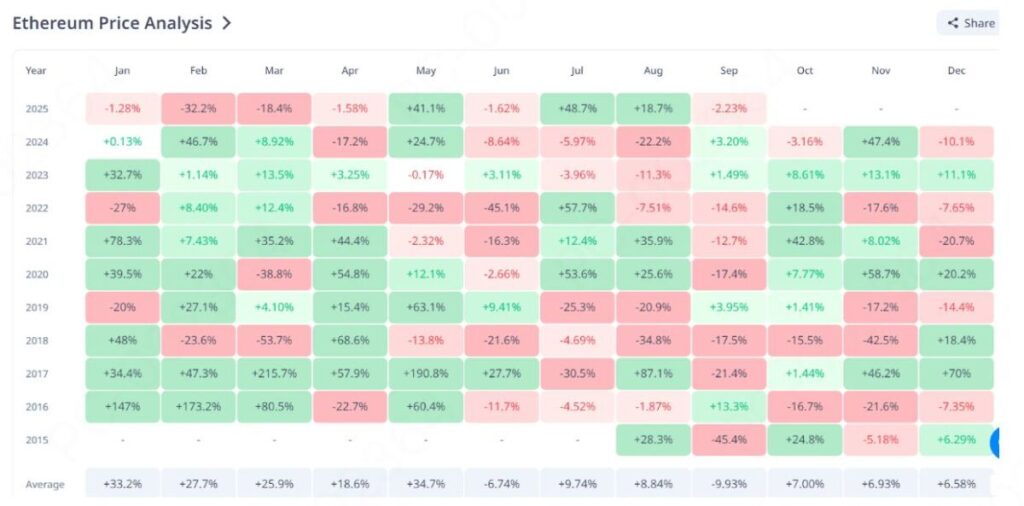

The Ethereum ecosystem showed the strongest growth rates in August since May 2021. The network’s underlying asset – the altcoin ETH – was closely approaching $5,000 last month.

According to CryptoRank, on August 24, crypto broke above $4,900, but by the end of the month it began to correct under the pressure of traders taking profits on the rally.

Overall, in the last summer month, ETH gained 18.7% in value. For the first time since 2021, the coin finished in the green in August. The rise of the digital currency was accompanied by a surge in network activity on Ethereum.

Last month, the ETH blockchain processed transactions totaling $346.16 billion (according to The Block). The trading volume on the network in August was the highest since May 2021.

1. A quick correction as a result of a change in traders’ tactics

The local peak for Ethereum on the exchange MEXC was marked at $4,952, reached on August 24.

But by the end of August, the altcoin began to correct as traders shifted to profit-taking. As a result, it fell to $4,266, but at the beginning of September managed to partially recover, strengthening to $4,385.

The relative strength index (RSI) this week found itself in the neutral zone, the rate ETH will be determined very soon.

Bulls face the task of overcoming the resistance formed in the range of $4,400 to $4,900. However, bears, on the contrary, are interested in weakening the rate and will press until they can push the crypto below $4,000.

Currently, traders targeting a bullish scenario are in a more advantageous position.

Open interest in perpetual futures for ETH on MEXC has been strengthening since August. As of September 3, the turnover of futures on the exchange grew to 4.838 billion USDT per day.

The funding rate is in positive territory, which also indicates preparations for a new run. Another factor hinting at long-term growth for Ethereum has been the increase in institutional investments in crypto-focused funds.

