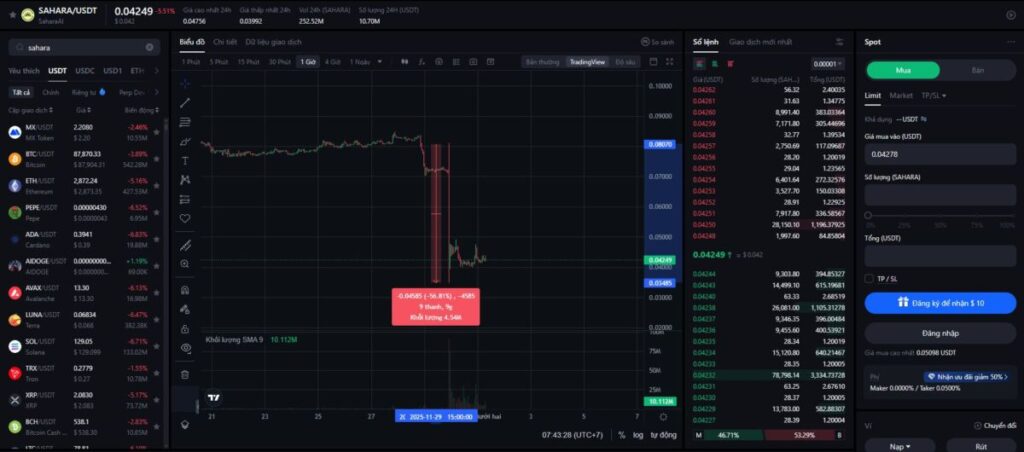

On November 29, the crypto market was suddenly shaken when the $SAHARA token plunged more than 50% in an extremely short period of time. A price chart that had been moving sideways abruptly printed a long red candle, wiping out multiple support levels. Community groups, Telegram channels, and X all went into chaos.

Questions started pouring in:

- “Did the team unlock and dump tokens?”

- “Was the smart contract hacked or taken over?”

- “Did the market maker pull liquidity?”

- “Is this a rug-pull?”

Everyone had a different theory. In the middle of the turmoil, traders rushed to find answers as quickly as possible — but noise spread faster than facts.

Amid this confusion, Sahara AI’s Co-Founder published a long statement, explaining the incident in detail and disclosing all related information. Notably, the post went deep — covering tokenomics, company operations, and market conditions — rather than serving as a shallow “damage-control” note.

This analysis will unpack each angle — from price movements and internal responses to the technical and economic drivers behind the dump — so you can get the most comprehensive view of what actually happened.

1. Sudden price crash — when market psychology overwhelms the facts

It’s no coincidence that the SAHARA price candle became the center of attention. The altcoin market has been extremely fragile: thin liquidity, declining inflows, and widespread fear after large-scale liquidations since October.

In such conditions, even a small catalyst can trigger a full “waterfall effect.”

A single large sell order can trigger a chain reaction

For tokens that lack deep liquidity across major tier-1 exchanges, one large sell order from a whale or a market maker can collapse the orderbook:

- Price slips downward

- Stop-loss orders get triggered

- Margin positions get liquidated

- Retail users panic and start selling

These fast crashes often lead outsiders to assume there must be “internal issues,” even though the crypto market has seen countless similar events caused simply by weak liquidity.

FUD erupts instantly

Crypto moves on rumors first, truth second.

- Telegram groups spread claims that “the team dumped.”

- Analysis channels rush out speculative takes.

- Some KOLs hint at “something suspicious.”

Within minutes, price drop + FUD + low liquidity form a perfect negative feedback loop. This is why the crash looks like an “internal incident,” even when it is primarily just normal market mechanics amplified by sentiment.

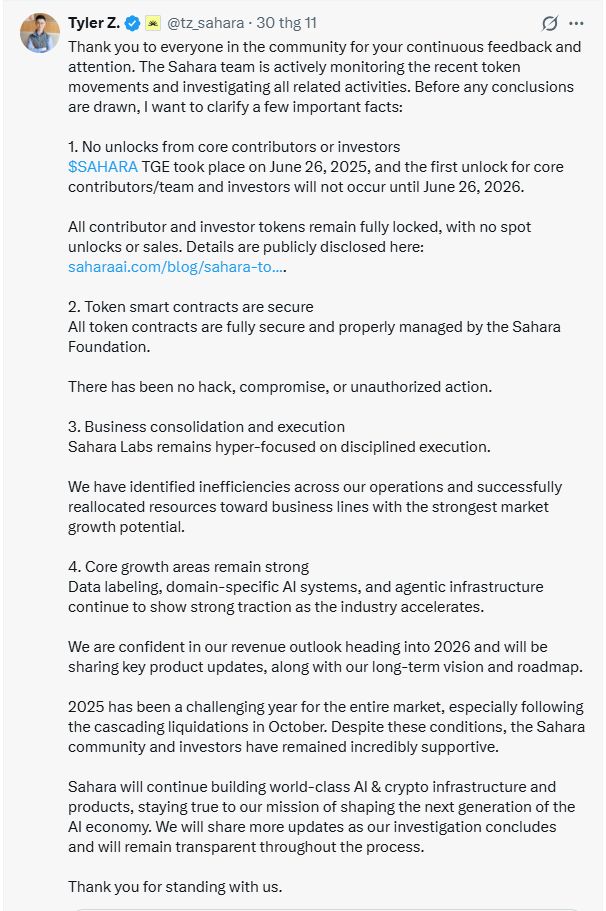

2. Response from the Co-Founder — deep dive into each statement

The Co-Founder of Sahara AI provided four key groups of information — and surprisingly, all four show meaningful depth in terms of tokenomics and business strategy.

1. No unlock from team, investors, or contributors

Why is this important?

