In a significant development for the cryptocurrency world, Bitcoin, the pioneering digital currency, has achieved a remarkable milestone, surpassing a market capitalization of over $1 trillion for the first time in over two years on February 14th.

This milestone comes as Bitcoin’s price surged above $51,000, driven by a surge in demand from both retail and institutional investors.

Despite facing a volatile market landscape, with traders continuously testing the $51,400 support level, Bitcoin has shown resilience, capturing the attention of investors worldwide.

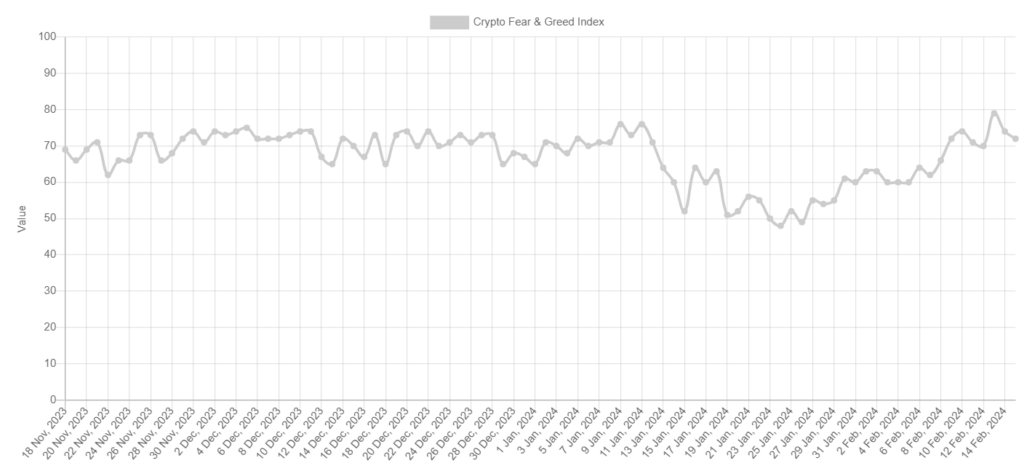

Bitcoin Enters Greed Territory

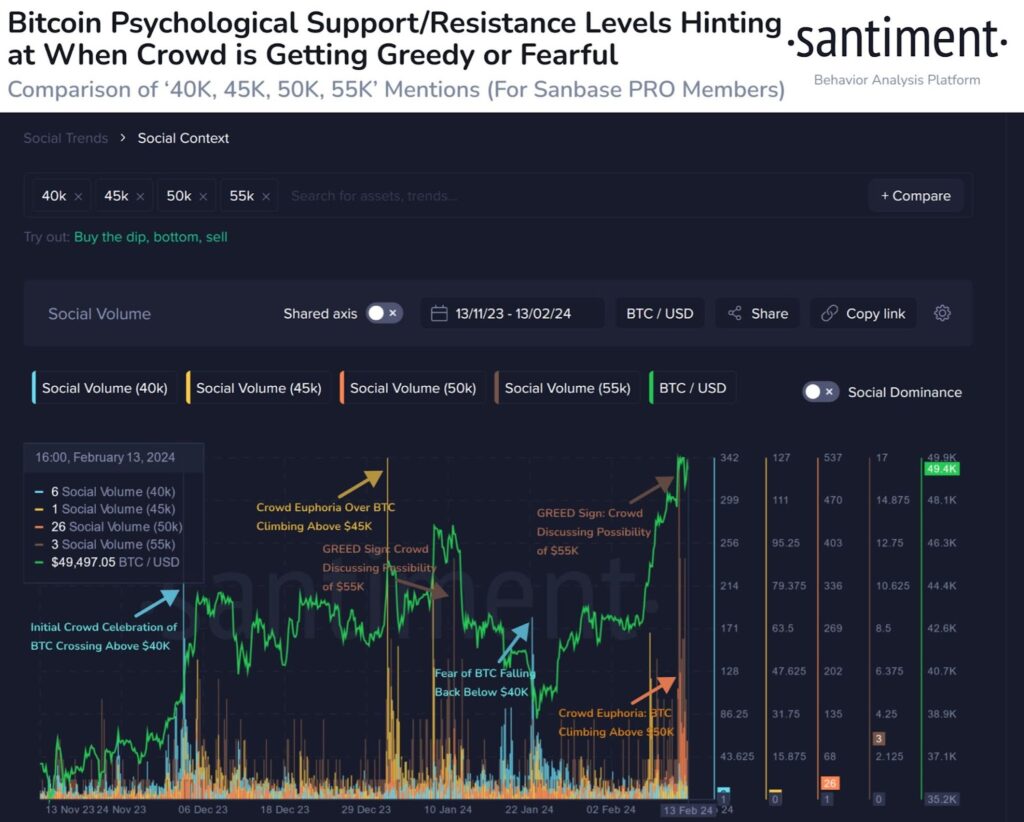

Analysts at Santiment, a prominent crypto analytics firm, highlighted the dynamic nature of market sentiment, which oscillates between fear and greed as Bitcoin approaches or breaches major price thresholds.

Santiment observed that with Bitcoin’s initial crossing of the $50,000 mark on Monday, February 12th, many traders anticipated a swift climb toward $55,000. This scenario mirrored the sentiment seen when Bitcoin breached the $45,000 mark just a month earlier.

