The Web3 industry is rapidly pivoting from speculative “meme” cycles toward a more foundational “Real Yield” era. At the heart of this shift is Real-World Asset (RWA) Tokenization, a sector that is no longer just a buzzword, but a seismic transformation in global finance. By 2030, this market is projected to reach a staggering $10 trillion.

Tokenization of real-world assets (RWAs) has been promised for almost a decade. Yet only recently has it moved from whitepapers and pilot projects into real balance sheets, real users, and real capital. The shift did not happen because blockchains suddenly improved. It happened because institutions finally found assets worth tokenizing and infrastructure mature enough to trust.

This article looks at tokenization as it exists today, not as a futuristic concept. We will examine how it actually works, where it is succeeding, where it is still fragile, and why RWAs are becoming one of the most serious narratives in Web3.

What tokenization really means

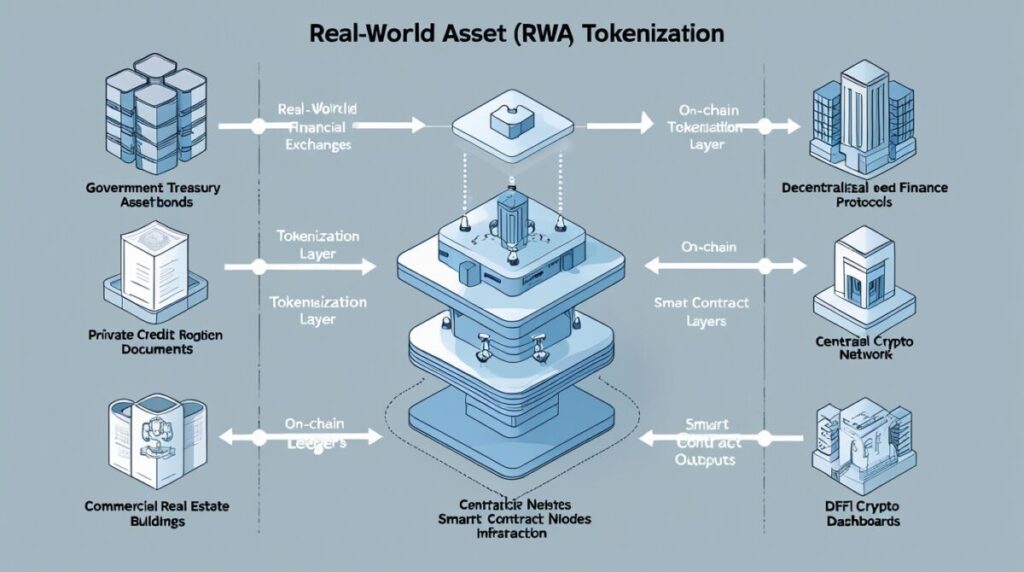

At its core, tokenization is the process of representing ownership or economic rights of a real-world asset on a blockchain. The asset itself does not magically move on chain. What moves is a legally enforceable claim tied to that asset.

This distinction matters. A token is only as strong as the legal, custodial, and operational systems behind it. Serious tokenization combines three layers: a legal structure that defines ownership, a custodian that safeguards the asset, and a smart contract that governs how tokens are issued, transferred, and settled.

When these layers align, blockchains stop being speculative rails and start acting like financial infrastructure

How tokenization works in practice

In real deployments, tokenization is less about code and more about coordination.

An issuer first structures the asset, often through a special purpose vehicle or trust that holds the underlying asset. Legal rights are clearly defined: whether token holders are entitled to yield, redemption, voting, or revenue share. Only then are tokens minted on chain, embedding compliance rules such as transfer restrictions or investor whitelisting.

Custody and reporting complete the loop. Assets are held with regulated custodians, and periodic attestations ensure that on-chain supply matches off-chain reality. Smart contracts automate distributions, but trust is anchored in audits, not promises.

This is why early success has concentrated around assets like treasury bills and money-market funds. They are simple to value, easy to custody, and already familiar to institutions.

