The most anticipated token launch on Solana just hit a 6-hour delay. HumidiFi’s $WET token sale—the inaugural offering on Jupiter’s revolutionary DTF (Decentralized Token Formation) platform—has been postponed from December 3 at 11:00 PM Beijing time to December 4 at 5:00 AM Beijing time (December 3, 9:00 PM UTC). The delay comes after community feedback prompted changes to the sale structure, including a reduction in the Wetlist allocation from 6% to 4% of total supply.

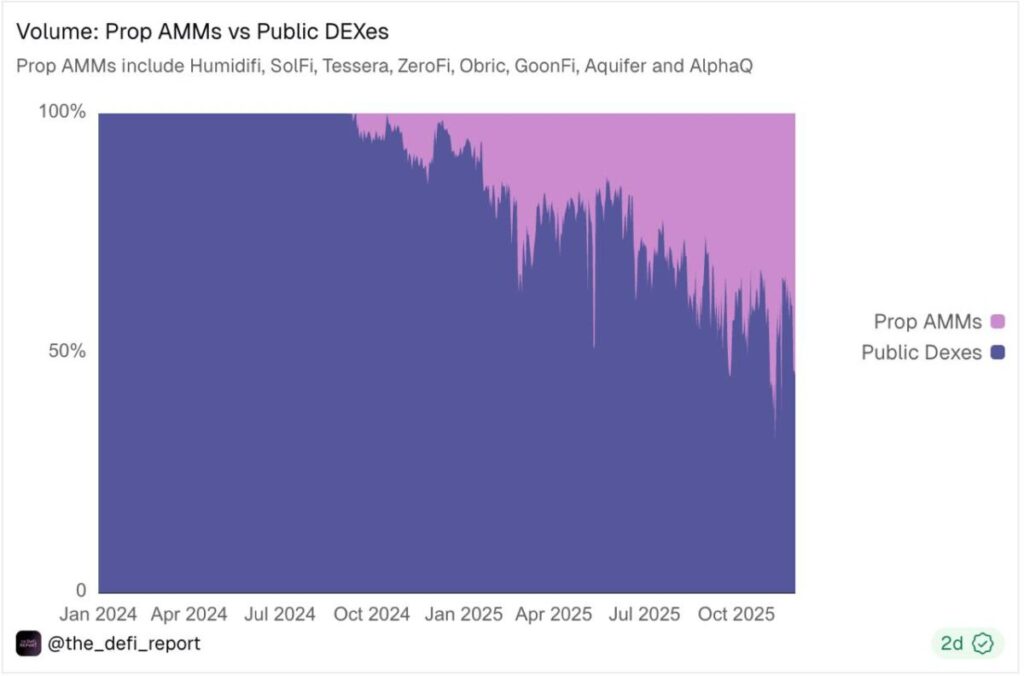

Despite the postponement, momentum remains explosive. HumidiFi dominates Solana’s DEX landscape with $37 billion in monthly volume and 35-40% market share, surpassing legacy platforms Raydium and Meteora. The project’s “dark pool” automated market maker model has processed over $133 billion since launching just six months ago, making it the most successful prop AMM in DeFi history. Now, with Jupiter’s DTF platform offering the fairest ICO structure crypto has seen in years, $WET is positioned to become one of 2025’s most significant token launches.

For traders navigating this opportunity, the revised timeline and allocation changes create new dynamics. With JUP stakers getting early access at $0.50 per token and public sale priced at $0.69, understanding the three-phase structure is critical. This guide breaks down everything you need to know about the delayed WET launch, from participation requirements to price forecasts based on HumidiFi’s market dominance.

The Delay: Why Jupiter DTF Postponed Phase 1

Jupiter announced the postponement late on December 3, responding to feedback from HumidiFi team members and the “Weterans” community. The first phase (Wetlist allocation) has been pushed back from 11:00 PM Beijing time December 3 to 5:00 AM Beijing time December 4—a 6-hour delay designed to accommodate broader global participation.

Key Changes Announced:

- New Launch Time: December 4, 5:00 AM Beijing time (December 3, 9:00 PM EST / December 4, 2:00 AM UTC)

- Reduced Allocation: Wetlist phase cut from 6% to 4% of total supply based on community input

- Improved Access: Additional time allows participants in different time zones to prepare wallets and verify eligibility

The delay follows concerns that the original 11:00 PM Beijing time slot disadvantaged European and American participants. By moving to early morning Beijing time, the sale now occurs during prime evening hours for U.S. traders (9:00 PM EST) and late night for Europeans—a more balanced global window.

