Mark your calendars for December 8, 2025, 1:00 PM UTC (8:00 AM EST)—the day Bitfinex and Tether launch the most anticipated stablecoin-focused blockchain of 2025. Stable, a Layer-1 network built exclusively for high-volume stablecoin transactions, goes live with its native $STABLE token, revolutionary USDT-denominated gas fees, and over $1.1 billion in pre-deposited capital from 10,000+ verified wallets.

This isn’t another general-purpose blockchain competing with Ethereum or Solana. Stable represents a paradigm shift: a network optimized exclusively for stablecoin payments, settlements, and DeFi applications, using USDT as the gas asset while STABLE powers governance and staking. With Tether’s dominance ($120+ billion USDT market cap) and Bitfinex’s institutional infrastructure, Stable enters the market positioned to capture trillions in stablecoin transaction volume currently fragmented across dozens of chains.

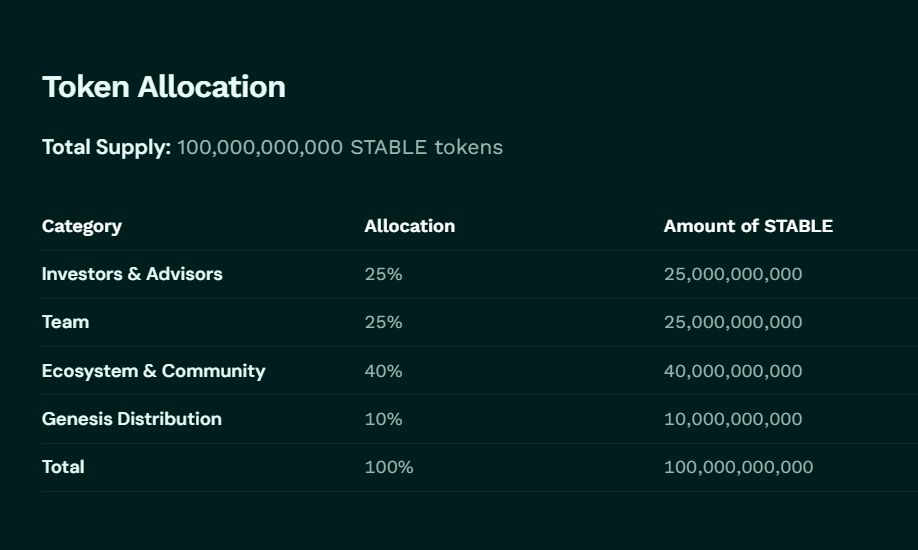

The tokenomics unveiled December 2 reveal a non-inflationary model with 100 billion STABLE total supply, strategic allocation prioritizing ecosystem development (40%), and a four-year vesting schedule ensuring team and investor alignment. Combined with $28 million in seed funding from PayPal Ventures and others, Stable launches with the capital, technology, and institutional backing to become the definitive home for stablecoin activity.

What Is Stable? The Stablecoin-First Blockchain

Core Concept:

Stable is a high-throughput Layer-1 blockchain designed exclusively for stablecoin transactions, payments, and decentralized finance applications. Unlike general-purpose chains like Ethereum or Solana that handle everything from NFTs to gaming, Stable focuses singularly on creating the optimal infrastructure for dollar-denominated digital assets.

The Innovation: USDT as Gas

The breakthrough that distinguishes Stable from all other Layer-1s: transaction fees (gas) are denominated and paid in USDT rather than a volatile native token. This seemingly simple change eliminates a fundamental pain point in blockchain adoption.

Traditional Model Problem:

- User wants to send $100 USDT on Ethereum

- Must also hold ETH for gas fees

- ETH price volatility creates unpredictable transaction costs

- Requires managing two assets (USDT + ETH) for simple transfer

Stable’s Solution:

- User sends $100 USDT on Stable

- Gas fees deducted directly from USDT balance

- Predictable, dollar-denominated costs

- Single asset management

For enterprises processing millions in stablecoin payments, this eliminates treasury complexity and provides cost predictability impossible on multi-asset chains.

