On November 3, 2025, Balancer—one of DeFi’s most established protocols—suffered a devastating exploit that drained $128.64 million across multiple blockchain networks. The attack exploited faulty access control in the protocol’s manageUserBalance function, marking Balancer’s third major security breach since 2020 and raising urgent questions about whether DeFi protocols can ever achieve the security standards necessary for mainstream adoption.

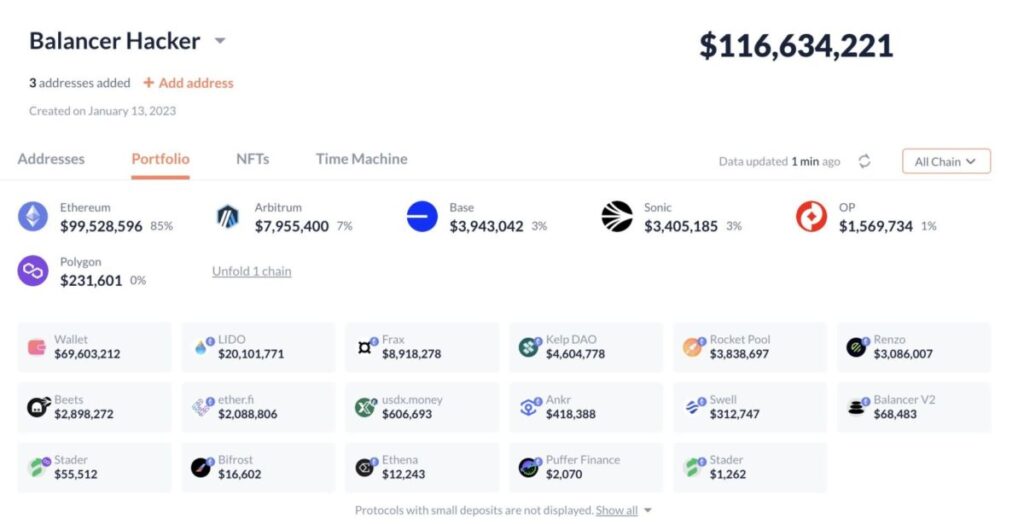

The hack hit Ethereum ($99M), Berachain ($12.86M), and Arbitrum ($6.86M), with the BAL governance token immediately dropping 8-10% as news spread. For a protocol that once represented DeFi’s cutting-edge innovation in automated market making, this latest breach represents more than financial loss, it’s a credibility crisis that threatens to push institutional capital further away from decentralized finance.

1.What Happened: The Technical Breakdown

The Balancer exploit centered on a critical vulnerability in the protocol’s manageUserBalance function, a component designed to allow users to manage their token balances within Balancer’s vault system.

The Vulnerability:

Balancer’s architecture uses a centralized vault that holds all tokens across different pools. The manageUserBalance function was supposed to enable users to deposit, withdraw, or transfer their tokens within this system. However, faulty access controls meant the function didn’t properly verify whether the caller had authorization to move specific tokens.

How the Attack Worked:

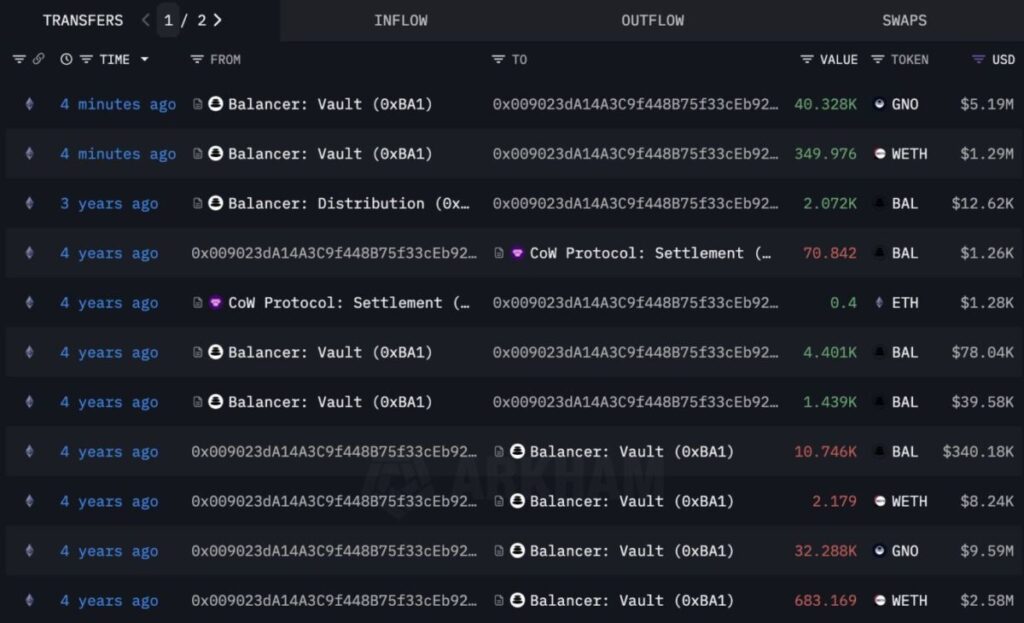

- Attacker identified the access control flaw in manageUserBalance

- Called the function to transfer tokens from other users’ balances without authorization

