Coming soon, Hyperliquid will initiate a major HYPE token unlock starting at the end of November 2025 and continuing under a 24-month vesting schedule. About 23.8% of the total HYPE supply, worth tens of billions of dollars and held by early investors and the core development team, will be unlocked during this period.

1.Upcoming HYPE Token Unlock Schedule

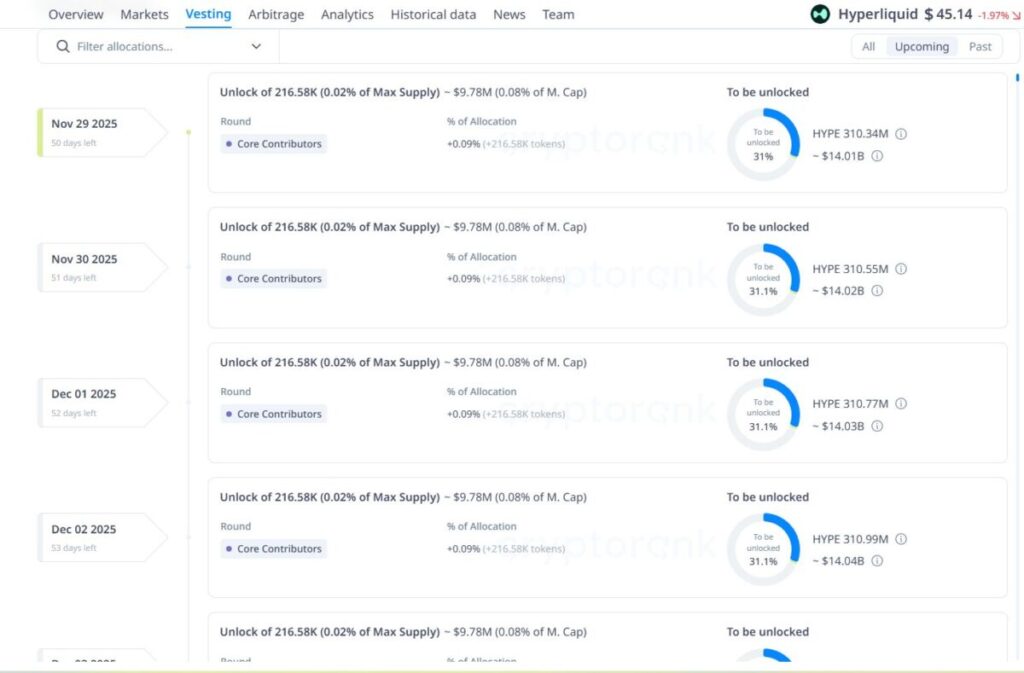

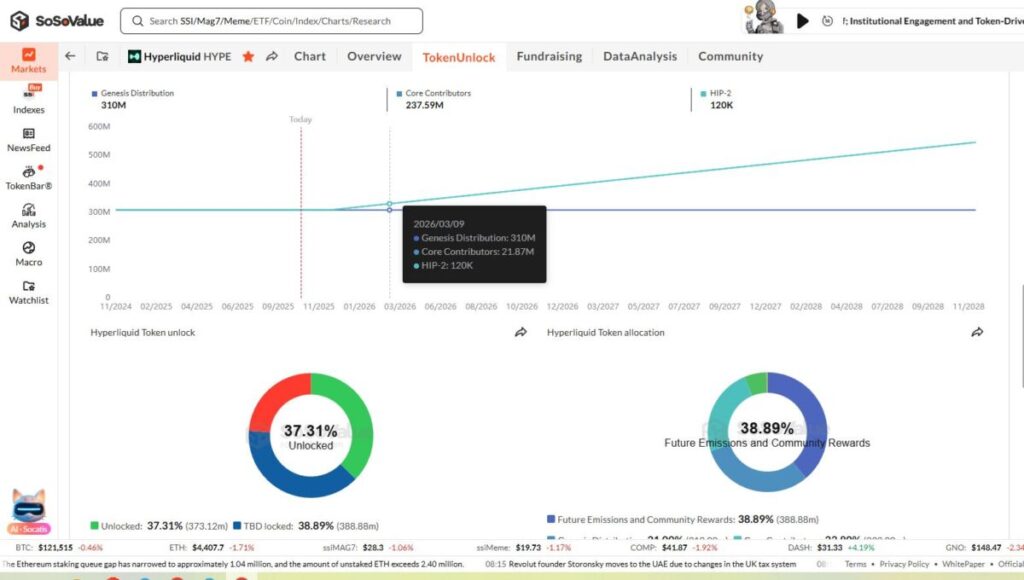

According to Hyperliquid’s smart contracts and various reports on the project, the large vesting event will begin on November 29–30, 2025, with approximately 237.8 million HYPE gradually unlocked over 24 months—equivalent to roughly $500M of new supply per month if the price remains unchanged. These numbers and the schedule are key factors shaping the risk analysis below.

Cryptorank data shows that Hyperliquid employs a cliff + linear vesting structure, with several large tranches belonging to core contributors and investors gradually becoming liquid after the cliff period. This means selling pressure will be distributed over a long period, but looking at the monthly unlock volumes, they are still very large.

2.Pressure from Token Unlocks

