Choosing the right crypto exchange is one of the biggest decisions for traders in India. With trading activity growing and market conditions shifting fast, fees can make or break profitability. A difference of even 0.05 percent adds up quickly when you trade often or handle larger positions. This guide compares MEXC with popular Indian and global exchanges to help you understand which platform truly offers the lowest fees and the best value for your trading style.

Table of Contents

Why Low Trading Fees Matter for Indian Crypto Users

India’s growing crypto adoption

More Indian traders are entering the market each year, often starting with small amounts. When capital is limited, high trading fees eat into profits. This is even more noticeable in volatile markets where users place frequent spot or futures orders.

How fees affect real profitability

A single taker trade at 0.1 percent may feel small, but multiply that by dozens of trades and the cost becomes substantial. Futures traders also rely on tight spreads and slim margins, so the platform’s fee design shapes long-term performance.

Understanding Crypto Exchange Fees

Maker and taker fees

Maker fees apply when you place a limit order that adds liquidity. Taker fees apply when you buy or sell instantly using a market order or an order that matches immediately. Makers typically pay less because they support market depth, while takers usually pay more because they remove liquidity.

Other fees Indian users should watch

- Deposit fees: Most Indian exchanges offer free UPI deposits, while international platforms rely on third-party payment providers that may add charges.

- Withdrawal fees: Vary widely depending on token and network.

- Spreads and slippage: Exchanges with thin liquidity may show low fees but still cost more overall due to wider price gaps.

- Conversion fees: When converting INR to USDT or other stablecoins, some platforms add hidden markups.

Why transparency matters

Beginners often focus only on the stated trading fee. Real cost comes from a mix of maker/taker fees, spreads, deposit charges, and liquidity depth. A platform with low visible fees but weak liquidity can still end up costing more.

MEXC Fees Overview: The Lowest Maker Fees in the Market

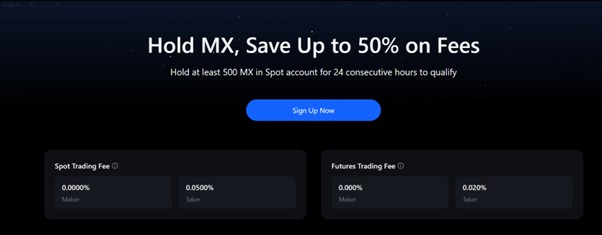

Spot trading fees

MEXC offers:

- 0 percent maker fee

- 0.05 percent taker fee

This is significantly lower than Binance (0.1 percent) or most Indian exchanges, which generally range from 0.2 percent to 0.5 percent. MEXC also lists more than 1,800 cryptocurrencies, which is beneficial for Indian traders exploring emerging altcoins.

Futures trading fees

MEXC’s perpetual futures fees are among the lowest in the world:

- 0 percent maker

- 0.02 percent taker

This structure supports scalpers, day traders, and strategy testers. During promotional periods, over 140 futures pairs offer 0 percent maker and 0 percent taker like BTC/USDT, ETH/USDC, reducing friction even further.

Why the fee model works well

Cost efficiency helps both beginners and active traders:

- Beginners can use limit orders without worrying about fees draining small accounts.

- High-frequency traders save significantly on maker fees.

- Futures traders enjoy deep liquidity without paying premium costs.

Indian users can install the MEXC app by visiting the official MEXC app download page.

Competitor Fee Comparison: Binance, CoinDCX, CoinSwitch, Bybit and Others

Binance fees

- Spot: 0.1 percent maker and taker (can drop with BNB discounts).

- Futures: 0.02 percent maker, 0.05 percent taker.

- INR support: Limited; relies on P2P trading.

Good global liquidity but slightly higher fees than MEXC for both spot and futures.

CoinDCX fees

- Spot fees often fall around 0.2 percent.

- Supports INR deposits through bank and UPI.

- Great for beginners but costlier for active traders.

CoinSwitch fees

- No visible trading fee, but spreads are wider than global exchanges.

- Simple interface and full INR support.

Overall cost is higher due to embedded spread markup.

Bybit fees

- Spot: 0.1 percent.

- Futures: 0.02 percent maker, 0.055 percent taker.

- No INR deposits.

A strong futures alternative, but still more expensive than MEXC.

Other Indian exchanges

- ZebPay: Charges membership fee + trading fees.

