The crypto market is unlike any other financial market. It runs 24/7 with no downtime, and trends/narratives along with capital flows can shift overnight. You could wake up one morning and realize the money has already rotated from one ecosystem to another, or a brand-new memecoin just listed on MEXC has already done a 10x before you even noticed.

Below is a step-by-step guide to help you stay fully informed about the market every single day.

1. Why Crypto Traders Need a Daily Information Check

Crypto runs 24/7, unlike traditional stock markets that open and close with weekends off. Money rotates quickly — sometimes within just a few hours. Missing a single day online can make you “outdated” with the market. Daily updates help you:

- Stay in sync with the market: Know where capital is flowing and what sectors are hot today.

- Filter noise: Cut through endless news and FUD to find real signals.

- Invest smartly: Keep a cool head instead of chasing pump-and-dump cycles.

- Catch narratives early: From LSDs, DeFi, and Memecoins to RWA or AI, narratives change at lightning speed.

2. Key Information to Check

2.1. Top Gainers

The first task of the day: check Top Gainers on exchanges or market-tracking tools.

- Tools like Sosovalue, CoinGecko: Filter coins → Note standout outperformers and weak underperformers.

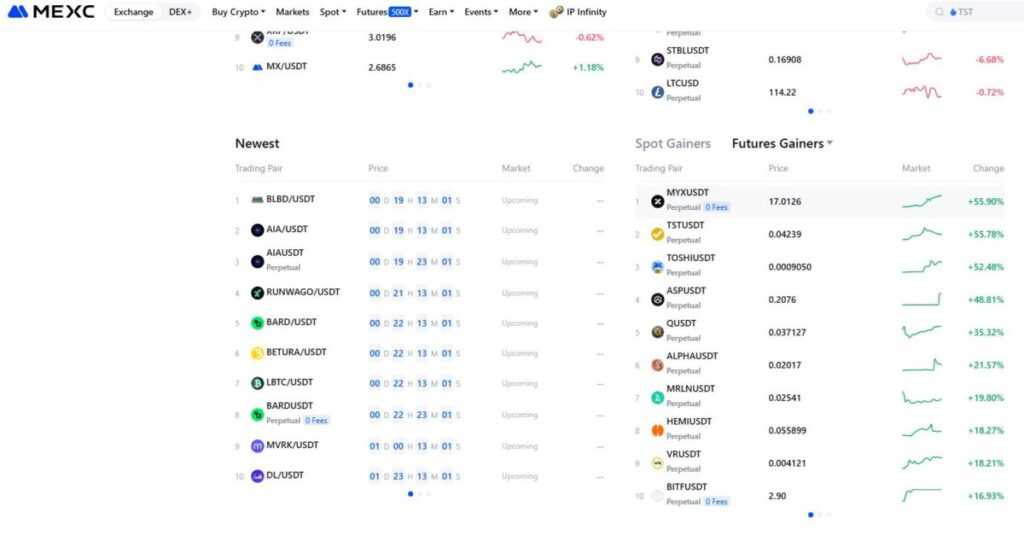

- MEXC Exchange: Look at futures as well, since this is where “hot money” flows.Coins that pump hard are often the leaders of a narrative. Example: $VIRTUAL led the AI-Agent trend; Solana memes gained traction via $BONK/$WIF. Spotting leaders helps you ride real flows instead of scattering investments blindly.

Always keep an eye on the top gainers on the exchangeImportant tips:

- Don’t just look at % gains. Always check volume. A 50% move with tiny liquidity is usually a low-cap pump-and-dump.

- Build a personal watchlist: “Top performers of the week.” This becomes your radar for coins that could keep growing.

2.2. Read the News

In crypto, news acts as a catalyst just as important as on-chain flows. A single tweet, a project update, or even a Fed meeting can flip the market in minutes. That’s why reading news daily is non-negotiable.

2.2.1. Types of Market-Moving News

- Macro news

- Central banks: FED, ECB, BOJ → rate decisions, speeches from Powell, Lagarde.

- U.S. economic data: CPI, PPI, NFP, Retail Sales → impact global markets.

- DXY & Bond Yields: Strong/weak USD = appetite for crypto risk-on/off.

Macro economic news has a big impact on the crypto market so it is important to keep an eye on it.

- Crypto-native news

- ETFs: Spot BTC/ETH ETF inflows/outflows.

- Stablecoins: USDT/USDC mint/burn.

- Regulation: SEC, MiCA, lawsuits.

- Chain-specific: upgrades, hard forks, hacks/exploits, airdrops.

- Project & VC news

- Big funds (a16z, Jump, Multicoin, Yzilabs): new buys/sells, fresh investments.

- Partnerships with big tech or CEX.

- Token unlocks: Vesting schedules that may trigger sell pressure.

- Alpha insights from KOLs & Crypto Twitter (CT)

- KOLs/degenerates often spark narratives before they go mainstream.

2.2.2. Best News Sources

- X/Twitter (CT) → Fastest alpha, but you need a quality curated list.

- Telegram Alpha Groups → Sometimes leak news before mainstream.

- News aggregators: CoinDesk, The Block, Sosovalue, WuBlockchain.

