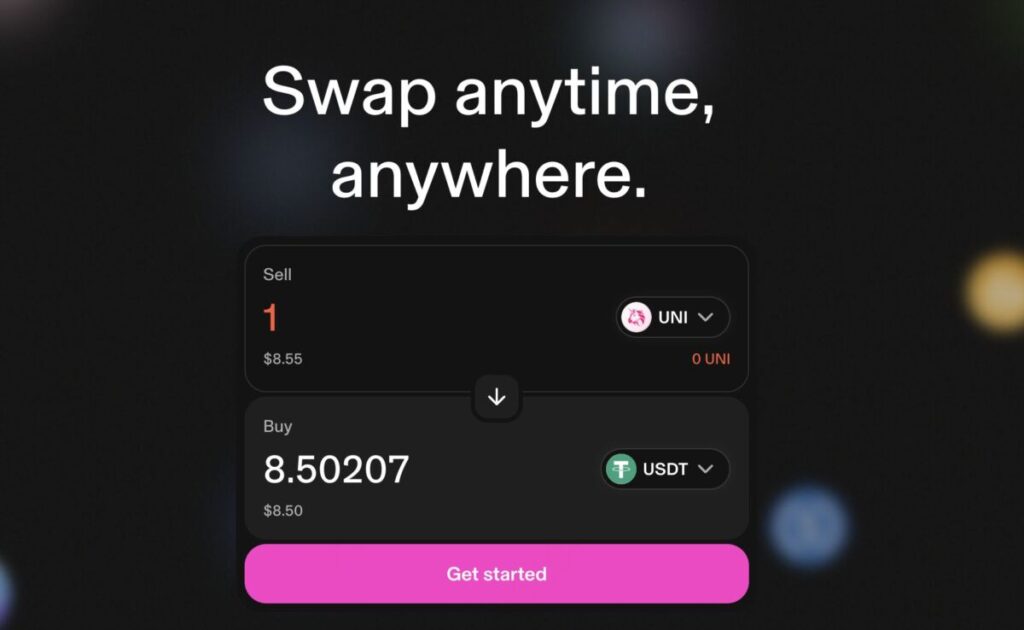

Late on November 10, 2025, Uniswap founder Hayden Adams posted the UNIfication proposal on the governance forum. Within 24 hours, UNI rose from $6.5 to $9.5, an increase of more than 40%. Trading volume passed $3.2 billion, making it one of the most notable DeFi events of 2025.

(Source:Mexc)

This rally was not short-term hype. It was a structural revaluation. For five years, Uniswap stood as a symbol of decentralized trading, with total trading volume reaching $1.8 trillion. However, the protocol fee switch had remained off, leaving UNI as a governance token without real yield or revenue support.

The UNIfication proposal changes this. It would turn on protocol fees, introduce a token burn mechanism, and reform governance and treasury management. In doing so, UNI would move from a “governance token” to an “income-generating asset.” For the broader DeFi ecosystem, this marks a shift toward a more sustainable and value-driven model. Uniswap is setting a precedent for how decentralized protocols can create and distribute revenue transparently.

How UNIfication Reshapes UNI’s Value Capture

The heart of UNIfication is activating protocol fees and creating a continuous token burn mechanism that allows UNI to capture real value from the network.

(Source:uniswapfoundation)

Under the new model, Uniswap will redistribute trading fees.

In version 2, the total fee is 0.3%. Liquidity providers (LPs) receive 0.25%, while the protocol takes 0.05%—one-sixth—to buy back and burn UNI.

In version 3, the split depends on the fee tier. High-fee pools send one-sixth to the protocol, and low-fee pools send one-fourth.

According to Dune Analytics, Uniswap generated about $222 million in trading fees over the past 30 days. Based on that, annualized protocol revenue could reach $2.6 billion. With a 1.5%–2% capture rate, the protocol could burn between 9 and 12 million UNI per year. That represents an annual deflation rate of 1.5%–2%, worth about $100 million at current prices. This gives UNI a consistent deflationary base.

Additionally, the plan would include Unichain Layer 2 sequencer fees in the UNI buyback process. After deducting L1 costs and revenue sharing, 85% of sequencer income would go toward burning UNI. This could contribute roughly $7.5 million in annual revenue. Through this design, UNI’s value capture expands from L1 trading to Layer 2 activity, forming a multi-source deflation loop.

Uniswap is therefore evolving from a functional protocol layer to a revenue-generating layer, allowing UNI holders to benefit directly from the ecosystem’s growth.

How the Uniswap Community Responded to UNIfication

The UNIfication proposal not only triggered a price surge but also reignited community participation. Discussions on the governance forum increased fivefold in 24 hours, and the proposal gained over 75% support in early voting—one of the highest levels in Uniswap’s history.

Community members believe this proposal brings real economic meaning back to governance. In the past, governance voting often felt symbolic, as there were few tangible incentives. With protocol revenue now tied to UNI holders, every vote has financial weight. Governance has become a meaningful expression of economic ownership.