Large token unlocks mean a sudden increase in circulating supply. If demand (from actual exchange buyers, staking, or utility use) does not increase proportionally, prices must adjust to rebalance. This is a simple supply-demand principle, but on a large scale, the impact is fast and strong.

Concerns are not baseless. The cryptocurrency market has witnessed numerous price crashes following similar token unlock events. Early investors, after long lock-up periods, often tend to take partial or full profits. Additionally, there is concern that competitors like $ASTER gaining traction and capturing PerpDEX market share could negatively impact Hyperliquid, which previously dominated this niche.

Adding to this is the silence from the Hyperliquid team. While the investor community expects clear strategies and countermeasures, the project has not yet provided any announcements or concrete actions, increasing skepticism within the community.

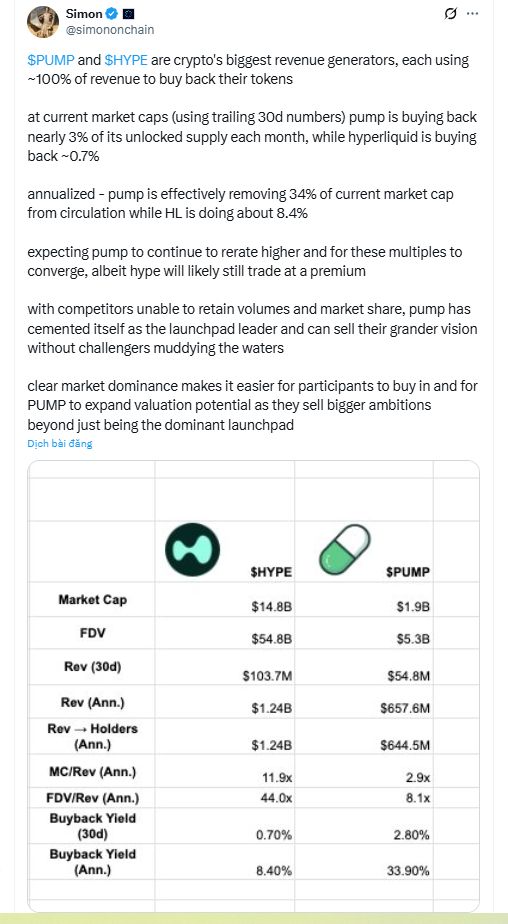

3.Buyback, Absorption Capacity, and Market Depth

Hyperliquid’s tokenomics are notable for a buyback mechanism that uses protocol revenue to repurchase HYPE, with most of the revenue reportedly reinvested into the buyback fund (>90% according to media reports). However, the actual monthly buyback capacity—i.e., the USD amount spent daily/monthly—is often much lower than the new supply being released each month.