Community response has been largely positive, with participants appreciating Jupiter’s willingness to adjust based on feedback. The allocation reduction from 6% to 4% addresses concerns about early participant concentration, distributing more tokens to JUP stakers and the public sale phases.

HumidiFi: The Dominant Force Behind $WET

Before diving into sale mechanics, understanding HumidiFi’s market position is critical. Since launching in May 2025, the platform has achieved metrics that took competitors years to reach:

Market Dominance:

- Monthly Volume: $37+ billion processed in November 2025

- Market Share: 35-40% of all Solana DEX volume

- Cumulative Volume: $133 billion in under 6 months

- Peak Daily Volume: $853 million in SOL/USDT trading alone (November 23)

Competitive Position: HumidiFi surpassed both Raydium and Meteora in monthly volume during early November 2025, becoming Solana’s #1 DEX by trading activity. On November 23, HumidiFi captured 57.9% of total Solana DEX volume ($1.44 billion), with the platform processing $853M compared to Tessera’s $258M and Orca’s $117M.

The “Dark Pool” Advantage: HumidiFi operates as a proprietary automated market maker (Prop AMM), routing trades privately through aggregators like Jupiter to eliminate front-running, reduce slippage, and deliver CEX-level pricing. This “dark liquidity” model provides tighter spreads than public AMMs while maintaining full decentralization—a breakthrough that explains the platform’s explosive growth.

With HumidiFi already dominating Solana trading, the $WET token launch represents the opportunity to gain governance and economic exposure to the ecosystem’s most successful DEX infrastructure.

Jupiter DTF: The ICO Platform Crypto Deserves

Jupiter’s DTF platform represents the most significant innovation in token launches since the original ICO era. Designed to restore fairness to an industry plagued by insider allocations and VC-heavy distributions, DTF introduces transparency and community access that have been missing from crypto fundraising for years.

Core DTF Features:

1. Full Transparency (Jup Lock): All token supply and allocations are escrowed on-chain before the sale begins. No hidden allocations, no surprise dumps—every token is accounted for and locked according to publicly visible rules.

2. No VC Presales: HumidiFi explicitly excluded venture capital funds from private presales. The only way VCs can acquire $WET is by purchasing through DTF or on the open market post-launch—putting retail and institutional investors on equal footing for the first time.

3. Immediate Liquidity: Tokens sold to the public will be immediately tradable on Meteora, Jupiter’s affiliated DEX. No waiting periods, no cliff vesting for public participants—instant liquidity from minute one.

4. Insider Lockups: Team and early investor allocations are locked on-chain with transparent vesting schedules. This prevents the insider dumping that has plagued countless token launches.

5. Tiered Access: The three-phase structure (Wetlist → JUP Stakers → Public) rewards ecosystem participants and long-term Jupiter supporters while still providing open public access.

Jupiter COO Kash Dhanda described DTF as bringing “the best of the ICO meta while protecting users from the worst”—a mission statement validated by $WET becoming the platform’s first certified project.

