Blockchain technology has brought a lot of innovation to the world of finance. One of the most significant developments is the emergence of decentralized finance (DeFi) applications that operate on a blockchain. These applications allow users to perform financial transactions without relying on a central authority, creating a trustless, permissionless, and transparent financial ecosystem.

However, the ordering of transactions on a blockchain can be a complex process that requires a lot of computation power. Miners and validators play a crucial role in this process by selecting, validating, and adding transactions to the blockchain.

As a result, miners and validators significantly influence the order of transactions, which can lead to a phenomenon called Miner Extractable Value (MEV).

History, Significant Events, and Publications of MEV:

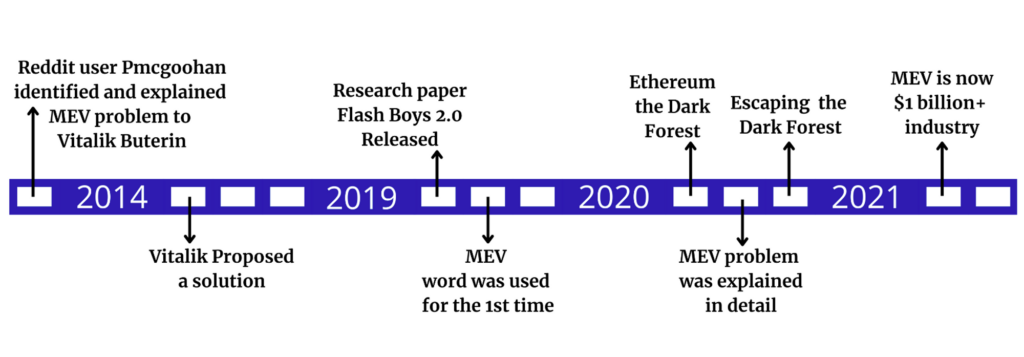

MEV (Maximal Extractable Value) has been a significant challenge in the Ethereum blockchain since before its launch in 2015. Here is a timeline of significant events and publications related to MEV:

2014: Reddit user Pmcgoohan discovered the MEV problem in Ethereum’s pre-Genesis draft documents, proposing a solution to Vitalik Buterin.

2019: Researchers released a paper titled “Flash Boys 2.0: Frontrunning, Transaction Reordering, and Consensus Instability in Decentralized Exchanges,” highlighting the MEV problem and coining the term.

2020: Georgios Konstantopoulos and Dan Robinson published “Ethereum is a Dark Forest,” and Samczsun published “Escaping the Dark Forest,” emphasizing the significance of MEV as a core term in crypto-economics.

2021: MEV extraction has grown into a billion-dollar-plus industry beyond Ethereum, with the Flashbots team releasing their “MEV in 2021: A Year in Review” report.

Flash Boy’s Gain, Everybody’s Pain: 2022 Mid-Year Report of Sandwich MEV on Ethereum

What is MEV?

MEV, initially referred to as Miner Extractable Value, refers to the number of value miners and validators can extract from ordering transactions on a blockchain. It can be generated by exploiting the transaction ordering process, creating opportunities for arbitrage, liquidations, front-running, and other profitable activities.

MEV can occur on any blockchain, regardless of whether it uses proof-of-work or proof-of-stake as its consensus mechanism. MEV strategies may differ depending on the specifics of the blockchain’s consensus mechanism and transaction ordering rules, but the concept of extracting maximum value by manipulating transactions remains the same.

It is a relatively new concept that has emerged with the growth of DeFi applications. As more users transact on these applications, the competition for block space has intensified, making MEV a more valuable resource.