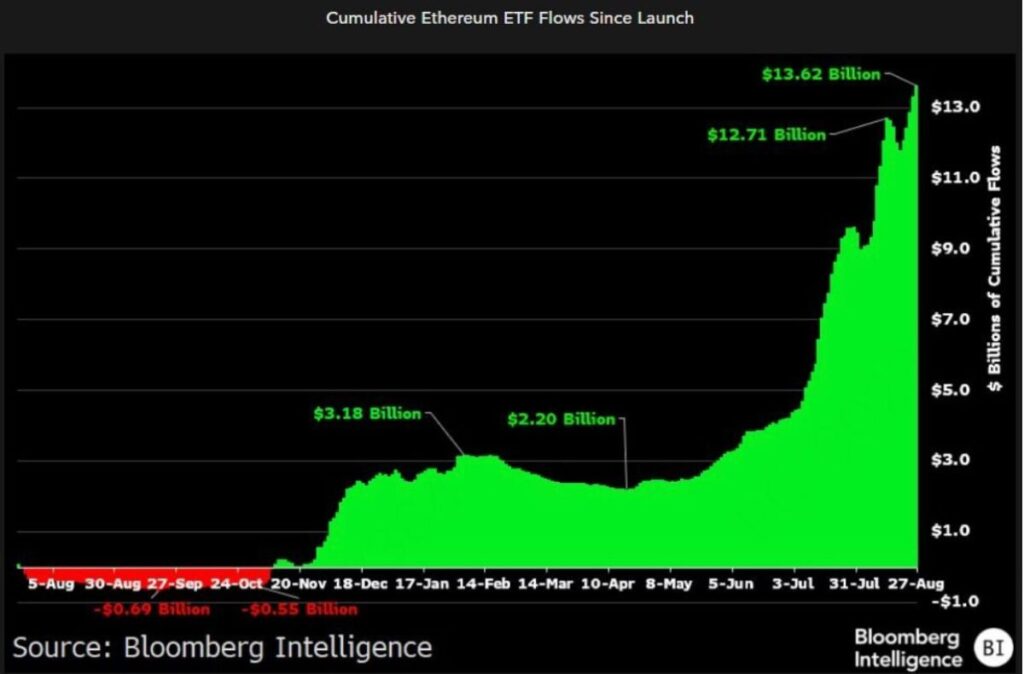

According to Bloomberg Intelligence, spot Ethereum ETFs in the American stock market have attracted nearly $10 billion since the beginning of July. The inflow of capital since the launch of such instruments has approached $14 billion.

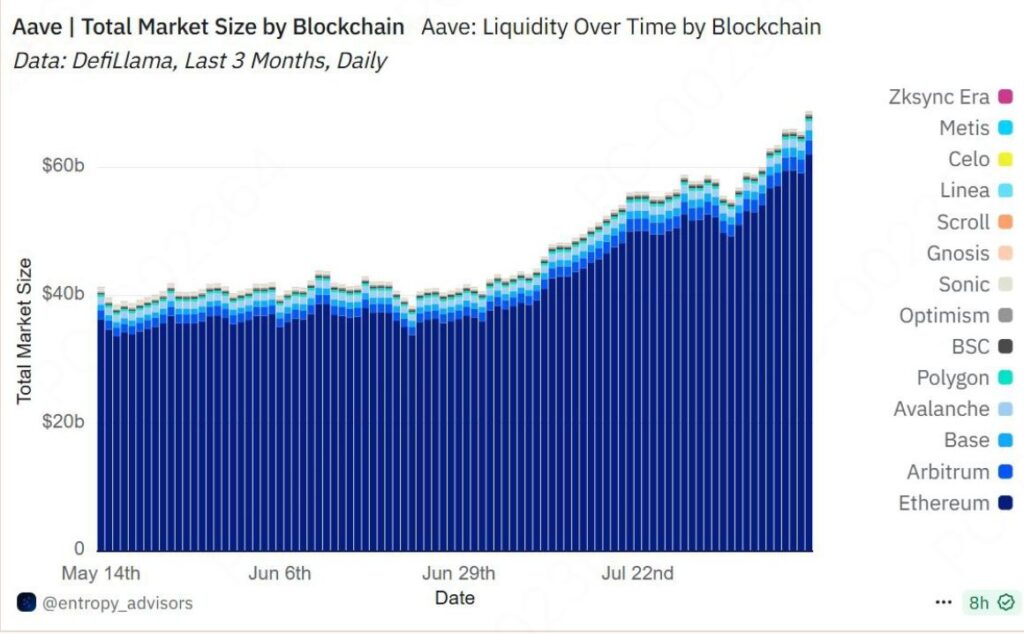

The attractiveness of ETH is enhanced by the expansion of the Ethereum ecosystem, as this altcoin serves as its underlying asset. The value of tokenized gold in the blockchain has increased to nearly $2.2 billion.

Ethereum remains the primary platform for the DeFi protocol Aave. About 90% of the liquidity of the project, which accumulated assets worth $69 billion, is based on ETH (according to Dune Analytics).

2. Low fees – as a trigger for activating ETH addresses

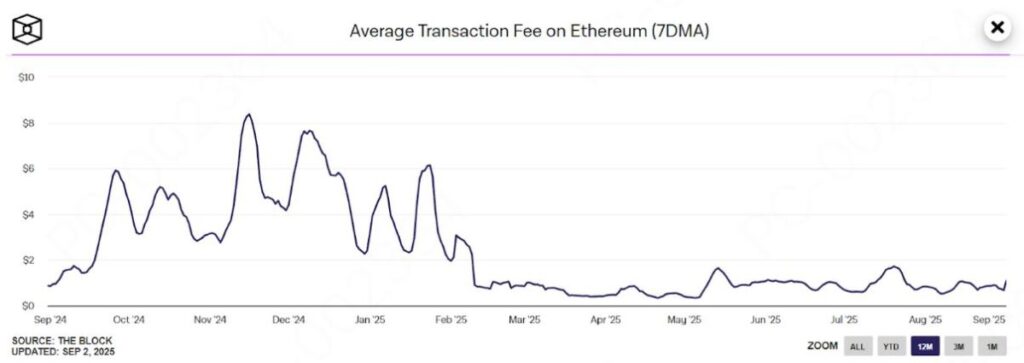

Transaction fees in the Ethereum network are currently at their lowest level in the last five years.

The decrease in the cost of sending funds encourages broader use of the blockchain. Network throughput was improved by developers through the Dencun update in March 2024. This fork activated the EIP-4844 solution, which has reduced data transmission costs.

At the same time, Dencun solved another problem – improving Ethereum’s compatibility with second layer (L2) blockchains, where fees are even lower.

