its security and infrastructure by advancing AML efforts, maintaining robust asset reserves, enhancing futures protection, and intensifying anti-fraud and asset recovery initiatives.

Enhanced AML & Korea Event

MEXC was highlighted at the 3rd International Counter-Fraud Conference (ICFC 2025) in Seoul for its active role in global financial crime prevention. As the first crypto exchange to establish international standards in this area, MEXC demonstrated its commitment to regulatory cooperation through its partnership with compliance firm Transight. The exchange has supported cross-border investigations by providing law enforcement with transaction data, identity verification, and on-chain tracking. This collaboration strengthens global AML efforts and aligns MEXC with South Korea’s evolving compliance requirements.

Strong Reserve Strengthening

MEXC’s latest Proof of Reserves data confirms that all major assets are fully backed with reserve ratios well above 100%. As of August 31, 2025, BTC reserve ratio stands at 129.85%, ETH at 104.05%, USDT at 113.23%, and USDC at 105.74%. This transparency highlights MEXC’s strong capability to safeguard customer assets while maintaining liquidity buffers that exceed industry standards.

Futures Insurance Fund Excellence

In July, MEXC’s futures insurance fund reached a record high of $559M USDT. This significant fund strengthens protection for futures traders against market volatility and negative equity, enhancing MEXC’s ability to ensure fair settlement and minimize auto-deleveraging during extreme market conditions.

Anti-Fraud Intelligence

During July–August, MEXC’s advanced security protocols helped intercept 48 fraud cases, freezing approximately $4.97M USDT of illicit funds. The risk control team also restricted over 17,000 collusive accounts and more than 2,000 bot-trading accounts, demonstrating MEXC’s firm commitment to maintaining market integrity and protecting users.

Illicit Asset Intervention

MEXC collaborates closely with law enforcement agencies to ensure asset security and regulatory compliance. Between July and August, the platform handled 593 assistance requests and processed 121 official freeze requests backed by law enforcement documentation. Additionally, the customer support team manually recovered over $900,000 USDT of user assets mistakenly sent to wrong addresses.

Industry Insights

In Q3, MEXC published its Q1-Q2 2025 User Survey, mapping shifting patterns in global crypto adoption. The report revealed that the use of crypto as an inflation hedge surged from 29% in Q1 to 46% in Q2, led by East Asia, Southeast Asia, and the Middle East. Regional differences stood out clearly: Latin America showed strong community-led growth, with memecoin ownership rising to 34% and 63% of new users citing passive income as their primary motivation. In South Asia, spot trading reached 52%, with 53% of users driven by financial independence.

Portfolio trends show that public chain tokens remain the backbone of user holdings, with 65%+ ownership globally. Meanwhile, high-net-worth wallets ($20k+) in East Asia declined from 39% to 33%, while mid-tier holdings expanded — indicating broader and more evenly distributed participation.

These findings highlight that crypto adoption is advancing at varied speeds across regions, shaped by different economic and cultural contexts. In response, MEXC is committed to developing localized strategies that build user trust and strengthen the global crypto ecosystem.

Community & Events

Token2049 Singapore

In Q3, MEXC reinforced its ecosystem vision with a $30M additional investment in Ethena, bringing its total commitment to $66M, while making a bold impression at TOKEN2049 Singapore. Chief Strategy Officer Cecilia Hsueh highlighted how MEXC is evolving from a trading venue into an integrated crypto ecosystem, providing capital, liquidity, and user access to high-potential projects like Ethena. As a Platinum Sponsor, MEXC showcased innovative experiences including TOKEN2049’s first-ever indoor zipline and a 0% fee tunnel, reflecting its mission to enhance accessibility, security, and seamless trading for users globally.

GM Vietnam 2025

MEXC joined GM Vietnam 2025 as a Diamond Sponsor, underscoring its commitment to Southeast Asia’s growing Web3 ecosystem. As a leading global crypto exchange with over 40 million users, MEXC continues to drive innovation through its Launchpad and Kickstarter platforms, Layer 2 integrations, and robust security measures like the $100M Guardian Fund. The sponsorship reflects MEXC’s dual focus on global leadership and local engagement, providing users and emerging projects with liquidity, exposure, and trusted infrastructure while strengthening its role as a key partner for the next generation of Web3 builders in Vietnam and beyond.

Blockchain Rio

Blockchain Rio is the largest blockchain innovation hub in Latin America and drew 10,000+ attendees, with MEXC serving as a Titanium Sponsor. Through a dedicated booth and side events including a yacht gathering with over 70 KOLs, MEXC enhanced its brand presence and community interaction. MEXC Latam representatives also joined panel discussions on the role of exchanges in the region’s digital finance ecosystem and the future of digital asset infrastructure.

Join MEXC and Get up to $10,000 Bonus!

Sign Up