- Drained funds systematically across multiple chains where Balancer was deployed

- Moved stolen assets to mixing services and cross-chain bridges to obscure the trail

The Impact:

- Ethereum: $99 million drained (largest portion)

- Berachain: $12.86 million stolen

- Arbitrum: $6.86 million taken

- Total: $128.64 million across all chains

The exploit’s sophistication was moderate—it didn’t require complex flash loan attacks or novel cryptographic breaks. It simply exploited a basic access control failure that should have been caught during auditing and testing.

2.Balancer’s History of Security Failures

This isn’t Balancer’s first major breach. Since launching in 2020, the protocol has suffered three significant exploits:

Breach 1: August 2020 – $500K

A vulnerability in certain pool types allowed an attacker to manipulate token prices through deflation token attacks, stealing approximately $500,000. Balancer responded by implementing emergency mitigations and compensating affected users.

Breach 2: August 2023 – $2M

A frontend DNS hijacking attack redirected users to a malicious interface that drained wallets when users approved transactions. While technically not a smart contract vulnerability, it demonstrated weaknesses in Balancer’s infrastructure security.

Breach 3: November 2025 – $128.64M

The current exploit, significantly larger than previous incidents, exploited access control failures in core protocol logic.

The Pattern:

Each breach involved different attack vectors, suggesting Balancer’s security challenges aren’t isolated bugs but systemic weaknesses in development processes, auditing rigor, or ongoing security maintenance. For a protocol managing billions in TVL and claiming institutional-grade security, three major breaches in five years is unacceptable.

3.Why This Hack Matters Beyond the Dollar Amount

While $128.64M is significant, the broader implications for DeFi extend beyond financial loss:

Implication 1: Audit Failure Raises Questions About Entire Industry

Balancer’s smart contracts were audited by reputable security firms. Yet a basic access control flaw—one of the most common and well-understood vulnerability types—made it through multiple audits and into production. This suggests either:

- Audits were inadequate or incomplete

- Code changes after audits introduced the vulnerability

- Auditors missed obvious issues due to workload or expertise gaps

Any of these explanations undermines confidence in DeFi security audits more broadly. If established protocols with professional audits can suffer basic access control exploits, what does that say about newer, less-scrutinized projects?

Implication 2: Multi-Chain Deployment Multiplies Risk

Balancer operates across Ethereum, Arbitrum, Polygon, Optimism, Gnosis, Berachain, and other chains. While multi-chain presence increases addressable market, it also multiplies attack surface. A single vulnerability affects all chains simultaneously, as demonstrated by this exploit hitting Ethereum, Berachain, and Arbitrum.

DeFi’s push toward multi-chain expansion may be creating systemic risk by spreading identical code across multiple environments, each with unique security assumptions and potential attack vectors.

Implication 3: Institutional Adoption Faces Another Setback

Traditional finance institutions exploring DeFi require assurance that protocols meet rigorous security standards. Each major hack pushes institutional adoption further away. Why would a bank or pension fund allocate to DeFi when established protocols lose nine figures overnight?

Implication 4: Insurance and Recovery Mechanisms Are Insufficient

Balancer’s response has been to pause affected pools and work with law enforcement and blockchain analysis firms to trace stolen funds. But recovery rates for DeFi exploits are notoriously low—typically under 10% of stolen funds are recovered. Without robust insurance or recovery mechanisms, users bear the full risk of protocol failures.

4.Market Reaction: BAL Token Down 8-10%

The immediate market reaction was predictable: BAL token fell 8-10% as news of the exploit spread. However, the relatively muted response (compared to 30-50% drops seen in previous DeFi hacks) suggests:

- Market desensitization: DeFi hacks have become so common that investors no longer panic-sell aggressively

- Limited BAL utility: Most users interact with Balancer without holding BAL tokens, limiting direct exposure

- Historical recovery: Balancer recovered from previous exploits, suggesting this won’t be fatal

That said, longer-term impacts on TVL (total value locked) and user trust are likely. Many institutional users who deposited funds in Balancer pools will reconsider their allocations, particularly if compensation isn’t forthcoming.

