Over $566 million in crypto tokens unlocked between Nov 24-Dec 1, led by HYPE’s $318M release. Learn which tokens face selling pressure, what unlocks actually mean, and how to trade around these supply shock events.

More than $566 million worth of cryptocurrency tokens are scheduled to unlock between November 24 and December 1, 2025; one of the largest weekly token release events of the year. For a market already struggling to stabilize after erasing over $1 trillion in value since mid-October, this sudden surge of new supply couldn’t come at a worse time.

The largest single unlock comes from Hyperliquid (HYPE), which will release 9.92 million tokens worth approximately $318 million on November 29. That’s nearly 60% of this week’s total unlock value concentrated in one event. Following close behind are Plasma (XPL) at $17.5 million, Jupiter (JUP) at $12.8 million, and Kamino (KMNO) at $12 million.

But here’s what makes this week particularly concerning: these unlocks aren’t happening in isolation. Major cryptocurrencies like Solana, Dogecoin, and Avalanche will also experience daily linear unlocks totaling over $179 million throughout the week. Combined with one-time cliff unlocks, the market faces a cumulative supply increase that could pressure prices across multiple tokens simultaneously.

For traders holding positions in affected tokens, the question isn’t whether these unlocks will impact prices, it’s how much, how fast, and whether you’re positioned correctly to navigate the volatility. This article explains what token unlocks actually are, breaks down this week’s biggest releases, reveals which tokens face the most pressure, and provides actionable strategies for trading around these high-risk events.

1. What Are Token Unlocks? The Supply Shock Explained

If you’re new to crypto tokenomics, token unlocks can seem confusing. Here’s the simple explanation:

When cryptocurrency projects launch, they don’t release 100% of their tokens to the public immediately. Instead, they lock up large portions and release them gradually over time according to a predetermined schedule. This practice is called **vesting**, and it serves several purposes:

Why Projects Lock Tokens:

– Prevents early investor dumping: Team members, venture capitalists, and early investors can’t immediately sell all their tokens and crash the price

– Aligns long-term incentives: Forces stakeholders to remain committed to the project’s success over months or years

– Creates price stability: Gradual release prevents sudden supply shocks that cause violent price swings

– Demonstrates commitment: Shows the team isn’t just trying to cash out quickly

The Two Types of Token Unlocks:

1. Cliff Unlocks (One-Time Releases): A large batch of tokens becomes available all at once on a specific date. Example: 10 million tokens unlocked on November 29.

2. Linear Unlocks (Gradual Daily Releases): Tokens are released continuously in small amounts every day over an extended period. Example: 13,400 tokens unlock daily for 365 days.

Why Unlocks Matter for Price:

Basic economics: when supply increases without a corresponding increase in demand, prices tend to fall. Token unlocks add new supply to the market. If recipients decide to sell those tokens (to realize profits or diversify holdings), the selling pressure can overwhelm buying interest and drive prices down.

However, unlocks don’t automatically mean prices will crash. It depends on:

– Who receives the tokens: Team members may hold; VCs often sell

– Current market sentiment: Strong demand can absorb selling pressure

– Token utility: Tokens with real use cases see less selling

– Price performance: If a token is already down significantly, unlock recipients may hold for better prices

2. This Week’s Biggest Unlocks: Token-by-Token Breakdown

Let’s examine the major unlocks scheduled between November 24 and December 1, focusing on those exceeding $5 million in value.

Hyperliquid (HYPE) – $318 Million (November 29)

Unlock Details:

– Tokens released: 9.92 million HYPE

– Dollar value: $318.17 million (at current prices)

– Percentage of circulating supply: 2.66%

– Recipients: Core contributors

What is Hyperliquid?

Hyperliquid is a decentralized perpetual futures exchange built on its own Layer-1 blockchain. It offers high-performance trading with sub-second transaction finality and on-chain order books—essentially competing with centralized exchanges like Binance and Bybit but in a fully decentralized manner.

