In a financial landscape where innovation is the norm, Bitcoin has once again captured headlines with a remarkable demand shock. The leading cryptocurrency is experiencing a surge akin to a commodities market frenzy, where demand for basic goods spikes due to unexpected events.

This extraordinary demand for Bitcoin follows the SEC’s recent nod to a spot-based ETF, granting Bitcoin exposure to over $14 trillion in assets.

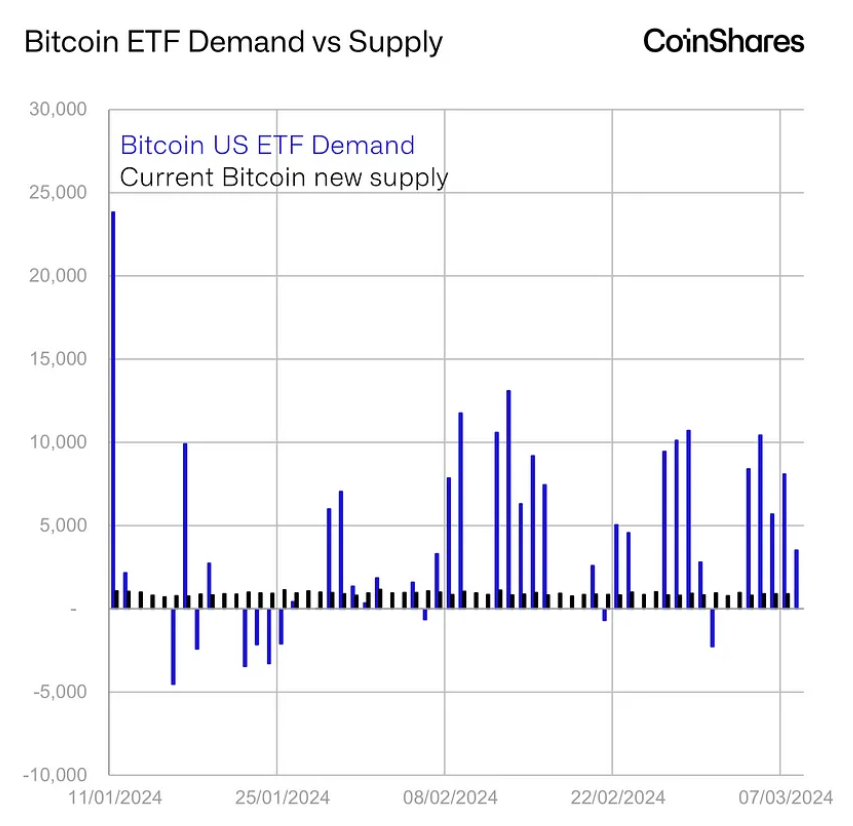

Current Bitcoin Demand Is 5x Minting Supply

Since the ETF’s launch on January 11, the daily demand for Bitcoin has skyrocketed to an average of 4,500 units. This figure is a staggering 5x the average daily creation rate of about 921 bitcoins.

The impact of this demand is palpable, with Bitcoin’s price soaring as the new supply struggles to meet the ETF issuers’ needs, who are now turning to the secondary market.

CoinShares’ data mirrors this trend, showing a 74% decrease in OTC desk coin holdings since 2020, signaling a pivot to ETFs.

In the first two months of 2024 alone, US ETFs have seen an influx of $10 billion, a figure that overshadows the initial $288 million inflow of the first Gold ETF by iShares in 2005.

Moreover, CoinShares reports that the amount of Bitcoin held in exchanges has dropped by 29% since 2020 as investors move towards ETPs and take personal custody of their Bitcoin, treating it as a valuable asset.

However, Bitcoin’s fixed supply, which halves every four years, does not allow for a supply response to this demand shock. Instead, the market adjusts through price changes, seeking a balance between supply and demand.

Despite the current surge, CoinShares projects a decrease in inflows later in the year, potentially aligning Bitcoin prices with the anticipated interest rate adjustments by the US Federal Reserve.

Bitcoin’s current scenario highlights its increasing significance and adaptability in the financial world. As Bitcoin continues to navigate these uncharted waters, its journey remains a testament to the evolving nature of digital assets.

Bitcoin Persists in Price Discovery Mode

Amid the raging demand shock, Bitcoin’s price remains in price discovery mode as it explores the mid-$73,000 mark as of the time of this report. With this much momentum behind it, the peak for Bitcoin is nowhere in sight right now, as 100% of all Bitcoin holders coast in profits.

On the flipside, however, a slight retrace might be brewing considering that the benchmark cryptocurrency has remained in this frenzied state for weeks now. In the near term, we see a strong support range around the $70,000–$68,500 axis.

However, on a broader scale (year-end), analysts predict that Bitcoin is unlikely to drop below the $50,000 mark again, except in the face of a black swan event.

BTC Statistics Data

BTC Current Price: $73,395

Market Cap: $1.43T

BTC Circulating Supply: 19.6M

BTC Total Supply: 21M

Market Ranking: #1

Get accurate, winning trading signals: https://learn2.trade/

Best crypto trading bot: https://learn2.trade/crypto-trading-bot

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up