The market also regained confidence. DeFi’s total value locked (TVL) rebounded, and liquidity positions increased. Analysts described the proposal as a new model for DeFi growth: connecting governance tokens directly to protocol cash flow to create an internal incentive loop.

This explains why not only UNI, but the broader DeFi sector, experienced a rally following the announcement. UNIfication is widely seen as the start of DeFi’s second growth phase.

How Uniswap Balances LP Returns and UNI Deflation

Turning on protocol fees can raise concerns among liquidity providers. To address this, UNIfication introduces the PFDA mechanism, short for Protocol Fee Discount Auction.

In PFDA, traders can bid for fee discounts. The funds paid in the auction are used entirely to burn UNI, making trading itself a deflationary event. At the same time, the protocol uses MEV data to provide LP compensation, keeping their net yield stable.

Model projections show that protocol revenue could increase by 20%–30%, while LP returns might decline by 10%–15%, most of which would be recovered through rebates from the auction. This structure allows Uniswap to grow revenue while keeping LP incentives balanced. At the same time, UNI supply decreases continuously through burns.

This mechanism demonstrates an important milestone for decentralized governance. By using on-chain data to dynamically manage incentives, Uniswap is transitioning from experimental tokenomics to a mature, data-driven revenue model.

Uniswap v4 Hooks: A New Engine for DeFi Liquidity Aggregation

UNIfication is not only a financial reform but also the foundation for Uniswap’s upcoming version 4. The key feature of v4 is the Hooks mechanism, a modular framework that allows developers to add custom logic directly into the trading process.

Hooks upgrade Uniswap from a single AMM (automated market maker) into an open liquidity platform. External protocols can integrate through Hooks and share liquidity across ecosystems. For example, part of the Unisocks v1 liquidity will migrate to Unichain, where LP positions will be burned during the transition, unlocking about $50 million in idle capital while supporting UNI deflation.

For investors, Hooks can offer higher returns. UNI/USDC liquidity providers may target annual yields between 8% and 12%, with additional benefits from the deflation effect. As more protocols integrate, total trading volume could increase by roughly 15%, pushing daily turnover above $1.1 billion.

At a higher level, Hooks mark the next phase of DeFi infrastructure—combining liquidity aggregation with revenue capture. For UNI holders, it means token value will be more closely tied to protocol growth and transaction activity.

Uniswap Organizational Reform and the Growth Fund Mechanism

UNIfication also brings major changes to Uniswap’s organizational structure. In the past, the Uniswap Foundation and Labs had overlapping responsibilities, leading to slow decision-making. The proposal introduces a five-member governance board and a new Growth Fund, representing a move toward a more formal and transparent governance model.

(Source:uniswap)

Starting in 2026, the Uniswap treasury will allocate 20 million UNI per year (around $200 million) for developer grants, ecosystem incentives, and potential acquisitions. Quarterly reports will disclose fund usage, with a goal of maintaining over 85% efficiency.

The Growth Fund will be strategically divided as follows:

- About 30% for developer grants related to v4 Hooks

- About 20% for acquisitions of DeFi tools and aggregators

- The remaining 50% for Unichain ecosystem incentives and cross-chain liquidity

This fund will act as a long-term growth engine for Uniswap. It also makes UNI holders active participants in the protocol’s development rather than passive governors.

Be Rational About Short-Term Volatility and Focus on Long-Term Value

Although UNIfication has boosted market optimism, short-term risks remain. LP rewards may temporarily decline as the new system takes effect, and some liquidity could leave. Regulatory uncertainty continues, especially around whether protocol fees may classify UNI as a security. Global liquidity conditions could also influence DeFi valuations.

Even so, UNI still offers an attractive risk-reward profile. Even if LP outflows reach 10%, protocol revenue is expected to stay positive. If global monetary policy shifts toward easing, liquidity could flow back into DeFi, benefiting UNI and similar assets.

For investors, it is important to monitor governance voting and protocol revenue data. Once UNIfication goes live on-chain, UNI’s value will shift from speculative sentiment to a quantifiable cash-flow model.

Conclusion: Uniswap’s UNIfication Moment and a New DeFi Paradigm

The UNIfication proposal has brought Uniswap back to the spotlight. It not only triggered a sharp price rally but also opened a new chapter in DeFi’s value-capture story. By activating protocol fees, adding token burns, and reforming governance and funding systems, Uniswap is evolving from a trading platform into core DeFi infrastructure.

For UNI holders, this marks the creation of a true long-term value foundation. For DeFi as a whole, it signals a transition from liquidity competition to sustainable revenue models and institutional design.

Once UNIfication is fully implemented, Uniswap could become not just a decentralized exchange, but the revenue hub of the DeFi ecosystem.

This time, UNI’s 40% surge is not just a price move—it is the rebirth of its value logic.

Join MEXC and Get up to $10,000 Bonus!