What is Margin Trading?

Margin trading refers to using the principal as a margin to borrow money from the platform to leverage up the funds for trading.

At present, MEXC margin trading supports up to 10 times leverage, which amplifies the profit ten times, while the risk of loss will also be amplified ten times. So please control the risk when using margin trading.

Why Use Margin Trading?

1. Multiple returns can be achieved. If you are bullish on certain crypto, you can use the principal as a margin to add leverage to the crypto, and both the principal and the borrowed crypto will “buy” the crypto to open a long position. For example, if you are bullish on the BTC market, you can borrow USDT while holding BTC, and then buy more BTC. If the market price rises, you can double/triple the income.

2. Short-selling income can be realized. If you are bearish on the market of certain crypto, you can use the principal as a margin to open a short position by “selling” the currency, and then “buying” the crypto to repay when the market falls to an ideal price. For example, if you are bearish on the BTC market, you can borrow BTC while holding USDT, and then sell it. If the market falls, you can buy back BTC and repay the loan. Thus, you can realize the profit of short BTC.

How to do Margin Trading?

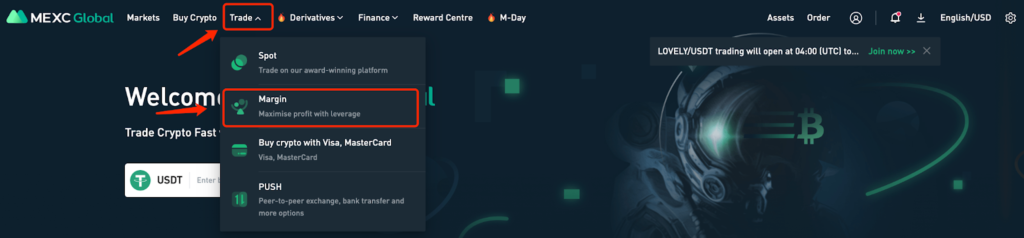

Step 1. Open a margin account. Log into your MEXC account, click on [Margin] on the top menu bar to go to the margin trading interface,

Click on “open a margin account” to open the corresponding margin account.

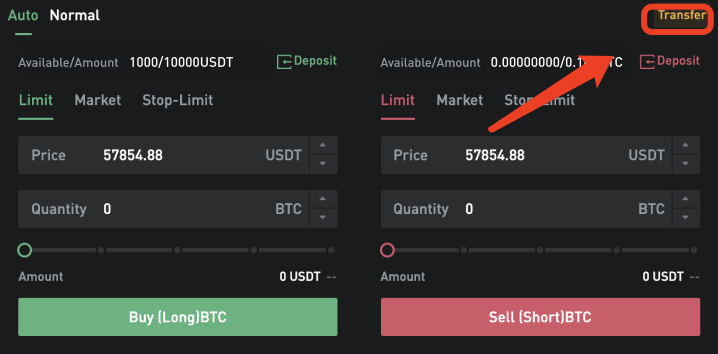

Step 2. Transfer Funds as Collateral. Click on [Transfer] and then transfer 1,000 USDT as collateral from spot account to a margin account.

Step 3. Auto-Borrow Trade.

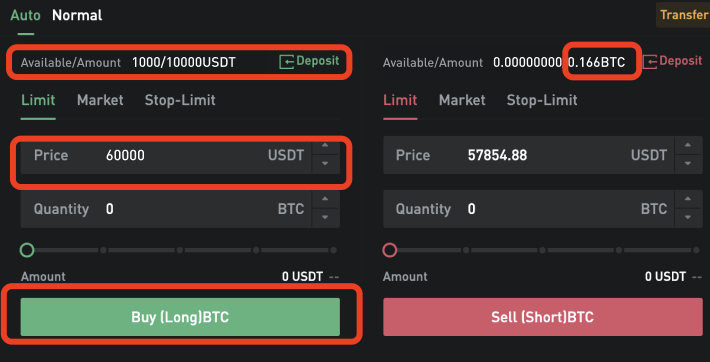

In the auto mode, you do not need to borrow/return the crypto manually, the system will automatically determine whether you need to borrow crypto according to your available assets and the number of orders placed. When placing an order, it starts to calculate the interest at the same time; if you cancel the order when the order is not filled or partially filled, the system will automatically repay the crypto to reduce the interest generated by your loan funds.

Now, with up to 10 times leverage for the BTC/USDT trading pair, the available amount is 10,000 USDT. This means you can buy up to 0.16 BTC in the margin trading when the BTC price is 60,000.

You may try to place an order with 6 times leverage. Enter price 60,000 and 0.1 for the quantity.

Once the order is fulfilled, you would have bought 0.1 BTC with the 1,000 USDT collateral and automatically borrowed 5,000 USDT.

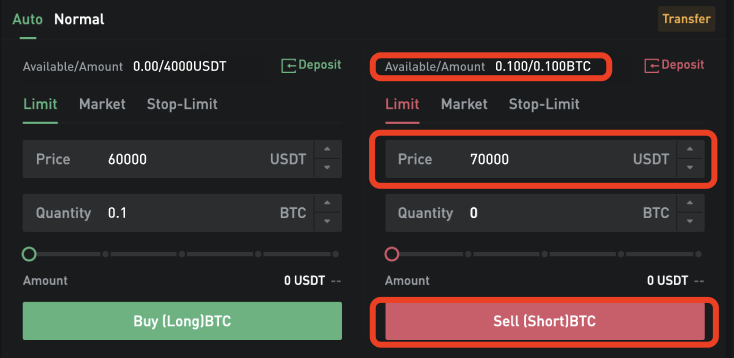

Step 4, Auto-Repay Trade. When BTC price is about 70,000 USDT, you may quickly sell 0.1 BTC at the market price. Once the order is completed, you will get 7,000 USDT.

After the borrowed 5,000 USDT is automatically refunded, there will be 2,000 USDT left in your margin account and you will earn 1,000 USDT profit (interest & commission excluded).

Summary

Margin trading is a way of trading by borrowing to amplify the principal. It may achieve multiple increases in income, but the risk will also increase as the leverage increases. You can learn margin trading knowledge and become proficient by reading other margin-related articles in MEXC Academy.

Join MEXC and Get up to $10,000 Bonus!

Sign Up