Three-Phase Sale Structure: Who Gets Access When

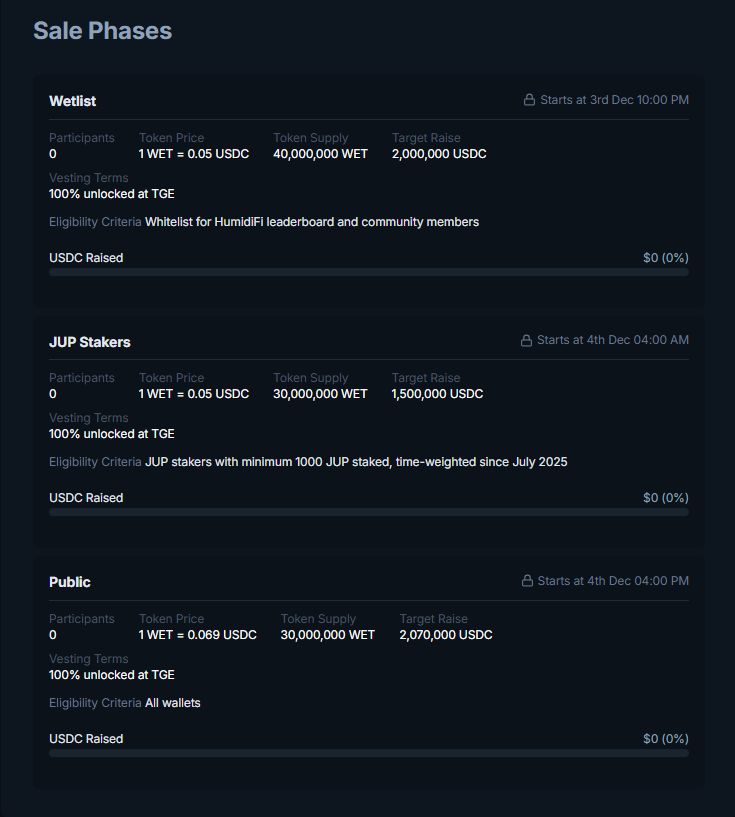

Phase 1: Wetlist (4% Allocation)

- Timing: December 4, 5:00 AM – 9:00 AM Beijing time (Dec 3, 9:00 PM EST – Dec 4, 1:00 AM EST)

- Price: $0.50 USDC per WET

- Eligibility: Whitelisted wallets (employees, early contributors, “Weterans”)

- Cap: Per-wallet limits apply (amounts TBD)

- Allocation: 4 billion WET tokens (reduced from 6%)

Phase 2: JUP Stakers (TBD% Allocation)

- Timing: December 4, immediately following Phase 1 completion

- Price: $0.50 USDC per WET (same discount as Wetlist)

- Eligibility: Users staking $JUP tokens on Jupiter

- Cap: $1,000 USDC maximum per wallet

- Benefit: Early access at 28% discount vs public price

Phase 3: Public Sale (20% Allocation)

- Timing: December 4, 10:00 AM – 10:00 PM EST (22:00 EST / 12-hour window)

- Price: $0.69 USDC per WET

- Eligibility: Anyone with Solana wallet

- Cap: $1,000 USDC maximum per wallet

- Allocation: 20 million WET tokens

- Access: First-come, first-served until sold out

Verification: Participants must connect their Solana wallet to the Jupiter DTF official website to check eligibility for each phase. KYC requirements may apply for certain allocation tiers.

$WET Tokenomics: What You’re Actually Buying

While complete tokenomics haven’t been publicly disclosed, analysts expect $WET to follow standard DeFi governance token structures with HumidiFi-specific utility:

Expected Utility:

- Governance: Vote on protocol upgrades, fee structures, and treasury allocation

- Liquidity Mining: Stake WET to earn rewards from trading fees

- Fee Discounts: Reduced trading fees for WET holders

- Revenue Share: Participation in protocol revenue distribution (speculative)

Supply Dynamics: Based on the 4% Wetlist allocation equaling 4 billion tokens (post-reduction), the total supply appears to be 100 billion WET tokens. With 20% (20 billion) allocated to the public sale, approximately 76 billion tokens remain for ecosystem development, team, advisors, and liquidity provisions.

No VC Presale Impact: HumidiFi’s decision to exclude private investors means no large VC unlock events will create future selling pressure—a massive advantage over typical high-FDV launches that have plagued 2025 (see: Monad’s 49% crash post-launch).

Price Forecast: What Could WET Trade At?

Conservative Estimate: $0.80-$1.20

Based on comparable DEX token launches and HumidiFi’s market dominance, analysts project WET could trade between $0.80-$1.20 in the immediate post-launch period (first 7-14 days):

Bull Case Drivers:

- Market Leadership: HumidiFi’s 35-40% Solana DEX share provides fundamental value backing

- Revenue Generation: $37B monthly volume generates significant fee revenue for token holders

- Limited Supply: Public sale represents only 20% of total supply, with remainder locked/vested

- No VC Overhang: Absence of private investor dumps removes primary source of launch-day selling pressure

Bear Case Risks:

- Market Conditions: Crypto markets down significantly from October peaks (Bitcoin -30% from ATH)

- Competition: Raydium, Orca, and new entrants continue fighting for market share

- Hype Fatigue: 2025 has seen numerous disappointing token launches creating skepticism

Mid-Term Potential: $1.50-$3.00

If HumidiFi maintains market leadership and WET captures meaningful governance adoption, a mid-term range of $1.50-$3.00 (30-90 days post-launch) is plausible. This assumes:

- Sustained 30%+ Solana DEX market share

- Introduction of revenue-sharing mechanisms for WET stakers

- Successful ecosystem expansion beyond core trading

Comparison: UNI and SUSHI Launches Uniswap’s UNI token launched at approximately $3.00 and peaked at $8.00 within weeks based on governance utility and fee expectations. SushiSwap’s SUSHI launched near $1.00 and hit $10+ during peak DeFi mania. While market conditions differ, HumidiFi’s current dominance suggests WET could follow similar trajectories if execution continues.

