“Aptos flips Solana in the Layer 1 game. I’ll put that out there.”

In June, Bitmex founder Arthur Hayes boldly predicted on a podcast that Aptos (APT) would surpass Solana (SOL) and become the second-largest Layer 1 blockchain within the next 1 to 3 years. Arthur Hayes didn’t dive into the reasons behind his prediction, but we can start to make sense of them by analyzing Aptos’ development.

Launched in October 2022, Aptos is the first Layer 1 blockchain built on the Move programming language, focusing on scalability, security, and developer experience. It addresses the long-standing security and scalability issues of the EVM and quickly captured attention after its launch.

The Aptos mainnet has officially been online for two years now and has achieved some remarkable milestones. Currently, the number of active addresses on the chain exceeds 27.8 million, with monthly active addresses reaching as high as 5.4 million and a total transaction count of 1.7 billion. It has completed a record of 326 million transactions in a single day, setting a new Layer 1 benchmark, and boasts over 250 innovative projects in its ecosystem. These achievements highlight Aptos’ strong appeal for both users and developers alike.

Aptos is Building the Premier Blockchain While Redefining the Future of Finance

In the blockchain world, programming languages serve as formal languages that define computer programs and are the foundational vehicles for achieving system functionality and goals. This is particularly important for Layer 1s, where the underlying programming language and logical architecture will largely determine its trajectory and future. Aptos’ impressive success over the past two years is largely thanks to its use of Move, one of the most efficient and secure programming languages available today.

Move was originally developed by Meta’s Libra team (now known as Diem) and is an open-source programming language based on Rust, designed to create customizable transaction logic and smart contracts. As an emerging programming language, Move offers enhanced security over traditional Solidity without increasing transaction compilation costs, helping to keep gas fees lower.

With the architectural advantages of Move, Aptos has managed to balance multiple dimensions, including security, performance, cost, and decentralization, making it a blockchain network with one of the best user experiences. However, Aptos’ potential extends far beyond this. In addition to “growing internally,” Aptos is able to bridge the gap between the real world and the blockchain world by connecting on-chain and off-chain data, breaking down barriers between reality and blockchain, and linking the decentralized characteristics and reliable data advantages of blockchain technology with the real world. From cross-border payments to institutional financial services, Aptos is changing the way value moves in the digital world.

On October 18, the Aptos Foundation announced that Franklin Templeton had launched the Franklin on-chain US government money fund (FOBXX) represented by the BENJI token on the Aptos Network. Institutional investors can access FOBXX assets in their digital wallets through Franklin Templeton’s blockchain integration platform, Benji Investments, and the BENJI token. Roger Bayston, head of digital assets at Franklin Templeton, stated, “We chose the Aptos Network given its unique characteristics which meet our rigorous suitability standards for the Benji platform.” Notably, Franklin Templeton is the second-largest tokenized fund by market capitalization and the first and only fund to utilize blockchain technology for transaction processing.

In September, the Hong Kong Monetary Authority (HKMA) launched the second phase of the “e-HKD” pilot program to further explore innovative use cases of new digital currencies for individuals and institutions. Aptos Labs is participating in this initiative and will collaborate with Hang Seng Bank and Boston Consulting Group to test the commercial viability of using the “e-HKD” to settle tokenized funds on a public blockchain.

Next year, Aptos will serve as the exclusive blockchain-supporting digital wallet service for the 2025 World Expo in Osaka, Japan. This will allow Expo participants to interact with NFTs, cryptocurrency, and decentralized applications through the Aptos-supported EXPO 2025 digital wallet. Potential use cases may include booth reservations, ticketing, and user engagement activities (such as digital collectibles). As the largest and most prestigious international exhibition, the Osaka Kansai World Expo is expected to attract over 28 million visitors from April to October 2025. This figure alone highlights the vast potential for applying blockchain technology in the real world—an opportunity often overlooked by other ecosystems.

Ongoing Initiatives to Build a Thriving Ecosystem

Returning to the Web3 world, the success of Layer 1 is inseparable from project innovation and development within the ecosystem. Aptos is well aware of the importance of the ecosystem and has been actively empowering its community through various community events, hackathons, grants, and external events since the launch of its mainnet, aiming to build a vibrant and sustainable ecosystem.

