Bitcoin has long worn the label of digital gold. It is a reliable store of value for many, but that reliability creates a problem: most BTC sits idle. Lombard aims to change that by turning Bitcoin into a productive asset that participates in DeFi while preserving holders’ exposure to BTC. If you want to keep your BTC but also earn yield and use it across chains, LBTC and Lombard are squarely designed for you.

What is BTC DeFi and why Lombard matters

Bitcoin DeFi, sometimes written as BTCFI, is the set of decentralized protocols and products that bring traditional DeFi functions to Bitcoin holders: lending, borrowing, yield generation, liquidity provisioning, and tokenized use across blockchains. Because Bitcoin itself does not natively support smart-contract staking in the way Ether does, BTCFI projects must build secure bridges, liquid staking wrappers, or restaking primitives to unlock that utility.

Lombard Finance positions itself as an institutional-grade liquid staking protocol for Bitcoin. Its stated mission is to move BTC from passive store of value into an asset that can earn yield, secure networks, and be composable inside DeFi without sacrificing the underlying Bitcoin backing. The core product is LBTC, a liquid-staked BTC token, and the protocol later introduced a native governance and utility token, BARD.

What is LBTC? The Key to a Productive Bitcoin

The cornerstone of the Lombard ecosystem is

LBTC, a tokenized version of Bitcoin that is fully backed 1:1 by native BTC. Think of it like depositing gold in a vault and receiving a certificate that you can trade and use freely, all while your gold remains securely stored.

When a user stakes their BTC on the Lombard platform, they receive an equivalent amount of LBTC in return. However, unlike traditional wrapped Bitcoin, LBTC is uniquely

yield-bearing. The underlying BTC is staked via Babylon’s Bitcoin Staking Protocol, allowing it to earn rewards from securing Proof-of-Stake networks. This yield is automatically captured by the LBTC token, causing its value to grow over time relative to BTC.

Crucially, LBTC remains liquid and cross-chain compatible. It is natively available on multiple blockchains like Ethereum, Base, and Sui, allowing holders to use it across a vast landscape of over 80 integrated DeFi protocols including Aave, Curve, and Uniswap without sacrificing their underlying staked position or its yield. This unique combination of features has driven incredible growth:

- Fastest Growing Yield Token: Reached $1 billion in Total Value Locked (TVL) in just 92 days.

- Massive Liquidity Injection: Brought over $2 billion of new liquidity to 12 different blockchains.

- Deep DeFi Integration: Over 80% of all LBTC is actively deployed in various DeFi protocols.

How Does Lombard Work?

Lombard has streamlined the process of putting Bitcoin to work, focusing on security and user experience. Here’s a typical user journey:

Stake Bitcoin: A user deposits native BTC to a unique, secure address generated by the Lombard platform. This address is linked to their chosen destination chain (e.g., Ethereum) where LBTC will be created.

Mint LBTC: After the Bitcoin network confirms the deposit, Lombard’s Security Consortium verifies the transaction. A corresponding amount of LBTC is then securely minted on the destination chain and sent to the user’s wallet.

Deploy in DeFi: The user can now use their liquid LBTC across dozens of integrated DeFi applications to lend, borrow, provide liquidity, or earn additional yield, all while continuing to earn the base staking reward.

Redeem BTC: To retrieve their original Bitcoin, the user can unstake at any time. This process involves burning the LBTC token and initiating a withdrawal, which is subject to a nine-day unstaking period before the BTC is returned.

BARD tokenomics the protocol’s economic engine

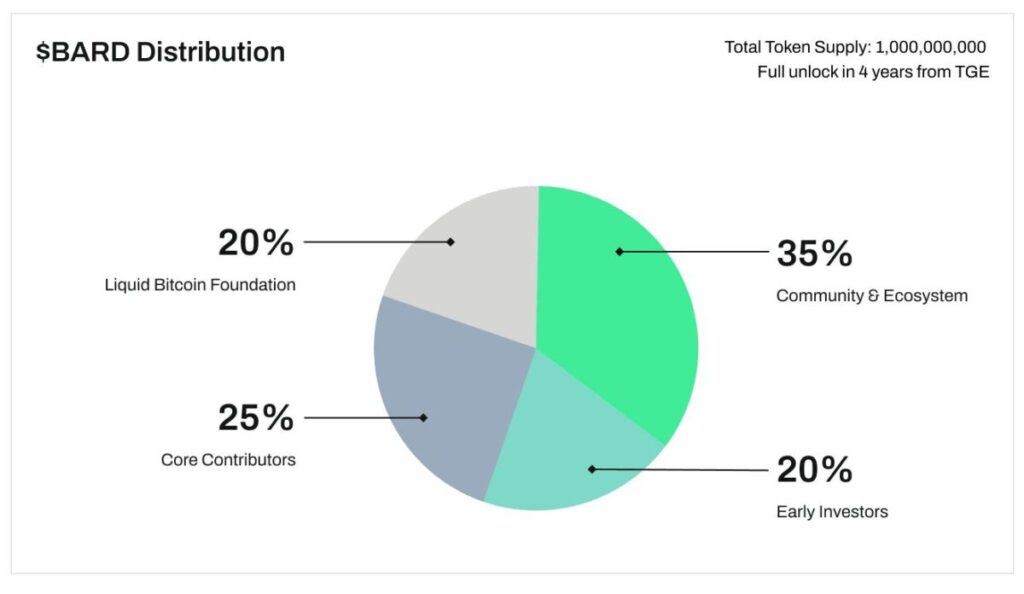

Lombard introduced a native token called BARD to coordinate incentives, governance, and security :

- Total supply: 1,000,000,000 BARD.

- Initial circulating supply at TGE: 225,000,000 BARD (22.5 percent).

