Bitcoin surges past $90,000 as three macro forces collide: an 85% chance of December rate cuts, a White House advisor predicting a $20T crypto market, and BlackRock officially validating the “sovereign store of value” thesis.

As of November 27, 2025, Bitcoin has reclaimed the $90,000 level, erasing the bearish market structure that haunted traders just 72 hours ago. While retail investors were panic-selling the dip to $81K earlier this week, smart money was aggressively front-running a convergence of macroeconomic signals that suggests the October peak of $126,080 might just have not been the top.

We are no longer looking at a market seeking stability; we are looking at market pricing in a liquidity supercycle.

In the last three days, the narrative has shifted violently. The Federal Reserve, the White House, and the world’s largest asset manager have inadvertently aligned to form a “perfect storm” for risk assets. The Fed is now signaling an 85% probability of a December pivot. A top White House advisor has dropped a bombshell prediction that new market structure laws could unlock $20 trillion in capital. And BlackRock has finally ended the identity crisis, explicitly framing Bitcoin as “Digital Gold” for sovereign wealth funds.

This isn’t a dead cat bounce. This is the market waking up to three distinct catalysts that could drive the next parabolic leg into Q1 2026. Here is the deep dive into the forces fueling the move back above $90K.

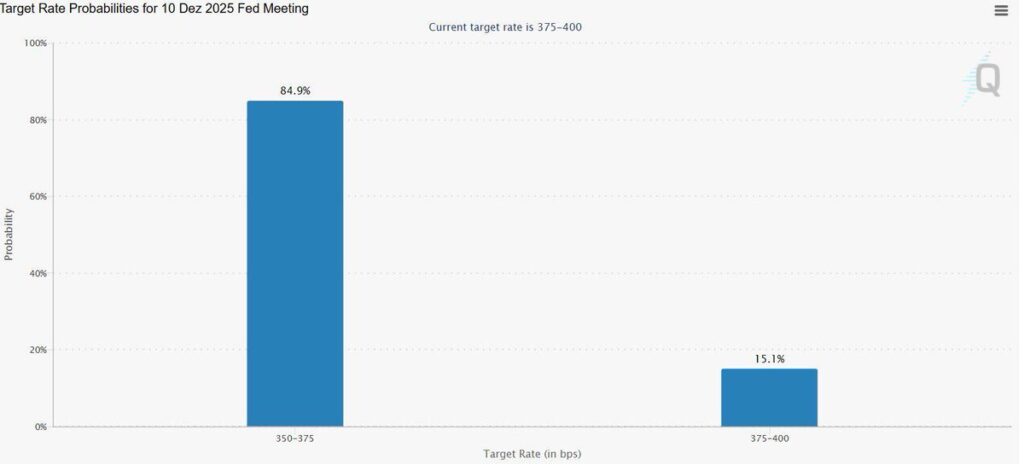

1. Catalyst 1: The Fed Pivot—85% Odds of December Rate Cut

The most immediate bullish signal comes from bond markets and Fed futures, which have violently repriced the probability of a December rate cut following dovish commentary from key Federal Reserve officials.

Mary Daly’s Signal: The “Fed Whisperer” Goes Dovish

On November 24, San Francisco Fed President Mary Daly stated in a Fox Business interview that a December rate cut is “absolutely not off the table” and emphasized that “we have to keep policy moving down to accommodate the economy.”

While Daly is not a voting member in 2025, markets treat her as a “Fed Whisperer”; her positions rarely deviate from Chair Jerome Powell’s consensus. Historically, when Daly shifts dovish, the full committee follows within weeks. Her comments triggered an immediate market reaction.

The Numbers: From Coin Flip to Near-Certainty

According to multiple sources tracking Fed funds futures and the CME FedWatch Tool:

- Before Daly’s comments: December rate cut probability was roughly 50-50

- Current probability (as of Nov 27): 85% chance of a 25 basis point cut

Money Magazine reports: “There’s now an 88% chance of a 25-point rate cut at the December 10 meeting,” while the Federal Reserve Bank of Atlanta’s tracking tool shows similar confidence. This convergence across probability models signals a genuine policy shift, not statistical noise.

The dramatic swing from 30% probability in mid-November (when government shutdown suspended economic data) to 85% today represents one of the sharpest sentiment reversals in recent Fed history. The catalyst was twofold: September PPI inflation data showing moderation, and coordinated dovish messaging from Powell’s key allies on the committee.

Why This Reverses the Correction

The recent correction which saw Bitcoin crash from $92,000 to $82,000 in just days was driven primarily by fears that the Fed would keep rates “higher for longer.” An 85% probability of a cut on December 10 means:

Immediate liquidity injection: Lower rates weaken the dollar and reduce the opportunity cost of holding non-yielding assets like Bitcoin

- Dovish 2026 trajectory: JPMorgan now forecasts four additional quarter-point cuts in 2026, bringing the federal funds rate to 3.0-3.25% by mid-2026

- Risk-on rotation: Historically, Bitcoin rallies 30-45 days after the Fed pivots dovish, as institutional capital rotates from bonds into higher-return assets

When markets priced in hawkish Fed (30% cut odds), Bitcoin fell from $92K to $82K in ten days. Now that markets price in continued easing (85% odds), that mechanism reverses; creating conditions for recovery toward $95K-$100K by year-end.

