As it stands today, Ethereum and Bitcoin have long held a dominant position in the cryptocurrency market.

In the cryptocurrency industry, Ethereum has been progressively gaining momentum despite Bitcoin’s historical dominance in terms of market capitalization.

This has led to a popular “The Flippening” discussion among the whole crypto community: Will Ethereum ever “flip” Bitcoin and become the most valuable cryptocurrency in the market?

Understanding The Flippening Phenomenon

The Flippening refers to the anticipated event when Ethereum’s market capitalization surpasses Bitcoin’s. This milestone would mark a significant shift in the cryptocurrency landscape, as Ethereum would become the new benchmark for the entire industry.

Flippening encapsulates the evolving dynamics within the cryptocurrency market, highlighting Ethereum’s increasing prominence due to its versatile blockchain technology and broader range of applications, such as decentralized finance (DeFi) and non-fungible tokens (NFTs).

This shift would not only symbolize Ethereum’s growth but it also indicates changing investor sentiment and technological advancements that favor Ethereum’s diverse ecosystem over Bitcoin’s more singular focus as a digital store of value.

Why Ethereum?

The allure of Ethereum is its adaptability. Ethereum, in contrast to Bitcoin, is a platform that lets every developer create decentralized apps (dApps) while Bitcoin is primarily thought of as a store of value.

These decentralized applications (dApps) include non-fungible tokens (NFTs), decentralized finance (DeFi) protocols, and decentralized exchanges (DEXs).

Now as we know, because of its adaptability, Ethereum has drawn a sizable and vibrant developer community, which has fueled innovation and network adoption.

Here are five important key factors that drive Ethereum as one of the best candidates to “flip” Bitcoin in the future.

1. Smart Contracts and Decentralized Applications (dApps)

Ethereum itself is pioneering the implementation of smart contracts and it has revolutionized the way agreements and transactions are executed.

These self-executing contracts, with their terms directly embedded in code, eliminate the need for intermediaries, reducing costs, increasing efficiency, and fostering trust.

2. Scalability and Network Performance

Scalability has been a critical challenge for Ethereum as it has grown in popularity. To address this, the network has undergone significant upgrades and is continuing to evolve.

The transition to a proof-of-stake consensus mechanism, known as The Merge, is a major step forward in enhancing scalability, reducing energy consumption, and increasing transaction throughput.

3. A Thriving Developer Community

Ethereum boasts a large and active developer community that is constantly building and innovating on the platform.

This vibrant ecosystem has led to the creation of a vast array of dApps, tools, and infrastructure solutions. The availability of developer resources, support, and funding has fostered a culture of experimentation and collaboration.

4. Institutional Adoption and Investment

Institutional investors have been a major factor in Ethereum’s growth. Traditional financial entity are recognizing the potential of blockchain technology and are allocating resources to explore opportunities in the crypto space. Ethereum network versatility, security, and established ecosystem make it an attractive option for them.

5. Network Effects and Token Economics

Ethereum benefits from strong network effects, where the value of the network increases as more users and applications join. This virtuous cycle attracts more developers, investors, and users to further strengthen the platform’s position.

Additionally, Ethereum’s token, Ether (ETH), plays a crucial role in the ecosystem. As the native currency for transactions and smart contract execution, ETH derives value from the network’s activity and growth.

Key Metrics to Watch for the Potential Flippening

The Flippening is more than just speculation. Experts think it could happen, and they’re looking at some key numbers to figure it out. Here are some important flippening metrics to watch:

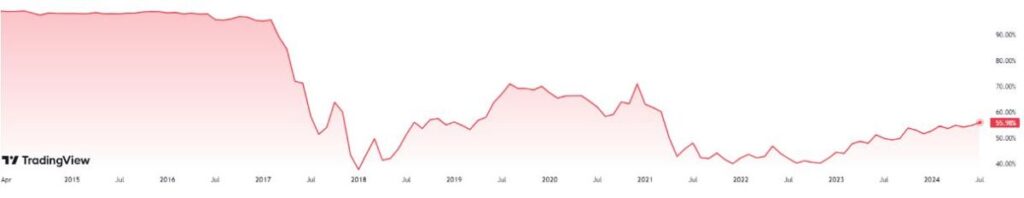

Market Dominance

Since the beginning of 2020, Bitcoin’s dominance within the cryptocurrency market has experienced a notable decline. Conversely, Ethereum has demonstrated increasing strength and influence during this same period.

A few years ago, Bitcoin dominated the market, holding between 60% and 70% of the total value but its current dominance has declined.

In contrast, Ethereum’s market share has steadily risen from a starting point of 8% to 10%, and it now hovers around the 20% mark.

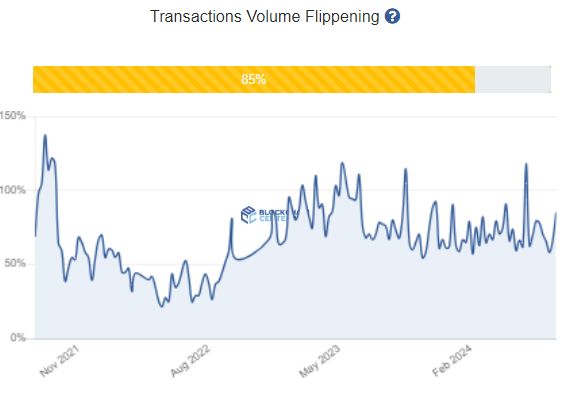

Transaction Volume

Transaction volume indicates the total amount of value exchanged on the network and market. In terms of BTC transactions alone, Ethereum now falls far behind Bitcoin in terms of dollar value handled. Nonetheless, this comparison is restricted since it fails to take into consideration the significant amount of token and stablecoin transfers that occur on the Ethereum network.

Ethereum’s transaction volume increases significantly when these are taken into account. This indicator is a crucial one for determining Ethereum’s growing power and has increased significantly in the last few years as you can see on the chart below:

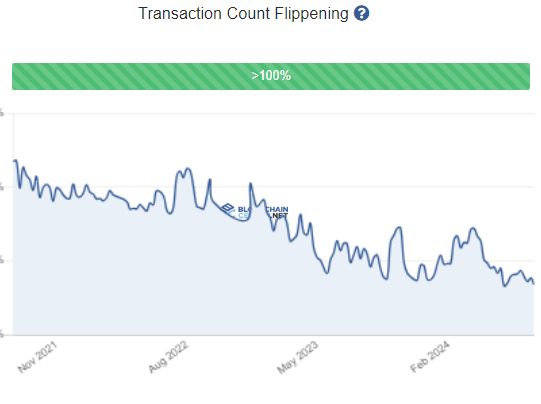

Transaction Count

Transaction count measures the total number of on-chain transactions processed by a network. Ethereum has significantly outpaced Bitcoin in this regard. While Ethereum handles an average of around 1 million transactions daily, Bitcoin processes only about 200,000. This substantial difference is a key indicator of Ethereum’s superior utility.

So, Will The Flippening Happen?

Ethereum enthusiasts are optimistic about Ethereum surpassing Bitcoin’s market capitalization soon. However, these two cryptocurrencies serve fundamentally different purposes. Ethereum aims to be a versatile platform for various applications beyond currency, while Bitcoin focuses on being a store of value. While experts predict The Flippening, a concrete timeline remains elusive.

Join MEXC and Get up to $10,000 Bonus!

Sign Up