Key Takeaways

- Chain-Key Tokens Solve Cross-Chain Problems: ckBTC and ckUSDT use ICP’s chain-key tech to make safe copies of BTC and USDT. They fix issues like high fees, slow times, and risky bridges, letting assets move fast and cheap without middlemen.

- ckBTC Brings Bitcoin to ICP: As a 1:1 backed twin of BTC, ckBTC offers 1-2 second deals at tiny costs (less than a penny). It uses canisters like the Minter and Ledger for minting, burning, and safe checks, turning Bitcoin into a tool for DeFi and memecoins.

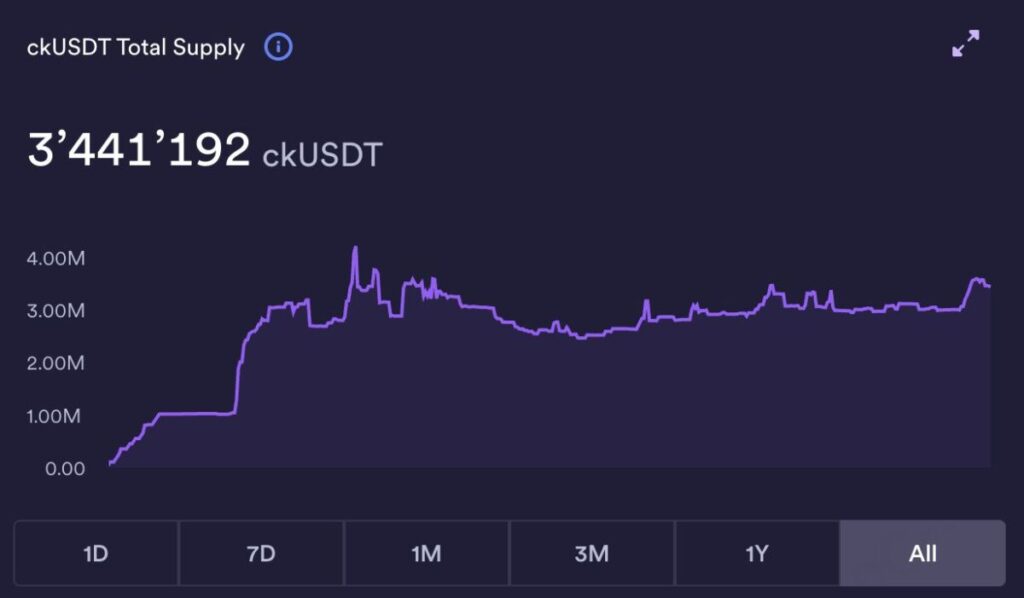

- ckUSDT Boosts Stablecoin Use: This ERC-20 twin of USDT gives sub-second settles and low fees on ICP. With parts like ckETH Minter and Ledger Orchestrator, it pairs well with ckBTC for liquidity pools and payments, keeping USDT’s steadiness while adding safety.

- Better Than Wrapped Assets: Unlike WBTC or bridged USDT, these tokens avoid keepers and bridges via threshold signing. They lead in speed, cost, and security, making multi-chain work smoother.

- Ecosystem Growth and Links: Projects like Odin Fun ($1B+ trades), Omnity ($36B TVL), Liquidium ($5B loans), and Oisy Wallet show real use. They link Bitcoin to Cosmos and Ethereum, with strong 2025 stats like high daily moves and new holders.

- Risks Are Managed: Network breaks or price swings are real, but ICP’s backups and tools like pools help. Rules checks and user teaching are ongoing, with fixes from past hacks building stronger systems.

- Bright Future Ahead: With Chain Fusion expanding to more chains and AI links, these tokens could change global finance, offering easy DeFi entry and quantum-safe updates for long-term growth.

A New Way for Blockchains to Work Together

In the world of blockchain, the Internet Computer Protocol (ICP), built by the DFINITY Foundation, has become a game-changing force. It runs smart contracts at web speed and offers endless growth. This “world computer” idea is not just a tech dream—it’s a fix for big problems in moving assets between chains, like safety risks, high costs, and slow times.

