In a positive development for the world’s largest cryptocurrency, Bitcoin rallied over 5% on Wednesday, May 15, following the release of softer-than-expected inflation data in the U.S.

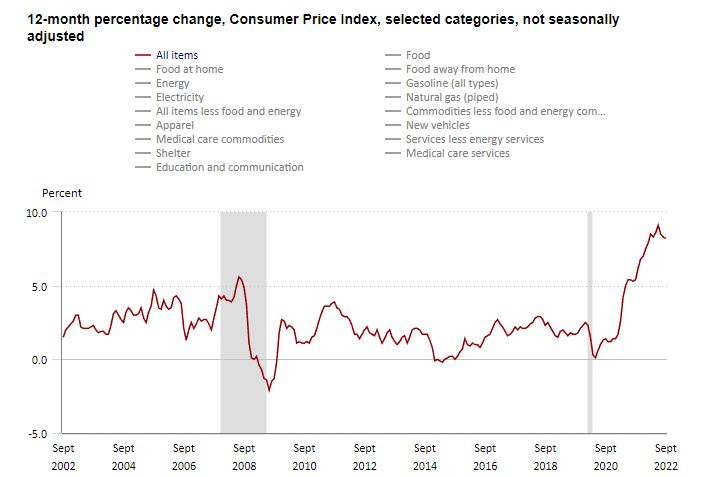

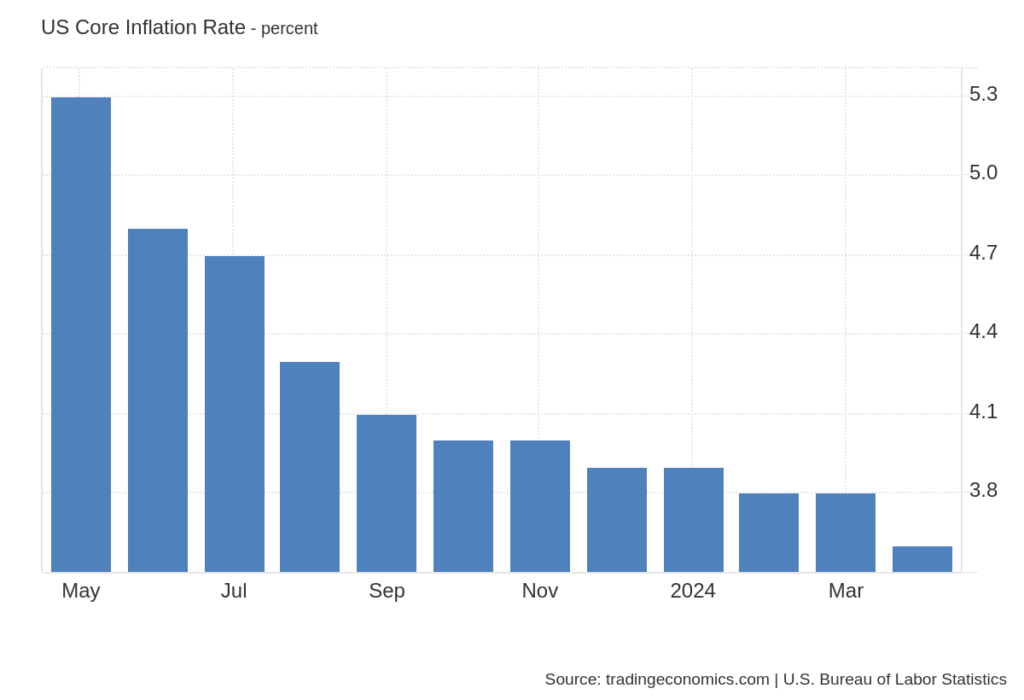

The Consumer Price Index (CPI) rose just 0.3% in April, lower than the 0.4% forecasted by economists. This easing of inflation pressure has reignited hopes that the Federal Reserve may consider interest rate cuts later this year, a prospect that had dimmed in recent weeks as economic data remained robust.

Bitcoin, which had been trading under pressure lately on expectations of persistently high interest rates, jumped above the $65,000 mark in the minutes following the CPI report. The cryptocurrency has a history of performing well during periods of accommodative monetary policy, as lower rates typically boost demand for risk assets.