What Is STABLE Token Used For?

If gas fees are paid in USDT, what purpose does the STABLE token serve?

1. Network Security: STABLE powers the StableBFT delegated proof-of-stake consensus. Token holders delegate stakes to validators, creating economic commitment that secures the network.

2. Governance: STABLE holders vote on protocol upgrades, treasury allocation, fee structures, and ecosystem development priorities.

3. Staking Rewards: Instead of inflationary token emissions, stakers earn rewards from USDT-denominated network fees collected in a protocol vault—creating real yield without dilution.

This separation of gas asset (USDT) from governance/security token (STABLE) represents a sophisticated tokenomics innovation that addresses both user experience and network security.

$STABLE Tokenomics: 100 Billion Non-Inflationary Supply

Bitfinex and Tether unveiled complete STABLE tokenomics on December 2, providing transparency rare in crypto launches. The structure reveals strategic thinking designed to build sustainable long-term ecosystem value.

Total Supply: 100 Billion STABLE (Fixed)

Unlike inflationary models that continuously mint new tokens, STABLE has a hard cap of 100 billion tokens—no additional issuance planned ever. This creates Bitcoin-like scarcity dynamics for a governance token.

Allocation Breakdown:

40% (40 Billion) – Ecosystem Development

- Developer grants and partnerships

- User incentives and liquidity mining

- Long-term funding for protocol growth

- Vesting: 8% unlocks at launch, 32% vests over three years

- Rationale: Largest allocation signals commitment to building robust application layer

25% (25 Billion) – Team

- Founders, developers, core contributors

- Vesting: One-year cliff, four-year vesting schedule

- Rationale: Extended vesting ensures team remains committed through launch and beyond

25% (25 Billion) – Investors and Advisors

- Seed round participants including PayPal Ventures

- Strategic advisors and early supporters

- Vesting: One-year cliff, four-year vesting schedule

- Rationale: Aligns investor incentives with long-term protocol success

10% (10 Billion) – Genesis Distribution

- Bootstrap liquidity and early community engagement

- Reward pre-deposit campaign participants

- Initial circulation to enable governance and staking

- Unlock: Significant portion available at mainnet launch

No Inflationary Emissions:

Traditional PoS blockchains mint new tokens continuously to reward stakers, creating perpetual selling pressure and dilution. Stable takes a different approach:

Reward Mechanism:

- Network collects transaction fees in USDT

- Fees accumulate in protocol vault

- USDT rewards distributed to STABLE stakers

- Zero token inflation

Benefits:

- Stakers earn real yield in stable dollars rather than inflationary tokens

- No perpetual dilution of token value

- Aligns staker incentives with network usage (more transactions = higher USDT rewards)

This model creates sustainable economics where token value accrues from network activity rather than speculative trading.

Pre-Deposit Campaigns: $1.1 Billion Raised Across Two Phases

Stable conducted two pre-deposit campaigns in October-November 2025, allowing users to lock stablecoins in exchange for future STABLE token rewards and ecosystem benefits. The campaigns raised over $1.1 billion from 10,000+ verified wallets, demonstrating significant institutional and retail interest.

Phase 1: The Whale Controversy

The first phase hit its $825 million cap in just 22 minutes, but faced immediate criticism on social media. Analysis revealed that a small number of large wallets deposited the majority of capital, with some addresses moving funds specifically before the campaign started. Critics accused Stable of favoring insiders and limiting regular user participation.

Phase 2: Course Correction

In response to community backlash, Phase 2 implemented stricter controls:

- KYC Requirements: Identity verification to prevent Sybil attacks

- Wallet Limits: Per-address caps to prevent whale dominance

- Eligibility Rules: Additional requirements to ensure broader participation

The adjustments worked. Phase 2 attracted over 10,000 verified wallets and closed successfully on November 15 with more equitable distribution. By launch, total pre-deposits exceeded $1.1 billion from genuine participants rather than concentrated whale positions.