Chain-key tokens are the key part of ICP’s linking features. They use advanced chain-key encryption to make safe, trust-free copies of assets from other blockchains. This guide looks closely at two main examples: ckBTC, a decentralized copy of Bitcoin (BTC); and ckUSDT, a chain-key form of Tether’s USDT stablecoin. These tokens are more than tech—they are changing DeFi, payments, and multi-chain systems by blending Bitcoin’s strong value store with stablecoin’s easy use.

ckBTC launched in 2023 and quickly became a core part of ICP. It later grew to include ckERC20 tokens like ckUSDT. These tokens are backed 1:1 by their real assets and use ICP’s threshold signing rules for smooth swaps without middlemen. This setup avoids the weak points of old bridges—those that caused billions in losses from hacks.

By November 2025, ckBTC has over 200 active addresses and millions in daily moves, while ckUSDT acts as a liquidity pillar in ICP’s growing DeFi space, boosting stablecoin trades. Through these tokens, ICP is not just another blockchain; it is turning into a hub that links Bitcoin, Ethereum, and other networks, letting builders make safer and faster apps.

ckBTC: Bitcoin’s Fresh Start on ICP

The Tech Core and How It Works

ckBTC is basically a mirror token of Bitcoin on the ICP network. It follows ICRC-1 and ICRC-2 standards strictly and is backed 1:1 by real BTC. This design drops the old wrapped token style like WBTC, which often relies on easy-to-hack central bridges. Instead, ckBTC uses the heart of chain-key encryption—threshold ECDSA signing—to let ICP nodes sign Bitcoin deals together. This creates direct on-chain links without a single weak spot. The system ensures deals are atomic and safe: users send BTC to a special address controlled by the minter, the system waits for Bitcoin checks, then mints equal ckBTC. The whole thing takes just 1-2 seconds on ICP.

(Source:Medium)

Behind the scenes, ckBTC relies on two main canisters: the ckBTC Minter (ID: mqygn-kiaaa-aaaar-qaadq-cai) handles minting and burning, checks deals, and scans for tainted addresses to stop bad funds; the ckBTC Ledger (ID: mxzaz-hqaaa-aaaar-qaada-cai) manages account balances, transfers, and auto-saves old data for easy searches. This setup boosts clarity and turns ckBTC into Bitcoin’s “virtual Layer 2.” Users can easily get back BTC without bridge worries. Picture this: a Bitcoin settlement that might take 10-60 minutes now happens in a flash on ICP—this is not just faster; it’s a rebuild of the system.

Real Benefits and Use Cases

The appeal of ckBTC comes from mixing Bitcoin’s built-in strength—as a reliable value holder—with ICP’s speed. Transfer fees are fixed at 0.0000001 ckBTC (about less than a penny), making tiny payments and fast DeFi real, while Bitcoin’s own network often blocks these with high gas costs. More key, ckBTC’s decentralized build cuts risks of rug pulls or hacks—all actions are checkable on-chain, with built-in scans for tainted BTC to keep things clean.

In real use, ckBTC fits into many areas. For example, in DeFi platforms, it supports trust-free Bitcoin business: users run lending or yield farms right in ICP smart contracts without outside keepers. This lowers risks and opens new ways for Bitcoin in memecoin worlds, letting builders create complex money tools. ckBTC’s linking power makes it a bridge from Bitcoin to other chains, driving fresh ideas from payments to NFT pledges.

ckUSDT: Stablecoins in the Cross-Chain Age

Main Structure and New Ideas

ckUSDT is part of the ckERC20 family—a 1:1 copy of Ethereum’s USDT that follows ICRC-2 standards. It takes the best of chain-key encryption to skip old bridge pains—those that lost huge sums from safety holes. The system uses the ckETH Minter (ID: sv3dd-oaaaa-aaaar-qacoa-cai) to handle deposits and pulls, smartly managing ETH fees for ERC-20 work; the Ledger Suite Orchestrator (ID: vxkom-oyaaa-aaaar-qafda-cai) watches over many ledger sets to ensure growth, adding new tokens easily via NNS votes. Ethereum’s Helper contract (address: 0x6abDA0438307733FC299e9C229FD3cc074bD8cC0) helps cross-chain tasks, so users send USDT to a set address, triggering mints on ICP, while pulls burn ckUSDT first before freeing the real asset.