Bitcoin Miners in the Spotlight as “Hash Ribbon” Suggests Possible Resurgence

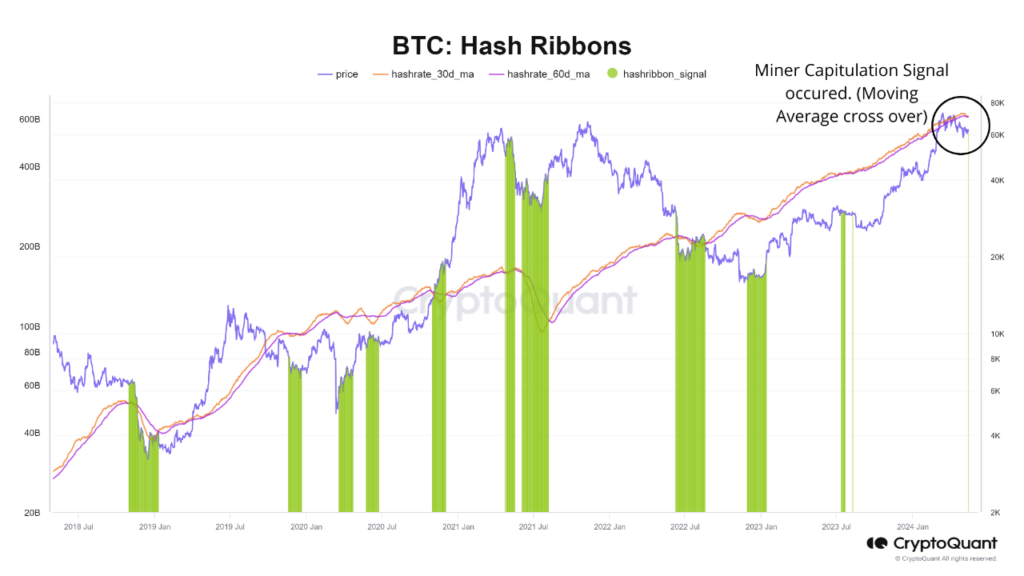

Bitcoin’s recent rally comes at a time when its network is undergoing a significant shift in mining dynamics. The Bitcoin Hash Ribbons, an indicator that uses the 30-day and 60-day moving averages of the network’s total hash rate to gauge miner health, recently flashed a capitulation signal.

This occurs when the 30-day moving average crosses below the 60-day moving average, suggesting that less efficient miners are being forced to shut down operations due to declining profitability.

Miner capitulation events have historically coincided with Bitcoin market bottoms, as they represent a flushing out of weak hands and a transfer of mining power to stronger, more efficient players. However, the exact timing of a bottom following a capitulation signal can vary, often unfolding over the subsequent days and weeks.

Several factors have likely contributed to the current miner stress, including Bitcoin’s recent price consolidation, the reduction in block rewards following the latest halving event, and potentially higher electricity costs in some regions.

As less efficient miners drop off the network, the remaining miners may see improved profitability and a stronger incentive to hold onto their earned Bitcoin, thereby reducing selling pressure.

What’s Ahead for Bitcoin?

Looking ahead, Bitcoin’s near-term prospects will likely hinge on the evolving macroeconomic landscape and the response from miners. If inflation continues to moderate and the Fed signals a more dovish stance, Bitcoin could extend its rally as investors seek out higher-risk, higher-reward assets. Conversely, if economic data surprises to the upside and forces central banks to maintain a hawkish tilt, Bitcoin may face renewed headwinds.

Regardless of the short-term volatility, however, Bitcoin’s underlying fundamentals remain strong. The network continues to attract significant investment and development activity, with a growing number of institutional investors and corporations holding Bitcoin as a reserve asset.

As the world navigates an uncertain economic environment, Bitcoin’s unique blend of scarcity, decentralization, and resilience could make it an increasingly attractive option for investors seeking to diversify their portfolios and hedge against inflation.

BTC Dominates in May

On the technical front, Bitcoin has recorded a strong performance in May since starting the month around the $56,555 mark. Per the 4-hour MEXC chart, BTC has steadily recorded higher lows over the past two weeks, despite being under bearish pressure. BTC has risen by about 15% from its May low to the present price of $65,000.

The latest surge could help the benchmark cryptocurrency return to the $67,000 area over the coming days as traders wait for the halving factor to kick in. In the meantime, any pullback will be met with strong resistance around the $62,500 support level, where more accumulation could occur and drive prices higher once again.

BTC Statistics Data

BTC Current Price: $65,000

Market Cap: $1.28T

BTC Circulating Supply: 19.6M

BTC Total Supply: 21M

Market Ranking: #1

Get accurate, winning trading signals: https://learn2.trade/

Best crypto trading bot: https://learn2.trade/crypto-trading-bot

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading! Learn about interoperability now!

Join MEXC and Start Trading Today!