On December 2, 2025, Kalshi announced it had successfully raised a record breaking 1 billion dollars at an estimated valuation of 11 billion dollars. This marks one of the largest fundraising events in the history of crypto and fintech. But what exactly is Kalshi, and what makes this project so notable in a market where most prediction platforms struggle to scale legally?

1. What Is Kalshi?

Kalshi is a prediction market platform, a trading venue where users buy and sell contracts based on the outcomes of real world events. The platform allows users to trade event contracts whose prices reflect whether an event will occur in reality.

According to the project, Kalshi is the first prediction market in the United States to receive an official license from the Commodity Futures Trading Commission (CFTC), operating as a fully regulated Designated Contract Market (DCM). This is a unique advantage that gives Kalshi a strong legal foundation in the US, something almost no other prediction market platform possesses. This is widely considered the key reason large scale capital has continuously flowed into Kalshi, helping the platform expand and deepen its liquidity.

Kalshi’s goal is to transform user information, data and predictions into a tradable asset class that transparently reflects collective expectations about the future.

Key differentiators of Kalshi include:

- A new asset class (Event Contracts): Kalshi creates a new asset class that does not rely on companies or commodities but on the probability of events.

- Fully regulated: As a CFTC licensed exchange, Kalshi stands apart from all previous prediction markets in the US.

- Simple binary trading: Users simply choose Yes or No for each listed event.

- Diverse trading topics: From politics and weather to culture, technology and macroeconomics.

- User protection mechanisms: User data is stored following audited compliance requirements, using trusted third parties such as Plaid and verified KYC providers.

2. How Kalshi Works?

The operational model of Kalshi works as follows:

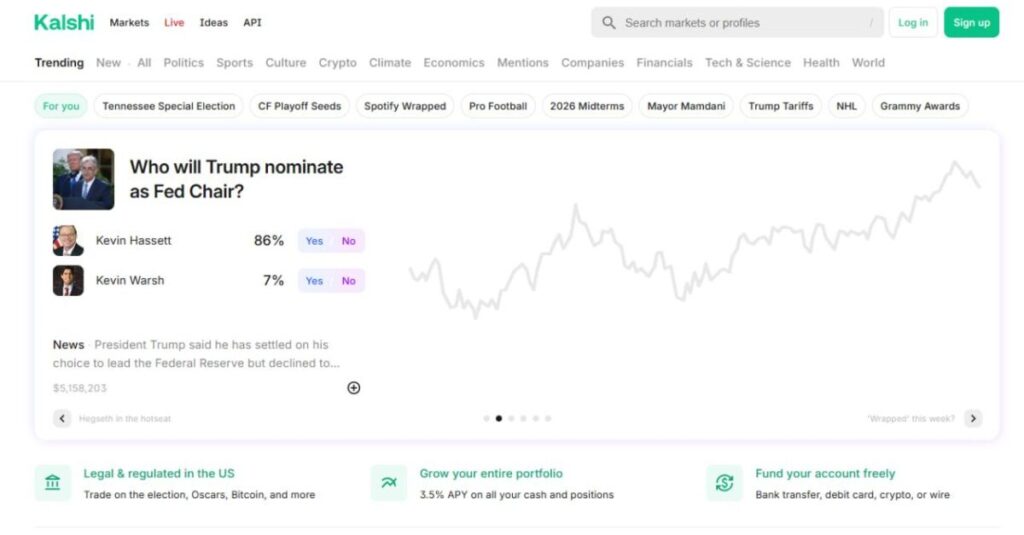

- Event listing: Kalshi selects and lists events that meet CFTC regulatory standards.

- Market creation: After approval, Kalshi opens a Yes or No market for that event, defining order cut off times and settlement dates.

- Placing orders: Users can place Quick Orders at current market prices or Limit Orders to wait for desired prices.

- Order matching: Orders match automatically when there is a counterparty. Limit Orders stay on the orderbook until filled.

- Custody and settlement: Once matched, contracts are recorded and held through Kalshi Klear. When the event concludes, Kalshi verifies and settles based on the real world outcome.

- Payouts: Yes contracts pay 1 dollar if the event occurs. No contracts pay 1 dollar if the event does not occur. Incorrect contracts settle at 0.

- Trading fees: Kalshi charges fees based on the expected earnings of each contract, with full transparency on the website.

For example, in a prediction market for next month’s egg prices, Kalshi might show that a 100 dollar Yes position could become 223 dollars, representing a potential 123 percent return.

Prices in each market fluctuate based on supply and demand, reflecting the aggregated beliefs of market participants. When traders strongly believe in a specific outcome, the price of the corresponding contract rises.

Beyond its core trading function, Kalshi also offers a feature called “Ideas”, designed as an open space for users to share views, discuss trading strategies and publish investment results. It functions like an internal social network where users can post, comment, reply and save notable analyses or predictions.

3. Team, Origins and Legal Journey

Kalshi was founded in 2018 by Tarek Mansour and Luana Lopes Lara, headquartered in New York City. From day one, the founders chose to follow a fully compliant regulatory path, applying for CFTC licensing and adhering to supervision, clearing, AML and KYC rules, instead of operating in legal gray zones like many other prediction platforms.

A major turning point occurred in 2024 when the CFTC rejected the listing of election contracts. Kalshi sued and a federal court later ruled in its favor, declaring that political event contracts are legal derivatives rather than gambling products. This ruling allowed Kalshi to become the first legally approved election prediction platform in the US in decades, giving it a powerful and trustworthy market position.

