On August 5, a massive crash wiped out billions of dollars in value, leaving traders and investors in a state of uncertainty. Bitcoin (BTC) is down by 15%, reaching the $49,000 mark for a brief moment, while Ethereum (ETH) and other altcoins continue to spiral downward. What happens next? Will the market recover, or is this the beginning of a prolonged downturn?

Crypto Market Price Updates

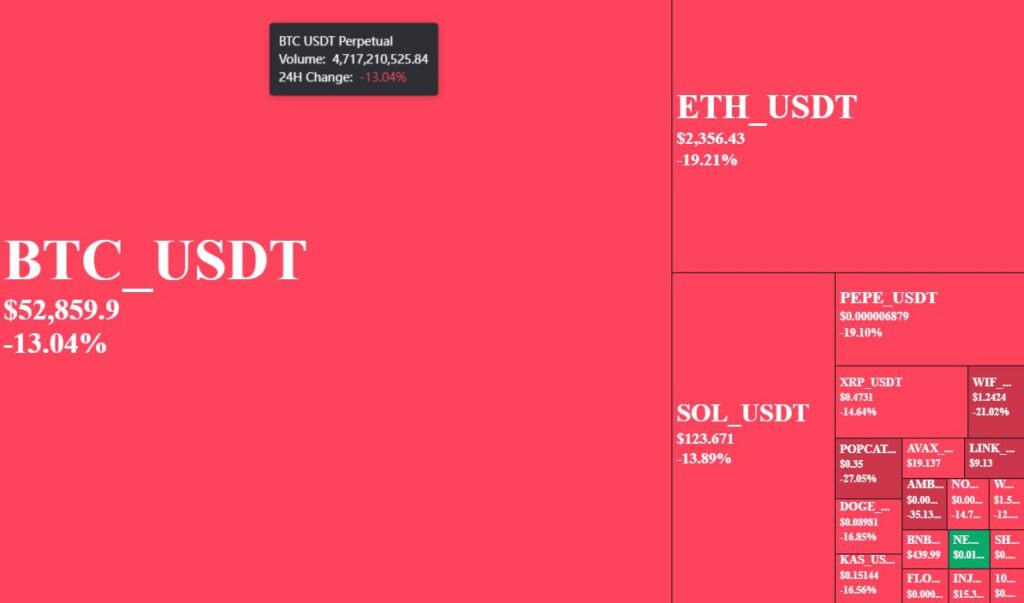

Bitcoin (BTC) opened trading at $60,684.38, with expectations of a relatively stable price movement. However, its price plummeted to $57,172. The bulls then launched a rally, lifting the leading cryptocurrency back above $59,000. Soon, Bitcoin failed to hold support, and BTC prices plummeted to a current low of $49,032.

At the same time, ETH‘s price plunged by more than 21%, trading at $2,117. During the past 24 hours, Ethereum’s lowest and highest prices were $2,117.09 and $2,923.47, respectively.

The overall altcoin market was at a huge loss as well. Prominent tokens such as MX Token (MX), Ripple (XRP), and Solana (SOL) dipped by 12.71%, 17.49%, and 18.71% respectively. Notably, only Tether Gold (XAUT) was up by 0.25% at the time of writing.

Why is The Crypto Market Down?

Currently, the crypto market is facing its worst week since the fall of FTX back in 2022. It has lost more than 13% of the global volume in a single week as well as more than $600 million outflows in leveraged long positions for major altcoins. Furthermore, the cause did not originate from a single source. There are a multitude of reasons.

Bank of Japan’s Rate Hikes

The recent crypto market drop is partly due to the Bank of Japan’s decision. On August 2, 2024, Japanese bank stocks notched their worst day of performance since 2008. Furthermore, they plan to raise interest rates from 0% to 0.25%. This rate hike, the first in years, has increased the cost of maintaining leveraged investments funded by cheap yen. Consequently, investors are left with fewer funds to invest in crypto assets, causing instability across financial markets, including cryptocurrencies.

Stock Market Correction

As a snowball effect, the Japanese stock market, the Nikkei 225, and TOPIX dropped by 12.5%. The loss on the Nikkei — which saw it close at 31,458.42 — was the worst day for the index since the “Black Monday” of 1987 and a 20% decline from their highs in July.

