Bitcoin, the world’s largest cryptocurrency, is making waves in the financial world once again. The benchmark cryptocurrency climbed to $66,113, marking a 4-week peak since June 20, before retracing slightly.

Not surprisingly, this has sparked excitement among investors and analysts alike, who have been straddled with aggressively bearish sentiments for some weeks now. This surge brings Bitcoin tantalizingly close to its all-time high, set in March 2024.

What’s Driving Bitcoin’s Price Up?

But what exactly is driving the price of Bitcoin—and the broader market by extension—higher? Here are some of the main factors fueling Bitcoin’s recent price rally:

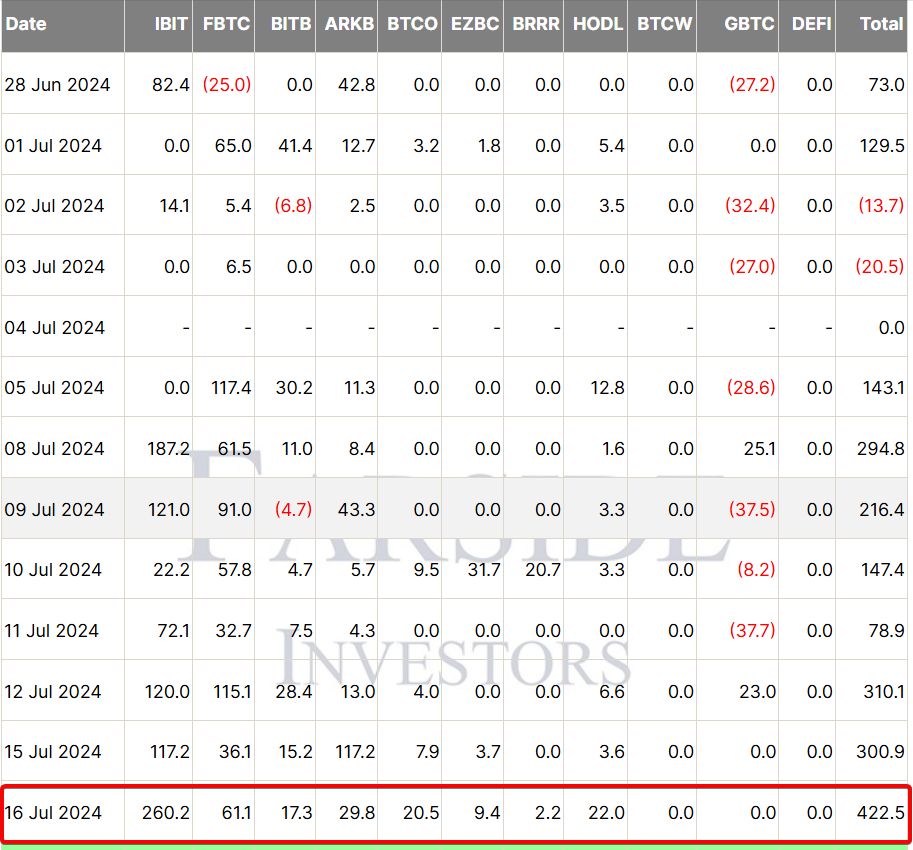

1. Strong ETF Inflows: U.S.-spot Bitcoin ETFs have seen a massive influx of capital. On Tuesday alone, these funds reported net inflows of $422.67 million, the largest since early June. BlackRock’s IBIT led the charge with $260.23 million in inflows.

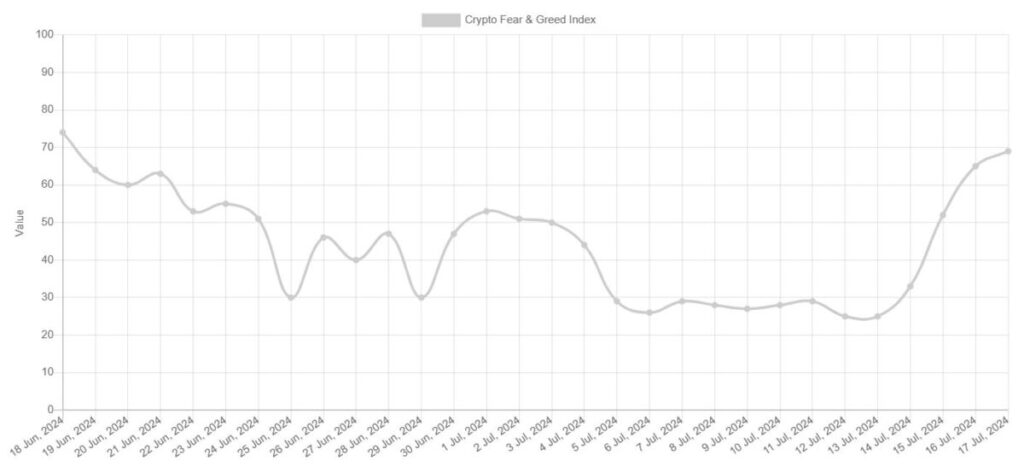

2. Positive Market Sentiment: Traders are becoming increasingly bullish on Bitcoin. This has helped the Bitcoin Fear and Greed Index return to greed levels after several weeks.

