Key Takeaways

- Definition: Working capital is the difference between current assets and current liabilities, measuring a company’s short-term liquidity.

- The Formula: Working Capital = Current Assets − Current Liabilities.

- Interpretation: Positive working capital indicates financial health, while negative working capital usually signals distress (though there are strategic exceptions).

- Optimization: Effective management involves speeding up receivables, optimizing inventory, and negotiating better payment terms with suppliers.

Working capital is the lifeblood of business operations, your short-term financial pulse that decides whether you can meet day-to-day needs, pay bills, and still have room to grow. It determines how well your business balances its short-term resources and obligations, revealing not only liquidity but also operational health.

In this guide, we’ll unpack the formula, explore its key components, and discuss its limitations so you can use it wisely to strengthen your financial strategy.

Table of Contents

What Is Working Capital? Definition & Meaning

Working capital represents the difference between current assets and current liabilities. In simple terms, it measures how much cash, or cash-convertible assets, your business has left after paying off short-term debts due within the next year.

Think of it like the fuel in your business engine. Without enough working capital, even a profitable company can stall because it can’t pay suppliers, make payroll, or fund inventories. But when working capital is strong, your business hums smoothly, covering essentials while keeping enough flexibility to invest, expand, or seize opportunities.

Why It Matters

Companies with optimized working capital often experience:

- 20–30% higher cash efficiency.

- Faster payment cycles.

- Better access to supplier discounts (improving overall competitiveness).

How to Calculate Working Capital: The Formula

At its core, the working capital calculation is beautifully simple. This equation lies at the heart of liquidity analysis:

Working Capital = Current Assets − Current Liabilities

Calculation Example

Let’s consider Company A:

- Current Assets: $120,000 (Cash + Inventory + Receivables)

- Current Liabilities: $70,000 (Payables + Short-term Debt)

Calculation: $120,000 – $70,000 = $50,000

This positive balance of $50,000 shows the business can pay short-term liabilities comfortably while still holding excess funds for growth. Conversely, if this number were negative, it would signal potential cash shortages.

Net Working Capital vs. Gross Working Capital

While the term “working capital” is often used loosely, financial analysts make a sharp distinction between Gross and Net figures. Understanding this difference is vital for accurate strategic planning.

| Feature | Gross Working Capital | Net Working Capital |

| Perspective | Quantitative View (Focus on Volume) | Qualitative View (Focus on Health) |

| Definition | The sum of Total Current Assets. | Current Assets minus Current Liabilities. |

| Formula | Total Current Assets | Current Assets − Current Liabilities |

| What It Measures | The total scale of liquid resources a company has at its disposal. | The “true” liquidity buffer available after covering short-term debts. |

| Primary Utility | Useful for assessing business size and total capital investment. | Critical for checking solvency and operational stability. |

| Limitation/Risk | High Risk: Ignores liabilities. A company can have $1M in Gross WC but owe $2M, making it technically bankrupt. | Low Risk: Provides a realistic picture of financial freedom and creditworthiness. |

Key Distinction

Gross Working Capital tells you the size of the company’s financial engine, but Net Working Capital tells you if there is enough fuel to run it.

For investors and managers, Net Working Capital (NWC) is the superior metric. A positive NWC grants operational freedom, allowing managers to seize new opportunities without the constant pressure of creditors knocking on the door. Conversely, focusing solely on Gross Working Capital can mask serious underlying debt problems.

Understanding the Working Capital Ratio

A related measure, the Current Ratio, expresses working capital as a proportion rather than a dollar amount.

Current Ratio = Current Assets / Current Liabilities

This ratio reveals how many times the company’s current assets can cover its current liabilities. Using the example above ($120k / $70k), the ratio is 1.7. This means the company has $1.70 available for every $1 owed.

What is a “Good” Ratio?

- < 1.0: Suggests liquidity stress (Liabilities > Assets).

- 1.5 – 2.0: Generally considered healthy for most firms.

- > 2.0: Can indicate excessive idle assets (lazy capital), perhaps too much cash sitting in the bank or slow-moving inventory.

Industry Benchmarks (2025 Estimates)

The ideal range depends heavily on your industry’s operating cycle.

| Industry | Average Current Ratio (2025) | Notes [Source] |

| Electrical Work / Electrical Equipment & Parts | 1.52-2.01 | Electrical contractors ~1.5; electrical equipment higher due to inventory. |

| Food Products / Food: Major Diversified / Packaged Foods | 1.55-2.06-2.92 | Processed foods ~2.0; food retail lower (~1.2). |

| Motor Vehicle Parts / Auto Parts | 1.70-1.85 | OEM auto parts ~2.25; industry avg. ~1.85. |

| Electric Services / Electric Utilities / Regulated Electric | 1.65-0.86 | Stable utilities with low ratios from predictable cash flows. |

| Hotels & Hospitality / Hotels/Resorts / Lodging | 0.90-1.37-0.69 | Hotels often <1.0 due to immediate payments and low inventory. |

