Why Perps DEX Are Becoming the Future of Perpetual Trading

In every major phase of crypto’s evolution, there has always been a category of product that defined the mood, ambition, and technological limit of the moment. In 2017, it was tokens and ICOs. In 2020, AMMs and liquidity mining reshaped how liquidity formed. By 2025, perpetual futures and centralized trading platforms dominated the conversation, volume, and institutional narrative.

But the same mechanisms that powered the rise of CEX perpetuals eventually exposed their fragility: opaque execution engines, custodied user deposits, trust-based liquidations, exploit-prone internal risk systems, and an operating structure where users could see the interface—but not what actually governed execution.

Now, something meaningful is changing.

Perpetual futures trading is shifting onto decentralized rails—not due to idealism, but because the trade-off that once made on-chain execution feel slow, expensive, or impractical has disappeared. Execution latency is no longer a dealbreaker. Clearing logic is transparent. And wallets—not user accounts—are now the default identity layer.

As the performance gap closes, traders are asking a new question:

If the trading experience is similar, why leave custody, execution, and liquidation to a black box?

In this transition, four platforms consistently appear in conversations among traders, researchers, and infrastructure teams building the next chapter of decentralized finance: Hyperliquid, Lighter, Aster, and edgeX.

They are not competing to solve the same problem in the same way. Rather, they represent four philosophies about what the future of perpetual futures trading should look like.

Hyperliquid: A High-Performance On-Chain Perps DEX

For years, the industry collectively assumed one rule: a fully on-chain CLOB perpetual exchange could not deliver CEX-level execution without compromise. Every attempt before Hyperliquid fell into one of three buckets: slow execution, hybrid custodial systems, or a diminished trading experience masked behind the idea of decentralization.

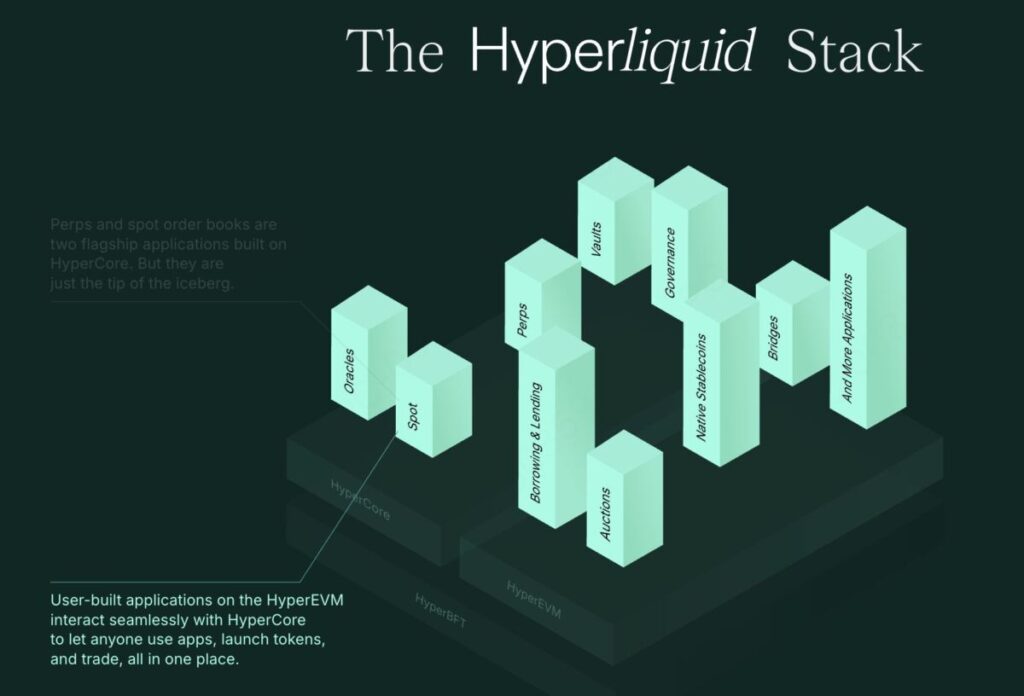

(Source:Hyperliquid)

Hyperliquid exists as the counterexample.

The first time a user places or cancels an order, the reaction is subtle but universal: it feels fast — not “fast for DeFi,” but genuinely fast. The order book updates without perceptible delay. Market order execution feels predictable rather than hopeful. And liquidation behavior follows rules, not internal systems hidden behind brand trust.

Hyperliquid proves something important: performance and transparency do not need to be opposites. In this model, decentralization is not a sacrifice layered behind a slow UI — it is the operating model.