How to Participate: Step-by-Step Guide

Prerequisites:

- Solana Wallet: Phantom, Solflare, or any SPL-compatible wallet

- USDC on Solana: Sufficient USDC for your allocation (max $1,000 for public)

- JUP Tokens (Optional): Staked JUP for Phase 2 early access

Participation Steps:

For JUP Stakers (Phase 2):

- Stake $JUP tokens on Jupiter before Phase 2 begins

- Connect wallet to Jupiter DTF portal

- Verify eligibility and allocation amount

- Approve USDC spending limit

- Purchase WET at $0.50 when Phase 2 opens

- Tokens delivered immediately upon purchase

For Public Sale (Phase 3):

- Prepare USDC (up to $1,000) in Solana wallet

- Connect wallet to Jupiter DTF at 10:00 AM EST December 4

- Purchase WET at $0.69 (first-come, first-served)

- Tokens immediately tradable on Meteora

- Optional: Hold for governance rights or trade immediately

Trading Post-Launch: WET will list on Meteora immediately after public sale concludes, with Jupiter aggregator routing providing instant liquidity. Expect listings on major CEXs like MEXC within 24-48 hours of mainnet trading.

Community Reaction: Hype Meets Skepticism

Bullish Sentiment: The Jupiter announcement generated massive engagement, with over 600 likes and 130 comments within hours. Community memes like “JUP & MET make me WET” and “Solana getting $WET” dominated crypto Twitter, reflecting genuine excitement about fair token distribution.

Supporters highlight that DTF represents crypto’s first legitimate attempt to restore ICO-era fairness while maintaining modern security standards. HumidiFi’s proven track record provides fundamental backing that most launches lack.

Cautious Voices: Critics note that $0.69 public price may be optimistic given current market conditions. Bitcoin’s 30% decline from October peaks has dampened risk appetite, and several 2025 launches (Monad, others) have disappointed immediately post-mainnet.

Others question whether HumidiFi’s dominance can persist as competitors like Raydium and Meteora improve their infrastructure. The DEX landscape is notoriously competitive, with market leaders frequently displaced by innovation.

Realistic Assessment: The delay and allocation reduction demonstrate Jupiter and HumidiFi’s willingness to listen to community feedback—a positive sign for governance post-launch. However, traders should approach with realistic expectations, understanding that even strong fundamentals cannot guarantee upside in volatile markets.

Conclusion: Fair Launch in Unfair Markets

The $WET token sale represents crypto’s best attempt at fair distribution since the ICO era ended. Jupiter’s DTF platform delivers transparency, eliminates VC insider advantages, and provides immediate liquidity, addressing the three primary complaints about modern token launches.

HumidiFi’s fundamentals are undeniable: $133 billion in 6-month volume, 35-40% Solana market share, and technology that delivers CEX-level pricing on-chain. These metrics justify optimism about WET’s long-term value proposition.

However, timing matters. Launching during a 30% market correction creates headwinds that even strong projects must overcome. The 6-hour delay and allocation adjustment show responsiveness to community concerns, but also reveal the challenges of coordinating global participation in decentralized sales.

For traders, the decision framework is clear:

- JUP Stakers: The $0.50 price with 28% discount versus public offers compelling risk/reward for ecosystem believers

- Public Participants: $0.69 entry provides access to proven infrastructure, but requires conviction to hold through potential volatility

- Wait-and-See: Trading WET on Meteora post-launch avoids allocation uncertainty but sacrifices early-bird discount

The delayed December 4 launch gives participants six additional hours to prepare. Whether WET becomes 2025’s breakout DEX token or another cautionary tale depends on execution over the next 90 days, but HumidiFi’s track record suggests they’ve earned the benefit of the doubt.

Access $WET immediately after Jupiter DTF sale concludes. MEXC offers spot trading, perpetual futures, and grid trading strategies for new Solana tokens. Monitor real-time liquidity and volume to time optimal entry points.

Disclaimer: This material does not constitute investment, tax, legal, or financial advice. MEXC Learn provides information for educational purposes only. Cryptocurrency investments carry significant risk. Please conduct thorough research and consult qualified advisors before making investment decisions. MEXC is not responsible for users’ investment outcomes.

Join MEXC and Get up to $10,000 Bonus!

Sign Up