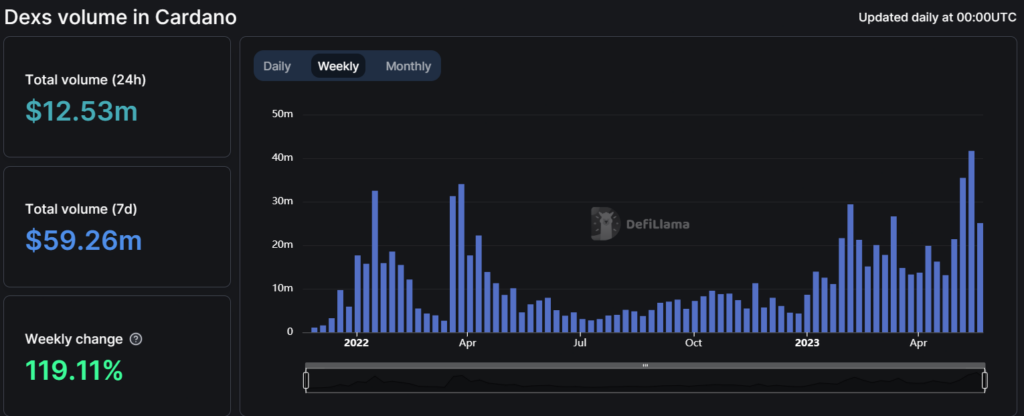

Cardano (ADA) is making waves in the decentralized finance (DeFi) landscape, soaring to the ninth spot on the list of the world’s largest decentralized exchanges (DEXs) by trading volume. With a trading volume exceeding a remarkable $12.5 million within 24 hours and a weekly average of over $55 million, Cardano has firmly established itself as a force to be reckoned with.

Minswap, a key player within Cardano’s ecosystem, is mostly responsible for the network’s remarkable success in the DEX space. Minswap’s user-friendly interface, combined with Cardano’s lightning-fast and rock-solid network, offers traders from all corners of the globe a seamless and enjoyable trading experience. Their efforts have played a vital role in propelling Cardano into the top 10, overtaking competitors like Fantom, and setting its sights on the next challenge: Tron.

What’s Behind Cardano’s Rapid Growth?

The rapid growth of Cardano within the DeFi sector speaks volumes about its robust and efficient network architecture, which has captured the attention of countless projects, developers, and users. While traditional DeFi projects have certainly contributed to Cardano’s rise, the emergence of meme coins on the platform adds an intriguing twist. These tokens, fueled by social media buzz and community engagement, have become a significant driver of Cardano’s recent trading volume.

The proliferation of meme coins on Cardano highlights the network’s adaptability and commitment to inclusivity. It’s a testament to Cardano’s ability to accommodate a wide range of tokens and projects, catering to both serious DeFi initiatives and those looking to embrace their inner whimsy with meme tokens. This versatility sets Cardano apart and solidifies its reputation as a dynamic force within the DeFi landscape.

Cardano Scores Big in On-Chain Metrics, IntoTheBlock Report Shows

But Cardano’s achievements don’t stop at DeFI trading volume alone. The network has also exhibited robust on-chain performance, as confirmed by a recent analysis from data analytics firm IntoTheBlock. According to their findings, Cardano’s transaction volume has skyrocketed by an impressive 205% year-to-date, with over 26 billion ADA being transacted daily.

What’s driving this surge in transaction volume? It turns out that ADA whales are making quite the splash. These large holders have been accumulating ADA significantly, and recent spikes in net flows reveal their continued confidence in the project. It’s clear that Cardano’s commitment to expansion through various initiatives and development pursuits is paying off.

Cardano’s resilience in the face of the cryptocurrency market downturn is also worth noting. While other projects have experienced setbacks, Cardano’s transaction numbers have remained steadfast. The analysis shows a resilient bounce of 33.45% from this year’s lows, with a notable peak in daily transaction volume reaching a three-month high of 98,000.