Risk Assessment:

This is HYPE’s first major token unlock since launching, making it particularly unpredictable. Core contributors receiving $318 million worth of tokens may choose to hold (bullish for price) or sell to diversify (bearish). The 2.66% supply increase is manageable compared to some unlocks, but the sheer dollar value creates significant potential selling pressure.

What to Watch:

Monitor HYPE’s price action on November 28-29. If it starts dropping before the unlock, that’s traders pricing in expected selling pressure. A strong hold or even rally into the unlock could signal confidence that recipients won’t dump immediately.

Plasma (XPL) – $17.5 Million (November 25)

Unlock Details:

– Tokens released: 88.89 million XPL

– Dollar value: $17.53 million

– Percentage of circulating supply: 4.74%

– Recipients: Ecosystem and growth fund

What is Plasma?

Plasma is a modular blockchain project focused on scalability solutions. The specific use case and adoption metrics are less established compared to projects like Hyperliquid.

Risk Assessment:

The 4.74% supply increase is notable, nearly double HYPE’s percentage despite a much smaller dollar value. However, tokens going to “ecosystem and growth” typically aren’t immediately dumped, as they’re meant to fund development, partnerships, and marketing over time.

What to Watch:

XPL’s relatively small market cap makes it vulnerable to even modest selling pressure. If you hold XPL, consider taking partial profits before November 25 or setting tight stop-losses.

Jupiter (JUP) – $12.8 Million (November 28)

Unlock Details:

– Tokens released: 53.47 million JUP

– Dollar value: $12.83 million

– Percentage of circulating supply: 1.69%

– Recipients: Team (38.89 million tokens)

What is Jupiter?

Jupiter is a decentralized liquidity aggregator on Solana that routes trades across multiple DEXs to get users the best prices with minimal slippage. It’s one of Solana’s most-used DeFi protocols with genuine product-market fit.

Risk Assessment:

JUP unlocks follow a monthly cliff schedule, meaning this isn’t a one-time event—similar unlocks will continue monthly. The team receiving the majority of tokens raises red flags, as team members sometimes sell to cover expenses or diversify wealth. However, JUP’s strong fundamentals and active user base may provide buying support that absorbs selling pressure.

What to Watch:

How did JUP perform during previous monthly unlocks? If historical data shows minimal price impact, this month’s unlock may be similarly manageable. Check on-chain data to see if large wallets start moving tokens to exchanges (a precursor to selling).

Other Notable Unlocks

Kamino (KMNO) – $12 Million: 6.92% supply increase; the highest percentage among major unlocks this week. High risk of price pressure.

Optimism (OP) – Amount varies: Optimism regularly unlocks tokens as part of its long-term vesting schedule. OP has weathered many unlocks before, making the market somewhat desensitized.

ZORA – $8.7 Million: 3.73% supply increase for the NFT marketplace protocol.

Humanity Protocol (H) – $7.4 Million: 3.42% supply increase.

SAHARA – $6.7 Million: 3.42% supply increase.

3. Daily Linear Unlocks: The Slow Bleed

Beyond one-time cliff unlocks, several major cryptocurrencies experience daily linear unlocks that collectively add over $179 million in supply this week:

Solana (SOL) – $65 Million

– Weekly release: 490,350 SOL tokens

– Weekly total: Approximately $65 million in new supply

Despite this continuous selling pressure, SOL has shown remarkable resilience. The Solana network’s strong fundamentals, growing DeFi ecosystem, and institutional adoption through ETFs provide consistent buying demand that typically absorbs daily unlocking.

Official Trump (TRUMP) – Amount varies

The controversial Trump-themed token continues regular unlocks. Given its speculative nature and lack of fundamental utility, Trump token unlocks pose higher risk of price impact.

Worldcoin (WLD), Dogecoin (DOGE), Avalanche (AVAX), Bittensor (TAO), Zcash (ZEC), ETHFI

These established cryptocurrencies have been experiencing regular unlocks for months or years. Markets have largely priced in these recurring events, making acute price shocks less likely, though cumulative selling pressure still weighs on prices during weak market conditions.