In May 2025, developers activated the Pectra fork, which expanded users’ capabilities on the network and increased validators’ efficiency.

The improvement in Ethereum’s throughput created conditions for reducing transaction fees. The average fee last month dropped to $0.76, at the beginning of September it rose to $1.

Let’s remember that in January 2025, network fees exceeded $6, and in November-December 2024 they reached $8.

Fees decreased despite the increased load on the blockchain in July-August. The number of withdrawal requests is growing, and a similar situation is observed with the number of applications for token deposits in ETH wallets.

User activity in the network increased, with more funds being sent for staking.

The ETH 2.0 deposit contract has accumulated tens of billions of dollars this year. Nearly 29.5% of the total Ethereum supply is already staked.

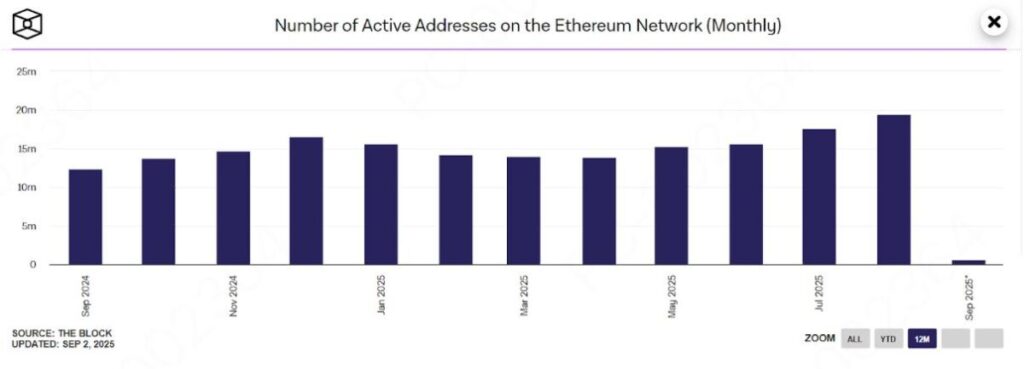

The number of active addresses on Ethereum in August was 19.45 million, and in the first days of September, it approached 700,000. (according to The Block).

Service EtherScan indicates a consistently high number of daily transactions on the network – 1.692 million.

3. Monthly volume of ETH transactions soared to a peak since 2021

In August, the transaction volume on Ethereum rose to $346.14 billion. The monthly turnover in the blockchain was the highest since May 2021, largely due to increased activity from participants in decentralized finance (DeFi) and tokenized corrections (NFT).

The ETH ecosystem demonstrated powerful growth last month in all areas, including the number of transactions and the daily number of addresses participating in transactions.

According to the service DeFiLlama, the value of digital assets locked in DeFi projects based on Ethereum exceeded $91.5 billion. The increase in network activity was accompanied by a capital inflow into spot crypto ETF funds, as well as an increase in corporate investments in Ether.

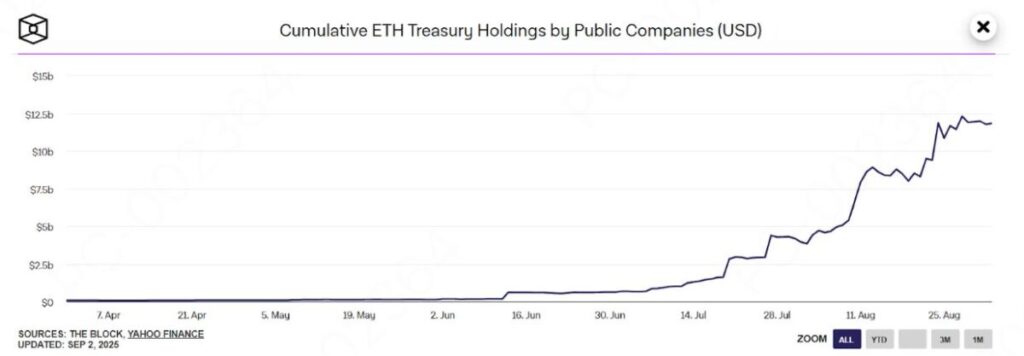

This digital asset is becoming more attractive to companies. Their Ethereum reserves have increased from $3 billion to $12 billion over the month. The largest crypto purchases were made by BitMine Immersion and SharpLink Gaming. с $3 млрд до $12 млрд. Самые крупные покупки крипты совершили BitMine Immersion и SharpLink Gaming.

Spot Ethereum ETFs in the American stock market accumulated over 5% of the altcoin’s market turnover. Analysts estimate that the inflow of institutional capital is becoming the leading factor driving the strengthening of the ETH price.

If corporate crypto purchases increase in the coming months, it could easily break above $5,000. Institutional support will be the main trigger for a new Ether rally.

Disclaimer: This information is not investment, tax, legal, financial, accounting, consulting, or any other related service advice, nor is it advice on the purchase, sale, or holding of any assets. MEXC Education provides information for reference purposes only and is not investment advice. Please ensure that you fully understand all risks and exercise caution when investing. The platform is not responsible for users’ investment decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up