While Ethereum suffered a brutal 10.55% weekly decline that pushed prices below $3,500, a different story was unfolding beneath the surface. On-chain data reveals that ETH whales accumulated a staggering 394,682 ETH worth $1.37 billion over just three days—one of the largest buying sprees in 2025. The largest single buyer borrowed 66,000 ETH from Aave (worth $229 million) and immediately purchased even more ETH, signaling extreme conviction that current prices represent a generational buying opportunity.

This disconnect between price action (bearish) and whale behavior (bullish) creates one of crypto’s most compelling contrarian setups. When smart money accumulates while retail panics, the stage is set for explosive reversals. Understanding why whales are buying, who’s behind the accumulation, and what it means for Ethereum’s next move could be the difference between missing the rally and positioning ahead of it.

1.The Numbers: $1.37B Whale Accumulation in 72 Hours

What Happened:

Between November 3-6, 2025, Ethereum whales (addresses holding 1,000+ ETH) accumulated:

- 394,682 ETH purchased

- $1.37 billion total value

- Average price: ~$3,470 per ETH

- Timeframe: 3 days (72 hours)

Context:

This accumulation represents approximately 0.33% of Ethereum’s circulating supply (120 million ETH) bought by whales in just three days. To put this in perspective:

- Daily ETH issuance: ~1,700 ETH per day (post-Merge staking rewards)

- Whale accumulation: 131,560 ETH per day (77x daily issuance)

- ETF comparison: U.S. Ethereum ETFs saw net inflows of $100M over same period (whales bought 13.7x more)

The magnitude of buying is unprecedented for such a short timeframe, especially occurring during a price decline rather than a rally. This suggests whales aren’t chasing momentum—they’re accumulating conviction positions.

2.The Biggest Buyer: 66,000 ETH Borrowed from Aave, Then Bought More

The most remarkable individual whale transaction involved a sophisticated strategy combining DeFi borrowing with spot accumulation:

The Trade:

- Whale address (0x742d…35Ad) deposited collateral into Aave

- Borrowed 66,000 ETH ($229 million at ~$3,470 per ETH)

- Immediately bought additional ETH with the borrowed funds

- Net position: Massively long ETH with leveraged exposure

Why This Matters:

Borrowing ETH from Aave to buy more ETH is an extremely bullish strategy indicating:

- Conviction: Whale believes ETH will appreciate significantly beyond borrowing costs

- Leverage: Amplifying upside exposure using debt (risky but high-reward)

- Timing: Borrowing during a dip suggests whale sees current prices as temporary weakness

Borrowing costs on Aave currently sit around 2-3% APY for ETH. For this strategy to be profitable, the whale needs ETH to appreciate more than 2-3% annually—a low bar suggesting the whale expects far greater returns (20-50%+ within 6-12 months).

Historical Precedent:

Similar whale accumulation patterns preceded:

- July 2021: Whales accumulated 500K ETH at $1,800 → ETH rallied to $4,800 (+167%)

- June 2022: Whales accumulated 300K ETH at $1,000 → ETH rallied to $2,100 (+110%)

- October 2023: Whales accumulated 400K ETH at $1,600 → ETH rallied to $4,000 (+150%)

Current accumulation (394,682 ETH at $3,470) could precede similar appreciation if historical patterns hold.

3.Why Are Whales Buying During a 10% Drop?

Ethereum’s 10.55% weekly decline seems bearish on the surface, but whales are looking at different factors:

- Technical Oversold Conditions

ETH’s decline pushed multiple technical indicators into oversold territory:

- RSI (Relative Strength Index): Dropped below 40 (oversold threshold)

- ETH/BTC ratio: Hit 6-month lows, suggesting Ethereum undervalued relative to Bitcoin

- Moving averages: ETH briefly broke below 200-day MA, historically a strong buy signal

Whales who trade based on technical analysis recognize that oversold conditions often precede sharp reversals—buying before the crowd recognizes the setup.

- Macro Liquidity Improving

Federal Reserve ending quantitative tightening December 1 creates improved liquidity conditions for risk assets. Whales are positioning ahead of this policy shift rather than waiting for price confirmation.