The launch of HIP-3 marks a critical milestone. By allowing anyone to deploy a permissionless perpetual market by staking $HYPE, Hyperliquid isn’t just a fast trading venue — it is evolving into a market layer that others can build on. And infrastructure layers in crypto rarely stay small.

Lighter: A Fast-Growing and Accessible Perpetual Futures DEX

If Hyperliquid represents inevitability driven by engineering, Lighter represents inevitability driven by adoption psychology.

Onboarding is one of the most underestimated barriers in decentralized trading. Many traders never complete their first transaction—not because they lack conviction, but because the interface feels hostile, technical, and uninviting.

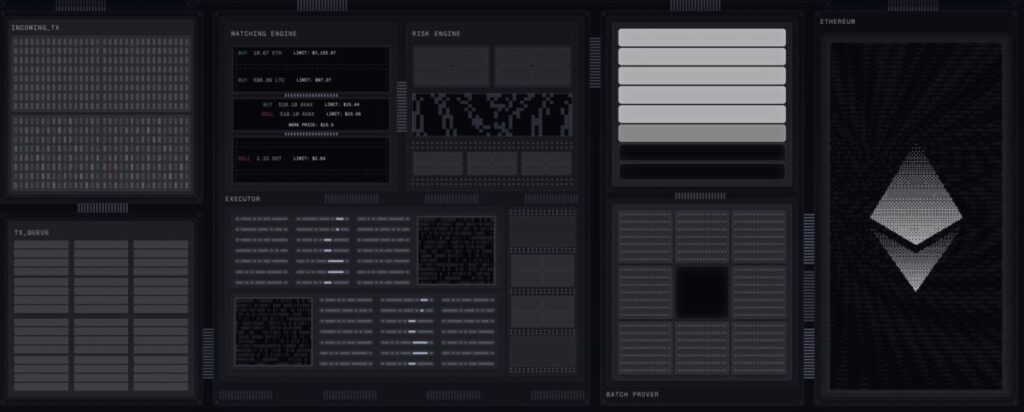

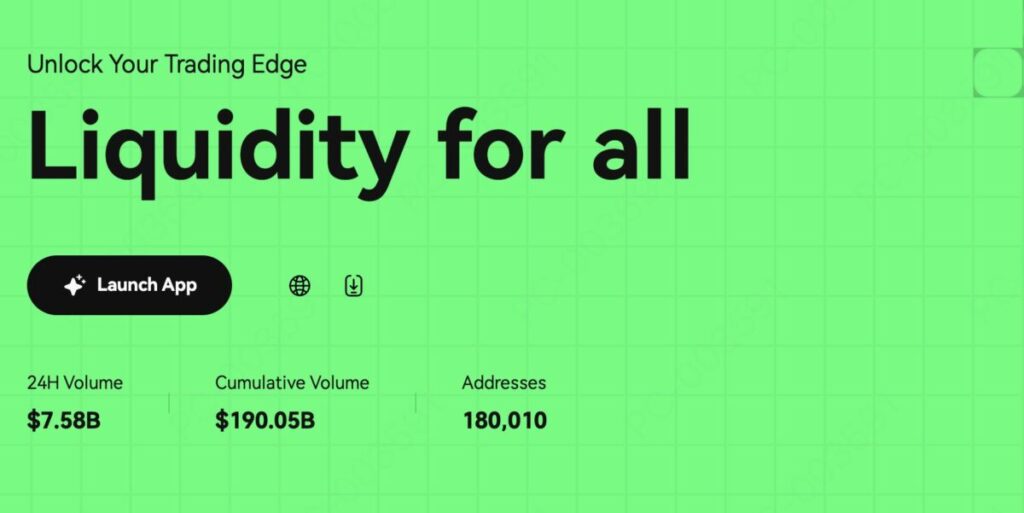

(Source:Lighter)

Lighter approaches this problem with a different mindset: make the first trade effortless. The interface is intentionally minimal and decisions feel approachable. Instead of overwhelming users with liquidation bands, funding rate parameters, margin tiers, and volatility exposure, Lighter offers a path to action—then gradually reveals depth.

What makes Lighter interesting is that beneath the simplicity, a second engine runs quietly: fee incentives built for high-frequency traders, market makers, and efficiency-driven strategies. As volume increases, depth improves. As depth improves, professional traders join. And as professionals join, more retail traders trust the platform.

Its recent mainnet launch and asset expansion including $ICP, $FIL, and $STRK signal that Lighter is not merely trying to feel simple—it is scaling into a platform where simplicity coexists with depth.