What Pre-Depositors Receive:

While specific reward structures remain undisclosed, pre-deposit participants will receive:

- STABLE token allocations from the 10% genesis distribution

- Potential staking bonuses or multipliers

- Early access to governance proposals

- Ecosystem benefits and partnership perks

The $1.1 billion in locked capital provides immediate liquidity for Stable’s DeFi ecosystem, enabling lending markets, liquidity pools, and stablecoin applications to launch with meaningful depth from day one.

Institutional Backing: Bitfinex, Tether, and PayPal Ventures

Stable enters the market with institutional backing that provides credibility and resources few crypto projects can match.

Bitfinex: Exchange Infrastructure

As one of crypto’s longest-operating exchanges (founded 2012), Bitfinex brings deep institutional relationships, compliance frameworks, and technical expertise. Bitfinex Securities, the firm’s tokenized securities arm, positions Stable to capture institutional settlement flows.

Tether: Stablecoin Dominance

Tether’s USDT commands over $120 billion market cap, representing approximately 70% of stablecoin volume globally. Tether’s November partnership with KraneShares and Bitfinex Securities aims to advance a tokenized securities market potentially reaching trillion-dollar scale over time—flows that naturally settle on Stable’s optimized infrastructure.

PayPal Ventures: Traditional Finance Bridge

PayPal Ventures’ participation in Stable’s $28 million seed round signals traditional payment giants’ interest in blockchain-based settlement infrastructure. PayPal’s own stablecoin initiatives (PYUSD) could eventually integrate with Stable’s network, providing bridge between Web2 payments and crypto-native stablecoin applications.

Strategic Positioning:

The combination of Bitfinex’s exchange relationships, Tether’s stablecoin dominance, and PayPal’s traditional finance connections creates a unique value proposition. Stable isn’t just another blockchain competing for attention—it’s infrastructure purpose-built to handle stablecoin flows from world’s largest issuers and payment processors.

Use Cases: What Will Actually Run on Stable?

1. High-Volume Payments and Settlements

Enterprises processing millions in daily stablecoin transactions face efficiency and cost challenges on general-purpose chains. Stable’s optimized infrastructure and predictable USDT gas fees enable:

- Cross-border B2B payments

- Payroll and contractor settlements

- Supply chain financing

- Remittances and international transfers

2. Decentralized Finance (DeFi) Applications

Stablecoin-focused DeFi protocols benefit from Stable’s architecture:

- Lending and borrowing markets (Aave/Compound models)

- Yield aggregators and vaults

- Synthetic asset protocols

- Options and derivatives platforms

The USDT gas model simplifies UX for DeFi users who typically hold stablecoins as base assets.

3. Tokenized Securities

Tether and Bitfinex Securities’ November partnership targeting trillion-dollar tokenized securities markets positions Stable as natural settlement layer. Tokenized bonds, equities, and real estate can settle efficiently on infrastructure designed for dollar-denominated assets.

4. Corporate Treasury Management

Companies holding stablecoin treasuries can deploy capital into yield-generating protocols without gas fee volatility. Stable’s predictable costs enable corporate finance teams to accurately forecast transaction expenses.

5. On-Chain Payment Rails

The network’s 24/7 availability and near-instant finality make it suitable for payment infrastructure traditionally handled by SWIFT or ACH systems. As businesses adopt stablecoin payments, Stable provides enterprise-grade reliability.

