The crypto industry is buzzing with excitement as Ethereum Exchange-Traded Funds (ETFs) move closer to reality.

In a significant development, issuers have received initial comments from the U.S. Securities and Exchange Commission (SEC) regarding their S-1 forms, which are crucial for the ETFs to begin trading. Sources have described the feedback as “light” and “reasonable,” indicating a positive step forward.

Consensys Celebrates Regulatory Win as SEC Drops Ethereum 2.0 Investigation

As the market braces for the next steps toward realizing Ethereum ETF trading, Consensys, the blockchain software company behind the popular MetaMask wallet, announced that the SEC is closing its investigation into Ethereum 2.0.

Consensys had previously filed a lawsuit against the SEC, challenging the agency’s categorization of Ether as a security. The company’s recent letter to the SEC, seeking confirmation that the approval of spot Ether ETFs meant an end to the investigation, seems to have yielded favorable results.

The closure of the SEC’s investigation into Ethereum 2.0 is being hailed as a “major win” for the industry. Consensys stated, “This means that the SEC will not bring charges alleging that sales of ETH are securities transactions.”

The company also emphasized that their fight continues, particularly in seeking a declaration that offering MetaMask swaps and staking does not violate securities laws.

As for the Ethereum ETFs, issuers are diligently working to address the SEC’s comments and resubmit their S-1 forms by Friday, June 21.

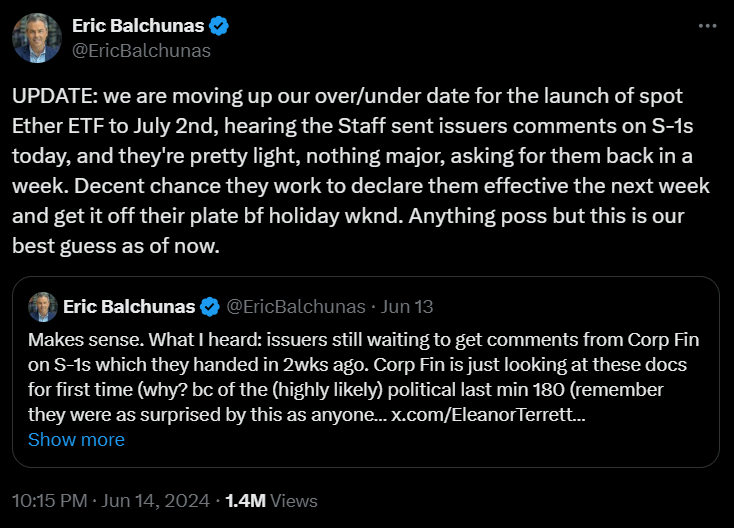

The exact launch date remains uncertain, but industry experts like Bloomberg Senior ETF Analyst Eric Balchunas are cautiously optimistic, estimating a potential launch timeline of July 2.

The impact of Ethereum ETFs on the market is a topic of much speculation, with some analysts predicting inflows of up to 20% compared to Bitcoin ETFs. The introduction of regulated investment vehicles like ETFs could attract institutional investors and drive mainstream adoption of Ethereum, the second-largest cryptocurrency by market capitalization.

The regulatory landscape surrounding Ethereum’s classification as a commodity or security has been a subject of ongoing debate. While SEC Chair Gary Gensler has avoided directly addressing the issue, Commodity Futures Trading Commission Chair Rostin Behnam has categorized Ether as a commodity.

The resolution of this debate will have significant implications for the future of Ethereum and its associated financial products.

As the crypto community eagerly awaits the arrival of Ethereum ETFs, the collaborative efforts between issuers, regulators, and industry players like Consensys are paving the way for a new era in digital asset investing.

The coming weeks will be pivotal in determining the timeline for these highly anticipated investment vehicles, which have the potential to reshape the crypto market and attract a new wave of investors.

With regulatory hurdles being cleared and the SEC’s feedback being addressed, the dream of Ethereum ETFs is closer than ever.

As clarity emerges and the regulatory framework evolves, the crypto industry stands on the cusp of a significant milestone that could unleash the full potential of Ethereum and its ecosystem.

Ethereum Prevents Bearish Onslaught

On the technical front, Ethereum has shown some grit as it fends off bearish attempts to push prices lower. The $3,350 support mark has prevented prices from falling any further, despite market-wide correction this week.

As some bullish momentum starts to seep back into the market, we can expect to see a strong recovery above the $3,800 mark in the near term. And if the bearish trend resumes, we can also expect the $3,350 support to keep the resistance.

ETH Statistics Data

ETH Current Price: $3,565

Market Cap: $435.8B

ETH Circulating Supply: 122M

ETH Total Supply: 122M

Market Ranking: #2

Get accurate, winning trading signals: https://learn2.trade/

Best crypto trading bot: https://learn2.trade/crypto-trading-bot

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up