- WazirX: Uses a maker/taker model but often has higher spreads.

- KuCoin: Low global fees but no INR on-ramp.

MEXC vs Competitors: Side-by-Side Fee Breakdown

Spot trading comparison

| Exchange | Maker Fee | Taker Fee |

| MEXC | 0% | 0.05% |

| Binance | 0.1% | 0.1% |

| CoinDCX | ~0.2% | ~0.2% |

| CoinSwitch | Spread-based | Spread-based |

| Bybit | 0.1% | 0.1% |

MEXC is the only major global exchange offering 0 percent maker fees consistently.

Futures trading comparison

| Exchange | Maker Fee | Taker Fee |

| MEXC | 0% | 0.02% |

| Binance | 0.02% | 0.05% |

| Bybit | 0.02% | 0.055% |

| KuCoin Futures | 0.02% | 0.06% |

MEXC has the lowest taker fees and leads the market with consistent 0 percent maker futures.

Other cost considerations

- Liquidity depth affects slippage.

- Indian exchanges often have poorer liquidity in altcoins.

- Global exchanges may require conversion costs for INR users.

Beyond Fees: Liquidity, Security, and Features That Matter

Liquidity and execution quality

MEXC provides strong liquidity across major and mid-cap assets. Higher liquidity reduces slippage, which matters just as much as the visible fee. Indian exchanges often have smaller user bases, creating wider spreads during peak volatility.

Security and reserves

MEXC maintains more than 100 percent in reserves and uses robust wallet management. Global risk systems and margin protection mechanisms reduce user exposure during rapid price movements.

Trading tools and features

MEXC includes:

- Copy trading

- Grid trading

- Cross and isolated margin modes

- Hedged positions

- High leverage options (up to 500× on selected pairs)

These tools help beginners experiment safely and give advanced users the flexibility to build complex strategies.

Which Exchange Is Best for Indians?

Best for Indian beginners

Exchanges like CoinDCX or CoinSwitch are easier for new users because they support instant INR deposits and simple interfaces. If your priority is local banking support, these platforms may feel more convenient.

You can download the MEXC exchange app in India directly from the official MEXC download page.

Best for lowest fees

For pure cost efficiency, MEXC offers the lowest fees in both spot and futures trading. Traders who operate actively or handle multiple limit orders will feel the difference quickly.

Best for futures traders

MEXC stands out with 0 percent maker and 0.02 percent taker, giving it a clear edge. Bybit and Binance are strong alternatives but remain costlier.

Best for strong liquidity

Global exchanges like MEXC and Binance offer deeper liquidity pools compared to most Indian platforms, especially for altcoins and futures.

Final Verdict: Is MEXC the Lowest-Fee Crypto Exchange in India?

After comparing major exchanges, MEXC offers the most cost-efficient structure for both new and advanced traders. Its 0 percent maker fees and very low taker fees in spot and futures trading make it the most economical choice for Indian users who focus on active trading, altcoins, or derivatives.

Indian exchanges remain useful for simple INR deposits, but for trading performance and long-term savings, MEXC delivers more value. Users should still assess their goals and risk tolerance, but if fees are your priority, MEXC clearly leads.

A practical next step is to compare platforms firsthand and choose the one that aligns with your style and comfort level.

FAQs

1. Which crypto exchange has the lowest fees in India?

MEXC currently offers the lowest maker and taker fees among major exchanges, especially with 0 percent maker fees on spot and futures.

2. Is MEXC safe for Indian users?

Yes. MEXC maintains high reserve ratios, strong security systems, and global risk controls that protect user assets.

3. Does MEXC support INR deposits?

MEXC does not offer direct INR deposits, so users typically convert through P2P or third-party providers. Costs are still lower overall due to low trading fees.

4. Are Indian exchanges cheaper than global exchanges?

Not usually. Indian platforms often have higher trading fees or wider spreads, making global exchanges like MEXC more affordable for active traders.

5. Is MEXC good for beginners?

Yes. The platform’s low fees, simple interface, and access to many trading tools make it beginner-friendly, though users should be mindful of deposit methods.

Disclaimer: The information provided in this article is for educational and informational purposes only. It does not constitute financial, investment, or trading advice, and should not be interpreted as an endorsement of any specific project, product, or service. Always conduct your own research and consult with a qualified financial professional before making investment or trading decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up