The Supporting Cast: Williams, Miran, and the Dovish Coalition

Mary Daly didn’t move the market alone. New York Fed President John Williams (FOMC vice chair) delivered remarks last week stating there’s “room for further adjustment in the near term” to move policy closer to neutral. This was interpreted as an explicit call for December action.

Additionally, Fed Governor Stephen Miran who has dissented at the last two FOMC meetings in favor of larger 50 basis point cuts signaled he will support a 25 basis point cut at the December meeting, ensuring a majority consensus.

The Wall Street Journal reported that “Powell’s allies have created an opening for another cut,” suggesting the December decision is essentially locked in barring a dramatic surprise in November economic data.

2. Catalyst 2: The $20 Trillion Regulatory Unlock

While the Fed manages liquidity, the Trump administration is preparing the regulatory runway that could bring pension funds, sovereign wealth funds, and institutional capital into crypto at scale.

The Market Structure Bill: Opening the Floodgates

According to reports from multiple sources, White House officials and crypto policy advisors predict that comprehensive stablecoin regulation and the Market Structure Bill will push the total crypto market capitalization to $15-20 trillion; a 5-7x increase from current levels around $3 trillion.

This projection surfaced in July 2025 from a White House crypto advisor and has gained renewed attention as the Senate Agriculture Committee advanced the Market Structure Bill in November, marking crucial progress toward the regulatory clarity the industry has awaited for years.

Why Regulation = $20 Trillion (Not Hype, But Math)

It sounds counterintuitive, but regulation is exactly what the biggest pools of capital in the world have been waiting for.

- The Problem: Sovereign wealth funds ($11 trillion globally) and pension funds ($50+ trillion) are often legally prohibited from investing in “unregulated” asset classes. Compliance officers at CalPERS, Norway’s Government Pension Fund, or Singapore’s GIC simply cannot allocate to crypto without clear regulatory frameworks defining custody standards, reporting requirements, and investor protections.

- The Solution: The Market Structure Bill currently advancing through Congress with strong bipartisan support defines the rules of the road. It clarifies SEC versus CFTC jurisdiction, establishes custody standards for digital assets, and creates compliant on-ramps for institutional capital.

Once passed, these massive institutional allocators receive “permission” to buy.

The Stablecoin Component: Dollar Dominance Through Crypto

The White House advisor emphasized that tokenized equities, 24/7 trading, and seamless global dollar access through stablecoins represent “the path to U.S. leadership in digital finance.”

The prediction includes that individuals and institutions accessing U.S. capital markets under the new regime would be required to use dollar-backed stablecoins, deepening dollar dominance globally while simultaneously creating on-ramps for Bitcoin and crypto broadly.

This strategic vision aligns crypto adoption with U.S. geopolitical interests, making regulatory approval more likely than the previous administration’s enforcement-first approach.

The Simple Math

For context:

– 1% of global pension assets = $500 billion entering crypto

– 1% of sovereign wealth funds = $110 billion

– Combined with continued retail and corporate adoption = $15-20T total market cap is conservative over 5-7 years

We’re witnessing the transition from the “Wild West” to the “Institutional Grade” market. The $20 trillion target reflects what happens when the world’s largest capital pools that were previously locked out by regulatory uncertainty receive green light to participate.

3. Catalyst 3: BlackRock Ends the Currency Debate

The final piece of the puzzle is narrative clarity from the world’s largest asset manager, which officially ended the “Bitcoin as currency” debate that has confused markets for years.

The “Digital Gold” Classification

In a podcast interview published November 22, 2025, BlackRock’s Head of Digital Assets, Robbie Mitchnick, made the institutional thesis crystal clear:

“For us, and most of our clients today, they’re not really underwriting to that global payment network case. That’s sort of maybe out-of-the-money option value. Clients are treating Bitcoin like digital gold, not for transactions.”

This classification is strategically critical. If Bitcoin is a currency, it needs high velocity (people spending it frequently). If it is Digital Gold, it needs scarcity (people hoarding it long-term).

BlackRock is telling the world’s wealthiest clients: “Do not spend this. Hoard it.”

What This Means for Supply

This creates a massive supply shock. As institutions lock Bitcoin into cold storage for 10+ year hold periods, liquid supply on exchanges evaporates:

– BlackRock’s IBIT ETF holds $85+ billion in Bitcoin (despite November turbulence, year-to-date inflows remain +$44.4B)

– These coins are effectively removed from circulation for strategic, not tactical, holds

– They don’t trade. They don’t hit exchanges. They sit in cold storage.

When BlackRock buys Bitcoin for client portfolios, those coins move into institutional custody and stay there. They’re removed from circulating supply for years, potentially decades.

The Stablecoin Corollary: Bifurcating the Market

Mitchnick also addressed why stablecoins, not Bitcoin, are winning the payments race:

“Stablecoins have been hugely successful in the payments sector. They have a massive product-market fit as a payment instrument.”

