With less than two weeks left before we enter 2026, according to the four year cycle narrative, the market is approaching a downtrend phase. In this cycle, the crypto market has changed completely. Regulatory frameworks across countries are gradually taking shape, Bitcoin ETFs have emerged, and as a result, the knowledge and strategies that helped many investors make money in previous cycles can no longer be applied mechanically to the current one. Rigidly reusing old strategies is one of the main reasons many portfolios have been cut in half or worse this cycle. So what are the most common mistakes when investing in crypto during this period? Let us break it down in detail.

1. The Crypto Market Context in This Cycle

The year 2025 marks a maturity turning point for the crypto market. Improved macro conditions combined with clearer regulatory frameworks, such as MiCA in Europe, digital asset registration regimes in Singapore, and the approval of Bitcoin and Ethereum ETFs in the US, have made crypto more institutionalized than ever. However, behind this maturity lies a deep shift in capital structure, rendering old cycle investment approaches ineffective.

Bitcoin and crypto as legitimate assets

Spot ETFs have brought Bitcoin into the portfolios of traditional financial institutions. This has supported steady growth in BTC market capitalization, but capital has become heavily concentrated in Bitcoin rather than flowing into altcoins as in previous cycles. Funds and traditional institutions now shape the market by focusing primarily on ETFs instead of directly buying altcoins, while native crypto investors no longer have the same influence as before. This has diminished the role of CEXs and reduced overall market excitement.

Ethereum losing its leadership role

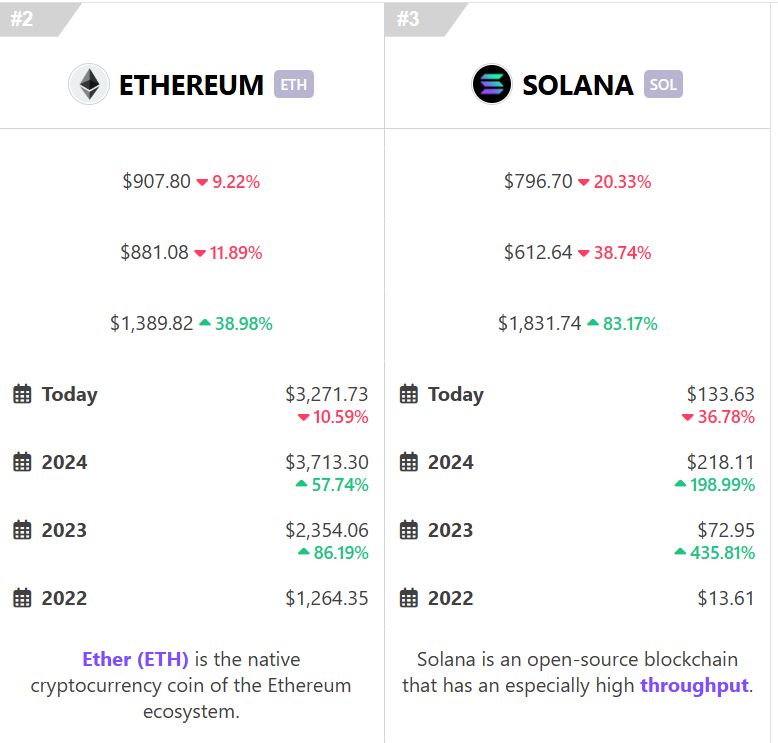

From 2020 to 2022, Ethereum was the center of innovation. However, during 2024 to 2025, ETH has clearly weakened:

- Gas fees dropping from over 100 USD to under 1 USD is not due to superior technology, but rather a sharp decline in on chain activity.

- Layer 2s have exploded, but liquidity and users are fragmented, with only a few L2s truly dominating

- Solana has led the speed and low cost narrative, attracting both builders and speculative capital, gradually stripping ETH of its role as the market’s primary indicator.

Solana is outperforming Ethereum this cycle.CEXs losing trust, listings becoming exit liquidity From 2023 to 2025, many projects were listed at unreasonably high FDVs compared to their products, revenue, and real adoption.

- Tokens entered the market at extreme valuations, creating heavy sell pressure from the very first trading sessions.

- Many projects exploited narratives and market expectations to justify inflated valuations, turning listings into profit taking opportunities for early participants, while late investors absorbed most of the risk.

- As a result, investors have become more cautious, prioritizing organic liquidity and asset control rather than chasing listings priced far above intrinsic value.

Liquidity fragmentation, a diluted market

In 2025, project launches reached a dizzying pace, alongside a constant rotation of trends such as restaking, modular, DePIN, RWA, L3, new GameFi, and memecoins. Instead of driving growth, this explosion of projects diluted liquidity:

- Dozens of new tokens launch daily, but capital is insufficient to lift the entire market.

- Tokens entered the market at extreme valuations, creating heavy sell pressure from the very first trading sessions.

- Retail investors get trapped in FOMO cycles, buying tops and falling out of sync with fast narrative rotation.

The large number of projects leads to fragmentation of cash flow. Older tokens are no longer repumped like in 2021 to 2022, making long term holding far less effective.