- On-chain alerts: Arkham, DeFiLlama → wallet tracking, smart money flows.

- AI tools: Kaito AI, Cookie → digest news faster, track narrative mindshare.

2.3. Check Charts of $BTC, $ETH & Key Indicators

Next, review charts of the major coins ($BTC, $ETH) and key indexes. Every move in these giants sets the tone for the whole market. They reflect overall sentiment since all news, flows, and emotions eventually show up on charts.

- ETH chart: Often the signal for altcoin strength. When ETH rallies, alt season ignites.

- BTC.D (Bitcoin Dominance): Measures whether capital is flowing to BTC or altcoins.

- Total3 (Altcoin market cap excluding BTC & ETH): Gauges the overall health of alts.

- Stablecoin supply: Shows how much capital is ready to deploy.

- Funding Rate & Open Interest (OI): Derivatives sentiment (are traders overhyped or scared?).

👉 Always monitor BTC & ETH first. Then use BTC.D and Total3 to track rotation between BTC vs. altcoins. When these indicators align, trading opportunities become much clearer.

2.4. Check Performance of Coin Sectors

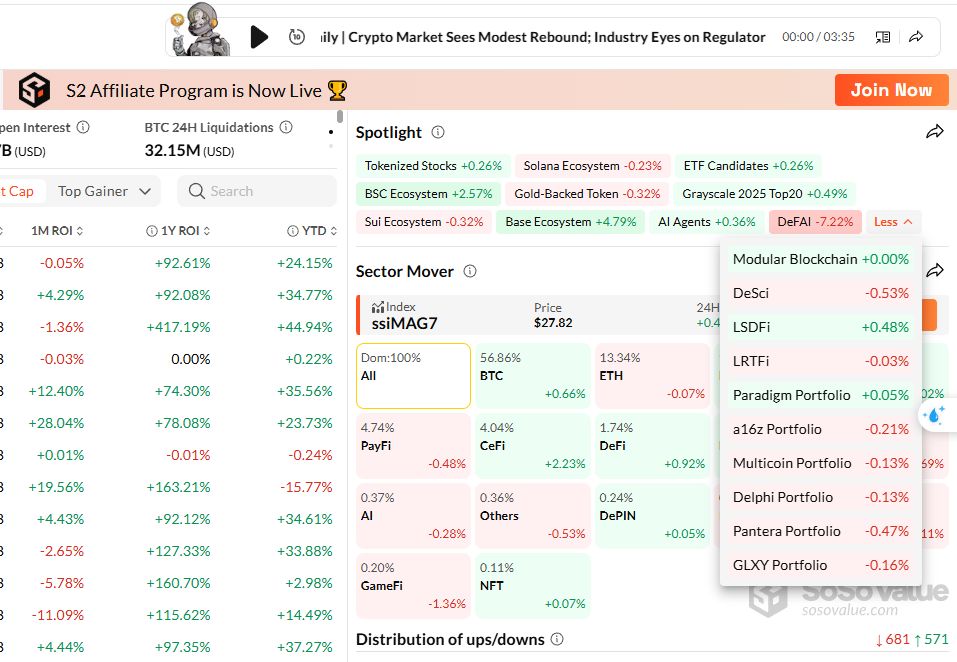

This step helps you see which narratives/sectors are heating up and where money is rotating. Markets often pump in waves: leaders first, then smaller sector coins follow.

How to track:

- Use Sosovalue dashboards to detect rising narratives/sectors.

- Identify leader coins in each sector and use them as benchmarks.

- Track performance: If leaders hold strength and smaller sector coins maintain price, the trend is intact.

Checking the top sector will help you know the market trend

Examples:

- AI-Agent sector: pumped by $AI16z, $VIRTUAL.

- Solana memes: started with BONK, WIF → then flowed to smaller-cap Solana memes.

3. Extra Notes

3.1. Key Trading Hours (UTC)

- 23:00 – 02:00: U.S. closes, Asia opens → macro news reactions overnight.

- 05:00 – 07:00: Europe opens → mini altcoin pumps/dumps.

- 13:00 – 16:00: U.S. opens → golden hours, volume surges.

- 17:00 – 18:00: Daily close → manage positions, prep for next day.

3.2. Information Management

- Use Google Sheets/Notion to gather links to tools, news, on-chain data.

- No single source covers everything — combine multiple.

3.3. Play to Your Strengths

- Good at TA → prioritize charts, volume, OI/funding.

- Good at narratives → prioritize newsfeeds, socials, on-chain.

- Airdrop hunters → focus on events like MEXC Earn, Launchpad/Launchpool.

3.4. Filter for Real Signals

- Keep only information that directly helps with trade decisions.

- Cut useless noise, avoid FUDs, and prevent information overload.

4.Conclusion

A proper daily routine won’t just keep you updated with news and market data — it will help you read capital flows, catch the right narratives, and most importantly, maintain discipline in a market that never sleeps.

Disclaimer: This content does not provide investment, tax, legal, financial, or accounting advice. MEXC shares information purely for educational purposes. Always DYOR, understand the risks, and invest responsibly.

Join MEXC and Get up to $10,000 Bonus!

Sign Up