Will Ethereum Dump After Shanghai Upgrade? Much Ado About Nothing

Within days, Ethereum’s Shanghai upgrade will let users withdraw their staked ETH tokens for the first time in years.

This event will unlock more than 1 million ETH worth several billions dollars. That includes Celsius’s 150,000 ETH and all of Kraken exchange’s staked ETH tokens.

Some people worry these entities and other stakers will dump their ETH after Ethereum’s Shanghai upgrade goes through. Are they right?

We’ll see.

In for a Penny . . .

Most of those stakers are diehards getting yield on a project they love while the prices are low and their positions probably aren’t much bigger now than when they first staked.

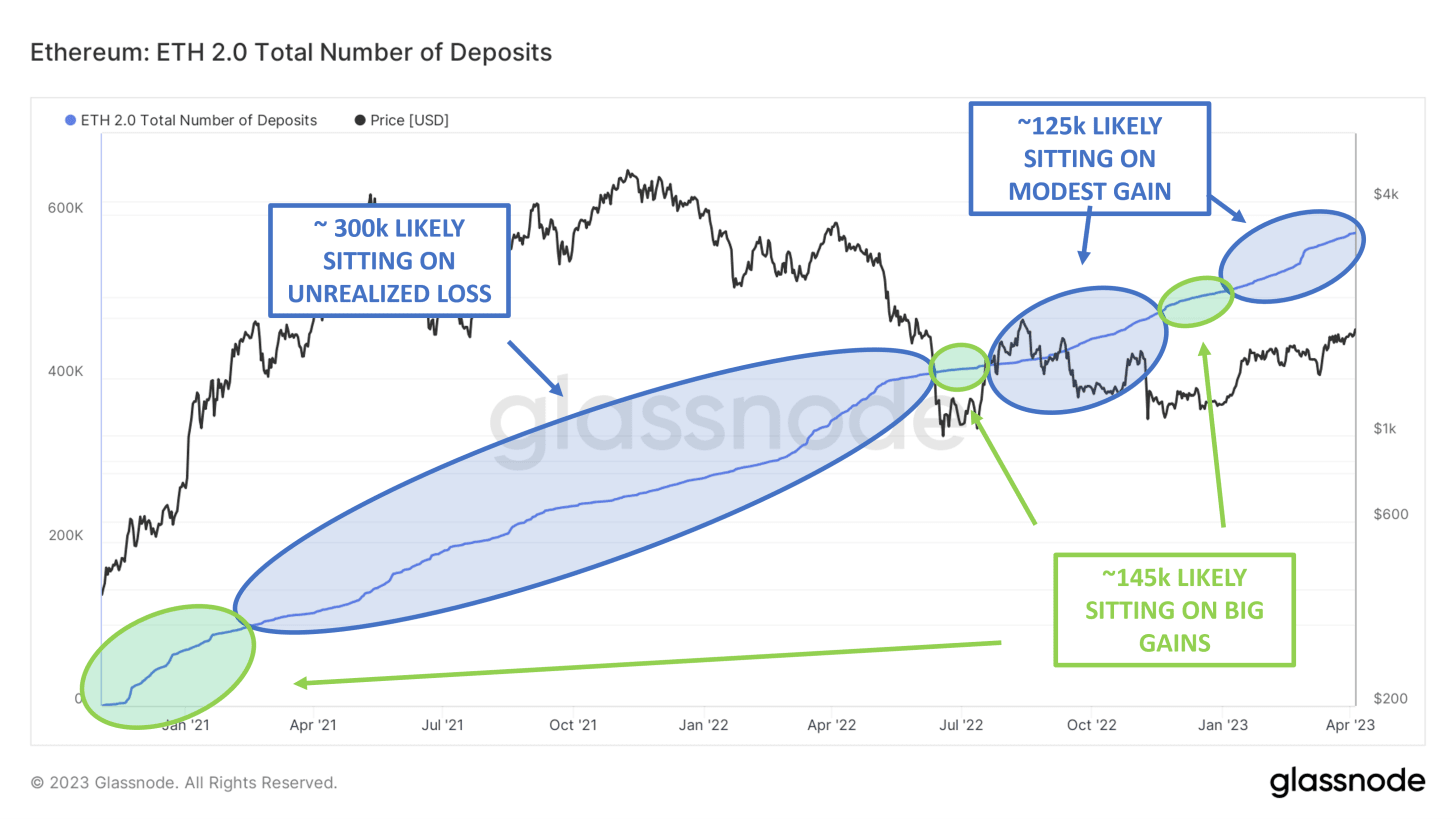

Take a look at this chart of deposits, a crude approximation of actual staking positions. Roughly 52% are probably underwater and roughly 23% probably have modest gains. Only about 25% have big gains.

If you’re underwater, why would you sell now?

If anything, you may actually buy more because now you know you can unstake when you need to, which you couldn’t do before.

Of course, some people will sell. Enough to swing prices?

Too little, Too Late

According to CoinGecko, daily ETH trading volume averages $10 billion. Can a hypothetical extra $1 billion make a substantial difference? Especially when that selling will likely take place over the course of weeks?

We can expect some downward pressure on ETH’s price after the Shanghai upgrade. If you’re selling or shorting based on that expectation, make sure you hedge your bet.

You’re not going to get much help from the market.

Liquid Staking FTW

Lost in the chatter?

Liquid staking derivative platforms, or LSDs. Now that stakers can withdraw their ETH at any time, liquid staking takes on greater importance.

(LSDs package small holders’ ETH into a synthetic ETH token. The original ETH goes into a staking pool on the protocol. While the pool collects rewards, users can use, buy, or sell their synthetic ETH.)

LSD tokens might get a boost from Shanghai. For example, Lido (LDO), Rocket Pool (RPL), Stakewise (SWISE), and Frax (FXS).

These tokens don’t have anything to do with the synthetic ETH their users create, but users can get rewards for staking them with their ETH. In some cases, they also get a role in governance and can post their tokens as collateral for borrowing.

Their platforms might benefit from the general hype around Ethereum even if ETH’s price goes down.

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! You can learn more about cryptocurrency industry news. There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading!

Join MEXC and Get up to $10,000 Bonus!

Sign Up