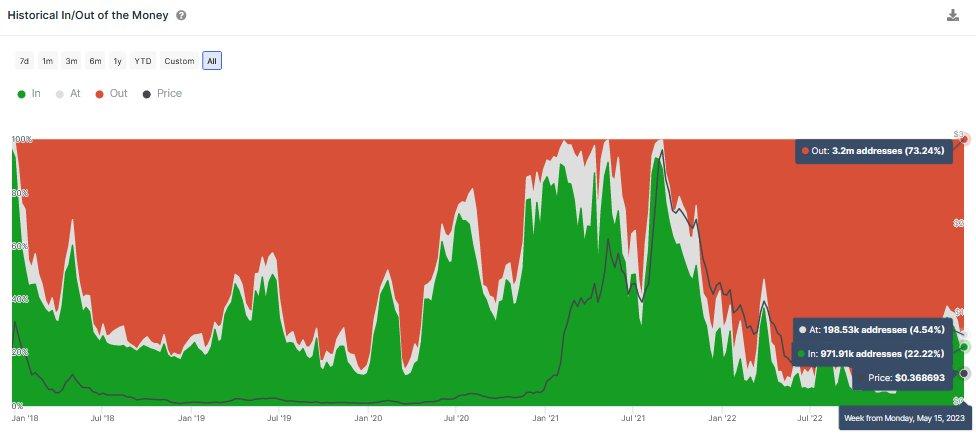

As for profitability, the IntoTheBlock report revealed an intriguing mix of fortunes. As of the time of the report, about 22% of ADA addresses were in the green, enjoying profits, while 4.5% were breaking even. However, a majority of 73.2% found themselves in the red, enduring losses.

For savvy investors, this presents potential opportunities to enter the market at attractive prices.

It’s Not Looking So Good for the Price of ADA at the Moment

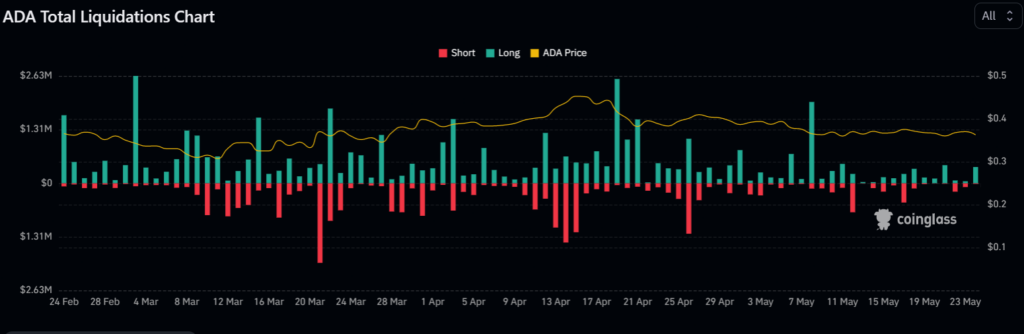

The last week of May has been rather unpleasant for the crypto market and Cardano, as crypto bulls count their losses. Amid significantly low volatility, the price of ADA appears to have fallen into a sideways pattern, with the $0.380 level acting as a strong ceiling. However, despite being in a sideways pattern, the overall bias remains tilted downward, with the cryptocurrency recording about $400K in liquidations.

Regardless, ADA is safe from a bearish selloff as long as the price holds above the $0.350 support mark. Failure to prop itself above this mark could lock it on course for the $0.300 11-week low.

ADA Statistics Data

Current Price: $0.362

Market Cap: $12.6B

Circulating Supply: 34.8B

Total Supply: 45B

Market Ranking: #7

Get accurate, winning trading signals: https://learn2.trade/

Best crypto trading bot: https://learn2.trade/crypto-trading-bot

Personal Note From MEXC Team

Check out our MEXC trading page and find out what we have to offer! You can learn more about crypto industry news. There are also a ton of interesting articles to get you up to speed with the crypto world. Lastly, join our MEXC Creators project and share your opinion about everything crypto! Happy trading!

Join MEXC and Start Trading Today!