Japan’s three largest banks—Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Banking Corporation (SMBC), and Mizuho Financial Group—are stepping into the future of international finance with a groundbreaking initiative. These banking giants have announced plans to pilot a cross-border stablecoin transfer platform, marking a significant development in how international transactions are handled. The pilot project, named “Project Pax,” seeks to leverage blockchain technology to create faster, more secure, and more efficient international settlement systems for enterprises.

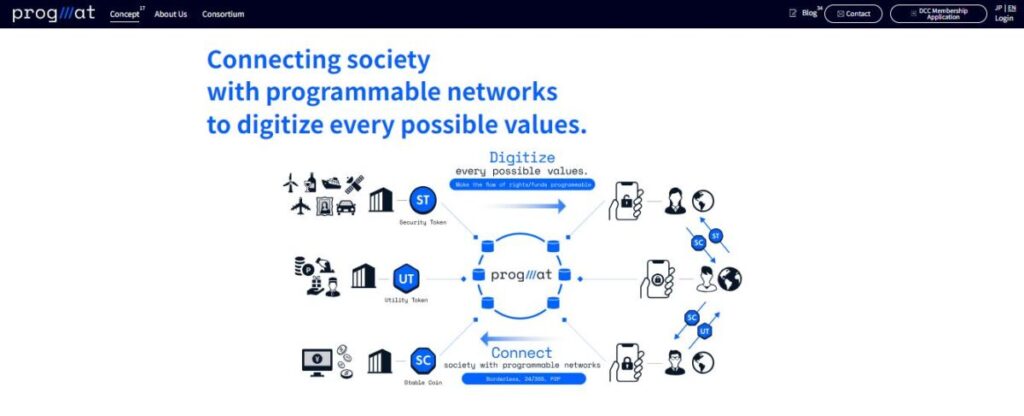

The trial will utilize stablecoins issued through Progmat, a blockchain startup supported by these three banks, along with notable players like SBI Holdings and the Japan Exchange Group. As global economies become more interconnected, the need for quicker and cheaper cross-border transactions has grown, and Japan’s financial institutions are preparing to take the lead in providing innovative solutions. This move not only signifies the growing importance of blockchain and stablecoins in mainstream finance but also highlights Japan’s desire to modernize its banking infrastructure.

In this article, we will explore the motivations behind this pilot project, the technological foundation of Project Pax, and its potential impact on the future of international settlements.

The Need for Change: Challenges in Traditional Cross-Border Transactions

International financial transfers have long been a vital component of global commerce. However, traditional methods of cross-border payments are often slow, costly, and inefficient. Transactions typically involve multiple intermediaries, including correspondent banks, each of which may charge a fee and add delays to the process. Settlement times can range from several days to a week, causing friction in business operations.

Moreover, the foreign exchange rates and the lack of transparency in fee structures can make it challenging for enterprises to manage costs effectively. For companies with global supply chains or multinational operations, these inefficiencies create significant operational challenges. Against this backdrop, blockchain technology and stablecoins are emerging as potential game-changers for cross-border transactions. Stablecoins, which are digital assets pegged to fiat currencies, offer the stability of traditional currencies with the efficiency of digital currencies.

Enter Project Pax: A Revolutionary Pilot in Cross-Border Payments

Project Pax, spearheaded by MUFG, SMBC, and Mizuho, aims to revolutionize the cross-border payment space by introducing blockchain-based stablecoin transfers. The pilot project will explore the feasibility of using stablecoins as a means of enabling faster, cheaper, and more secure international settlements between enterprises. The stablecoins will be issued through Progmat, a blockchain startup created with the backing of Japan’s top financial institutions.

Progmat’s Role in the Project

Progmat plays a central role in the execution of Project Pax. It is a blockchain infrastructure provider that focuses on creating digital financial products, such as stablecoins, that are compliant with regulatory frameworks. The stablecoins used in this pilot will be pegged to major fiat currencies like the Japanese yen and the U.S. dollar, providing a stable medium of exchange for cross-border transactions. What makes Progmat’s technology so attractive to banks like MUFG, SMBC, and Mizuho is its ability to integrate blockchain-based assets seamlessly into existing financial systems.

The Stablecoin Advantage: Speed, Cost, and Security

Stablecoins represent a revolutionary innovation in the world of finance, and their use in cross-border payments could provide several distinct advantages.

- Speed: One of the most significant benefits of blockchain-based stablecoins is the near-instantaneous nature of transactions. Unlike traditional banking systems, which require clearinghouses and intermediaries to process payments, blockchain networks can facilitate real-time settlement. For businesses involved in international trade or those with global supply chains, this could dramatically reduce the time it takes to move funds across borders, making operations smoother and more predictable.

- Lower Costs: The use of stablecoins can significantly reduce the costs associated with cross-border transfers. In traditional systems, multiple intermediaries—such as correspondent banks—take a cut of each transaction, inflating the overall cost. By bypassing these intermediaries and relying on blockchain’s peer-to-peer model, businesses can enjoy reduced transaction fees, making international transfers more affordable, especially for small- and medium-sized enterprises.

- Security and Transparency: Blockchain technology inherently provides a high level of security due to its decentralized and encrypted nature. Every transaction on the blockchain is recorded on a public ledger, which ensures transparency and immutability. This is a vital feature in international transactions, where fraud and discrepancies are major concerns. By utilizing stablecoins on a blockchain platform, Project Pax will enhance the security of cross-border payments, providing peace of mind to enterprises.

- Regulatory Compliance: Unlike many other cryptocurrencies, stablecoins are often designed to comply with regulatory requirements. Progmat’s stablecoin platform has been built with regulatory compliance in mind, ensuring that the pilot will meet the standards of financial authorities in Japan and abroad. This makes it a much more appealing option for large financial institutions like MUFG, SMBC, and Mizuho, which must adhere to strict regulations.

The Collaboration: MUFG, SMBC, Mizuho, and Industry Partners

Japan’s three megabanks—MUFG, SMBC, and Mizuho—are no strangers to innovation, having each invested heavily in financial technology (fintech) solutions over the past decade. Their collective involvement in Project Pax highlights the significance of this pilot for Japan’s banking sector and beyond.

MUFG has long been a leader in digital finance. The bank’s early investment in blockchain technology and cryptocurrency platforms demonstrates its commitment to staying at the forefront of financial innovation. SMBC and Mizuho, while perhaps more conservative in their approach, have followed suit by investing in fintech solutions, recognizing the importance of digital transformation in the banking sector.

SBI Holdings and the Japan Exchange Group are also integral to the success of Project Pax. SBI Holdings has been an active player in blockchain and digital finance, particularly through its partnerships with Ripple and other blockchain companies. The Japan Exchange Group, one of the largest financial exchanges in the world, brings expertise in financial infrastructure, making it a key partner in ensuring the smooth execution of Project Pax.

The Potential Impact on Global Finance

If successful, Project Pax could have far-reaching implications for both the Japanese banking sector and the global financial system. A functioning cross-border stablecoin transfer platform would be a monumental step forward in the way enterprises handle international transactions. It could serve as a model for other countries and financial institutions to follow, potentially leading to a worldwide shift toward stablecoin-based cross-border payments.

For Japan, this project positions the country as a leader in blockchain and fintech innovation. As the world’s third-largest economy, Japan’s financial moves are closely watched, and a successful rollout of stablecoin transfers could prompt other major economies to explore similar systems. This could accelerate the adoption of blockchain technology in global finance, reducing reliance on traditional correspondent banking systems.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up