Targeted activity in the Ethereum blockchain began to intensify in the middle of this week. The basic digital asset of the network – ETH suffered large losses at the turn of October-November along with bitcoin.

The leading cryptocurrency on Tuesday briefly dropped below $100,000. The local bottom BTC groped in the range of $98,000 to $99,000 and quickly bounced amid the return of whale support.

ETH dropped to $3009 and was able to return to the growth phase along with bitcoin and other digital currencies after on social networks pessimistic sentiment stimulated a change in tactics of traders who returned to purchases at low prices. As a result, the market was able to restore positions after the recent collapse.

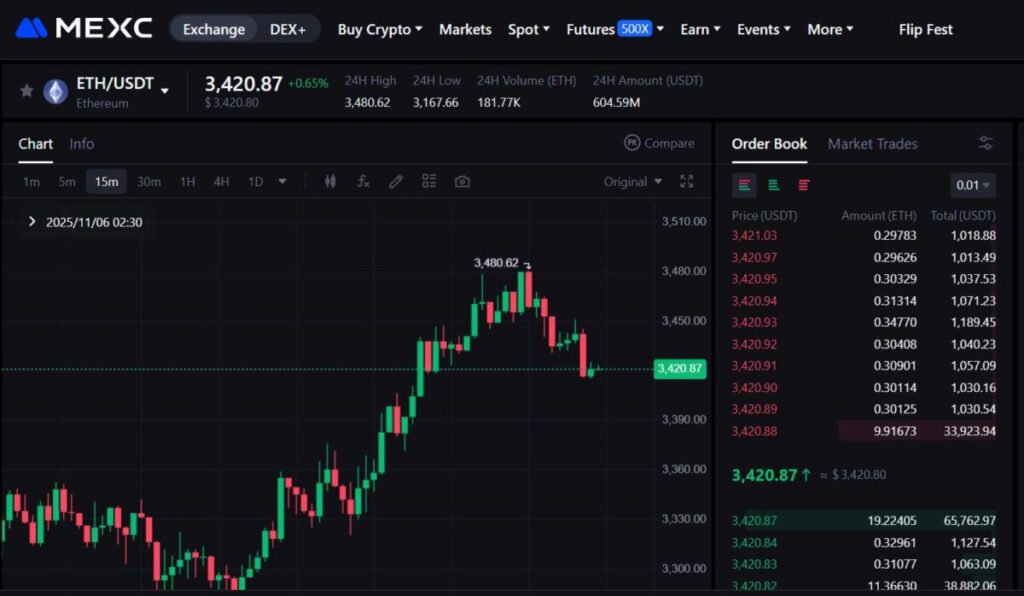

Ether is trying to overcome the resistance zone formed at the level of $3,500-3,700.

- Usually, increased network activity creates conditions for strengthening the asset. Just such a scenario we are seeing this week, the MEXC Research team notes.

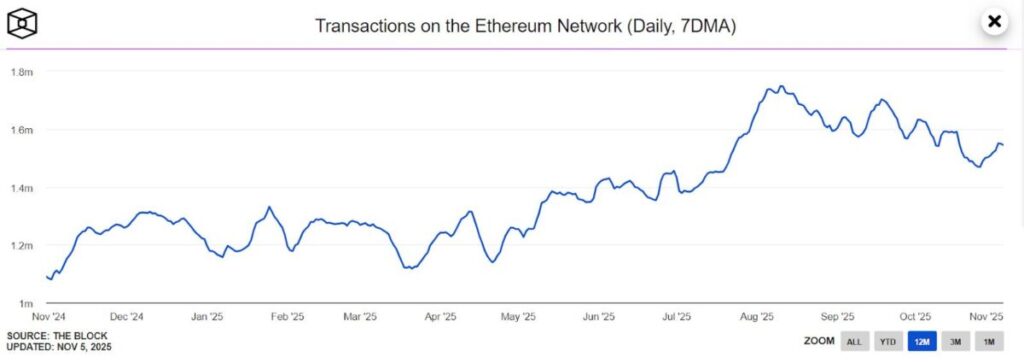

According to The Block, the daily number of transactions in the Ethereum blockchain exceeded 1.55 million. At the end of October, this number dropped to 1.47 million, which led to such a strong weakening of the ETH rate.