In September 2024, the Aptos Foundation hosted the first Aptos Experience conference in Seoul, bringing together numerous developers, industry leaders, and investors to collaboratively discuss the future of the Web3 ecosystem. Developers connected with other builders and thought leaders within the ecosystem, gaining inspiration for the next round of on-chain innovations.

In mid-October, the Aptos Code Collision Hackathon, which lasted for two and a half months, officially concluded. The event received support from many well-known institutions, including Google Cloud, MEXC Ventures, and Foresight Ventures, with almost 700 submissions entering the hackathon, making it the largest hackathon in the history of the broader Move ecosystem. The participating projects spanned various traditional fields such as DePin, ZK, gaming, NFTs, and DeFi, as well as emerging areas like AI, social, tooling, community, RWA, payments, VR, TG tools, dating, UBI, on-chain database systems, and decentralized machine learning infrastructure.

Earlier MEXC (MEXC and MEXC Ventures) announced a $20 million Aptos ecosystem fund aimed at supporting ongoing innovation in the Aptos ecosystem, sponsoring hackathons, investing in and incubating early projects, and providing support for the Move developer community. Meanwhile, MEXC launched a series of events centered around Aptos’s native token, APT, with a total prize pool of up to 1.5 million USDT. The events officially began on October 21, giving all users the chance to participate and share in huge prizes through events like Locked Savings and futures trading. During the event, MEXC allows users to trade and hold APT tokens without worrying about trading fees.

Bybit also recently launched an Aptos-themed airdrop event to actively encourage users to explore Aptos ecosystem applications such as Panora, Amnis Finance, Balance, and VibrantX through airdrops.

All these measures support the vibrant activity of the Aptos ecosystem across various sectors.

Overview of Aptos Ecosystem Projects: The Alpha of the Future

In a recent article celebrating its 2nd anniversary, the Aptos Foundation pledged over $150 million to drive innovation in 165 projects.

Currently, the Aptos ecosystem includes over 250 innovative projects across multiple fields, including DeFi, RWA, Memes, and GameFi. Here are some of the most notable top projects in the Aptos ecosystem:

Aries Markets is the largest DeFi lending project on Aptos and the first OG project to launch in the ecosystem. The project offers various functions, including lending, leveraged trading, and interest-bearing assets, and recently introduced an “Efficiency Mode” aimed at improving capital utilization. Currently, the project’s TVL has reached $260 million, accounting for more than a quarter of the total TVL in the Aptos ecosystem. To date, the protocol’s borrowing volume has exceeded $410 million, underscoring its importance in the ecosystem.

Recently, Aries Markets launched the “Insight into 2 Years of Aries Markets” campaign to celebrate its 2nd anniversary. From October 26 to November 13, participants can join the event by discussing their Aries Markets insights on Twitter by tagging @AriesMarkets and adding the #AriesMarkets hashtag.

Amnis Finance is the first liquid staking protocol in the Aptos ecosystem and one of the largest projects in this field. As a foundational component of the Aptos ecosystem, Amnis Finance has launched a secure, user-friendly, and innovative liquid staking protocol that allows users to earn rewards in APT tokens while unlocking liquidity. Currently, its TVL exceeds $252 million, with over 300,000 stakers and a staking amount close to 25 million APT.

In September, Amnis Finance announced an investment from Gate Ventures, which will enable it to accelerate the integration of its innovative liquid staking solution within the Aptos DeFi ecosystem.

As major contributors to Aptos’s TVL, Aries Markets, and Amnis Finance have recently attracted attention from MEXC Ventures, which has committed to investing in these promising projects.

In the spirit of ‘promoting growth through synergy,’ MEXC Ventures looks to stay at the forefront of Aptos’ innovation and actively collaborate with Move builders to drive ecosystem development. Alongside its OG projects, the Aptos ecosystem also has a roster of emerging stars:

Echo is a groundbreaking protocol focusing on the BTCFi multifunctional protocol within the Move ecosystem. It brings Bitcoin liquidity restaking, bridging, and yield infrastructure into the Aptos ecosystem, marking an important milestone in cross-chain interoperability and yield generation. The launch of Echo Protocol has led to significant TVL growth in the Aptos ecosystem, injecting $147 million within just one month. As of this writing, its TVL stands at $311 million.