- TGE: 26/06/2025

- First unlock: 26/06/2026

- No spot unlock • No override • No hidden unlock mechanisms

This is an extremely rare kind of tokenomics in crypto:

- Most projects unlock team tokens after ~6 months.

- Investors often get 10–20% unlocked right after TGE.

- Many projects even allocate bonus/instant tokens to pay internal salaries.

A full 12-month lock means:

- Strong commitment from the team

- Lower risk for retail investors

- Near-zero probability of insider dumping

- Higher confidence in a healthy token distribution

What does this rule out?

- “Team is dumping”

- “Investors are dumping”

- “Contributors are liquidating”

At the time of the dump, the Sahara team did not own a single token that could be sold.

2. The token smart contract is fully secure

The Co-Founder made it very clear: no hack, no unauthorized access, no on-chain irregularities.

To go deeper, we can cross-check typical hack patterns:

- Extra tokens minted? → No

- Admin/owner role changed? → No

- Tokens moved out from vesting wallets? → No

- Contract upgraded without authorization? → No

- Liquidity pulled from AMMs? → No

The smart contract is so clean that there isn’t even a small suspicious action on-chain.

This means the entire “hack” narrative is pure FUD, not data-driven.

3. Sahara is restructuring operations to become stronger

The Co-Founder mentioned “inefficiencies” — something very few crypto projects are willing to admit.

Restructuring signals that:

- The project is not afraid to change

- Underperforming units can be removed or downsized

- Focus can be shifted toward revenue-generating business verticals

- Governance is moving toward a real company model, not just a hype-driven crypto project

This matters because most AI/crypto projects:

- Scale too fast

- Lack clear direction

- Have a high burn rate

- Survive mainly on tokenomics

Sahara, by contrast, is confronting its weaknesses, fixing them, optimizing, and reallocating resources.

4. Core business lines are still growing strongly

The Co-Founder didn’t just offer reassurance — he highlighted that the business engine is intact:

Data labeling

- A market worth tens of billions of dollars

- Accelerating as enterprise AI demand grows

- Revenue is relatively predictable

Domain-Specific AI Systems

- Vertical AI is a key trend for 2025–2030

- Industry-focused models are often easier to sell than broad, general-purpose LLMs

- Contracts can be large-ticket and sticky

Agentic Infrastructure

- The newest major meta in AI

- AI agents will replace many repetitive tasks

- Enterprises are actively investing in infrastructure for this

All of this shows that despite the token price volatility, Sahara’s underlying business fundamentals remain intact.

3. Smart contract security

Q: If the smart contract were hacked, what would the market see?A: A series of abnormal transactions: extra minting, token draining, owner changes. → On-chain data shows none of these signs.

Q: Could a hacker exploit the vesting contract?A: If so, tokens in vesting wallets would have been moved. → All vesting wallets show zero transactions.

Q: Was the liquidity pool drained?A: No. The LP remains intact.

Q: So can technical causes be ruled out?A: Yes. 100%.

Technical indicators show absolutely no link to the dump.

4. Operational restructuring

Sahara AI is performing a “clean-up” — a difficult but crucial step for any startup.

Why restructure?

- The AI market is extremely competitive

- High operating costs

- Certain departments have low ROI

- Team structure must align with real market demand

Positive results of this strategy

- Reallocating resources → higher efficiency

- Cost optimization → longer runway

- Prioritizing revenue-generating units → sustainable growth

- Reducing reliance on tokenomics → lower risk

Comparable to major tech/AI startups

This mirrors moves by:

- OpenAI in 2018

- Anthropic in 2021

- ScaleAI in 2022

- InflectionAI in 2024

All had to downsize or restructure to increase performance.

This shows Sahara is not a project chasing token narratives — but a real AI company adjusting its strategy to market realities.

5. Growth pillars

1. Data Labeling

Enterprise demand for AI is exploding. Every model requires large amounts of high-quality labeled data. This industry is:

- Extremely large

- Growing annually

- Stable, with long-term clients

- High-margin

- Less competitive than building LLMs

Labeling generates real revenue, independent of token price.

2. Domain-Specific AI Systems

General-purpose LLMs are becoming saturated. But industry-specific AI systems:

- Command higher prices from enterprises

- Meet real operational needs

- Solve specialized problems

- Can lead to contracts worth hundreds of thousands to millions of USD

Sahara’s strategy of building vertical AI systems is aligned with where enterprise AI spending is shifting.

3. Agentic Infrastructure

AI is no longer just “answering questions.” It is now:

- Executing tasks

- Automating workflows

- Making decisions

- Carrying out multi-step processes like a human

The ecosystem for AI agents requires:

- Tools

- Data

- Execution layers

- Monitoring systems

→ Sahara is building the hardest and most defensible layer: the infrastructure layer.

This gives the company long-term advantages that are difficult for competitors to replicate.

Conclusion

The SAHARA incident shows that the crypto market reacts not only to facts, but also to expectations — and fears. The project has fully disclosed all relevant information: no unlocks, no hacks, no on-chain anomalies; meanwhile, its core business lines continue to grow. Yet even when the data is in Sahara’s favor, the price reflects something else entirely — the reality of investor emotion.

So the final question is no longer about the project itself, but about the market:

- Is the market evaluating SAHARA based on data, or based on emotion?

- Was this merely a temporary reaction, or a deeper shift in how investors judge AI–crypto projects?

- And more importantly: now that the facts are clear, will the market adjust its perception — or continue to let fear take the lead?

No one can answer that today. But those questions will determine SAHARA’s future far more than any single price dump ever could.

Disclaimer:The information provided here is for informational purposes only and should not be considered financial, investment, legal, or professional advice. Always conduct your own research, consider your financial situation, and, if necessary, consult with a licensed professional before making any decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up