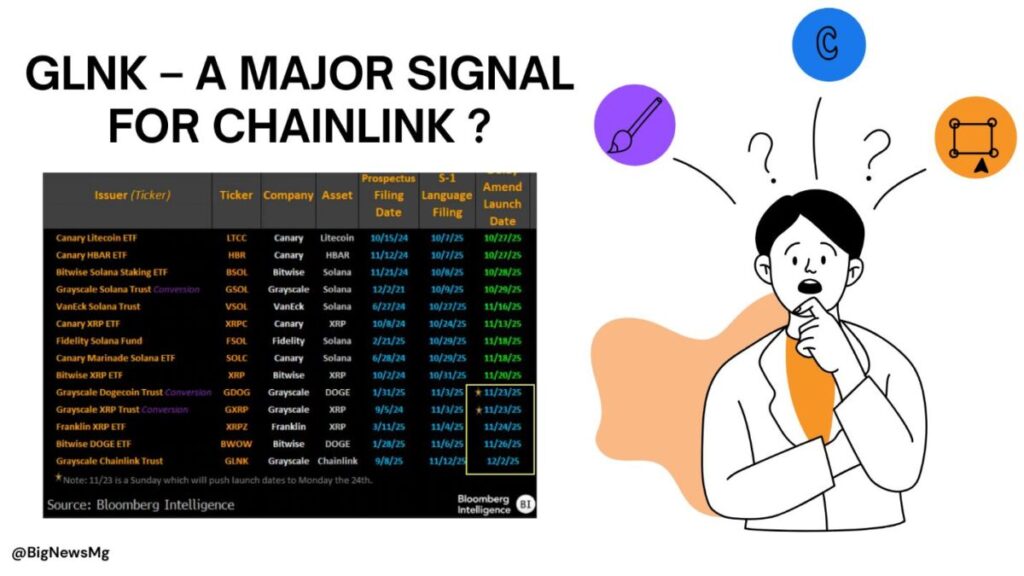

The appearance of GLNK in the ETF filing tracker compiled by Bloomberg Intelligence — along with the official data page from Grayscale — makes one thing clear:

Chainlink is no longer just a component of DeFi; it is now being recognized as an asset qualified to enter the traditional financial ecosystem.

Grayscale’s push to convert the Grayscale Chainlink Trust → Chainlink ETF (GLNK) places LINK in the same league as major assets like Bitcoin, Ethereum, XRP, and Solana in the broader ETF-ization process.

Even more noteworthy, the filing dates, amendment updates, and projected launch milestones in Bloomberg’s table fully confirm that GLNK is not a rumor — but a strategic move with a clearly defined roadmap.

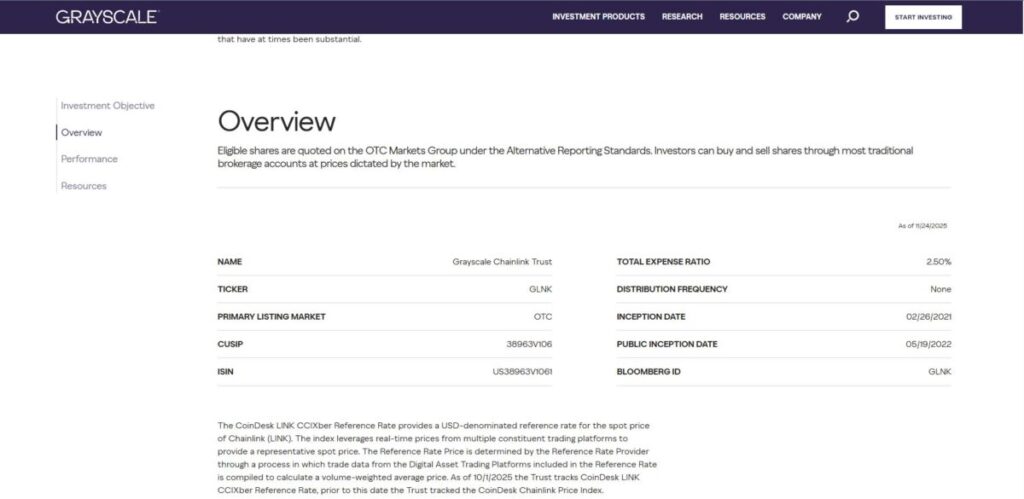

At the same time, Grayscale’s official information page shows that GLNK is still structured as a Trust, but is undergoing a transition: updating benchmark indices, increasing transparency of NAV data, and preparing the necessary requirements to align with the ETF framework.

