Key Takeaways

- The Core: Inventory Turnover Ratio measures how fast you sell and replace stock.

- The Formula: Calculated as COGS ÷ Average Inventory.

- The Goal: A higher ratio generally indicates efficient sales and liquidity; a low ratio suggests overstocking.

- The Benchmark: Varies by industry (e.g., Grocery is high ~12+, Luxury Fashion is lower ~4).

Hey there, if you’re running a business or just diving into finance basics, you’ve probably heard buzz about the Inventory Turnover Ratio.

I remember when I first crunched these numbers for a retail client—it was a game-changer for spotting cash tied up in unsold stock. You see, this simple metric tells you exactly how fast your goods are flying off shelves and getting replaced, turning potential headaches into smooth operations.

In this post, we’ll break it down step by step so you can calculate it, interpret the results, and use it to spot winning stocks to trade on platforms like MEXC.

Table of Contents

What Is Inventory Turnover Ratio?

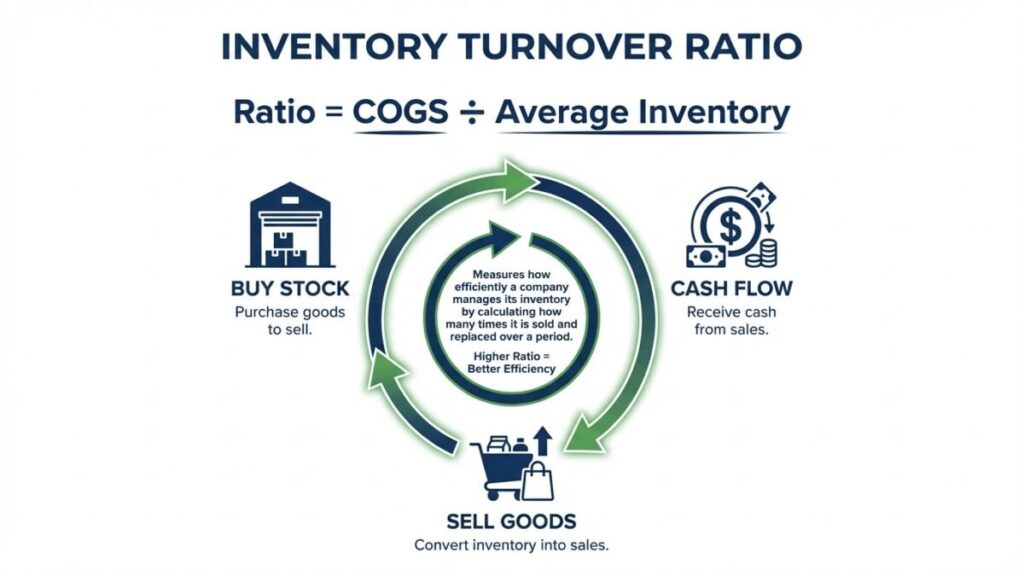

The Inventory Turnover Ratio is an efficiency metric that measures how many times a company sells and replenishes its stock over a specific period. Think of it as the company’s “pulse”, a fast pulse usually means a healthy, active business.

Let’s start simple: the inventory turnover ratio shows how often a company sells through its entire stock. It’s like checking how quickly a supermarket shelf empties.

- Too slow? The company is tying up cash in unsold goods.

- Just right? They are converting products into cash efficiently.

For traders, we love this metric because it reveals operational efficiency. A strong ratio signals liquidity and smart management, traits of a “Blue Chip” stock that often performs well in the market.

How Inventory Turnover Ratio Works

This ratio works by comparing Cost of Goods Sold (COGS) against Average Inventory. Higher numbers indicate brisk sales and strong cash flow, making the stock more attractive to investors.

Picture this: COGS is the expense to produce what is sold, while Average Inventory is the stock sitting in the warehouse. The ratio crunches these numbers to reveal the speed of the business cycle.

For example, a tech company like Apple or NVIDIA relies on moving inventory fast before it becomes obsolete. A high turnover ratio here tells traders that demand is exploding, often a bullish signal for the stock price.

Inventory Turnover Ratio Formula and Calculation

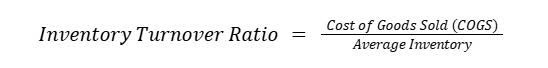

The formula is Inventory Turnover Ratio = COGS / Average Inventory. To be precise, calculate Average Inventory as (Beginning Inventory + Ending Inventory) / 2.

Here is the formal breakdown for your analysis:

Where:

- COGS: Found on the company’s Income Statement.