Example:

- Monthly unlock: $500 million

- Average buyback: $30–120 million per month depending on stage

- Gap: $380–470 million per month that could exert selling pressure

This illustrates that, although the buyback mechanism exists, market absorption capacity is still limited, especially when large token tranches unlock in quick succession.

Selling pressure is not only a matter of USD value—market depth is also a decisive factor. Order books can only absorb a certain amount of selling before prices drop through support levels. On DEXes and alternative markets, liquidity is often fragmented; large sell volumes can cause significant slippage, leading to cascading effects like margin call liquidations in derivatives markets.

Worst-case scenario: Large tranches are sold on spot/DEX → slippage lowers the price → margin calls trigger → liquidation amplifies the price drop.

The team’s continued silence also heightens holder anxiety. Information gaps are quickly filled with negative speculation, and without a transparent roadmap regarding unlocks, hedging, or absorption mechanisms, panic is likely. Conversely, publishing detailed vesting schedules, buyback plans, burn mechanisms, or staking incentives could alleviate most concerns.

4.Price Scenarios in the Upcoming Context

Base / Well-Managed Scenario: The team announces clear handling measures (aggressive buyback + long-term staking programs + burn/OTC sales) → sell-off shock is controlled, price adjusts mildly, then recovers, supported by strong market growth absorbing most new supplies.

Moderately Negative Scenario: Buyback insufficient, some holders take profits, liquidity thin → price drops 30–50% (less severe than predicted due to uptrend absorbing part of the supply), recovery slow depending on demand and sentiment.

Worst-Case Scenario: Large tranches + whales sell simultaneously → cascade liquidation → sharp drop >50–60%, long-term confidence eroded. However, the probability of a very sharp drop in Q4 is lower if the overall trend is bullish, compared to sideways or down markets.

5.Hyperliquid Team’s Potential Solutions and Actions

To minimize risk, the Hyperliquid team could implement the following measures. Clear signals from the project would reassure holders:

- Transparent announcements: Publish unlock schedules for each tranche, beneficiaries, and purposes of release; the more detailed the information, the more confidence the market gains.

- Supply absorption mechanisms: Expand staking/vesting, implement long-term staking with increasing yields, or conduct OTC sales to large funds with commitments not to sell on the open market.

- Clear buyback/burn roadmap: Disclose monthly buyback targets, provide clear procedures (source of funds, exchange used, public reporting); if possible, convert part of revenue into token burns to reduce lasting supply.

- Collaboration with LPs / market makers: Increase depth, reduce slippage during large sell flows.

- Communication & governance: Organize AMAs, update governance proposals if tokenomics changes are required; build trust and provide clear direction for the community.

These measures tightly link absorption capacity, selling pressure, market sentiment, and governance solutions, keeping all detailed information while maintaining logical clarity.

6.Short Advice for Investors

- Check portfolio concentration: If HYPE occupies a large portion of holdings, consider gradually reducing exposure before unlocks to avoid concentrated risk.

- Hedge: Derivative traders can use short hedges (options/futures) for protection.

- Monitor on-chain activity: Watch large wallets and token transfers to exchanges as early indicators of selling pressure.

- Wait for official information: Team updates can rapidly alter the risk profile.

7.Conclusion

The upcoming HYPE unlock will have a significant impact. The token’s price trajectory will primarily depend on:

- The speed and volume of token releases

- Market absorption through buyback, staking, or liquidity

If supply exceeds absorption capacity, strong price adjustments are inevitable. Conversely, if the team acts transparently with clear plans and appropriate mechanisms to support demand, the unlock can still be well-managed. This is a critical period that all investors should monitor closely.

Disclaimer: This content does not constitute investment, tax, legal, financial, or accounting advice. MEXC provides this information for educational purposes only. Always DYOR, understand the risks, and invest responsibly

Join MEXC and Get up to $10,000 Bonus!

Sign Up