Financially, Kalshi is backed by reputable investors such as Sequoia Capital, Y Combinator, SV Angel and Charles Schwab. Its transparent operations, high regulatory compliance and strong support from elite venture funds have created deep trust from both users and markets, forming a core competitive advantage that most prediction markets lack.

4. Kalshi Investors and Fundraising Histor

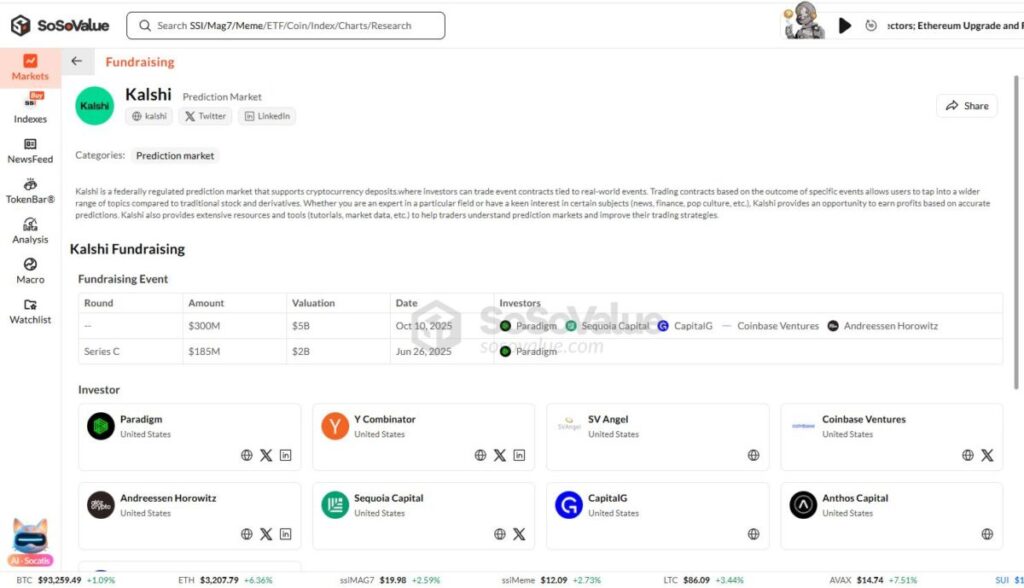

Since launching in 2018, Kalshi has built an impressive fundraising track record, raising more than 1.3 billion dollars from global top tier funds. The standout factor in Kalshi’s journey is the quality of its backers, including Sequoia Capital, Paradigm, a16z, Y Combinator, CapitalG, Multicoin Capital, SV Angel and major industry figures like Charles Schwab and Henry Kravis.

Kalshi began with a 150 thousand dollar Pre Seed round from Y Combinator in 2019, followed by a 30 million dollar Series A led by Sequoia in 2021. By late 2024, the project raised an additional 50 million dollars in debt financing to expand product capabilities and prepare for regulatory processes.

The major breakout came in 2025. In June, Kalshi closed a 185 million dollar Series C led by Paradigm with participation from Sequoia and Multicoin Capital. Only a few months later, as trading volume surged and prediction markets became a hot narrative, Kalshi raised another 100 million dollars in October 2025, pushing its valuation to roughly 5 billion dollars.

The peak arrived in December 2025 when Kalshi announced a new 1 billion dollar funding round that lifted its valuation to 11 billion dollars. This round included CapitalG, Sequoia, a16z, Paradigm and other major funds, showing strong conviction in Kalshi’s fully regulated model and its tokenization strategy.

The backing of top tier investors and massive capital reserves gives Kalshi a decisive edge in regulation, technology and scaling capabilities. This is why Kalshi is increasingly viewed as the leading contender to dominate the US prediction market and potentially expand globally between 2025 and 2030.

5. Latest News and Key Developments

The year 2025 has been explosive for Kalshi across multiple fronts. In November 2025, the platform recorded a monthly trading volume of 5.81 billion dollars, nearly double Polymarket. This reflects strong user traction, especially after expanding into sports related contracts. Around the same time, Kalshi completed a 300 million dollar Series D round, raising its valuation to roughly 5 billion dollars. Some reports now estimate its valuation at around 11 billion dollars, signaling rapid growth and significant market expectations

Another major milestone is Kalshi’s move to tokenize its contracts on the Solana blockchain. If widely adopted, this could bring the entire prediction market sector into DeFi, opening new opportunities for traders and investors while creating an on chain event asset class that can integrate with other DeFi applications.

However, major opportunity also comes with legal challenges. Despite Kalshi’s court victory allowing election contracts, sports related event contracts still face regulatory hurdles in certain US states, meaning the legal environment is not completely stable.

Overall, 2025 marks a defining year for Kalshi, with strong growth in trading volume, valuation, capitalization and technological progress in blockchain. The platform continues to strengthen its position as the leading legally compliant prediction market in the United States.

6. Conclusion

Kalshi represents a notable step forward in modern finance by creating a new event based asset class. Instead of investing in companies or traditional assets, users can profit or hedge through simple, transparent and tightly regulated contracts. With a clear legal framework, intuitive trading mechanics and broad topic coverage, Kalshi is shaping a new way for people to interact with financial markets and real world information.

Disclaimer: This content does not constitute investment, tax, legal, financial or accounting advice. MEXC provides this information for educational purposes only. Always conduct your own research, understand the risks and invest responsibly.

Join MEXC and Get up to $10,000 Bonus!

Sign Up