Bears prevent ETH from taking off

On the MEXC exchange MEXC the air groped the bottom at 3057 USDT, which was reached on November 5.

At that point, the Relative Strength Index (RSI) fell to its lowest level in several weeks. Its fall signaled an oversold asset that, after a brief consolidation, was able to partially recover.

- In the range from $3,500 to $3,700, a zone of strong resistance has formed, which the cryptocurrency cannot break due to the dominance of the bearish trend.

Some analysts agree that if support does not increase in the coming days, the lack of resources to jump above $3,500 could trigger a new and more powerful retreat of the ether.

In the most negative scenario, the coin will drop below $3,000 and even may go to $2,400 or $1,700.

However, investors, primarily whales and sharks, are not interested in such a collapse. Most likely, the asset is already at the bottom and will be traded in a narrow range in the coming days.

According to CryptoRank, 2025 was the most unsuccessful for the air in the past seven years. The coin finished in the red zone for 9 months – this is the longest retreat since 2018, following which the ETH rate fell by 93%.

For the month, losses of ETH traders amounted to approximately 12.8%, reports Santiment. For short-term investors, the fall in cryptocurrency has become the most painful since April, and for long-term – since June 2025.

- Overcoming the barrier at $3,500 will be difficult, since at the moments of storming this psychological mark, traders will start selling to level losses.

- A jump above $3,500 is possible if the support turns out to be not only powerful, but also long-term. The chances of the return of the bullish scenario will improve when investors can minimize losses, the MEXC Research team notes.

Capital outflow from ETF funds indicates weakening institutional interest

The interest of institutional investors in digital assets has been weakening in recent days despite the fact that the US Federal Reserve has lowered the discount rate.

On Tuesday in the American market spot crypto ETF funds, focused on bitcoin and ether, recorded capital outflows of $797 million.

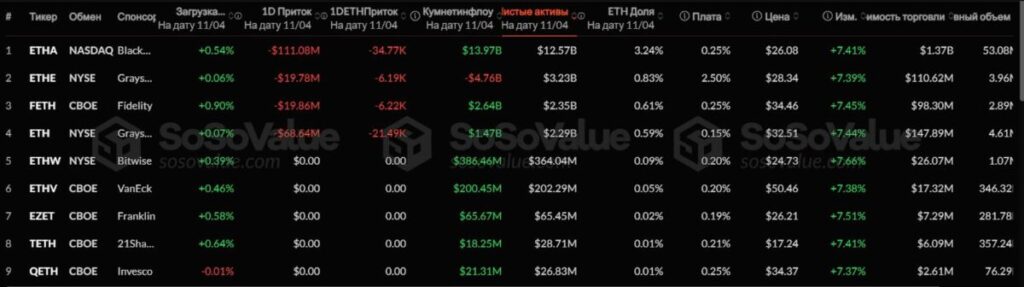

According to SoSoValue, investors withdrew $577.74 million from bitcoin ETF, and $219.37 million from Ethereum ETF.

- The outflow of funds from tools that track the performance of the largest digital currencies continued for five consecutive days. During this time, ETF funds recorded an exit of about $1.9 billion .

Of the ether-focused ETFs, BlackRock’s ETHA and Grayscale and Fidelity funds were the most affected.

The Fed hinted that in December the rate is likely to remain unchanged. Risks for the American economy remain, and the authorities decided to take a pause to analyze the effects of monetary policy easing.

In this situation, investors went to a quick review of tactics and switched to traditional assets, which led to a sharp strengthening of the US dollar index.

Projects related to digital currencies and artificial intelligence (AI) turned out to be less attractive in conditions of uncertainty. As a result, the pressure increased, and we saw fall of the cryptocurrency market at the turn of October-November.

- The recovery this week signals that traders are trying to prevent a more serious fall in bitcoin and altcoins. However, large capital is not yet ready to expand its presence in the digital asset market.

Disclaimer: This information is not investment, tax, legal, financial, accounting, advisory or any other related services advice, nor is it advice to buy, sell or hold any assets. MEXC Training provides information for reference purposes only and is not investment advice. Please ensure that you fully understand all risks and exercise caution when investing. The platform is not responsible for users’ investment decisions.

Join MEXC and Get up to $10,000 Bonus!