- Ethereum Pectra Upgrade (Q1 2026)

Ethereum’s next major upgrade (Pectra) is scheduled for Q1 2026, bringing:

- Increased validator limits (from 32 ETH to 2,048 ETH max)

- EIP-7702: Account abstraction improvements

- EIP-7251: Validator consolidation efficiency

Major upgrades historically drive price appreciation 3-6 months before implementation. Whales are accumulating ahead of upgrade hype cycle.

- ETH ETF Inflows Resuming

After weeks of net outflows, Ethereum ETFs saw $100M in net inflows November 4-6. Whales may be front-running institutional capital returning to ETH.

- Staking Yield + Price Appreciation

ETH staking currently yields 3-4% APY. Combined with expected price appreciation, total return could exceed 20-50% if whales are correct about bottom formation. This risk/reward ratio is attractive for large capital allocators.

4.Who Are These Whales? Identifying Smart Money

Not all whales are equal. Some are exchanges moving funds, others are retail whales with poor track records. But on-chain analysis reveals the current accumulation includes highly sophisticated actors:

Institutional Funds

Several whale addresses match profiles of institutional investment funds:

- Multi-sig wallets (requiring multiple approvals for transactions)

- Custody solutions (Coinbase Custody, Fireblocks addresses)

- Regular monthly purchases (dollar-cost averaging patterns)

These institutional buyers have long time horizons and aren’t deterred by short-term volatility.

DeFi Protocols and DAOs

On-chain data shows several DeFi protocol treasuries added ETH:

- MakerDAO increased ETH reserves for DAI collateral

- Aave treasury bought ETH for protocol backstop

- Lido staking protocol absorbed ETH inflows

These entities need ETH for operational purposes, creating structural demand independent of price speculation.

High-Net-Worth Individuals

Analysis of transaction patterns suggests individual whales (not institutions) are accumulating:

- Large single purchases (10,000-50,000 ETH transactions)

- Immediate transfers to cold storage (holding long-term, not trading)

- Staking deposits (ETH moved to staking contracts)

These HNWIs are positioning for 12-24 month holds, not quick trades.

5.What This Means for Ethereum’s Price

Whale accumulation doesn’t guarantee immediate price appreciation, but it creates favorable conditions:

Supply Removed from Market

394,682 ETH bought by whales represents supply removed from circulation. If this ETH is staked or held in cold storage, it reduces available supply for sellers, creating upward price pressure when demand returns.

Selling Pressure Absorbed

Whales accumulating during a decline means they’re absorbing selling pressure from weaker hands (retail capitulation, ETF outflows, liquidations). Once this selling exhausts, price can rise without fighting distribution.

Institutional FOMO Could Follow

Whales often front-run institutional capital. If their accumulation proves correct and ETH rallies, it triggers FOMO from institutions who missed the bottom—creating momentum that amplifies the move.

Short Squeeze Potential

If significant short interest exists (traders betting on ETH decline), a whale-driven rally could trigger short covering, accelerating upside as shorts are forced to buy ETH to close positions.

Price Targets Based on Whale Accumulation:

If this accumulation mirrors historical patterns:

- Conservative target: $4,200 (+21% from $3,470)

- Moderate target: $4,800 (+38%)

- Optimistic target: $5,500 (+58%)

Timeframe: 3-6 months (Q1-Q2 2026)

6.Risks: What Could Go Wrong

Despite bullish whale accumulation, several risks could prevent ETH rally:

- Whales Could Be Wrong

Smart money isn’t infallible. Whales have accumulated before market crashes (2022 bear market saw whale accumulation at $2,000+ before ETH fell to $880).

- Macro Shock

Recession, geopolitical crisis, or unexpected Fed hawkishness could override whale accumulation and drive ETH lower regardless of on-chain activity.

- Ethereum Competitors Gain Share

Solana, Sui, Aptos, and other high-performance Layer-1s could capture market share from Ethereum if they execute better on scalability and user experience.

- Continued ETF Outflows

If ETH ETF outflows resume and exceed $200M+ weekly, it signals institutional selling that even whale buying can’t overcome.

- Bitcoin Weakness Drags ETH

Ethereum has 0.75-0.85 correlation with Bitcoin. If BTC enters deeper correction, ETH likely follows regardless of whale accumulation.