Blind DCA and hold to die became graves in 2024 to 2025

- Capital no longer spreads evenly. BTC absorbs liquidity via ETFs, while altcoins fail to benefit from spillover effects.

- Narratives rotate faster, often lasting only two to four weeks, not long enough for old holdings to appreciate.

- Tokenomics increasingly favor exit liquidity, with large unlocks, high FDV, and unfriendly allocation structures driving long term price decay.

- Fundamental value growth remains weak, with slowing revenue, fees, and user metrics, leaving prices driven mainly by speculation.

2. Common Mistakes in This Cycle

Believing in blind DCA and holding old coins

During 2024 to 2025, DCA and hold to die strategies have lost their effectiveness. ETFs concentrate capital into Bitcoin, leaving old altcoins without the reflation seen in prior cycles. The market is highly fragmented, with thousands of new projects splitting liquidity and eliminating the broad rising tide effect. Many older altcoins carry high FDVs, outdated tokenomics, and no alignment with new narratives, causing investors who keep DCAing to become capital trapped. DCA turns into slow bleeding while new opportunities pass by.

This cycle has seen unprecedented narrative rotation speed. From restaking to modular L3s, DePIN, AI, memecoins, and even sub trends like AI meme and AI agents, many narratives last only weeks. Investors often FOMO at peak hype, driven by news or influencers rather than real data. Entering mid cycle usually means buying into distribution and becoming liquidity for smart money exits. The result is repeated buy high sell low behavior.

Poor capital allocation

In a market where capital rotates rapidly, concentrating all funds into one token or narrative is extremely risky. Once hype fades, portfolios can evaporate quickly. Lack of diversification weakens trading psychology and increases sensitivity to bad news. With altcoins moving independently and no longer benefiting from broad market spillover, capital management becomes a survival factor. All in strategies in pursuit of quick life changing gains are often the root cause of heavy losses.

Unrealistic profit expectations

Many investors still carry a 2021 mindset into 2025, expecting 10 to 30x gains within weeks. The market has matured, regulatory pressure has increased, and institutional capital presence prevents reckless pumps. Real projects grow slowly, while hollow ones pump to dump. Chasing fast profits pushes investors into high risk tokens without checking fundamentals, leading to repeated pump and dump losses. Impatience drives emotional decisions and consistent losses.

Ignoring macro factors

As crypto matures, macroeconomic and regulatory factors increasingly influence both crypto and equity markets, which now move largely in sync. Market makers and large funds control capital flows. Ignoring macro dynamics causes mistimed entries and false expectations that markets will behave like previous cycles, when in reality the structure has fully reset. Without tracking regulations, policy shifts, and ETF flows, investors will always lag behind.

Investing based on VC valuation

The belief that buying near VC prices is safe has wiped out many accounts in 2024 to 2025. VCs operate under different rules, with OTC deals, hedging, long unlock schedules, and clear exit strategies. Retail investors buying at inflated FDVs often enter at peak valuation. Wormhole is a clear example. Despite raising 225 million USD with top tier backing, the token still dropped nearly seven times from perceived fair value. Blind trust in VCs turns retail into exit liquidity.

FOMO based on fundraising size

Believing that higher fundraising equals higher credibility is another common mistake. Projects like Monad, zkSync, and Starknet raised hundreds of millions, yet their tokens trended down after listing due to inflated FDVs, weak real user demand, and heavy sell pressure from teams and node operators. Fundraising primarily sells tokens to funds and generates media hype, but does not guarantee price appreciation. Retail buyers chasing fundraising valuations often buy at peak FDV, exactly when insiders begin distributing tokens.

3. Conclusion

The 2024 to 2025 cycle, and likely future cycles, are no longer driven by luck or pure FOMO. The market is more mature, competitive, and demands rapid adaptation to narrative rotation, regulatory tightening, and institutional capital dominance.

Most losses do not come from choosing the wrong coin, but from outdated mindsets carried over from previous cycles. Crypto still offers opportunities, but it is filled with traps disguised as narratives, big name funds, and flashy valuations.

Tokenomics must come first. A token has real value only when tied to genuine utility, cash flow, or an irreplaceable role within its ecosystem. Instead of roadmaps and promises, investors must focus on core metrics such as revenue, user count, transaction frequency, and on chain activity.

Second, never blindly trust funds. VCs are human, they FOMO, misjudge tops, and cut losses when conditions change. Big backing does not guarantee long term success. DYOR is not a slogan but a requirement for survival.

Third, realistic valuation is the strongest defense. Projects with excessively high FDV relative to intrinsic value offer little upside to late entrants. Avoiding absurd valuations allows investors to survive long enough to catch real opportunities.

Finally, Bitcoin remains the market’s compass. Regardless of narrative shifts, capital flow and sentiment still revolve around BTC. Fighting Bitcoin usually means embracing unnecessary risk. Crypto still offers life changing opportunities, but only for those with patience and intelligent strategy.

Disclaimer: This content does not constitute investment, tax, legal, financial, or accounting advice. MEXC provides this information for educational purposes only. Always do your own research, understand the risks, and invest responsibly.

Join MEXC and Get up to $10,000 Bonus!

Sign Up