All these factors paint a broader picture:

GLNK is not only the first ETF dedicated to Chainlink — it represents the formal integration of Chainlink into traditional finance, opening the gate for institutional capital to flow into the most critical oracle infrastructure of Web3.

1. Why is GLNK a strategic move?

1.1 The ETF structure enables LINK to enter the “institutional zone”

Previously, institutional investors could not easily access LINK due to:

- Compliance restrictions when directly purchasing tokens

- Custody challenges for digital assets

- Complex financial reporting requirements

- Operational risks related to self-managing private keys

GLNK eliminates all of these issues.

With an ETF:

- LINK becomes a security that can be traded through traditional brokerage accounts

- Assets are custodied under SEC-compliant standards

- Transparent reporting and periodic audits are provided

- Clear NAV and the ability to redeem for underlying assets

- Suitable for pension funds, strategic funds, and family offices

=> Chainlink transitions from a crypto asset → to a fully compliant financial asset.

1.2. GLNK unlocks the institutional capital that was previously inaccessible

Before ETFs existed, most funds:

- Were not allowed to purchase non-securities

- Could not open accounts on crypto exchanges

- Lacked custody infrastructure for digital assets

- Had no quantitative models to assess token risk

ETF access allows LINK to bypass all these barriers, opening the door for:

- Pension funds

- Endowment funds

- Banks

- Sovereign funds

- Thematic ETFs

- Global institutional investors

… to legally and compliantly gain exposure to LINK.

1.3. GLNK creates large-scale secondary liquidity

ETFs turn LINK into an asset with:

- Support from traditional market makers

- Dense liquidity

- Tight spreads

- Lower volatility

- Easy integration into multi-asset portfolios

This is a critical factor for LINK to appear in the investment portfolios of major institutions.

1.4. Establishing a financial-standard valuation framework

When LINK enters an ETF:

- It will have standardized NAV

- Daily performance data will be available

- Risk analyses such as volatility and Sharpe ratio will be published

- It will be incorporated into Bloomberg and Morningstar asset models

This elevates Chainlink to the same “level” as:

- BTC with its ETF

- ETH with its ETF

- And soon, XRP and SOL

=> A very powerful narrative: LINK becomes an asset that can be valued under traditional financial standards.

2. How GLNK Transforms the Landscape for Chainlink (LINK)

2.1. The Arrival of Institutional Capital — LINK Finally Meets the Big Money

ETF flows behave differently from crypto-native capital. They move slowly, steadily, and with purpose — more like rivers carving canyons than waves washing ashore.

Two characteristics define institutional ETF inflows:

- They are long-term and significantly less speculative. These are pensions, endowments, insurance portfolios — capital that doesn’t flinch easily.

- They create a cascade effect. Once an asset receives its first ETF, other thematic ETFs begin to circle around it, analyzing whether it fits their mandate.

We’ve seen this before:

- BTC ETF → a historic wall of institutional money

- ETH ETF → staking recognized as legitimate yield

- XRP & SOL ETF filings → a clearer legal framework emerging

Now, imagine GLNK entering the room.

Suddenly, LINK becomes eligible for inclusion in:

- Web3 Infrastructure ETFs

- Tokenization and RWA-focused funds

- Distribution pipelines of traditional brokerages

This is capital that spot traders, whales, or even crypto VCs cannot replicate.

This is slow-moving, deep-pocketed, legacy money — and GLNK is the doorway.

2.2. A Structural Reduction in LINK’s Liquid Supply

Every ETF has one job at its core: buy underlying assets and hold them.

When GLNK purchases LINK to back its shares:

- Those tokens are pulled out of the open market

- Circulating supply shrinks

- Selling pressure decreases

- Scarcity increases — slowly, silently, and consistently

This is exactly the mechanism that turned BTC ETFs into long-term supply sinks.

And if GLNK eventually integrates staking?

- Staked LINK grows

- Oracle network security strengthens

- A real yield emerges inside a regulated product

At that point, GLNK stops being just an ETF — it becomes a machine designed to lock LINK over time.