7.How to Trade This Whale Accumulation Signal

For Aggressive Traders:

- Enter ETH positions near current levels ($3,400-$3,500)

- Use stop-losses below $3,200 (invalidates accumulation thesis)

- Target profits at $3,800 (+11%), $4,200 (+23%), $4,800 (+41%)

- Consider 3-5x leverage via MEXC Futures with tight risk management

For Conservative Traders:

- Wait for confirmation: ETH holding above $3,500 for 5-7 consecutive days

- Enter on pullbacks to $3,300-$3,400 support

- Use smaller position sizes (2-3% of portfolio)

- Target profits at $4,000 (+18%) and $4,500 (+32%)

For Long-Term Investors:

- Dollar-cost average into ETH over 4-8 weeks

- Consider ETH staking (3-4% yield while holding)

- Focus on 12-24 month horizon, ignore short-term volatility

- Allocate 15-25% of crypto portfolio to ETH

Risk Management:

- Never allocate more than 5% of portfolio to any single leveraged position

- Use trailing stops to lock in profits if rally accelerates

- Monitor on-chain data weekly—if whale accumulation reverses (net selling), exit immediately

8.On-Chain Metrics to Monitor

Track these metrics to confirm whale accumulation continues or reverses:

Exchange Netflows

- Negative netflows (ETH leaving exchanges) = bullish (whales withdrawing to cold storage)

- Positive netflows (ETH moving to exchanges) = bearish (preparing to sell)

Staking Deposits

- Increasing deposits = bullish (ETH locked for 12+ months)

- Decreasing deposits = bearish (unstaking to sell)

Whale Transaction Count

- Increasing large transactions (>1,000 ETH) = accumulation continuing

- Decreasing transactions = accumulation phase ending

ETH ETF Flows

- Net inflows >$100M weekly = institutional buying accelerating

- Net outflows >$200M weekly = institutional selling overwhelming whale buying

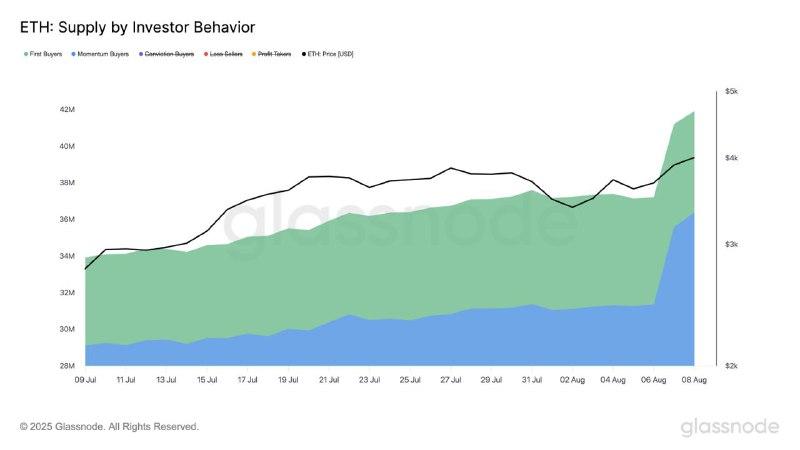

Use platforms like Glassnode, CryptoQuant, or Nansen to track these metrics in real-time.

9.The Bottom Line: Smart Money Is Positioning

Ethereum whales accumulated $1.37 billion worth of ETH in just three days while price dropped 10.55%—a textbook contrarian signal that smart money is positioning for a rally while retail panics. The largest buyer even borrowed 66,000 ETH from Aave to amplify exposure, demonstrating extreme conviction that current prices won’t last.

While no bottom is certain until hindsight confirms it, whale accumulation combined with oversold technical conditions, improving macro liquidity (Fed ending QT December 1), and upcoming Pectra upgrade creates a compelling setup. Historical precedent shows similar accumulation patterns preceded 100-150% rallies within 6-12 months.

For traders willing to follow smart money rather than fight it, current ETH levels around $3,400-$3,500 may represent one of 2025’s best risk/reward opportunities. The question isn’t whether whales are buying—on-chain data proves they are. The question is whether you’ll join them before the rest of the market catches on.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!