Why tokenization matters, concrete benefits

Tokenization’s value is practical and measurable:

- Democratizes access. Fractional ownership lowers minimums and opens markets to retail and smaller accredited investors.

- Improves liquidity. Illiquid assets become tradeable on secondary markets, reducing bid–ask spreads and enabling price discovery.

- Faster settlement and lower friction. Settlement moves from T+2/T+3 banking rails to near-instant blockchain settlement where permitted.

- Transparency and auditability. On-chain records reduce information asymmetry; third parties can verify holdings and flows.

- Programmability. Automated coupons, graduated distributions, and compliance checks can be baked into the token.

These are not theoretical advantages, several institutional tokenized funds have launched and are operating with real AUM, proving the model’s viability in practice.

Real examples

Large incumbents and specialized builders are both active in 2025:

- BlackRock’s BUIDL: a tokenized institutional money-market product that captured meaningful AUM and proved institutional issuance at scale.

- Franklin Templeton’s BENJI / tokenized funds : demonstrating retail and regulated tokenized funds in several jurisdictions.

- Ondo Finance (USDY) : focused on tokenized short-term treasuries and cash equivalents, available in non-US jurisdictions.

On the platform side, firms like Securitize, Tokeny, Polymath, RealT, Swarm, ADDX and others provide issuer and compliance toolkits so banks and corporates can launch tokens without rebuilding custody and legal frameworks from scratch. These providers are the plumbing enabling wider issuance.

The hard problems no one should ignore

Despite progress, tokenization is not frictionless.

Legal enforceability remains jurisdiction-dependent. Liquidity is uneven, especially for niche assets. Custodial risk cannot be abstracted away. Oracles and off-chain data introduce attack surfaces that purely on-chain systems do not face.

Most importantly, regulatory clarity is still fragmented. Tokenization moves faster than lawmaking, and this gap creates both opportunity and risk. Any serious RWA project must treat regulation as a design constraint, not an afterthought.

Where RWA Tokens Are Actually Accessible

Over the past few years, a growing number of RWA-related tokens, yield-bearing assets, and tokenized finance products have found listings on major exchanges, with MEXC emerging as one of the more active platforms in this category.

MEXC has consistently listed:

- RWA-focused protocols

- Yield-generating tokenized assets

- Infrastructure projects supporting real-world asset integration

If you are interested in tracking, trading, or gaining exposure to RWA-related tokens as the sector continues to mature, MEXC currently offers one of the broader selections available on a centralized exchange.

Most RWA-related tokens are already available on MEXC. If you haven’t created an account yet, you can get started here aand explore the market directly.

Emerging trends to watch (2025 → 2027)

- Tokenized money-market funds lead adoption. Short-term cash products are the first major success because they align easily with custody and regulation. BlackRock and Franklin’s pilots show the product-market fit here.

- Interoperable regulatory tooling. Platforms that combine legal wrappers with programmable compliance (transfer restrictions, whitelists) will win.

- Integration with CeFi on-ramps. Exchanges and custodians providing direct fiat rails and token listings speed adoption, the CEX distribution channel is a force multiplier.

- Selective DeFi composability. Expect guarded composability: institutions will permit DeFi exposure under controlled conditions (e.g., insured vaults, capped leverage).

- Realistic market projections. Estimates for tokenized asset markets vary widely from conservative $2T scenarios to lofty $30T outcomes by 2030 but most informed studies anticipate major growth if regulation and custody scale. Treat long-range numbers as conditional on legal progress.

Conclusion:

The tokenization of real-world assets is a fundamental restructuring of how we own and trade value. By converging DeFi’s speed with the stability of physical assets, the global economy is becoming more inclusive and transparent. In the coming decade, we won’t just “own” assets; we will stream them, fractionalize them, and trade them with the same ease we send a text message.

Disclaimer

This article is educational and does not constitute financial or investment advice. Personal circumstances vary. Consider speaking with a licensed financial advisor before making major financial decisions. Always confirm platform details and regulatory status with official sources.

Join MEXC and Get up to $10,000 Bonus!

Sign Up