(Source:X )

This setup lets ckUSDT hit sub-second final times on ICP, with fees as low as a fraction of a penny—far better than Ethereum’s crowds and gas. Most important, it keeps USDT’s steadiness while boosting safety—all deals checkable on-chain, cutting bridge attack risks. New token rolls depend on community rule, ensuring fair and lasting growth.

Benefits in Action and System Fit

The real worth of ckUSDT is how it pairs with ckBTC to make a full DeFi loop. Its low costs and quick settles make it perfect for payments and trades: users shift multi-chain assets smoothly in ICP wallets without cross-chain fears. In practice, ckUSDT often teams with ckBTC for liquidity pools or stablecoin loans, like building Bitcoin-stablecoin pairs on DEXes such as ICPSwap. This boosts flow and lets builders try complex money add-ons, like ongoing contracts or choices.

Compared to old wrapped USDT, ckUSDT’s low-trust model stands out in multi-chain spots—it is not just a stablecoin; it is ICP’s door to Ethereum liquidity, driving wide use from daily pays to big DeFi.

Comparing ckBTC and ckUSDT: Better Than Old Wrapped Assets

Though ckBTC and ckUSDT share chain-key bases, they differ in focus: ckBTC stresses Bitcoin’s UTXO model, needing real-time Bitcoin sync to handle its unique deal shapes; ckUSDT fits Ethereum’s account model via ckETH minter, focusing more on ERC-20 fee handling and growth.

(Source:ICP)

This gap makes ckBTC stronger in Bitcoin DeFi, while ckUSDT shines in stablecoin flow. In contrast, old wrapped assets like WBTC or bridged USDT rely on keepers and bridges, with weaker safety—ICP’s no-bridge way via threshold signing gives top protection, a big driver in a time of frequent bridge hacks. Overall, these chain-key tokens lead in settle times (1-2 seconds vs. minutes), costs (tiny vs. network-based), and safety (threshold signing vs. keeping), marking cross-chain tech’s growth.

Ecosystem Links: From Bitcoin to Multi-Chain Bridges

Key Projects Overview

The use of ckBTC and ckUSDT is not alone—they are deeply part of ICP’s DeFi world and spread to wider Bitcoin and cross-chain areas. Take Odin Fun: this Bitcoin memecoin launch pad has over $1 billion in total trades. It uses ckBTC’s quick settles for 2-second deals, letting memecoin systems thrive on ICP. Though it faced a hack once, the platform bounced back fast with stronger safety checks. Omnity, a top cross-chain base, has TVL over $36 billion and links ckBTC to Cosmos spots like Osmosis for trust-free multi-chain flow—this boosts Bitcoin’s use and opens doors for Runes and BRC-20 tokens.

Lending and Wallet Uses

Liquidium shows new ideas in lending: this biggest Bitcoin loan platform has handled over $5 billion in deals. Its new clear-out system relies heavily on ckBTC and ckUSDT as flow tools, using custom oracles and indexes to skip bridge risks, letting users pledge Ordinals for stablecoin loans. Oisy Wallet, made by the DFINITY Foundation, makes things easier for users: this multi-chain wallet supports ckBTC, ckUSDT, and mainnet assets like BTC, ETH, SOL. Through ICP’s Chain Fusion tech, it allows smooth links, so regular people can join multi-chain rule and swaps easily.

Support from Institutions and Communities

Plus, groups like Copper’s keeping service mix in ckBTC and ckUSDT, backing ICRC/SNS tokens with over 50% growth in big TVL; SNS DAOs use ckBTC for rewards, with over 100 projects involved. These links show how chain-key tokens grow from Bitcoin DeFi to Cosmos and Ethereum. Real-time data from November 2025 backs this: ckBTC’s 24-hour moves hit $785,000, with 273 new holders and $343,000 minted; ckUSDT’s moves are $576,000, ranking high in ICP token stats. These projects build a lively system where chain-key tokens are not islands but the glue for multi-chain money.