Launch Sequence: What Happens December 8

Timeline:

December 8, 1:00 PM UTC (8:00 AM EST)

- Mainnet activation

- Genesis block produced

- Validator onboarding complete

Immediate Post-Launch:

- Governance activation for STABLE holders

- Pre-deposit rewards distribution begins

- Initial dApp deployments (lending, DEXs, yield protocols)

- Developer tooling and documentation available

First Week:

- Bridge infrastructure activation (Ethereum, Solana, other chains)

- Major DeFi protocols deploying Stable versions

- CEX listings for STABLE token (expected MEXC, others)

- Ecosystem grant program applications open

First Month:

- Tether potentially deploying native USDT0 on Stable

- Enterprise partnerships announced

- TVL growth as locked pre-deposits deploy into protocols

- Validator set expansion beyond initial operators

First Quarter 2026:

- Tokenized securities pilot programs

- Institutional custody integrations (Fireblocks, Anchorage, others)

- Cross-chain liquidity aggregation

- Mobile wallet support and simplified onboarding

How to Participate: Staking, Governance, and Trading

For Pre-Deposit Participants:

If you participated in October-November campaigns:

- Monitor official Stable channels for claim instructions

- Connect wallet to Stable mainnet on December 8

- Claim allocated STABLE tokens

- Delegate to validators or self-stake if running node

- Participate in governance proposals

For New Participants Post-Launch:

Acquire STABLE Tokens:

- CEX listings (MEXC, Bitfinex, others expected within 24-48 hours)

- DEX trading on Stable network

- Bridge from other chains once infrastructure live

Stake for USDT Rewards:

- Acquire STABLE tokens

- Delegate to validator through Stable wallet/interface

- Earn pro-rata share of USDT network fees

- Restake or withdraw rewards regularly

Governance Participation:

- Hold minimum STABLE threshold (TBD)

- Vote on protocol proposals

- Submit improvement proposals if qualified

- Participate in ecosystem treasury decisions

DeFi Opportunities:

- Provide liquidity to STABLE/USDT pools

- Use STABLE as collateral in lending markets

- Participate in yield farming incentives

- Trade synthetic assets on Stable-native protocols

Price Prediction: What Could STABLE Trade At?

Launch Price Discovery:

With 10% (10 billion tokens) unlocking at genesis for community distribution and liquidity provision, initial market cap depends on price discovery. Assuming conservative valuations:

Scenario 1: $0.01 per STABLE

- Genesis market cap: $100 million

- Fully diluted valuation: $1 billion

- Comparable to mid-tier Layer-1 launches

Scenario 2: $0.05 per STABLE

- Genesis market cap: $500 million

- Fully diluted valuation: $5 billion

- Comparable to successful DeFi infrastructure projects

Scenario 3: $0.10 per STABLE

- Genesis market cap: $1 billion

- Fully diluted valuation: $10 billion

- Aggressive valuation requiring strong launch momentum

Bull Case Drivers:

- $1.1B pre-deposited capital creating immediate TVL

- Tether/Bitfinex institutional relationships

- USDT gas model solving real user pain point

- PayPal Ventures validation

- Tokenized securities market potential

Bear Case Risks:

- Crowded Layer-1 market with strong competitors

- Unproven network in real-world conditions

- Stablecoin-only focus may limit application diversity

- Regulatory uncertainty around stablecoin networks

- Macro headwinds affecting all crypto risk assets

Mid-Term Outlook (6-12 Months):

If Stable successfully onboards institutional stablecoin flows and captures even 5% of daily stablecoin transaction volume, the network could process $3-5 billion daily. With meaningful fee generation flowing to STABLE stakers, token value could appreciate significantly from launch prices.

Key metric to watch: Total Value Settled (TVS) rather than TVL. For payment-focused chains, transaction volume matters more than locked liquidity.