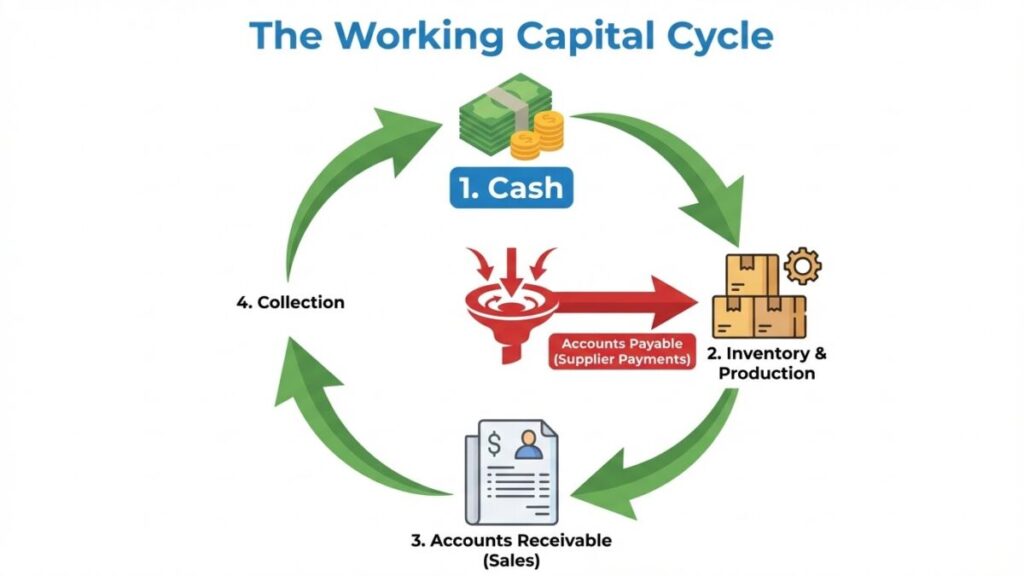

Key Components of Working Capital

To manage liquidity, you must control the levers that drive it.

1. Current Assets (Inflows)

Resources expected to convert into cash within 12 months:

- Cash & Equivalents: Money ready to deploy.

- Accounts Receivable: Money owed by customers. Efficient collection is key here.

- Inventory: Goods available for sale. The goal is to avoid overstocking.

- Prepaid Expenses: Payments made in advance (e.g., insurance) that provide future value.

2. Current Liabilities (Outflows)

Obligations due within 12 months:

- Accounts Payable: Money owed to suppliers.

- Short-term Loans: Debts payable within the year.

- Accrued Expenses: Wages, taxes, and interest incurred but not yet paid.

Expert Insight: Is Negative Working Capital Always Bad?

This is a common misconception. While negative working capital usually signals distress, it can sometimes indicate superior efficiency.

Giant retailers (like Walmart or Amazon) often operate with negative working capital. Why?

- They sell inventory and collect cash from customers instantly.

- They negotiate long payment terms (e.g., 60–90 days) with suppliers.

In this scenario, negative working capital is a strategy, not a failure. However, for most small-to-mid-sized businesses without such bargaining power, negative working capital remains a serious risk.

5 Factors That Influence Working Capital Levels

Working capital fluctuates based on internal decisions and external trends:

- Business Growth: Expansion requires more inventory and receivables, temporarily eating up cash.

- Seasonality: Retailers see asset/liability spikes before holidays.

- Credit Policy: Giving customers longer to pay increases receivables but tightens immediate cash.

- Inventory Management: Just-in-Time (JIT) strategies reduce capital tied up in stock.

- Operational Efficiency: Automated billing and collections tighten the cash conversion cycle.

Limitations of Working Capital Analysis

While vital, this metric isn’t flawless.

- Short-term Focus: It reflects immediate liquidity, not long-term solvency.

- Timing Distortions: Balance sheets are snapshots. A seasonal business might look “rich” in December but “poor” in February.

- Quality of Assets: It assumes all current assets are liquid. In reality, obsolete inventory or bad debts (uncollectible receivables) can inflate the numbers falsely.

Practical Application: Using Working Capital in Trading

Working capital isn’t just for accountants, it’s a leading indicator for price movements. Here is how traders capitalize on it:

- The Bull Case (Growth): Consistent growth in Net Working Capital often signals expansion. Investors can capture this long-term value by buying global equities via MEXC Spot xStocks.

- The Bear Case (Distress): A Current Ratio falling below 1.0 often precedes a price drop. Traders can profit from this distress by “shorting” the stock using MEXC Stock Futures.

Pro Tip: Always combine fundamental data with technical analysis. Ready to start? Read our step-by-step guide on How to Trade Stock Futures on MEXC.

Conclusion: Mastering Your Financial Engine

Mastering working capital gives you more than a number, it gives you control. By understanding the formula and tracking its components, you can manage liquidity smarter, reduce stress, and fuel sustainable growth.

Every dollar tied up unnecessarily in working capital is a dollar that could drive innovation or expansion elsewhere. Whether you’re optimizing receivables, streamlining inventory, or negotiating smarter payables, the goal is clear: keep your financial engine well-oiled and always ready for what’s next.

Frequently Asked Questions (FAQs)

Q1: What is a good level of working capital?

Aim for positive working capital aligned with your industry norms. A current ratio between 1.5 and 2.0 is typically healthy, offering a cushion without indicating idle assets.

Q2: How often should I monitor working capital?

Monthly reviews are best for most SMEs. This helps spot potential liquidity gaps early.

Q3: Can a profitable business go bankrupt?

Yes. If a profitable company has poor working capital management (e.g., all cash tied up in inventory or unpaid invoices), it may run out of cash to pay bills. This is technically “insolvency.”

Q4: How can I improve my working capital quickly?

The fastest levers are: accelerating collections (chasing overdue invoices), reducing slow-moving inventory, and negotiating longer payment terms with suppliers.

Q5: Is working capital the same as cash flow?

No. Working capital is a snapshot of your financial position at a specific moment. Cash flow tracks the movement of money over a period of time.

Join MEXC and Get up to $10,000 Bonus!

Sign Up