2.3. Chainlink Steps Into the Corporate Spotlight

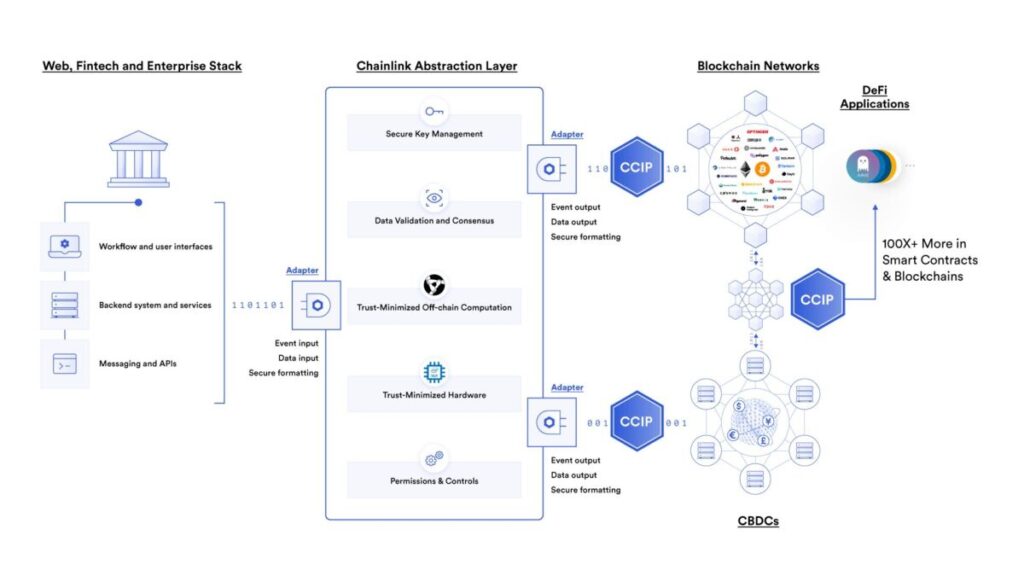

Chainlink is not a blockchain, and that is precisely why it matters. It serves as the middleware, the connective tissue, the data layer that modernized finance quietly depends on.

Its core components —

- Oracles for price and operational data

- Proof-of-Reserve for real-time transparency

- CCIP for cross-chain settlement

- Automation for logic and execution

— together form the infrastructure layer that institutional finance can understand, audit, and integrate.

ETF-ization places Chainlink into a new universe — one where:

- Banks

- Corporations

- RWA issuers

- Payment networks

… can include LINK in dashboards, models, and asset workflows without ever touching a wallet or worrying about private keys.

This isn’t just “adoption.” It’s normalization — Chainlink becoming part of the background fabric of global finance.

3. GLNK in the Tokenization Landscape — Where Chainlink Becomes the “Data Backbone”

Tokenization — the process of bringing real-world assets onto blockchain rails — is no longer a theory or an experiment. It is becoming an irreversible shift in global finance.

Treasury bonds are being tokenized. Money market funds are being tokenized. Real estate, equities, gold, commodities — one by one, they are being reimagined as programmable digital assets.

As capital markets migrate to blockchain infrastructure, one truth becomes increasingly clear:

Every tokenized asset needs reliable data, transparent verification, and a secure way to move across chains.

And that is precisely where Chainlink stands at the center.

3.1. Oracle — The source of accurate, trusted financial data

Tokenized assets do not survive on price feeds alone. They need a constant stream of precise, verifiable information:

- NAV updates

- Interest rate changes

- Real-time asset status

- Collateral verification

This is operational data — the kind that determines whether a tokenized fund is solvent, whether a bond remains valid, whether collateral still meets requirements.

Chainlink’s oracle network has become the institutional-grade data layer that makes tokenized assets function reliably.

3.2. Proof-of-Reserve — Transparency that institutions can trust

In traditional finance, trust is built on audits. In the tokenized world, it is built on cryptographic transparency.

Chainlink’s Proof-of-Reserve (PoR) has already become a standard used by:

- Leading stablecoins

- Tokenized investment funds

- Vault-backed digital assets

PoR allows institutions to verify — in real time — that assets truly exist, are properly collateralized, and remain unchanged.

This eliminates one of the largest friction points in institutional crypto adoption: opaque reserves.

3.3. CCIP — The connective tissue of a multi-chain financial world

Tokenized assets will not live on a single chain. Their lifecycle will span multiple environments:

- Issuance on private, permissioned chains

- Trading on public, open markets

- Settlement across other networks

This requires a secure, standardized cross-chain messaging and transfer protocol.

Chainlink’s CCIP is shaping up to become exactly that — the interoperability layer for global tokenized finance.

It enables different ecosystems to communicate, settle, and exchange value without compromising security.

=> The bigger picture: GLNK transforms LINK into an institutional asset

Once LINK enters the ETF structure, it is no longer just the native token of an oracle network.

It becomes:

the institutional gateway to the “data backbone” of the emerging digital economy.