Competition: How Stable Stacks Up Against Other Chains

General-Purpose L1s (Ethereum, Solana, Avalanche):

- Advantage: Established ecosystems, diverse applications, network effects

- Disadvantage: Not optimized for stablecoins, volatile gas fees, complex UX

- Stable’s Edge: Specialized infrastructure, predictable costs, simplified treasury management

Stablecoin-Friendly L2s (Optimism, Arbitrum, Base):

- Advantage: Ethereum security, growing adoption, improving costs

- Disadvantage: Still use ETH for gas, inherit Ethereum complexity

- Stable’s Edge: USDT-native gas, no bridge security risks, purpose-built architecture

Payment-Focused Chains (Stellar, Algorand):

- Advantage: Fast finality, low costs, payment-specific features

- Disadvantage: Limited DeFi ecosystems, smaller network effects

- Stable’s Edge: Institutional backing, Tether integration, comprehensive DeFi support

Stablecoin Issuers’ Own Chains:

- Circle’s potential USD Coin infrastructure

- Tether dominance on Stable gives first-mover advantage

Competitive Moat:

Stable’s sustainable advantage comes from:

- Tether Partnership: Preferential USDT integration

- Bitfinex Infrastructure: Institutional relationships and compliance

- Tokenized Securities Pipeline: Trillion-dollar market opportunity

- Network Effects: As more stablecoin apps deploy on Stable, it becomes default home

Risks and Considerations

Technical Risks:

- Mainnet launch bugs or vulnerabilities

- Validator centralization concerns

- Bridge security for cross-chain assets

- Scalability under extreme load

Market Risks:

- Crypto bear market suppressing valuations

- Regulatory crackdowns on stablecoin infrastructure

- Tether regulatory challenges affecting ecosystem

- Competition from better-funded projects

Adoption Risks:

- Enterprises slow to migrate from established chains

- DeFi protocols reluctant to deploy on new network

- Insufficient developer tools and documentation

- Network effects favoring incumbents

Tokenomics Risks:

- Large unlocks (65% vesting over 4 years) create future selling pressure

- Governance token value may not correlate with network usage

- USDT reward model depends on sustained transaction volume

Regulatory Risks:

- Unclear legal status of stablecoin-focused chains

- Potential restrictions on USDT usage in certain jurisdictions

- Securities law implications for STABLE token

- Compliance requirements for validators and users

Conclusion: Betting on the Stablecoin Future

Stable’s December 8 launch represents a bold thesis: the future of blockchain infrastructure is specialized, not general-purpose. While Ethereum and Solana compete to be everything to everyone, Stable focuses singularly on becoming the definitive home for stablecoin activity—and that specialization may prove to be its greatest strength.

The tokenomics reveal sophisticated thinking. The separation of gas asset (USDT) from governance/security token (STABLE) solves real user problems while creating sustainable economics. Non-inflationary rewards paid in USDT rather than minted tokens provide genuine yield without dilution. Four-year vesting for team and investors ensures alignment through critical growth phases.

With $1.1 billion pre-deposited, backing from Bitfinex and Tether, and participation from PayPal Ventures, Stable launches with resources and relationships few projects can match. The tokenized securities partnership potentially unlocking trillion-dollar markets provides a long-term growth narrative extending beyond typical DeFi speculation.

However, launching amid a 30% crypto market correction and competing against entrenched Layer-1s with massive network effects creates genuine challenges. Success requires flawless technical execution, rapid developer adoption, and institutional migration from established chains—none of which are guaranteed.

For traders and investors, the December 8 launch presents a calculated bet on specialization over generalization. If stablecoin transaction volume continues explosive growth and Stable captures meaningful market share, the STABLE token could appreciate significantly as network usage generates USDT rewards for stakers. If the network fails to differentiate or adoption stalls, even strong tokenomics won’t save valuations.

The next 90 days will tell the story. Watch Total Value Settled (TVS), validator decentralization, institutional partnership announcements, and DeFi protocol deployments. These metrics—not price speculation—will determine whether Stable becomes the stablecoin infrastructure winner or another ambitious blockchain that couldn’t escape incumbent gravity.

December 8, 1:00 PM UTC. The countdown begins.

Trade STABLE on MEXC Post-Launch: MEXC will list STABLE/USDT immediately following mainnet activation. Access spot trading, perpetual futures, and grid strategies. Set price alerts to capture launch volatility and monitor on-chain metrics for informed entries.

Disclaimer:This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up