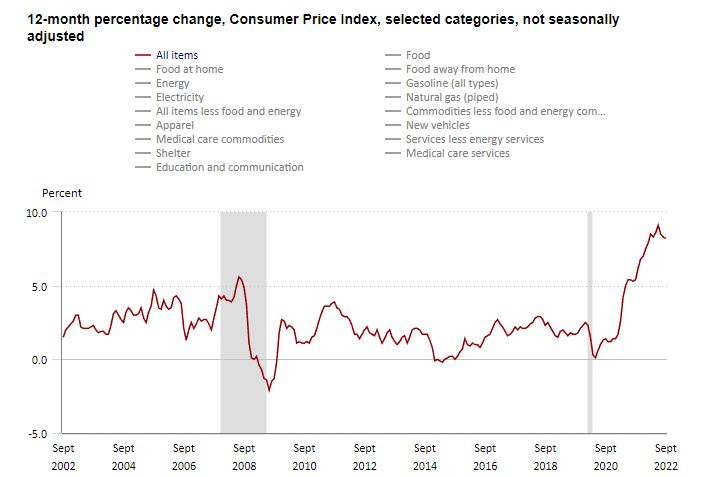

On October 13, the U.S. Bureau of Labor Statistics announced the Consumer Price Index (CPI) for All Urban Consumers increased 0.4% in September, and rose 8.2% in the past 12 months. CPI is one of the key measurements of inflation, which represents the cost of purchasing a market basket of consumer goods and services. The hike of CPI indicates it is more expensive for people and households to afford daily spending such as food and gas. With the highest level of inflation since the 80s, the Fed is very likely to continue raising interest rates in November, which tumbles the crypto market. So how does the hotter inflation affect the price of Bitcoin (BTC) and Ethereum (ETH)?

Along with high inflation rates, Bitcoin (BTC/USDT – Trade it here) price on MEXC bottomed at its 3-week low $18,184.22 today and Ethereum (ETH/USDT – Trade it here) price reached its low at $1,150.00 since July this year. Bitcoin has been trading from roughly $18,000 to $22,000 since the beginning of September. With today’s inflation report, it may become the direct or indirect cause of a breakout of Bitcoin and other cryptocurrencies in the near future.

According to MarketWatch, history demonstrates that once inflation rises above 5%, it typically takes 10 years to decrease to 2% – the most consistent percentage for maximum employment and price stability. Indicating this would be a long-term challenge for both the White House and the Federal Reserves. Although it is painful to see the bearish market, it is necessary to implement tightening monetary policy to avoid rising inflation rates, or worse, hyperinflation. This is because hot inflation will devalue the US dollar and increase the price of imports, therefore worsen the inflation over time.

However, things could change quickly based on different monetary and fiscal policies. Despite the fact the Bitcoin price bounced back to $19,000 level later today, the charm of crypto volatility is always there. Investors and traders should pay close attention to the macroeconomic environment and news from the Fed and make adjustments accordingly to minify potential loss. To deal with price volatility, you can consider changing your investment strategy to dollar-cost averaging (DCA) to lower the average price per unit over time, instead of investing 100% of your funds at once. This helps you to buy in increments at different prices in an uncertain market.

With continuously tightening monetary policies and the tumbling market, it may not be a bad idea to include cryptocurrency (at lower price!) in your investment portfolio to diversify the market risks. MEXC provides a wide variety of crypto to fulfill your investment needs, do your own research and purchase your first crypto now with MEXC!

Join MEXC and Get up to $10,000 Bonus!

Sign Up