Aster: A User-Centric Perps DEX With a Guided Learning Experience

Crypto often treats trading as purely mechanical: numbers, leverage, liquidation thresholds, risk. But the truth is simpler: adoption is emotional before it is technical. Aster is the first Perps DEX that seems to recognize this reality.

Instead of assuming every trader already understands funding rates, perpetual construction, or risk curves, Aster offers a guided layered experience. The platform welcomes new users through tasks, progressive unlocking, and structured learning paths. Trading becomes something that can be learned—not something users must already master.

(Source:Aster)

Aster is not attempting to dethrone Hyperliquid in raw execution or Lighter in onboarding speed. Instead, it is reshaping the relationship users have with perpetuals. The Simple/Pro interface duality isn’t just UI—it’s a philosophy: start without fear, graduate when ready.

Recent upgrades — including refined tick sizes, anti-wash-trading mechanics, and enabling $ASTER as margin collateral — show clear movement toward ecosystem maturity. Aster is building a trading environment where users do not merely trade; they grow.

EdgeX: An Institutional-Grade Decentralized Perpetual Futures Platform

While the first three platforms speak to broad audiences, edgeX speaks to a narrow one — and intentionally so.

edgeX is designed for users who do not think of trading as button-clicking, but as execution: automated systems, arbitrage engines, market-making strategies, and liquidity optimization logic. Its tone is not introductory or emotional. It is infrastructure-oriented — structured, precise, and unapologetically technical.

(Source:EdgeX )

Built on StarkEx, edgeX prioritizes deterministic execution and system predictability over approachability. Every technical choice signals its target users: institutional teams, systematic strategy builders, and liquidity specialists.

With edgeX V2 transitioning from a single-rollup perpetual app into a modular financial settlement layer, it becomes not just a trading venue — but an execution and settlement backbone for derivatives, lending, and structured strategies.

In that sense, edgeX is not trying to win everyone. It is trying to win the few who matter most in markets: the traders who move liquidity, not just participate in it.

Which Perps DEX Will Become the Default On-Chain Standard?

These platforms are not competing for the same crown. They are building different interpretations of what perpetual futures should become.

Hyperliquid demonstrates that full transparency does not require performance sacrifice.

Lighter proves that removing friction accelerates adoption more than complexity ever could.

Aster reminds the industry that designing for emotion is as important as designing for mechanics.

edgeX asserts that professional markets will always require professional infrastructure.

So the question is no longer, “Which Perps DEX is objectively the best?”

The real question is:

- Which one will become the default entry point?

- Which one will attract liquidity migration rather than curiosity?

- Which one will replace centralized perpetual exchanges—not just narratively, but in practice?

The answer won’t be written in branding, roadmaps, or marketing.

It will be written in volume, execution, behavior, and time.

Because the era of on-chain perpetual trading has already begun — and these four platforms are shaping the direction it will take.

Frequently Asked Questions

1. What is a Perps DEX and how is it different from a centralized exchange?

A Perps DEX is a decentralized perpetual futures trading platform where custody, execution, liquidation, and settlement are verifiable on-chain. Unlike centralized exchanges, users maintain wallet ownership instead of trusting a third-party operator. This shift removes custodial risk and brings execution transparency, though historically at the cost of speed—something that platforms like Hyperliquid, Lighter, Aster, and edgeX now address.

2. Which Perps DEX is best for beginners?

Aster and Lighter are currently the most approachable options. Aster focuses on guided onboarding and emotional usability, while Lighter prioritizes simplicity and streamlined execution. Both allow new traders to enter perpetual markets without being overwhelmed by professional tooling.

3. Which platform offers the closest experience to a centralized perpetual futures exchange?

Hyperliquid currently delivers the strongest match to CEX-level performance while maintaining on-chain execution transparency. Its high-performance CLOB architecture creates a familiar trading experience for high-frequency and professional users.

4. Which Perps DEX is designed for institutional or automated strategy traders?

edgeX is engineered for system-level trading rather than manual participation. With a StarkEx-backed execution environment and modular financial layer, it is positioned for market makers, arbitrage strategies, and institutional desks.

5. Will Perps DEX platforms replace centralized perpetual futures exchanges?

Replacement is possible but not immediate. The shift depends on execution reliability, liquidity migration, regulatory clarity, and trader behavior. However, the convergence of performance and transparency is accelerating the move toward on-chain perpetual trading.

Join MEXC and Get up to $10,000 Bonus!

Sign Up