In this blog interview, you’ll find insights about the RDNT project.

Q1: Please share with us about RDNT. What project is this? Can you introduce its team and the financial background?

Capital in DeFi is extremely fragmented across chains, evidenced by the dozens of different money markets, all with their own liquidity.

Radiant aims to be the first omnichain money market where users can deposit any major asset on any major chain and borrow various supported assets across multiple chains.

Radiant’s cross-chain interoperability functions atop Layer Zero, with v1 leveraging Stargate’s stable router interface. For example, lenders may reclaim their collateral and can direct which chain to withdraw funds from and what percentage they’d like sent to each chain.

Radiant V2 will include revolutionary changes to core protocol mechanics, emissions, utility, and deeper cross-chain functionality.

Users of Radiant Protocol can lock Radiant LP (Liquidity Provider) tokens to receive a share of borrower loan repayments. Locking RDNT liquidity also activates the ability to receive $RDNT emissions from borrowing and lending within the money market. In addition, locked Radiant LP’s hold governance power via the Radiant DAO and have the ability to create proposals and vote on the future direction of the protocol.

Radiant Capital has a team of 14, formerly from Morgan Stanley, Apple, and Google. We have been in DeFi since the early days of summer 2020, and many of us have been in crypto since 2015. A few team members are:

Isaac Prada- Chief Communications Officer & Project Management

- Isaac Prada serves the DAO as Radiant’s Chief Communications Officer & Project Management.

- Isaac is a former formula one (F1) engineer with over ten years of management consulting experience. After winning a global engineering competition, he found his passion in innovation strategy and finance control to ensure the execution of great tech ideas in real life. He has worked on €25 million R&D projects at Airbus and obtained €7 million in funding for a cutting-edge indoor skydiving project at his tech startup. Isaac holds a Ph.D. in Electrical Engineer Cum Laude and has been a public speaker for fifteen years.

Hung Vu- Radiant DAO Administrator

- Top 10 High-tech Leaders (Washington Post & Techway Magazine) and First Vietnamese American Naval Aviator (87)

- DAO Administrator for DeFi’s 1st omnichain money market (6m old with 300m market size)

Q2: Why did RDNT choose to be deployed on the Arbitrum chain?

Given the current state of alt L1s, Radiant launched v1 on what we believe to be the most secure and decentralized blockchain – Arbitrum.

Arbitrum’s transaction fee mitigation, combined with Ethereum’s security and institutional adoption, enables our team to build an ecosystem that provides our users with competitive interest-bearing opportunities while maintaining a high degree of safety.

Radiant V2 will begin with the expansion to the BNB Chain, and the DAO will continue deploying to additional EVM chains in the near future to unite the billions of fragmented liquidity.

Q3: What are the highlights of RDNT?

Answer:

Revenue Share / “Real Yield” Model:

- DeFi 1.0 tokens like $AAVE and $COMP do not accrue any of the economic activity that occurs on their platforms. The token holders are not rewarded with any of the protocol fees generated.

- Radiant Protocol token holders are rewarded with “Real Yield”, in that they receive 60% of borrowing interest that occurs on the platform. This means that in exchange for staking RDNT or RDNT LP tokens, they will receive rewards in the form of BTC, ETH, BNB, and stablecoins such as BUSD, USDC, and USDT.

- The APR paid in “blue chip assets” has averaged 60-100% APR over the last 6 months for locking RDNT.

- Since its launch in July, only deployed on Arbitrum, the protocol has generated and paid out $5.2M in protocol fees.

Dynamic Liquidity / Dynamic Emissions

- One of the issues with “DeFi 1.0” tokens and “Liquidity Mining” is that the emissions always exceed the revenue of the protocol. The other issue is that emissions are given to anyone who uses the protocol instead of users that provide value back to the protocol.

- In Radiant v2, we are introducing the concept of “Dynamic Liquidity”, which means that only users who provide liquidity in the form of LP staking will receive RDNT emissions. While any user can take advantage of the omnichain functionality of Radiant (e.g., lend on BNB Chain, Borrow on Mainnet), only users who provide value will receive the emissions. This is to prevent “vampire farming,” where users suck the protocol dry and move to the next thing

More on the functionality for our major new product release, Radiant v2, which is coming in 10 days (2/20/23), can be found at the following links:

https://medium.com/@RadiantCapital/cryptos-most-profitable-protocol-a-new-era-for-defi-b374ca82a741

https://medium.com/@RadiantCapital/defis-most-profitable-protocol-part-two-7ab13b11c2c2

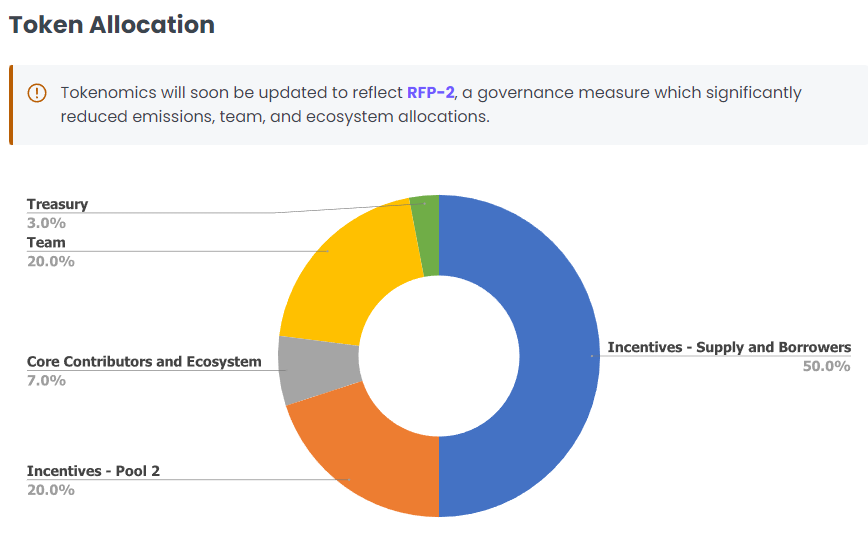

Q4: What is the tokenomics of RDNT?

