Understanding crypto taxation is becoming increasingly important for Nigerian traders and long-term investors. As digital assets gain wider adoption, regulatory clarity continues to grow, and every user deserves to know how taxes may apply to their crypto transactions.

MEXC’s goal is simple: help you trade confidently by understanding the rules that protect you. This guide breaks down the key things every Nigerian trader needs to know about crypto taxes in clear, simple language.

1. Is Crypto Taxable in Nigeria? The Current Regulatory Reality

Nigeria does not yet have a full, dedicated crypto tax law. However, the Federal Inland Revenue Service (FIRS) has signaled that digital assets may fall under existing tax categories, depending on how they are used.

This means every trader should understand the general tax principles that may apply:

- Income Tax — if crypto trading is your primary source of income

- Capital Gains Tax (CGT) — if you profit from buying and selling assets

- Value-Added Tax (VAT) — likely only applies in business-related crypto transactions

- Company Income Tax (CIT) — if a registered business earns from crypto.

See FIRS Capital Gains Tax framework

2.What Crypto Transactions May Be Taxable in Nigeria?

Below are the most common crypto activities and the tax categories they may fall under based on Nigeria’s existing laws.

1. Spot Trading (Capital Gains Tax)

If you buy BTC, ETH, USDT, or any asset and later sell at a higher price, the profit may fall under Capital Gains Tax (10%).

Example:

- Buy BTC at ₦20m

- Sell at ₦25m

- Profit = ₦5m

- CGT applies on the ₦5m gain

2. P2P Trading (Income or CGT)

If you occasionally buy or sell crypto via MEXC P2P, it may be treated as capital gains. If you operate as a merchant, frequent profits may classify as income, subject to Personal Income Tax.

3. Futures Trading (Taxable Income)

Profits from futures trading, whether isolated or cross margin, may be categorized as income, since they function like financial derivatives.

Learn how MEXC Futures work

4. Staking & Earn Products (Income Tax)

Rewards from:

- MEXC Simple Earn

- Flexible staking

- Fixed staking

- Launchpool rewards

are typically viewed as passive income, similar to interest earnings.

5. Crypto Used for Business Transactions (VAT & Income Tax)

If a company uses crypto for payments, payroll, or services, normal tax rules apply:

- VAT (7.5%)

- Company Income Tax (30%)

- Withholding tax where applicable

This applies to businesses, not personal traders.

3. What Is Not Taxable?

Nigeria does not typically tax the following activities:

- Holding crypto without selling

- Transferring crypto between your own wallets

- Receiving crypto as a gift (unless later sold for profit)

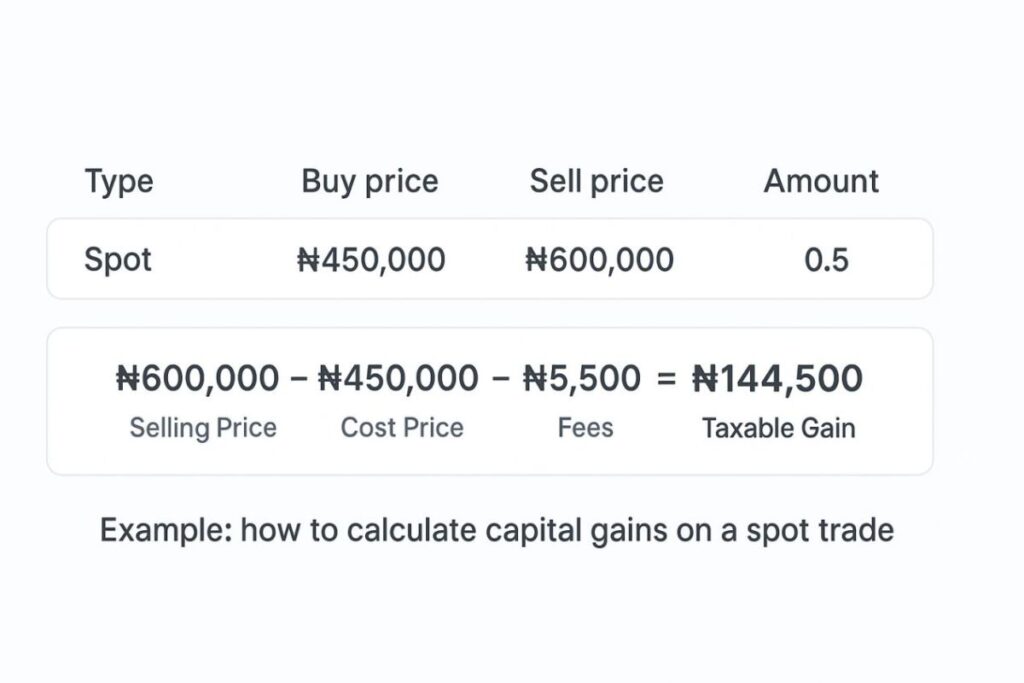

1.1 How To Calculate Your Crypto Taxes (Simple Method)

Taxable events usually follow this formula:

For Capital Gains: Profit = Selling Price – Cost Price – Transaction Costs

For Income: Taxable Income = Total Profit Earned (after deducting eligible expenses)

Record Keeping: What Nigerian Traders Should Track

To stay compliant and avoid issues with regulators, traders should keep:

- Transaction history

- Deposit & withdrawal proof

- P2P order receipts

- Bank transfer records

- Trading fee statements

- Staking reward logs

MEXC makes this easier through downloadable reports available on your user dashboard. How to download MEXC transaction history

How MEXC Helps Nigerian Users Stay Confident and Compliant

As regulations evolve, MEXC is committed to offering transparency, education, and user-friendly tools. Here’s how we support our Nigerian community:

1. Clear Transaction Reports

Downloadable trading records help users calculate potential gains or income easily.

2. Secure & Transparent P2P System

All orders are logged, verifiable, and protected under MEXC’s escrow system.

3. Zero-Fee Trading on Select Markets

Zero-fee trading supports users by allowing them to maximize net gains and reduce friction. Explore MEXC Zero-Fee Pairs

4. Educational Resources & Guides

Tax literacy is part of responsible trading. MEXC publishes compliance-friendly guides to help users stay informed.

5. Global Standards, Local Awareness

MEXC follows international security compliance frameworks, giving Nigerian users access to a platform that meets global best practices.

Crypto Taxation FAQs in Nigeria

1. Does Nigeria officially tax crypto? Nigeria does not yet have a dedicated crypto tax law, but existing tax laws can apply in certain situations.

2. Will all crypto trades be taxed? No. Only profit-generating events may qualify.

3. Are P2P bank transfers monitored? Banks may request clarification for high-volume activities. Keeping proper records protects traders.

4. Should small traders be worried? No. Tax systems are designed for fairness, nor punishment. Understanding the basics helps you stay prepared.

Final Call: Trade Confidently, Stay Informed

Crypto taxation doesn’t need to be complicated. With the right information and careful record-keeping, Nigerian traders can navigate the ecosystem with confidence.

MEXC is committed to supporting Nigerians with clarity, transparency, and the tools needed to trade responsibly and successfully.

Disclaimer:

This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up