GLNK formalizes Chainlink’s role at the heart of tokenization — the infrastructure that feeds data, verifies reserves, and connects assets across chains.

4. GLNK and Chainlink’s Competitive Moat – Why This ETF Truly Matters

Not every oracle network can become the foundation for an ETF. Chainlink stands apart — and GLNK exists precisely because of the structural advantages the network has built over years of development.

4.1. A massive network effect that is almost impossible to replicate

Chainlink has quietly become the silent backbone of Web3. It powers:

- More than 1,000 decentralized applications

- Hundreds of DeFi protocols

- Early-stage pilots by global banks and financial institutions

- The new wave of RWA and tokenization platforms

- Major Layer-1 and Layer-2 ecosystems

Once an oracle network is deeply integrated at this scale, replacing it is no longer a technical decision — it becomes economically and operationally impractical.

Chainlink isn’t just another oracle provider. It is a systemically important piece of digital financial infrastructure.

4.2. Seven years of reliability — a rare trait in crypto

While countless crypto projects have risen and fallen, Chainlink has remained remarkably steady:

- No major network failures

- No catastrophic hacks

- A mature, battle-tested oracle network

- Trusted by long-term enterprise partners

Institutions don’t just invest in technology; they invest in track records, predictability, and operational resilience. Chainlink offers all three — a rarity in an industry defined by volatility.

4.3. Deepening enterprise connections

Chainlink is not knocking on the doors of traditional finance — it is already inside the room.

It has been integrated, tested, or piloted by:

- SWIFT

- DTCC

- ANZ

- Siemens

- BNP Paribas

- And a growing list of major banks and financial institutions

This level of enterprise alignment is something only a handful of crypto networks have ever achieved.

And GLNK is the bridge that makes these relationships more than experiments — it turns them into capital flows.

5. Risks and Challenges — The Other Side of the GLNK Narrative

Every major structural shift comes with uncertainties, and GLNK is no exception. To understand its long-term impact, we must also explore the shadows cast behind the spotlight. A strong narrative is valuable — but a clear-eyed assessment is essential.

5.1. Regulatory uncertainty — the factor no one can fully control

GLNK exists at the intersection of crypto and traditional finance, and that is a terrain heavily shaped by regulation.

ETF approval is not just a checklist; it is a dynamic, evolving dialogue with regulators.

- S-1 filings must withstand intense scrutiny

- Custody arrangements must meet institutional standards

- The SEC may revise expectations at any moment

A single regulatory shift — even unrelated to LINK — can ripple into the ETF approval timeline. This is not a weakness of GLNK, but a reality of operating in a space where law and innovation move at different speeds.

5.2. Rising competition in the oracle ecosystem

Chainlink may be the current leader, but leadership invites challengers.

Emerging oracle networks like:

- Pyth

- API3

- RedStone

are innovating rapidly, targeting niches such as high-frequency price feeds or specialized data rails.

While none yet match Chainlink’s breadth or enterprise penetration, the competitive landscape ensures that the oracle sector will not remain static. GLNK strengthens Chainlink’s institutional presence — but it also raises expectations for continuous innovation.

5.3. Macro volatility — the force that shapes all risk assets

Even with the structure and discipline of an ETF, LINK does not escape the gravitational pull of global markets.

Its performance will still be influenced by:

- Interest-rate cycles

- Liquidity shifts between risk-on and risk-off environments

- Broader crypto market cycles

- Investor sentiment

The ETF reduces operational barriers, but it does not insulate LINK from the emotional waves of global capital.

This is the paradox of GLNK: it stabilizes access, but cannot fully stabilize perception.

6. Conclusion – GLNK is the legitimization step for Chainlink to become global financial infrastructure

Summarizing the key elements:

- A clear ETF progression (via Bloomberg Intelligence)

- Transparent data from Grayscale

- Chainlink’s rising critical role in the Tokenization sector

- Strong competitive moat

- Long-term demand for LINK via ETF mechanisms

=> GLNK is a strategic milestone in Chainlink’s journey toward mainstream adoption.

It not only creates a new capital inflow channel for LINK, but also serves as validation of Chainlink’s role in the digital asset economy — where data, verification, and cross-chain communication become foundational infrastructure layers.

GLNK is not just an ETF.It is the official certification that Chainlink has become a component of the global financial system.

Disclaimer:The information provided here is for informational purposes only and should not be considered financial, investment, legal, or professional advice. Always conduct your own research, consider your financial situation, and, if necessary, consult with a licensed professional before making any decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up