5.What Balancer Got Wrong: Lessons for DeFi Developers

The Balancer exploit offers clear lessons for DeFi protocol developers:

Failure 1: Insufficient Access Control Testing

Access control bugs are among the most common smart contract vulnerabilities. That Balancer’s manageUserBalance function lacked proper authorization checks suggests testing processes didn’t adequately cover privilege escalation scenarios. Every function that moves user funds should have multiple layers of authorization verification.

Failure 2: Inadequate Pre-Deployment Audits

Either audits didn’t cover the affected code paths, or auditors missed the vulnerability. Both scenarios indicate audit processes need strengthening—more time, more auditors, or more comprehensive testing methodologies.

Failure 3: Lack of Real-Time Monitoring

Sophisticated DeFi protocols implement real-time monitoring that detects anomalous behavior (large withdrawals, unusual access patterns) and automatically pauses contracts before damage scales. Balancer’s $128.64M loss suggests monitoring was either absent or ineffective.

Failure 4: Multi-Chain Risk Underestimation

Deploying identical code across multiple chains without chain-specific security reviews created a multiplier effect where one vulnerability impacted three networks simultaneously. Multi-chain deployments require chain-specific threat modeling.

6.What This Means for DeFi Users and Investors

If you’re a DeFi user or investor, the Balancer hack reinforces several critical principles:

Principle 1: No Protocol Is 100% Secure

Even established, audited protocols can suffer catastrophic exploits. Never allocate more capital to DeFi than you can afford to lose. Treat DeFi positions as high-risk, high-reward investments, not safe savings vehicles.

Principle 2: Diversification Across Protocols

Don’t concentrate all DeFi exposure in a single protocol. Spread capital across multiple platforms (Aave, Uniswap, Curve, etc.) to limit single-point-of-failure risk. If one protocol is exploited, you lose only a fraction of your DeFi allocation.

Principle 3: Monitor TVL Changes

Protocols with rapidly declining TVL may indicate insider knowledge of security issues or loss of confidence. If a protocol’s TVL drops 20%+ suddenly without explanation, consider reducing exposure before vulnerabilities are publicly disclosed.

Principle 4: Prioritize Insurance-Covered Protocols

Some DeFi protocols partner with insurance providers (Nexus Mutual, InsurAce) that offer coverage for smart contract exploits. While insurance adds cost, it dramatically reduces downside risk. Favor insured protocols when possible.

Principle 5: Use CEXs for Large Holdings

For capital you can’t afford to lose, centralized exchanges like MEXC with institutional security, insurance, and regulatory compliance offer materially better risk profiles than DeFi protocols. DeFi is powerful for earning yield and accessing unique strategies, but CEXs are safer for core holdings.

7.Will Users Be Compensated?

Balancer has not yet announced a compensation plan for affected users. Historical precedent suggests several possible outcomes:

Scenario 1: Partial Compensation from Treasury

Balancer’s DAO controls a treasury funded by protocol fees and BAL token reserves. The community may vote to compensate affected users partially (20-50% of losses) using treasury funds. This maintains goodwill but doesn’t make users whole.

Scenario 2: No Compensation, Users Bear Losses

Many DeFi protocols take the position that users accept smart contract risk when depositing funds. Balancer may decline to compensate, arguing that all users are warned about risks in terms of service. This protects the protocol’s finances but damages trust.

Scenario 3: Insurance Payouts (If Covered)

Some users may have purchased third-party insurance covering smart contract exploits. These users could file claims, but coverage is typically limited and complex to navigate.

Scenario 4: Law Enforcement Recovery

Balancer is working with blockchain forensics firms to trace stolen funds. If attackers are identified and assets recovered (unlikely but possible), users may receive partial restitution. Recovery rates are historically under 10%.

8.The Bottom Line: DeFi’s Security Crisis Continues

Balancer’s $128.64M exploit is the latest in a long series of DeFi security failures that collectively total billions in losses. While DeFi offers revolutionary financial tools, its security track record remains unacceptable for mainstream adoption.

For users and investors, the lesson is clear: treat DeFi as high-risk experimental technology, not mature infrastructure. Use it for specific purposes (yield farming, liquidity provision, novel trading strategies), but don’t trust it with funds you can’t afford to lose. And when security breaches inevitably occur, as they will, ensure you’re diversified enough that no single exploit destroys your portfolio.

For the DeFi industry, this hack should trigger soul-searching about whether current development and auditing practices are sufficient. Three major Balancer breaches in five years isn’t bad luck, it’s evidence that something fundamental needs to change.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!