Risks and Challenges: Balancing New Ideas with Care

Network Reliance and Price Swings

Though ckBTC and ckUSDT bring big upsides, they are not perfect. First, relying on the ICP network is a possible risk: if ICP hits breaks or crowds, token access might suffer. But ICP’s multi-node copies and spread-out agreement fix this well, with backup designs ensuring 99.99% up time, and ongoing upgrades make the network steadier. Second, Bitcoin and Ethereum swings pass to these copy tokens, so price risks are real; yet ICP’s built-in flow pools and add-on tools—like ckUSDT’s steady tie—help users hedge swings, and platforms like Liquidium’s loans add buffers.

Rules Check and Use Barriers

Rules oversight is another test, especially for stablecoins like ckUSDT—world laws might add extra needs, like KYC or anti-money wash checks. However, the DFINITY Foundation acts ahead: through tainted address scans and on-chain checks, it ensures rules fit, while joining world standard making to cut friction. Use barriers exist too—users might not know chain-key tech, slowing spread; but teaching steps like Oisy Wallet guides and community DAO chats are fixing this bit by bit. Past events like Odin Fun’s hack showed weak spots, but quick checks and payback ways not only fixed issues but lifted the whole system’s strength. These fixes show risks are not unbeatable—they are being solved step by step, pushing chain-key tokens to a riper stage.

Future Outlook and Closing: The Dawn of Multi-Chain Money

Looking ahead, ckBTC and ckUSDT have a bright path as ICP’s plan grows: Chain Fusion will reach more chains like Solana and BNB, backing AI-driven smart contracts to let these tokens play bigger in auto DeFi. Projects like WaterNeuron’s liquid staking frame mark DeFi’s deepening—users lock ckBTC for extra earnings without losing flow. Quantum threats loom, but ICP’s encryption boosts—like post-quantum signing—are on the list for long safety.

On a bigger scale, these tokens could reshape world money: picture a place where Bitcoin as reserve asset enters DeFi smoothly via ckBTC; USDT’s flow spreads to new markets through ckUSDT. This is not just tech growth—it’s a jump in money inclusion, with faster big use making chain-key tokens the norm for multi-chain times.

ckBTC and ckUSDT are not just tokens—they are ICP’s smart answer to blockchain splits, blending Bitcoin’s value strength with stablecoin’s real use. Through trust-free tech and deep system links, they cut DeFi risks, boost access, and build bridges from Bitcoin to Ethereum. As ICP keeps creating, these chain-key tokens are quietly redefining cross-chain money, opening a more linked and safe blockchain age.

FAQ

Q1: What are ckBTC and ckUSDT?

ckBTC and ckUSDT are 1:1 value-backed on-chain versions of Bitcoin (BTC) and USDT, running on the Internet Computer (ICP). They allow users to access the value of BTC and stablecoins with faster transaction speeds and significantly lower fees.

Q2: How do they work?

Both assets rely on ICP’s Chain-Key technology and threshold signing to manage the original blockchain assets:

- Deposit BTC → mint ckBTC

- Deposit USDT on Ethereum → mint ckUSDT Transactions typically finalize within 1–2 seconds, with fees costing less than a penny.

Q3: How do ck-assets compare to wrapped tokens like WBTC or bridged USDT?

Unlike traditional wrapped assets that depend on bridges or centralized custodians, ck-assets offer:

- Higher security (no single custody point)

- Faster settlement (seconds instead of minutes)

- Ultra-low transaction fees

Q4: Are ckBTC and ckUSDT safe to use?

They are built with decentralization and security in mind, using threshold signing, on-chain verification, and address screening. However, like all digital assets, usage may still be affected by factors such as market behavior, network conditions, and user knowledge.

Q5: How do I start using ckBTC and ckUSDT?

- Create a wallet that supports ICP (e.g., Oisy Wallet).

- Deposit BTC or USDT through the supported minting process.

- Use ck-assets across ICP applications such as ICPSwap for trading or Liquidium for lending.

Q6: Which projects currently support ckBTC and ckUSDT?

Ecosystem adoption includes Odin Fun, Omnity, Liquidium, ICPSwap, and Oisy Wallet, with more integrations continuing to grow.

Q8: What does the future look like for ckBTC and ckUSDT?

Upcoming developments include integration with additional chains (such as Solana and Cosmos), AI-driven smart contracts, liquid staking features, and quantum-resistant cryptography—all aimed at expanding utility and long-term security.

Join MEXC and Get up to $10,000 Bonus!

Sign Up