This clarity helps institutional investors understand the crypto ecosystem is bifurcating into:

1. Store of value layer: Bitcoin (digital gold)

2. Payment/transaction layer: Stablecoins (USDC, USDT)

Bitcoin isn’t competing with Visa for payment volume; it’s competing with gold, Treasury bonds, and real estate as a portfolio diversifier and inflation hedge. This framing gives every other institutional allocator permission to follow BlackRock’s lead.

The 1-2% Allocation Standard

BlackRock includes Bitcoin at 1-2% in its model portfolios for institutional clients. This seemingly small allocation has massive implications:

– Global investable assets: ~$400 trillion

– 1% allocation: $4 trillion potential demand

– Current Bitcoin market cap: ~$1.7 trillion

If even a quarter of global institutional assets adopt BlackRock’s 1-2% allocation standard, Bitcoin’s market cap would need to expand 2-3x just to absorb the demand—without considering any retail or corporate buying.

4. What the Charts Show: Bull Market Resumed?

The reclaim of $90,000 has repaired the technical damage from mid-November and signals the correction phase is complete.

Key Levels to Watch:

$90,000 – $92,000: We are currently battling to flip this previous resistance into support. A daily close above $92K confirms the breakout and opens a path to the psychological $100K level.

$100,000: The ultimate psychological barrier. Breaking this decisively would confirm the bull market has resumed and likely trigger FOMO buying from retail investors who sold during the correction.

$87,000: The new “line in the sand.” As long as Bitcoin holds above $87K on any retest, the uptrend remains intact. Breaking below would signal the correction isn’t finished.

Bullish Technical Signals:

Long-term holders have stopped selling:The 815,000 BTC sold in November by long-term holders represents supply exhaustion; these holders don’t sell twice in quick succession

Short-term capitulation complete: The crash to $82K flushed out weak hands; SOPR (Spent Output Profit Ratio) below 1.0 indicates panic sellers exited at losses

72% of supply still in profit: At $100K, 72% of all Bitcoin remains in profit; a healthy ratio that suggests we’re nowhere near a bear market top where 90%+ of supply typically becomes underwater

Fear & Greed Index reversal: After hitting 15 (Extreme Fear) for three consecutive weeks, historically a bottom signal, the index has begun recovering as $90K reclaim restores confidence

Liquidation flush complete: Long liquidations exceeded $220 million earlier this week but have since dropped 70% to just $2.18 million, indicating forced selling pressure has been exhausted

5. The Convergence: Why All Three Catalysts Matter Simultaneously

Each of these catalysts is powerful individually. Occurring simultaneously, they compound exponentially:

Fed cuts rates (85% probability) → Dollar weakens → Bitcoin becomes more attractive as inflation hedge

Market Structure Bill passes → Institutions get regulatory permission → $15-20T capital can enter

BlackRock provides narrative clarity → “Digital gold” positioning → Institutions know how to classify and hold Bitcoin

This is the trifecta: liquidity (Fed), access (regulation), and narrative (institutional positioning).

Historical Precedent: The 2020-2021 Parallel

A similar convergence occurred in 2020-2021:

– Fed went dovish: Cut rates to zero, printed trillions in pandemic response

– Institutions entered: MicroStrategy, Tesla, Square bought for treasury

– Narrative shifted: From “internet money” to “inflation hedge”

Result: Bitcoin went from $10,000 (October 2020) to $69,000 (November 2021); 590% in 13 months.

The current setup has even stronger fundamentals:

– ETF infrastructure now exists ($95B in spot Bitcoin ETFs vs. zero in 2020)

– Regulatory clarity improving, not deteriorating

– Institutional adoption broader (BlackRock, Fidelity, Citadel, JPMorgan all engaged)

If history rhymes, the next 12-18 months could deliver similar outsized returns as liquidity, access, and narrative align perfectly.

6. Conclusion: The Window Is Closing

The “Perfect Storm” is forming in real-time:

Immediate Liquidity: The Fed will likely cut rates December 10 (85% probability), reversing the hawkish pressure that drove November’s correction

Structural Demand: White House projects $15-20T crypto market cap from regulatory clarity via Market Structure Bill and stablecoin regulation

Institutional Supply Shock: BlackRock is classifying Bitcoin as “digital gold” and removing coins from circulation through 10+ year institutional holds at the 1-2% portfolio allocation standard

The price action at $90,000 isn’t noise; it’s the market waking up to these convergent catalysts. While retail investors obsess over daily charts, the Fed is pivoting dovish, Congress is advancing crypto-friendly legislation, and BlackRock is telling sovereign wealth funds to treat Bitcoin like gold.

Yes, November was brutal. Yes, technical damage needed time to repair. But the fundamental reality is that the largest financial actors in history are positioning for the next decade of Bitcoin adoption.

The best time to buy is when you least want to. Just 72 hours ago, at $87K with Extreme Fear dominating sentiment, that moment arrived. Those who bought the fear are already up 3%+. The question now is whether you’re positioned for what comes next.

Disclaimer: This content is for educational and reference purposes only and does not constitute investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up