While most crypto projects chase hype cycles and speculative narratives, Celo has spent 2025 executing one of the industry’s most ambitious technical transformations: migrating from an independent Layer-1 blockchain to an Ethereum Layer-2 using Optimism’s OP Stack. Completed in March 2025, the migration unlocked dramatic growth—600,000 daily active users, over $1 billion in monthly stablecoin volume, and 365% protocol revenue growth—yet CELO token price remains down 62% year-to-date at $0.2506.

This disconnect between technical achievement and market valuation creates one of crypto’s most interesting contrasts: a project with genuine product-market fit and real-world adoption trading at levels that suggest failure, not success. For investors willing to look beyond price action, Celo represents a rare case study in how blockchain infrastructure achieves actual usage—and why that usage doesn’t always correlate with token price.

1.What Celo Actually Does: Mobile-First Payments for Emerging Markets

Celo’s mission is straightforward but ambitious: make cryptocurrency-based payments accessible to anyone with a mobile phone, particularly in emerging markets where traditional banking infrastructure is limited or nonexistent.

The project’s flagship product, MiniPay is a mobile wallet designed for simplicity, speed, and ultra-low costs. Unlike MetaMask or other crypto wallets that assume users understand gas fees, seed phrases, and blockchain networks, MiniPay abstracts away complexity:

- Phone number as address: Send money using phone numbers instead of complex wallet addresses

- Sub-cent transaction fees: Transactions cost fractions of a penny, enabling micropayments

- Stablecoin-first: Users transact primarily in USDC and cUSD (Celo’s native stablecoin), avoiding crypto volatility

- Fiat on/off ramps: Direct integration with local payment systems in target markets

The Target Market:

Celo focuses on regions where traditional finance is broken or inaccessible:

- Africa (Kenya, Nigeria, Ghana, South Africa)

- Latin America (Argentina, Brazil, Venezuela)

- Southeast Asia (Philippines, Indonesia)

In these markets, inflation erodes local currencies, cross-border payments are expensive and slow, and billions of people lack access to basic banking services. Celo’s value proposition: use your smartphone to send, receive, and store money in stable dollars, paying almost nothing in fees.

2.The Numbers: Real Adoption Metrics That Matter

Let’s separate Celo’s technical achievements from its price performance and focus on usage metrics:

MiniPay Adoption:

- 10+ million activated wallets (as of September 2025)

- 275 million transactions processed since launch

- 60+ countries with active users

- 8+ million wallets milestone reached earlier in 2025

Post-L2 Migration Performance:

- 600,000 daily active users

- $1 billion+ monthly stablecoin volume

- 365% protocol revenue growth post-migration

- Sub-cent transaction fees maintained post-migration

Technical Infrastructure:

- 1-block finality (faster than most L2s)

- Isthmus hard fork completed July 2025, improving efficiency

- OP Stack rollups providing Ethereum security guarantees

These aren’t vanity metrics or bot-inflated numbers. These are real people using Celo to send remittances, pay for goods and services, and store value in stable assets. This level of adoption is rare in crypto—most blockchains struggle to reach even 10,000 daily active users, let alone 600,000.

3.The L2 Migration: Why Celo Gave Up Independence

In March 2025, Celo completed its transition from an independent Layer-1 blockchain to an Ethereum Layer-2 using Optimism’s OP Stack. This was a strategic gamble: abandon sovereignty and independence in exchange for Ethereum’s security, liquidity, and developer ecosystem.

Why Make This Change?

Reason 1: Security Through Ethereum

As an independent L1, Celo had to secure its own network through validators and consensus mechanisms. This required significant capital and ongoing maintenance. By becoming an Ethereum L2, Celo inherits Ethereum’s security—one of the most robust and battle-tested networks in crypto. This reduces security risks and operational costs.

Reason 2: Access to Ethereum’s Liquidity and DeFi Ecosystem

Ethereum hosts trillions of dollars in DeFi liquidity across protocols like Uniswap, Aave, Compound, and MakerDAO. As an Ethereum L2, Celo can tap into this liquidity directly, enabling users to access a far wider range of financial services than was possible as an isolated L1.

Reason 3: Developer Ecosystem and Tooling

Ethereum has the largest developer community in crypto. By migrating to an Ethereum L2, Celo makes it trivial for Ethereum developers to build on Celo—they can use the same tools (Solidity, Hardhat, Foundry) and deploy contracts without learning a new blockchain. This dramatically expands Celo’s potential developer base.

Reason 4: Interoperability With Other L2s

As part of the Optimism Superchain (a network of L2s built on OP Stack), Celo gains native interoperability with other OP Stack chains like Base, Optimism, and Zora. Users can move assets between these L2s seamlessly, creating network effects that isolated L1s can’t achieve.

4.The Results: 365% Revenue Growth and Real Usage

The migration worked. Post-L2 transition, Celo’s key metrics surged:

- Protocol revenue up 365%: More transactions = more fees captured by the protocol

- Daily active users 3x previous highs: Improved user experience and lower costs drove adoption

- Stablecoin volume exceeded $1B monthly: Real economic activity, not just speculation

Critically, Celo maintained its core advantages:

- 1-block finality: Transactions finalize in seconds, not minutes

- Sub-cent fees: Even with Ethereum security, fees remain a fraction of a penny

- Phone-number addressing: User experience improvements weren’t sacrificed for technical migration

The Isthmus hard fork in July 2025 further optimized the network, improving throughput and efficiency without compromising decentralization.

5.Why Is CELO Token Down 62% Despite Success?

