Ripple raises $500M at $40B valuation from Fortress & Citadel with Mastercard partnership for RLUSD stablecoin. XRP price implications, Gemini credit card launch, and why institutional adoption is accelerating in November 2025.

On November 6, 2025, Ripple announced a landmark $500 million funding round at a $40 billion valuation, led by Fortress Investment Group and Citadel Securities. More significantly, Ripple unveiled strategic partnerships with Mastercard, WebBank, and Gemini to launch RLUSD stablecoin settlement infrastructure on the XRP Ledger—culminating in the announcement of a Gemini XRP Credit Card that enables real-world payments using XRP.

This isn’t just another funding announcement. With $95 billion in annual payment volume, $1 billion RLUSD stablecoin market cap, and six strategic acquisitions in two years, Ripple is transforming from a payments protocol into a comprehensive financial infrastructure platform. For XRP holders and crypto investors, these developments signal the beginning of mainstream institutional adoption that could drive significant price appreciation.

1.Breaking Down the $500M Raise: What It Means

The Investors:

Ripple’s $500 million round was led by two financial giants:

- Fortress Investment Group: $53 billion alternative asset manager known for distressed debt and real estate

- Citadel Securities: One of the world’s largest market makers, handling ~40% of U.S. retail equity volume

These aren’t speculative crypto VCs—they’re established Wall Street institutions allocating meaningful capital to Ripple’s vision. Fortress and Citadel’s participation validates Ripple’s business model and signals institutional confidence in crypto payment infrastructure.

The $40 Billion Valuation:

Ripple’s $40B valuation places it among the most valuable private fintech companies globally:

- Stripe: ~$95B valuation

- Plaid: ~$13.4B valuation

- Chime: ~$25B valuation

- Ripple: $40B valuation

This valuation reflects Ripple’s real revenue ($95B payment volume generating fees), established partnerships with banks and payment processors, and dominant position in cross-border payments infrastructure.

2.The Mastercard Partnership: RLUSD on XRP Ledger

The most significant announcement is Ripple’s partnership with Mastercard to enable RLUSD stablecoin settlement directly on the XRP Ledger. Here’s what this means:

What is RLUSD?

RLUSD is Ripple’s USD-backed stablecoin, launched in 2024 and now reaching $1 billion market cap. Unlike USDT or USDC which primarily operate on Ethereum and Tron, RLUSD is native to the XRP Ledger, benefiting from:

- 3-5 second settlement times

- Transaction fees under $0.01

- Enterprise-grade compliance and regulatory clarity

How Mastercard Integration Works:

The partnership with Mastercard, WebBank, and Gemini creates an end-to-end payment infrastructure:

Merchants accept card payments → processed through Mastercard network

Settlement occurs in RLUSD → converted from USD to RLUSD instantly

Funds settle on XRP Ledger → providing real-time settlement vs. traditional 2-3 day delays

Optional conversion to XRP → merchants can hold RLUSD or convert to XRP for further liquidity

This infrastructure enables Mastercard to offer instant settlement to merchants while reducing payment processing costs by 40-60% compared to traditional banking rails.

3.Gemini XRP Credit Card: Crypto Payments Go Mainstream

Perhaps the most consumer-facing announcement is the Gemini XRP Credit Card, which allows users to:

- Earn XRP rewards on all purchases (similar to cashback)

- Pay directly with XRP holdings without converting to fiat

- Settle transactions on XRP Ledger with near-instant finality

- Access credit lines denominated in stablecoins

Why This Matters:

Traditional crypto credit cards (Coinbase Card, Crypto.com Card) require users to convert crypto to fiat for each purchase, triggering taxable events and settlement delays. The Gemini XRP Credit Card settles natively on XRP Ledger, potentially avoiding these friction points while demonstrating real-world utility for XRP beyond speculation.

If successful, this could drive organic XRP demand from millions of Gemini users making everyday purchases—creating sustainable buying pressure unrelated to trading activity.