Gui Inu is the top memecoin community on Aptos, aimed at incentivizing and rewarding creative development through community grants, fostering a captivating atmosphere, high engagement, and a culture of friendship. Its core principle revolves around rewarding the entire ecosystem, promoting seamless integration across the Aptos ecosystem, supporting the growth of diverse use cases, and ensuring ongoing revitalization within the ecosystem. The market capitalization of this token has exceeded $12.8 million, making it one of the most popular meme coins on the Aptos chain.

Because there isn’t time to give a full introduction to the many exciting projects in the Aptos ecosystem, we’ll briefly mention 4. Projects such as Thala, LiquidSwap, Cellana Finance, and Propbase have all achieved remarkable success in their respective niches, warranting market attention.

Could Aptos Be the Solana Killer?

Despite already having amassed many excellent projects, we believe that the Aptos ecosystem is still in a golden era of infrastructure development, with more projects set to join in the future, thanks to generous funding and support.

On the occasion of its 2nd anniversary, Aptos is still making strides, reaffirming its $150 million support plan for ecosystem projects and announcing a collaboration with Ignition AI accelerator, supported by NVIDIA, to support AI startups in the Asia-Pacific region and beyond.

On October 28, USDT officially launched natively on Aptos, ensuring that funds can flow seamlessly and securely across borders at minimal cost, providing higher liquidity for the Aptos ecosystem, which is crucial for its ecological development.

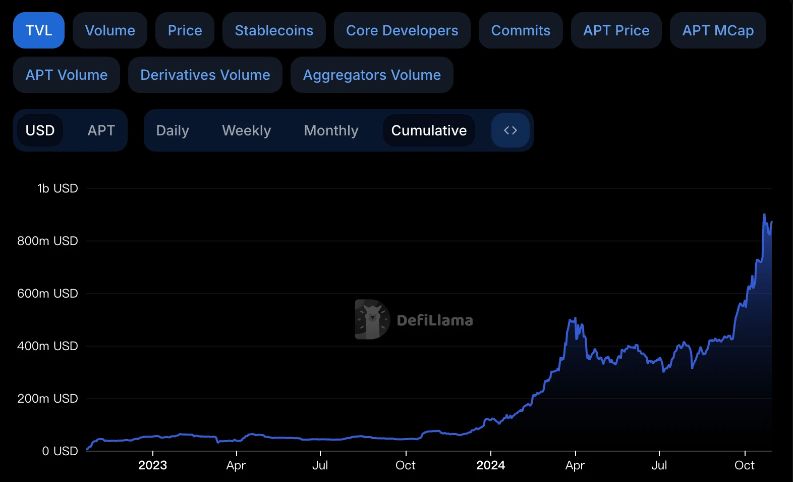

According to research from OurNetwork, Aptos’ TVL has grown nearly fivefold since the beginning of 2024, ranking among the top in growth among Layer 1 and Layer 2 projects, even surpassing the popular Layer 1 network Solana in 2024. Data from DefiLlama shows that Aptos’s current TVL is $875 million, continuously setting new record highs.

Looking ahead, the Aptos ecosystem will further leverage the advantages of the Move architecture to continue building a new economic system. By providing faster, cheaper, and safer financial solutions, Aptos will lead people into a new era of digital finance, attracting billions of new users.

Currently, we have reason to believe that Aptos, with its active ecosystem, substantial funding support, focus on user experience, and intention to bridge the gap between the blockchain world and the real world, will experience rapid growth, potentially becoming a Layer 1 network on par with Bitcoin and Ethereum.

Where to buy APT Token

You can find APT Tokens here at MEXC! We are listing APT/USDT in our main market! Furthermore, you can now enjoy 50% spot trading fee discounts on MEXC. Get your APT tokens now!

How to buy Aptos Token (APT)?

You can buy APT Tokens on MEXC by following the steps:

- Log in to your MEXC account. Click on [Spot].

- Search “APT” using the search bar to see the available trading pairs. Take APT/USDT as an example.

- Scroll down and go to the [Spot] box. Enter the amount of APT you want to buy. You can choose from opening a Limit order, a Market order, or a Stop-limit order. Take Market order as an example. Click [Buy APT] to confirm your order. You will find the purchased APT in your Spot Wallet.

You can find a detailed guide on how to buy APT Tokens here.

Join MEXC and Get up to $10,000 Bonus!

Sign Up