While Ethereum (ETH) price dropped $1.37 billion) in three days. Here’s why this accumulation could signal a setup for a big rally.

1.The Numbers

Over Nov 3-6, 2025, addresses holding ≥1,000 ETH accumulated $1.37 billion at ~$3,470/ETH).

The largest individual acquisition: Borrowed 66,000 ETH (~$229 million) via Aave, then purchased more—strong conviction.

This accumulation took place amid a ~10.55% weekly price drop (ETH below ~$3,500).

2.Why this is meaningful

Major accumulation during a decline suggests smart money is buying the dip rather than chasing pumps.

The borrowed ETH trade signals conviction: to borrow ETH (at cost) and buy more implies expectation of strong upside.

Historically, such whale accumulation precedes major rallies in ETH (though not guaranteed).

3.Key catalysts supporting this setup

Upcoming technical upgrade (e.g., Pectra in Q1 2026), could spark renewed interest.

Macro liquidity tail-winds: With the Federal Reserve ending quantitative tightening December 1, risk-asset environment may improve.

Institutional flows returning: ETF inflows into ETH may follow if valuation / macro environment cooperates.

4.Risks to watch

Whales can be wrong: accumulation doesn’t guarantee short-term rally.

Market sentiment & broader crypto cycle: If Bitcoin collapses, ETH will likely follow.

Borrowed positions mean leverage: If things go wrong, forced selling may accelerate the drop.

5.Strategy Suggestions

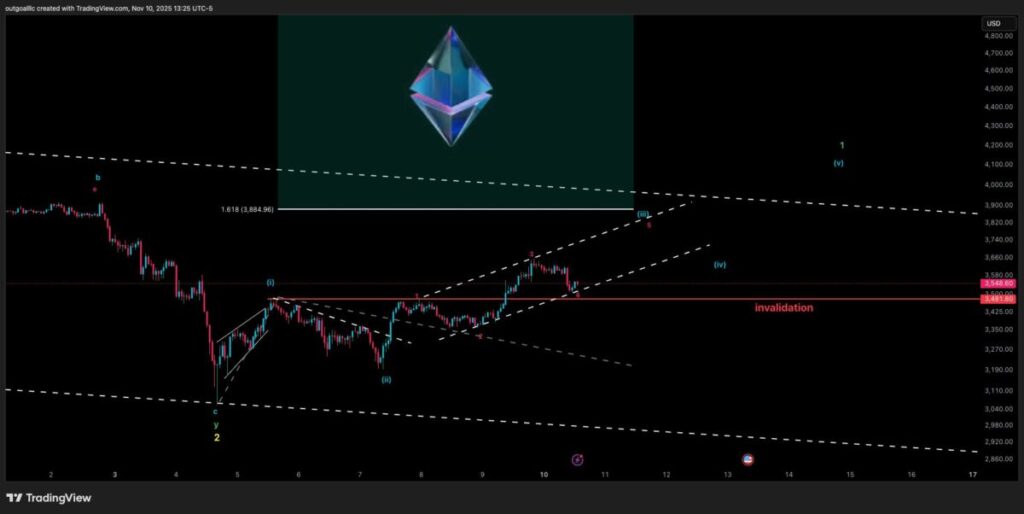

For traders: Consider accumulation in the ~$3,400-$3,500 zone with stop-loss below ~$3,200.

For long-term investors: DCA into ETH over 4-8 weeks; accumulate during dips and ignore short-term noise.

Watch on-chain metrics: Netflows from exchanges (ETH leaving = bullish), staking deposits rising, large whale address movement.

6.Bottom line

Whale accumulation of $1.37 billion in three days during a price drop is a notable contrarian signal. While not a guarantee, it suggests that some of the largest players believe we may be entering a pre-rally phase for ETH. If you believe in the fundamentals, current levels may offer attractive risk/reward—but always pair with disciplined risk control.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions

Join MEXC and Get up to $10,000 Bonus!