- Average Inventory:

Step-by-Step Calculation Example

Let’s look at a hypothetical scenario for a company you might find on MEXC Spot xStocks:

- Step 1: Locate COGS. Let’s say it is $500,000.

- Step 2: Average Inventory is calculated to be $125,000.

- Step 3: Divide: $500,000 / 125,000 = \mathbf{4}$.

Result: The company turned its inventory 4 times that year.

Note: If you are trading Stock Futures, you’d compare this 4 against the industry average to decide if you should go Long (Buy) or Short (Sell).

Interpreting Inventory Turnover Ratio: The Trader’s View

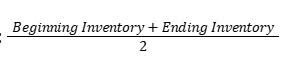

A “good” ratio is relative. Generally, 5-10 is healthy for retail. For traders, a ratio rising quarter-over-quarter is a strong “Buy” signal, while a declining ratio might suggest “Shorting” opportunity.

Interpreting is where the magic happens. You don’t just calculate; you benchmark.

2025-2026 Industry Benchmarks Table

| Industry | Average Turnover Ratio | Trading Insight |

| Grocery / FMCG | 12 – 15 | High volume. Stability is key for long-term holding. |

| Electronics (e.g., NVDA, AAPL) | 6 – 10 | High turnover here often triggers stock price surges. |

| Apparel (e.g., NKE) | 4 – 6 | Seasonal. Watch for dips in ratio to catch short-term corrections. |

Pro Tip for MEXC Users: When you see a company like Tesla or Amazon beating these benchmarks consistently, it often correlates with stock price growth.

- Conservative Traders: Might look to buy these shares via Spot xStocks for long-term holding.

- Active Traders: Might use Stock Futures on MEXC to leverage these insights, capitalizing on the earnings reports where these ratios are revealed.

How to Improve Your Inventory Turnover Ratio

You can boost your ratio by adopting accurate demand forecasting, implementing Just-in-Time (JIT) inventory methods, running strategic sales promotions for slow movers, and utilizing modern ERP software to automate reordering.

Want to supercharge your ratio? Here are the smart moves we’ve seen deliver results:

- Master Demand Forecasting: Don’t guess. Use historical sales data and seasonal trends to predict demand. Order just enough to meet sales without overflow.

- Adopt Just-in-Time (JIT): Restock only when needed. Case studies show this can slash excess holding costs by 20%+.

- Marketing for Slow-Movers: Identify items sitting too long (low turnover) and run promotions to clear them out. This converts dead stock back into cash.

- Tech Upgrades: Use ERP and AI analytics to track inventory in real-time. Predictive tools can boost performance by 20-30% by eliminating human error in ordering.

- Pareto Principle (80/20 Rule): Focus on your top 20% profitable items. Negotiate faster delivery with suppliers for these winners to keep the cycle moving.

Conclusion: Turning Data into Trades

Understanding the Inventory Turnover Ratio gives you an edge. It allows you to look under the hood of a business and see if the engine is running smoothly or stalling.

- Is the ratio high and rising? The company is efficient. It might be time to look at a Long position.

- Is the ratio falling below benchmarks? They might be in trouble.

Once you’ve done your analysis, you need the right tools to execute. You don’t need a separate brokerage account to act on these stock insights. You can trade top-tier US stocks directly alongside your crypto portfolio using MEXC’s Stock Futures (offering up to 50x leverage for pros) or explore Spot xStocks for a traditional approach.

Check out the Guide to Trading Stock Futures on MEXC and start applying your financial analysis today.

Frequently Asked Questions (FAQs)

Q1: What does the inventory turnover ratio tell us?

It reveals how efficiently you’re managing stock. A higher number generally means faster sales and fresher inventory, unlocking cash for growth instead of letting it sit in the warehouse.

Q2: What is considered a good inventory turnover ratio?

Aim for 5-10 in general retail. If you are in groceries, aim for 12-15. Always match your industry benchmark for the most accurate target.

Q3: How often should I calculate my inventory turnover ratio?

Calculate it quarterly for most businesses to spot trends early. If you sell highly seasonal goods (like swimwear or holiday gifts), track it monthly.

Q4: Can inventory turnover ratio be too high?

Yes. Balance is key. A super-high ratio might mean you aren’t carrying enough stock to meet demand, leading to stockouts and lost customers.

Q5: How can I improve my inventory turnover ratio quickly?

Forecast better, discount slow-moving items immediately, switch to JIT ordering, and use inventory management software. Many businesses see a 20-30% lift within the first year of applying these tactics.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please conduct your own research (DYOR) and assess your risk tolerance before trading. MEXC does not accept liability for any investment decisions made based on the information provided herein.

Join MEXC and Get up to $10,000 Bonus!

Sign Up