4. How Token Unlocks Actually Impact Prices: What the Data Shows

Theory is one thing; reality is another. Do token unlocks actually crash prices, or is the fear overblown?

Historical Unlock Price Impact:

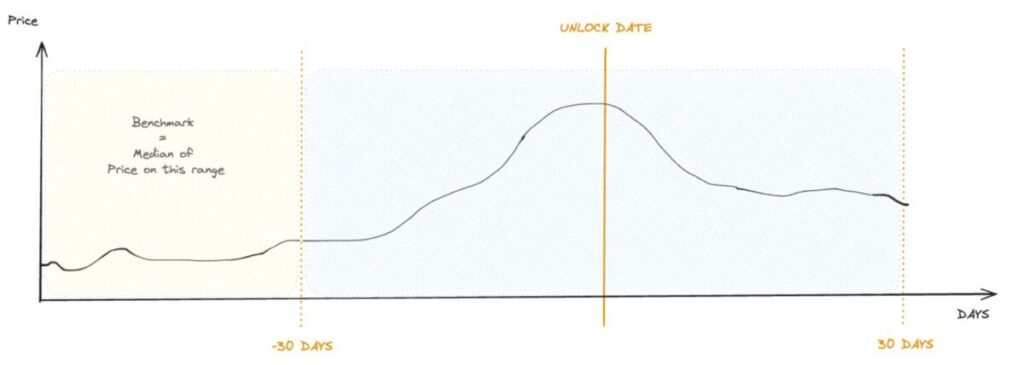

Research shows that token unlock events typically create short-term price pressure (1-7 days before and after the unlock) followed by recovery within 2-4 weeks if fundamentals remain strong.

Average price impact:

– 24 hours before unlock: -3% to -8%

– Day of unlock: -5% to -15% (if recipients sell immediately)

– 7 days after unlock: -10% to -20% (worst-case scenarios)

– 30 days after unlock: Often recovers 50-100% of losses if project fundamentals are intact

Why Some Unlocks Don’t Crash Prices:

1. Already priced in: Markets know unlock schedules months in advance. Smart traders exit positions before unlocks, meaning the selling pressure hits before the actual unlock date.

2. Recipients hold: Not all unlock recipients sell immediately. Team members committed to long-term success, investors who believe in further upside, and ecosystem funds that deploy capital over time often hold tokens.

3. Strong demand: Projects with genuine utility, growing user bases, and positive momentum can generate enough buying interest to absorb unlocking sales.

4. Market conditions: During bull markets, even large unlocks barely dent prices. During bear markets, small unlocks can trigger disproportionate crashes.

Current Market Context:

It’s important to note that we’re currently in an unforgiving market environment. Bitcoin is down 16.5% in November; its worst month since 2019. Bitcoin ETFs have bled $2.96 billion. The crypto market has lost over $1 trillion in value since October. Federal Reserve rate cut probabilities have collapsed from 90% to 71.5%, creating macro uncertainty.

In this fragile context, $566 million in token unlocks over seven days poses elevated risk. When markets are weak, even modest selling pressure can trigger cascading liquidations and panic selling.

5. Trading Strategies: How to Navigate This Week’s Unlocks

If you hold tokens affected by this week’s unlocks or want to trade around these events, here are specific strategies:

Strategy 1: Take Profits Before Unlocks (Conservative)

Who this is for: Risk-averse holders of HYPE, XPL, JUP, or other tokens with major unlocks

The approach:

– Sell 30-50% of your position 2-3 days before the unlock date

– This locks in profits and reduces exposure to potential price drops

– Set limit buy orders 10-15% below current price to re-enter if panic selling occurs

– If price doesn’t drop significantly, you still hold 50-70% of your position

Why it works: You avoid the worst-case scenario (holding through a 20% drop) while maintaining exposure if the market absorbs the unlock without crashing.