However, such lofty expectations often precipitate temporary pullbacks as the market corrects itself following rapid ascents.

Consequently, Santiment advised investors to vigilantly monitor crowd sentiment, as it can offer insights into potential price movements. A healthy level of exuberance following a milestone is viewed favorably, whereas an uptick in greed and unrealistic forecasts may indicate a local peak.

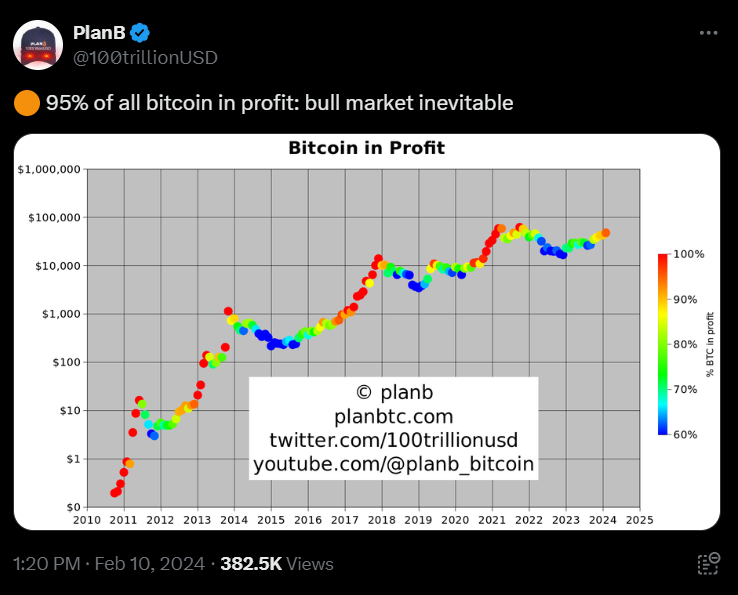

Notwithstanding the challenges, Bitcoin continues its upward trajectory, buoyed by growing confidence from experts and analysts. Notably, PlanB, a respected crypto analyst renowned for the stock-to-flow model, recently asserted on Twitter that a bullish market for Bitcoin is “inevitable.”

Impressive Spot Bitcoin ETF Volumes Propelling BTC Higher

A key catalyst propelling Bitcoin’s price surge is the increasing adoption of Bitcoin exchange-traded funds (ETFs), which enable investors to gain exposure to the cryptocurrency without direct ownership.