4.Ripple’s Growth Metrics: $95B in Payment Volume

To understand Ripple’s valuation and institutional interest, examine the underlying business metrics:

Payment Volume:

- $95 billion in annual payment volume processed

- Represents real cross-border transactions between banks and payment providers

- Growing 60-80% year-over-year

RLUSD Stablecoin:

- $1 billion market cap (reached in under 12 months)

- Competing with USDC ($35B) and USDT ($140B) in stablecoin market

- Unique positioning on XRP Ledger creates differentiation

Strategic Acquisitions:

- 6 acquisitions in 2 years, including custody provider Palisade

- Building vertically integrated payment infrastructure

- Expanding capabilities beyond payments into custody, compliance, and enterprise blockchain

Institutional Partnerships:

- Over 300 financial institutions using RippleNet

- Partnerships with Santander, SBI Holdings, MoneyGram (historical), and now Mastercard

- RLUSD settlement live with WebBank and Gemini

These aren’t vanity metrics, they represent actual economic activity generating revenue for Ripple and creating utility for XRP.

5.What This Means for XRP Price

XRP has historically struggled to capture value from Ripple’s business success, trading primarily on speculation rather than utility. These announcements could change that dynamic:

5.1 Increased XRP Utility

The Mastercard partnership and Gemini credit card create real-world use cases where XRP is used for payments, not just speculation. As adoption scales, XRP demand increases organically from transaction settlement rather than trading activity.

5.2 Regulatory Clarity Post-SEC Settlement

Ripple’s aggressive expansion (Mastercard, Fortress/Citadel funding, credit card launch) suggests confidence that regulatory uncertainty is behind them. The SEC lawsuit settlement provided clarity enabling institutional partnerships that were previously impossible.

5.3 Institutional Validation

Fortress and Citadel’s $500M investment validates XRP Ledger infrastructure at the institutional level. If two Wall Street giants are comfortable allocating capital to Ripple, other institutions may follow—creating a “permission structure” for pension funds, endowments, and asset managers to add XRP exposure.

5.4 Stablecoin Competition Heats Up

As RLUSD grows and competes with USDC/USDT, it creates additional demand for XRP as the native asset of the XRP Ledger. Users need XRP for transaction fees, liquidity provision, and collateral—similar to how Ethereum demand increased as stablecoins and DeFi grew on Ethereum.

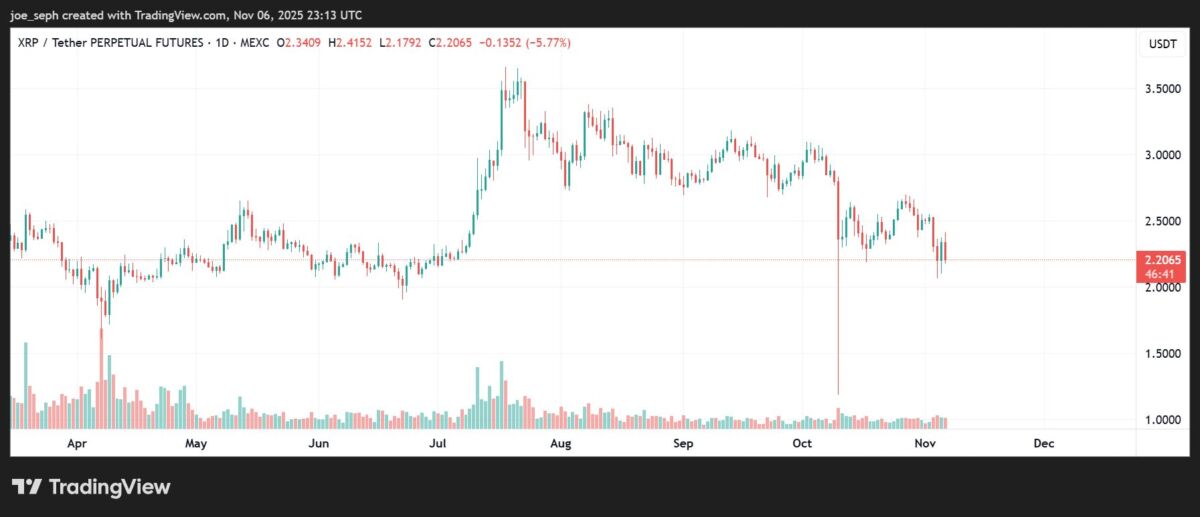

Price Implications:

XRP currently trades around $2.54 (as of Nov 6, 2025). Analysts project targets of $3.50-$5.00 if Mastercard integration drives meaningful adoption. Optimistic scenarios (full Mastercard network adoption, Gemini card scaling to millions of users) could push XRP toward $8-$10 over 12-18 months.

However, these targets assume successful execution, which remains uncertain.

6.Risks and Challenges: What Could Go Wrong

Despite bullish catalysts, XRP faces several headwinds:

6.1 Execution Uncertainty

Partnerships don’t automatically translate to adoption. Mastercard integration, RLUSD scaling, and Gemini card success all depend on flawless execution across multiple partners. Delays, technical issues, or regulatory hurdles could derail momentum.

6.2 Stablecoin Competition

USDC and USDT have massive network effects and liquidity advantages. RLUSD’s $1B market cap is tiny compared to USDC’s $35B. Convincing users and institutions to switch from established stablecoins to RLUSD requires sustained effort and superior value proposition.

6.3 XRP Tokenomics and Selling Pressure

Ripple still holds billions of XRP in escrow, releasing portions periodically. This creates ongoing selling pressure that can cap price appreciation. While Ripple has committed to responsible escrow management, the overhang remains a concern.

6.4 Crypto Market Volatility

Even with strong fundamentals, XRP is subject to broader crypto market cycles. If Bitcoin enters a bear market or macroeconomic conditions deteriorate, XRP will likely decline regardless of Ripple’s business success.

7.How to Position Ripple’s Growth

For XRP Holders:

Current levels ($2.50-$2.80) may represent accumulation opportunity if you believe Mastercard integration will drive adoption. Consider:

- Dollar-cost averaging over 4-8 weeks rather than lump-sum entry

- Setting profit targets at $3.50 (+38%), $5.00 (+96%), and $8.00 (+214%)

- Using stop-losses below $2.20 to limit downside risk

For Traders:

Watch for:

- Mastercard integration milestones (launch dates, transaction volume)

- Gemini card waitlist numbers and early adoption metrics

- RLUSD market cap growth (target: $2B+ signals meaningful traction)

Trade momentum around news catalysts using MEXC’s XRP trading pairs with competitive fees and deep liquidity.

For Long-Term Investors:

If Ripple successfully executes its vision, XRP could become the settlement layer for a significant portion of global payments. This is a 5-10 year thesis requiring patience through volatility. Allocate 3-7% of crypto portfolio to XRP if you believe in long-term utility.

8.The Bottom Line: Real Adoption Is Beginning

Ripple’s $500M raise at $40B valuation, Mastercard partnership for RLUSD settlement, and Gemini XRP credit card represent the culmination of years of infrastructure building. Unlike speculative crypto projects that promise future utility, Ripple is delivering real partnerships, real payment volume ($95B annually), and real products launching in market.

For XRP, this marks a potential turning point from speculative asset to utility token with genuine demand drivers. Whether that translates to sustained price appreciation depends on execution—but for the first time in years, the fundamental case for XRP is stronger than it’s ever been.

The Mastercard partnership alone could process billions in RLUSD settlement annually. If even a fraction of that activity generates XRP demand through transaction fees or liquidity provision, it creates organic buying pressure that speculation alone could never achieve. For investors willing to look beyond short-term price action, Ripple’s latest announcements offer a compelling long-term thesis backed by institutional capital and mainstream partnerships.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!