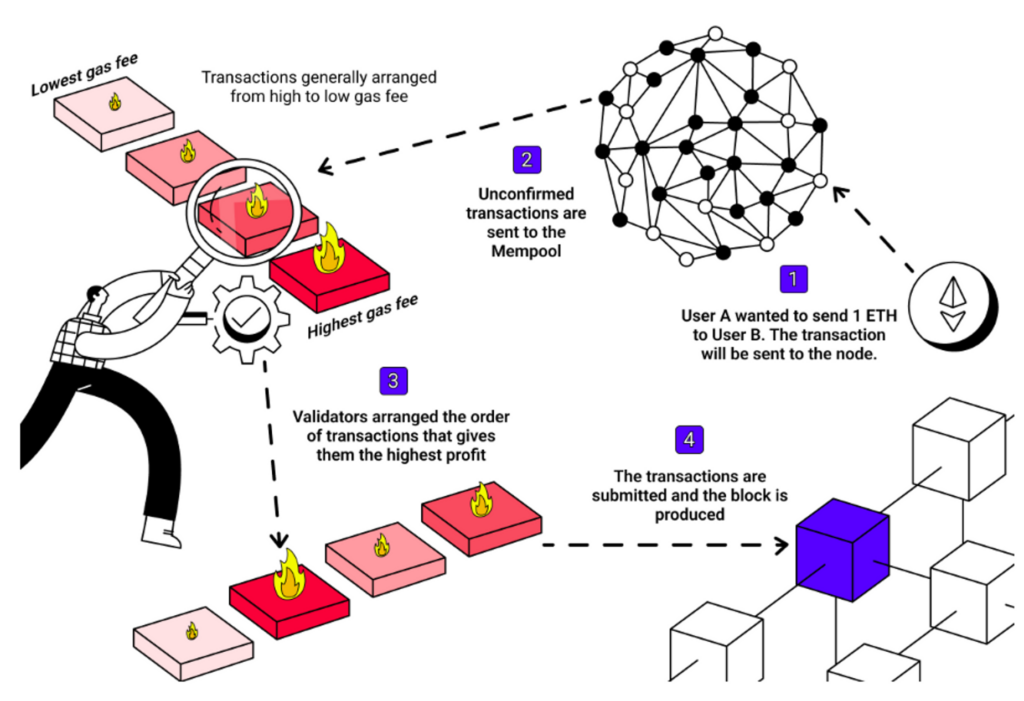

How Does MEV Work?

Using the transaction ordering process on a blockchain will generate MEV. Various factors, such as gas prices, the timing of transactions, and the inclusion of specific types of transactions, can influence the process of ordering transactions.

For example, suppose a miner or validator sees two users trying to trade on a DeFi platform. If the miner can see the transaction before its addition to the blockchain, they can perform the same trade with a higher gas price, effectively front-running the original trade and earning a profit.

Another example of MEV is when a liquidation occurs on a DeFi platform. If a user’s collateral value falls below a certain threshold, their position can be liquidated, and the assets are sold to repay the lender. However, if a miner or validator can see the liquidation transaction before its addition to the blockchain, they can take advantage of the situation and buy the assets before the selling happens, effectively earning a profit.

Popular MEV Technics

Gas golfing: This involves submitting a transaction with a low gas price. It will temporarily clog the network and push up gas prices. Then, quickly submit a second transaction with a higher gas price to take advantage of the higher gas price.

Generalized front-running: This is a more sophisticated version of front-running. It starts with a trader observing an incoming transaction and identifying its intent. Then, he executes a transaction before the original transaction is included in a block to take advantage of the expected price movement.

Back-running: This involves observing a transaction that is about to be executed and then executing a transaction after the original transaction has been confirmed but before it is executed, effectively “back-running” the original transaction to profit from its effects.

Sandwich attack: involves placing two transactions around a target transaction in a block to capture value. The first transaction takes advantage of a market inefficiency or price discrepancy. Meanwhile, the second transaction executes a trade that takes advantage of the price movement caused by the first transaction.

All of these strategies are examples of how participants in a blockchain network can use various techniques to extract value from transactions by manipulating their order or taking advantage of market inefficiencies.

Watch the video for a better understanding of these methods:

How to Maximize Profits with MEV?

MEV can be a profitable resource for miners, validators, and traders alike. Here are some strategies for maximizing your profits with MEV:

Use Flash Loans: Flash loans are a relatively new DeFi innovation that allows users to borrow assets without collateral. Flash loans can be used to execute profitable transactions quickly and efficiently, making them an ideal tool for MEV strategies.

Participate in Liquidity Provision: Providing liquidity to DeFi platforms can also be a profitable way to earn MEV. By providing liquidity, users can earn trading fees, which can be enhanced by taking advantage of MEV opportunities.

Use Automated Trading Strategies: Automated trading strategies can also be used to take advantage of MEV opportunities quickly and efficiently. By using algorithms to detect and exploit MEV opportunities, traders can earn profits with minimal effort.

worth reading

MEV Rewards on Ethereum Reach All-Time High During SVB Bank Run and USDC Depeg

New oracle system to help DApps retrieve millions lost to MEV

Flashbots introduces MEV-Share protocol to share profits with Ethereum users

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! You can learn more about crypto industry news. There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading!

Join MEXC and Start Trading Today!