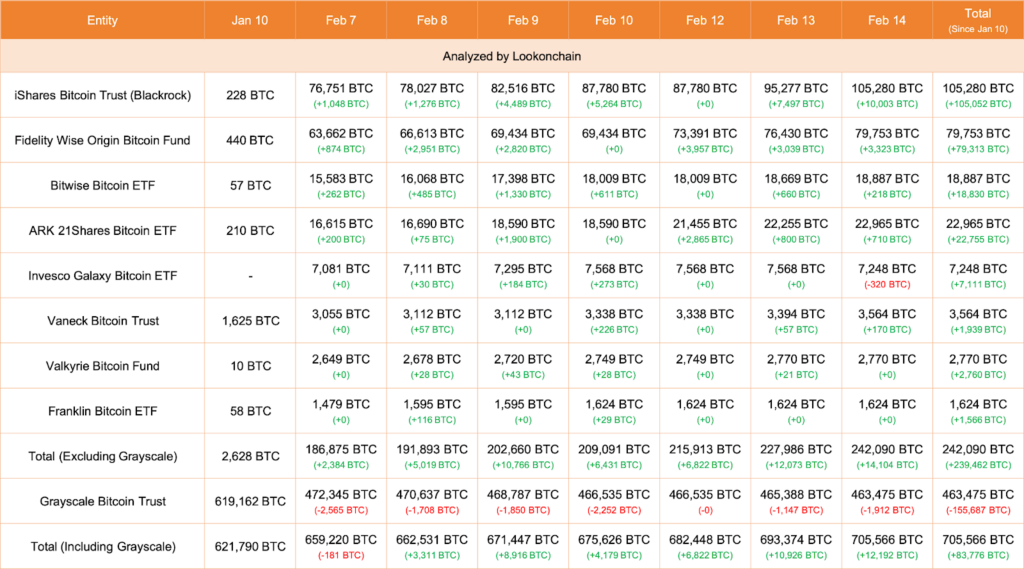

Lookonchain, a blockchain data platform, reported record inflows of 14,104 BTC, valued at $730.3 million, across eight Bitcoin ETFs on February 14.

Among these, BlackRock’s iShares Bitcoin Trust and Fidelity’s FBTC emerged as leaders, accumulating 10,003 BTC and 3,323 BTC, respectively. Other notable Bitcoin ETFs include ARK 21 Shares, Bitwise Bitcoin ETF, Vaneck Bitcoin Trust, and Valkyrie Bitcoin Trust.

Excluding Grayscale, the largest Bitcoin trust globally, the eight Bitcoin ETFs approved since January 10th currently hold 242,090 BTC. Including Grayscale, the total Bitcoin holdings reach a staggering 705,566 BTC, equivalent to over $36.5 billion.

BlackRock’s iShares Bitcoin Trust notably ascended to the top five U.S. exchange-traded products (ETPs) by capital inflow last week, attracting $3.2 billion since its inception. It now stands alongside leading traditional ETPs such as the Vanguard S&P 500 ETF and the iShares Core S&P 500 ETF.

Spot Bitcoin ETFs have witnessed a meteoric rise, accumulating $10 billion in assets under management within the initial 20 days of trading. Bloomberg ETF analyst Eric Balchunas highlighted that achieving this milestone took the GLD ETF, the largest gold ETP, almost two years, whereas Bitcoin ETFs accomplished it in just 32 days.

Bitcoin’s surge past the $1 trillion market cap threshold underscores its growing prominence in the global financial landscape, marking a watershed moment for the cryptocurrency industry as it continues to garner mainstream acceptance and investment interest.

Will Bitcoin Push for $64,000 in the Near Term?

On the technical analysis front, Bitcoin is firmly on track to breach the $52,000 top in the near term as traders turn their focus toward the $64,000 peak. Except for February 13, the benchmark cryptocurrency has now recorded a 9-day bullish streak, climbing over 22% within this relatively short period.

Regardless, this doesn’t isolate BTC from a sharp drop in the coming days, which is always a possibility when it comes to crypto. In such an event, however, we can expect some support action from the $50,000 round figure, followed by the $47,500 mark.

All in all, it would be interesting to see how Bitcoin performs in the coming week, keeping in mind that February is a historically bullish month for Bitcoin and the crypto market.

BTC Statistics Data

BTC Current Price: $51,900

Market Cap: $1.023T

BTC Circulating Supply: 19.6M

Total Supply: 21M

BTC Market Ranking: #1

Get accurate, winning trading signals: https://learn2.trade/

Best crypto trading bot: https://learn2.trade/crypto-trading-bot

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Get up to $10,000 Bonus!

Sign Up