Answer:

Note:

—Radiant DAO governance RFP-2 was ratified to reduce emissions by 50% globally and redirected to the Radiant DAO reserve. As of February 11, the reserve holds 96M locked tokens (25% of total supply) for lending/borrowing emissions on future chain expansions.

—Radiant V2 will reallocate Pool 2 emissions to suppliers & borrowers. Upon V2 launch, 70% of emissions are allocated towards lending/borrowing, increasing the runway to a minimum of 5 years.

Q6: Could you introduce Dynamic Liquidity provisioning and what can it bring to investors?

Answer:

Dynamic Liquidity / Dynamic Emissions

- One of the issues with “DeFi 1.0” tokens and “Liquidity Mining” is that the emissions always exceed the revenue of the protocol. The other issue is that emissions are given to anyone who uses the protocol instead of users that provide value back to the protocol.

- In Radiant v2, we are introducing the concept of “Dynamic Liquidity”, which means that only users who provide liquidity in the form of LP staking will receive RDNT emissions. While any user can take advantage of the omnichain functionality of Radiant (e.g., lend on BNB Chain, Borrow on Mainnet), only users who provide value will receive the emissions. This is to prevent “vampire farming,” where users suck the protocol dry and move to the next thing

More on the functionality for our major new product release, Radiant v2, which is coming in 10 days (2/20/23), can be found at the following links:

https://medium.com/@RadiantCapital/cryptos-most-profitable-protocol-a-new-era-for-defi-b374ca82a741

https://medium.com/@RadiantCapital/defis-most-profitable-protocol-part-two-7ab13b11c2c2

- $RDNT provides utility to token holders through governance power over the Radiant Protocol and DAO. Token holders have the ability to create proposals and discuss protocol improvements within the Radiant discussion platform (https://community.radiant.capital/) as well as create and vote in on-chain proposals (https://dao.radiant.capital).

- $RDNT lockers can earn 60% of the protocol fees generated on the platform. Over the last 6 months, this averaged from 60-100% APR, all paid in BTC, ETH, and Stablecoins.

- ONLY $RDNT liquidity providers can activate the ability to receive incentivized $RDNT emissions for lending and borrowing activity on the Radiant Protocol. While any user (token holder or not) can use the protocol, cross-chain borrowing functionality, and collateral management, $RDNT LPs can also receive incentivized emissions in the form of additional $RDNT tokens.

Q7: What is the RDNT roadmap?

Answer:

1. Radiant Protocol launched on July 24, 2022. At the time, Radiant was (and still is) DeFi’s first cross-chain money market, where users can deposit and borrow assets x-chain seamlessly. This means that a user can deposit on Arbitrum as collateral, and borrow on the BNB Chain, within a few minutes or less.

2. Unlike AAVE/COMP, there is significant value accrual (“Real Yield”) to token holders in the form of protocol fees. Thus far, there is roughly $5.3m in revenue for the protocol. This comes to RDNT lockers in the form of yield in BTC, ETH, USDC, USDT, and Stablecoins. Radiant is quite unique in this respect, giving yield in Blue-Chip assets, whereas COMP/AAVE are solely governance related.

3. After working with our community (over 20% token-holder participation in governance) and several advisors, we came up with Radiant v2.

After eight months of development by a team of 14, Radiant v2 will go live in 2 weeks. This Medium does a good job of summarizing the product Roadmap, Parts 1 and Part 2

https://medium.com/@RadiantCapital/cryptos-most-profitable-protocol-a-new-era-for-defi-b374ca82a741

https://medium.com/@RadiantCapital/defis-most-profitable-protocol-part-two-7ab13b11c2c2

https://dao.radiant.capital/#/ – Here, you can find the community-generated and voted-on proposals for v2 Mechanics, including changes to protocol fee distribution (even more to users), vesting timelines, expanding the runway for tokenomics, and other changes.

The above articles will help you understand core mechanics like “Dynamic Liquidity”, which our alpha testers have been calling “Club Membership” (i.e., requiring locked LP tokens to earn RDNT emissions, getting rid of mercenary farmers).

Collateral Additions

- In v1, Radiant was intentionally super conservative on collateral (3crv + BTC/ETH) as we saw tons of money markets blow up with poor risk parameters or improper collateral params (even Aave was exploited in this way)

- In v2, Radiant will work to add new collateral options in lend-only markets (at first) to further expand your x-chain borrowing power. For ARBI, think GLP/MAGIC/STG/etc. where you could collateralize those tokens and then borrow on BNB Chain (if you so choose). These will all be done with hyper-conservative parameters to let the markets scale safely, and we are working with a number of advisors on this.

X-Chain Functionality

- Currently, on v1, you can go into Radiant on Arbi, and borrow on Avalanche using LayerZero messaging in a couple of minutes or less.

- With v2, you can have several new “home chains” where you can deposit collateral. The first new deployment of Radiant on v2 will be on BNB Chain (~Feb 20)

- On v2, we’re also expanding this to include a new set of collateral assets (think, borrow against your ARBI MAGIC on mainnet or get additional leverage on ARBI to lever up)

Join MEXC and Start Trading Today!

![[2022 9/26] MEXC Twitter Space Talkshow——Is the future of SocialFi promising? [2022 9/26] MEXC Twitter Space Talkshow——Is the future of SocialFi promising?](https://blog.mexc.com/wp-content/uploads/2022/10/1.jpeg)