- Locked supply at TGE: 775,000,000 BARD (77.5 percent).

- Full unlock schedule: roughly 4 years.

- Reported market cap: about $187 million at the time .

Key utilities for BARD include governance rights, staking to strengthen cross-chain bridge security, and ecosystem incentives such as liquidity rewards for LBTC pools. Staking BARD is also presented as part of the protocol’s security contribution, rewarding holders who support the Security Consortium and relayer operations.

Where you can buy Lombard tokens and LBTC

Your draft notes that major exchanges such as MEXC list BARD, and that Lombard has had exchange integrations and promotional events

1,000,000 Prize Pool Awaits go now Trade Hassle free $bard with 0 Fee and Stake, Spin and Earn Amazing Prizes Now !

Expanding beyond LBTC products and integrations

Lombard has not stayed static. Your notes list several extensions that broaden use cases:

- eBTC : a liquid restaking token concept launched in collaboration with EtherFi. This allows BTC capital to participate in restaking economies, securing services like oracles and DA layers while earning extra yield

- BTCK : a wrapped BTC variant tied to a specific Layer 2, in your draft named as a Katana Inu Layer 2 example.

- Lombard Ledger : a settlement layer secured by the Security Consortium for seamless interoperation between on-chain and off-chain assets.

- Lombard Vaults and SDK : yield vault products and a developer SDK to help exchanges and wallets integrate LBTC functions.

The Lombard ecosystem adoption and integrations

Your draft lists integrations with more than 80 DeFi protocols across lending, trading and restaking, including major names like Aave, Morpho, Maple, Pendle, Curve, and restaking projects such as EigenLayer and EtherFi. Exchanges named include OKX, Bybit, and MEXC. Those integrations matter because broad liquidity and cross-protocol use are what make an LST useful rather than just theoretically interesting

Security Consortium

Lombard emphasizes security through a consortium of validators and institutions, combined with multi-signature or CubeSigner key management. The idea is to decentralize custody and verification so that no single party can unilaterally mint LBTC or drain funds. Security Consortium validators take part in transaction verification, and Chainlink’s CCIP is used for cross-chain messages to reduce bridge risk. That architecture is a key selling point for institutional users who worry about centralized wrapped BTC custody models.

Risks and considerations what can go wrong

No product is risk-free, and LBTC / Lombard introduce a mix of on-chain and off-chain risks buyers must understand.

Depeg risk LBTC is market priced and may trade above or below 1:1 with BTC. Price divergence can happen because of liquidity gaps, redemption delays, or market stress. Your notes reference historic depeg dynamics and warn that LBTC can temporarily trade at a premium or discount

Unstaking and liquidity timing Lombard’s unstaking period is non-instant your file cites roughly a nine-day withdrawal window. In a crash or liquidity crunch, that gap can be important. If LBTC holders attempt mass redemptions, the market price could diverge significantly from BTC until redemptions settle

Validator slashing and operational risk If validators misbehave or suffer faults, there may be slashing or penalties. Although Lombard aims to use reputable validators and a Security Consortium to limit this, slashing risk is a live technical exposure.

Smart contract and bridge risk The minting and burning of LBTC, cross-chain relayers, or third-party integrations are all software. Bugs, exploits, or bridge failures remain a constant risk in DeFi.

Counterparty concentration If a small number of entities hold a large share of BARD or LBTC, that concentration can create price volatility and governance risk. Good tokenomics design and transparent vesting help, but market participants must study ownership breakdowns carefully.

Comparative analysis LBTC versus other BTC representations

A straight comparison helps frame Lombard’s place in the market.

- WBTC

- Pros: Deep liquidity and broad exchange support.

- Cons: Centralized custodian model; counterparty risk concentrated with custodian services such as BitGo. WBTC is not yield-bearing by default.

- tBTC (Threshold Network)

- Pros: Emphasizes decentralization through threshold signatures and distributed custody.

- Cons: Historically more complex to mint and may have overhead in liquidity and UX.

- BadgerDAO / eBTC variants

- Pros: DeFi-first approaches with yield and composability strategies.

- Cons: Often experimental and dependent on multi-project coordination.

- LBTC (Lombard)

- Pros: 1:1 backed, yield-bearing via Babylon staking, cross-chain native minting, security consortium to reduce single-custodian risk. Your notes highlight rapid TVL growth and broad integrations as a sign of market product-market fit

- Cons: Newer product with unlocking schedules for BARD, reliance on validators, and operational complexity from cross-chain infrastructure.

This comparison is not exhaustive but highlights that Lombard aims for a middle ground between the liquidity of custodial wrappers and the decentralization of threshold models, while adding yield and cross-chain utility.

Where Lombard fits in a crypto portfolio

- Yield seekers who don’t want to sell BTC: LBTC lets you earn staking yields while retaining exposure to BTC.

- DeFi users who want BTC composability: Use LBTC as collateral in lending, LP in DEX pools, or as base capital in vault strategies.

- Institutions seeking productized BTC exposure: Lombard’s Security Consortium, SDK, and settlement layer are pitched at exchanges and custodians that want to offer LBTC to customers.

What to watch next

Key milestones to monitor: proof of consistent LBTC deployment across protocols, successful audits, security consortium expansion, and measurable revenue flows to ecosystem funds. If those align, Lombard may shift from a promising tokenized idea to a durable infrastructure layer for BTC DeFi.

Conclusion

If you are evaluating Lombard, treat it the way you should treat any DeFi primitive: read the tokenomics closely, verify on-chain metrics, understand the unstaking mechanics, and consider concentration risks. Done right, Lombard can add a useful tool to the BTC investor’s toolkit. Done without care, it’s another complexity layer with real operational risk.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!

Sign Up