Meanwhile, the completion of the German government’s Bitcoin sales and the distribution of Mt. Gox funds to creditors have eased concerns about potential sell pressure.

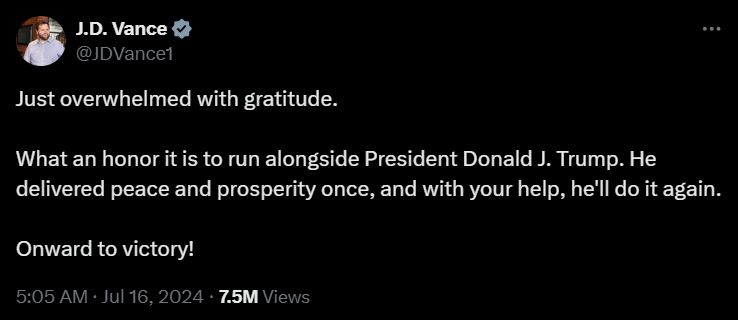

3. Political Developments: Recent events in U.S. politics, including former President Donald Trump’s campaign activities and his choice of running mate, have influenced market sentiment.

Trump recently selected J.D. Vance, who’s believed to be a strong Bitcoin proponent, as his running mate in the upcoming presidential elections. Some analysts believe a Trump victory could lead to crypto-friendly policies.

4. Short Squeeze Potential: A rapid rise in Bitcoin’s price could trigger a short squeeze, potentially liquidating up to $800 million in short positions if the price breaks $68,000.

Bitcoin ETF Enthusiasm Continues to Grow

The success of Bitcoin ETFs has been a game-changer for the crypto market. Since their launch in January, these funds have accumulated a total net inflow of $16.48 billion. This steady influx of institutional money is providing strong support for Bitcoin’s price.

Fidelity’s FBTC, Ark Invest, 21Shares’ ARKB, and VanEck’s HODL are among the other ETFs seeing significant inflows. The total trading volume for U.S. spot Bitcoin funds on Tuesday reached $1.76 billion.

While Bitcoin steals the spotlight, Ethereum is also making moves. Spot Ethereum ETFs are expected to begin trading on July 23, potentially bringing another wave of institutional investment to the crypto market.

Risks and Considerations

Despite the optimism, investors should remain cautious. The crypto market is known for its volatility, and several factors could impact Bitcoin’s price:

1. Regulatory changes

2. Macroeconomic shifts

3. Technological developments or setbacks

Additionally, the ongoing distribution of Mt. Gox funds, while seemingly overblown in its market impact, remains a factor to watch.

Bitcoin Eyeing Additional Gains

Bitcoin has recorded a strong comeback in July, pushing for a possible bullish close to the month. At the time of this report, the benchmark cryptocurrency has returned near the $64,000 floor as it seeks renewed support to stage a strong recovery to the $67,500-$68,000 axis.

In the meantime, Bitcoin could hold the $64,000 support for a little while bulls accumulate around that price point.

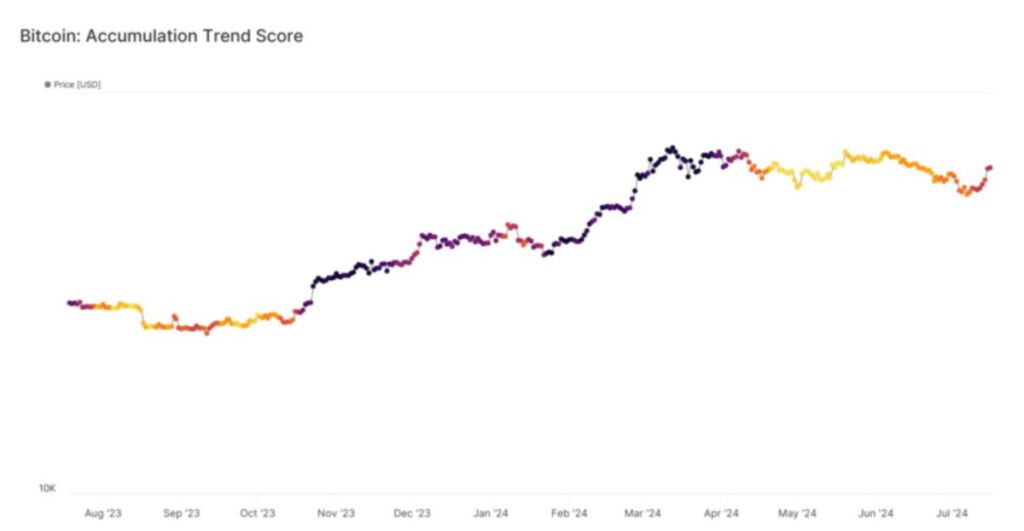

On-chain data also supports a bullish outlook. The Accumulation Trend Score from Glassnode, which measures the behavior of large market participants, has risen to 0.55. This indicates increased on-chain purchasing activity.

BTC Statistics Data

BTC Current Price: $64,250

Market Cap: $1.26T

BTC Circulating Supply: 19.7M

BTC Total Supply: 21M

Market Ranking: #1

Get accurate, winning trading signals: https://learn2.trade/

Best crypto trading bot: https://learn2.trade/crypto-trading-bot

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up