Mt.Gox Distributions

The long-anticipated Mt. Gox distributions are adding more pressure to the market. Previous instances of large Mt. Gox transfers triggered price declines and we believe this is another continuation of the situation. According to data from Arkham, Mt. Gox has successfully unloaded more than $7 billion in tokens, almost finishing its $9 billion asset distribution. As former creditors receive their payouts, some are choosing to sell their Bitcoin, increasing supply and pushing prices downward.

Tensions From Geopolitical Conflicts

Increasing geopolitical conflicts are significantly impacting investor sentiment. As the conflict between Iran and Israel escalates, we could potentially see worsening token prices. These issues contribute to the current market fear, and add to the challenges faced by the cryptocurrency market, further destabilizing it.

What Will Happen Next?

Just a few months prior, traders and investors were hoping for a bull run in the upcoming months. However, we are now holding on to our dear lives. Simultaneously, futures for the Dow Jones Industrial Average fell by around 1.5%. S&P 500 futures decreased by 2.8%, and Nasdaq-100 futures dropped by 4.9%. Nasdaq also recorded its third consecutive week of losses, plunging over 10% from its record high last month.

Therefore, it is believed that we are officially entering a bear market with a growing fear of recession. However, not all is lost. CEO of Bitwise Hunter Horsley believes that this could be the setting stage for an incredible bull run. He further notes that when interest rates come down and the fear of recession kicks in, wealth in equities and incomes will find their way into the market.

This holds especially true for the current situation. It is undeniable that the market is going down. However, it opens up opportunities for greater profits down the road. It also creates the best environment to purchase tokens at a much lower price. Buy the dip, am I right?

Top 3 Tokens That Are Worthy of Your Attention

Tether Gold (XAUT)

Tether Gold stands out as one of the few major altcoins that have managed to maintain its value, even amid current market volatility. Its stability and potential for growth make it an attractive investment, especially for those looking to hedge against inflation and economic uncertainty.

- As a token pegged to gold prices, it is relatively stable.

- It is seen as a hedge against inflation and market volatility.

- XAUT/USDT is currently trading at $2,436.49 (-0.72%)

- Learn how to buy XAUT/USDT at MEXC now!

MX Token (MX)

The MX Token (MX) is constantly gaining popularity with MEXC, known for its extensive range of trading pairs and competitive fees. As the native token of one of the fastest-growing exchanges, MX offers various benefits, including reduced trading fees and access to exclusive promotions, making it a token worth considering for investors seeking both utility and growth potential.

- Holding MX allows users to receive 200+ free airdrops monthly from MEXC, providing stable profits amidst the bear market.

- One of the best-performing CEX tokens with +600% growth since 2022.

- MX tokens are still in its infancy stage with a huge room to grow.

- MX/USDT is currently trading at $3.3495 (-6.93%)

- Learn how to buy MX/USDT at MEXC now!

Avalanche (AVAX)

Avalanche (AVAX) has rapidly risen in popularity due to its high performance and scalability. As a platform designed for decentralized applications and custom blockchain networks, AVAX offers fast transaction speeds and low costs, which are critical features in the evolving DeFi landscape. Its innovative consensus mechanism and growing ecosystem position AVAX as a promising token with significant long-term potential.

- Despite being in a bear market, the DeFi landscape continues to grow.

- This allows AVAX to show its full potential.

- AVAX/USDT is currently trading at $18.83 (-17.07%)

- Learn how to buy AVAX/USDT at MEXC now!

Conclusion

Despite the severe crash in the crypto market, there is potential for a strong recovery. Key tokens like Bitcoin and Ethereum have taken substantial hits. However, these challenges also create opportunities for strategic investments. Tokens like Tether Gold (XAUT), MX Token (MX), and Avalanche (AVAX) demonstrate resilience and promise. As market conditions evolve, particularly with potential declines in interest rates and easing recession fears, the current downturn could set the stage for future gains. Investors who navigate these turbulent times with insight and patience may reap significant rewards.

Join MEXC and Get up to $10,000 Bonus!