Strategy 2: Short-Term Bearish Trades (Aggressive)

Who this is for: Active traders comfortable with shorting or derivatives

The approach:

– Open short positions 24-48 hours before major unlocks (especially HYPE and KMNO)

– Use tight stop-losses 5-7% above entry to limit downside if the market rallies unexpectedly

– Target 10-15% price drops; close positions within 48 hours of the unlock

– Don’t get greedy; these are quick tactical trades, not long-term bets

Why it works: Historical data shows most unlocks create at least temporary downward pressure. A well-timed short with strict risk management can capitalize on this pattern.

Warning: Shorting is risky. Never risk more than 2-3% of your portfolio on a single short position.

Strategy 3: Buy the Panic (Contrarian)

Who this is for: Long-term investors with conviction in specific projects

The approach:

– Wait for panic selling to push prices down 15-20% from pre-unlock levels

– Start accumulating in small batches (dollar-cost average over 3-5 days)

– Focus on projects with strong fundamentals, real utility, and growing ecosystems (like JUP or SOL)

– Accept that prices may continue falling short-term but position for 3-6 month recovery

Why it works: Market overreactions create opportunities. If you believe in a project’s long-term value, buying during unlock-driven panic often provides excellent entry points.

Example: Jupiter has genuine product-market fit and processes billions in monthly trading volume. If JUP drops 20% due to unlocking fear, that could be a gift for long-term buyers.

Strategy 4: Avoid Entirely (Safest)

Who this is for: Traders who prefer waiting for clarity

The approach:

– Don’t hold positions in tokens with major unlocks this week

– Sit on stablecoins or blue-chip cryptos (BTC, ETH) until unlock volatility passes

– Re-evaluate positions on December 2-3 after dust settles

– Focus on tokens without imminent unlock risk

Why it works: Sometimes the best trade is no trade. Avoiding unlock risk entirely means you preserve capital and avoid stress while others navigate volatility.

6. Beyond This Week: What’s Coming in December

This week’s $566 million is just the beginning. December 2025 is shaping up to be one of the heaviest unlock months of the year, with projections exceeding $3.6 billion in total token releases.

Major December unlocks to watch include continuation of Solana’s linear releases, additional cliff unlocks from projects like Aptos (APT), Avalanche (AVAX), and Arbitrum (ARB), and year-end vesting schedules for numerous 2024 token launches.

For traders, this means:

1. Increased volatility: More unlocks = more potential supply shocks

2. Opportunities for accumulation: Weak holders selling creates entry points for patient investors

3. Need for vigilance: Track unlock calendars religiously using tools like Tokenomist or DropsTab

7. The Bottom Line: Respect the Supply Shock

Token unlocks are unavoidable events in crypto markets, but they don’t have to destroy your portfolio. Understanding what they are, tracking when they occur, and adjusting positions accordingly transforms unlocks from unpredictable risks into manageable, even profitable, opportunities.

This week’s $566 million in unlocks arrives during a fragile market environment where Bitcoin struggles, ETFs bleed capital, and macro uncertainty weighs on risk assets. The combination of large one-time unlocks (especially HYPE’s $318 million) and continuous daily releases creates elevated risk of downward price pressure across multiple tokens.

For holders of affected tokens, the conservative move is reducing exposure before unlock dates and planning re-entry during panic dips. For active traders, unlock events create short-term volatility that can be profitably traded with proper risk management. For long-term investors, unlock-driven selloffs often provide excellent accumulation opportunities in fundamentally sound projects.

The key is preparation. Track upcoming unlocks, understand which tokens you hold face near-term supply shocks, and have a plan before prices start moving. Markets punish the unprepared but reward those who anticipate volatility and position accordingly.

As December’s even larger unlocks approach, staying informed about token vesting schedules becomes not just useful, but essential for protecting capital and finding opportunities in one of crypto’s most predictable yet widely misunderstood market dynamics.

Disclaimer: This content is for educational and reference purposes only and does not constitute investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up