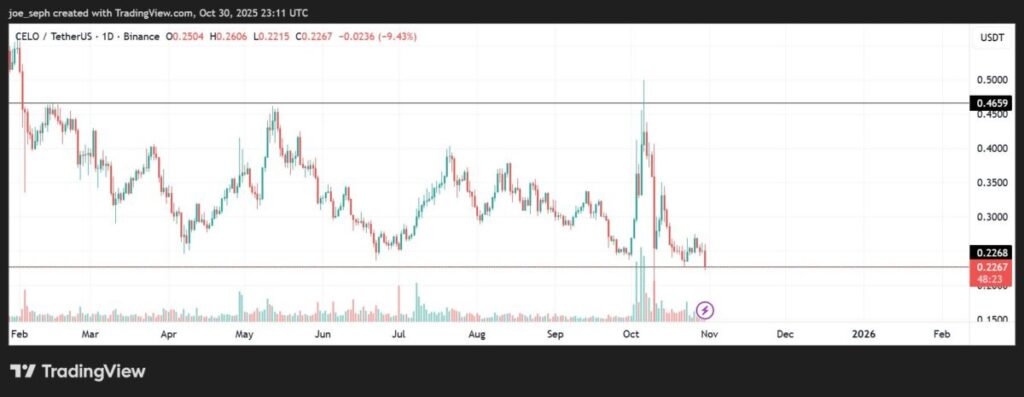

This is the paradox: Celo the product is succeeding. Celo the token is failing. As of October 30, 2025, CELO trades at $0.2506, down 62.41% year-to-date. Technical indicators show weak momentum (RSI at 41) and consolidation around support levels.

Possible Explanations:

- Token Utility Disconnect

CELO token’s primary use case is governance and staking. But MiniPay users don’t need CELO—they transact in USDC and cUSD. This creates a disconnect: the product succeeds without driving demand for the token. As usage grows, token price doesn’t necessarily follow.

- Stablecoin-First Approach Reduces CELO Demand

By design, Celo prioritizes stablecoin usage to avoid volatility for end users. This is correct product design—no one wants to pay for groceries with an asset that might drop 10% before the transaction confirms. But it means CELO isn’t required for everyday usage, limiting organic demand.

- Broader Altcoin Market Weakness

2025 has been brutal for altcoins. Even projects with strong fundamentals have suffered as capital concentrated in Bitcoin and Ethereum. CELO’s 62% decline may reflect broader sector weakness rather than Celo-specific failures.

- Mento Reserve Restructuring Uncertainty

In September 2025, Celo’s community voted to restructure the Mento Reserve (which backs cUSD stablecoin) to optimize yield generation. While this improves protocol economics, it may have created short-term uncertainty among token holders about how value accrues to CELO.

- RSI and Technical Weakness

RSI at 41 indicates weak momentum. While not oversold (below 30), it suggests limited buying pressure. Without a clear catalyst to reverse sentiment, technical weakness can persist even as fundamentals improve.

6.The Bull Case: Why Undervaluation May Not Last

Despite price weakness, several factors suggest CELO could be undervalued relative to its fundamentals:

Factor 1: Real Revenue Generation

Celo generates actual revenue from transaction fees. With 600K daily active users and $1B+ monthly volume, the protocol captures meaningful fees. If revenue continues growing 365% year-over-year, token valuation may eventually reflect this.

Factor 2: Emerging Market Adoption Is Early

Celo’s target markets (Africa, Latin America, Southeast Asia) represent billions of potential users. With only 10M wallets activated, penetration is still under 1% of addressable market. As adoption scales, network effects compound.

Factor 3: Ethereum L2 Narrative Gaining Momentum

Ethereum L2s like Base, Arbitrum, and Optimism have seen significant capital inflows. As this narrative strengthens, Celo’s positioning as a mobile-first L2 could attract attention from investors seeking exposure to L2 growth.

Factor 4: Stablecoin Usage Is Growing Globally

Global stablecoin usage exceeded $200B in 2025. Celo’s focus on stablecoin-based payments positions it to capture a share of this massive market, particularly in regions underserved by traditional stablecoin infrastructure.

Factor 5: Technical Setup: RSI at 41 Isn’t Oversold, But Close

While current momentum is weak, RSI at 41 suggests CELO isn’t deeply oversold. A catalyst (partnership announcement, major user milestone, or broader altcoin recovery) could reverse technical weakness quickly.

7.How to Approach CELO: Strategic Considerations

Given the disconnect between fundamentals (strong) and price (weak), how should traders and investors approach CELO?

For Value Investors:

- Current levels ($0.25) may represent accumulation opportunity if you believe usage growth eventually drives token demand

- Dollar-cost average over 3-6 months rather than entering all at once

- Set clear thesis-invalidation levels (e.g., if daily active users decline below 400K, fundamental thesis is damaged)

For Traders:

- Wait for technical confirmation (RSI above 50, break above $0.30 resistance) before entering

- Use tight stop-losses below $0.22 to limit downside

- Target initial profits at $0.35-$0.40 (40-60% gains from current levels)

For Long-Term Holders:

- Focus on protocol metrics (daily active users, transaction volume, revenue) rather than price

- CELO may underperform in 2025 but outperform in 2026-2027 as adoption scales

- Consider this a “boring infrastructure” play, not a moon shot

Risk Management:

- Allocate no more than 2-3% of portfolio to CELO given price weakness and uncertainty around token utility

- Monitor user growth quarterly—if DAUs stagnate, the thesis weakens significantly

8.The Bottom Line: Success Doesn’t Always Mean Price Appreciation (Yet)

Celo is executing at a high level: 600K daily active users, $1B monthly stablecoin volume, 365% revenue growth, and successful technical migration to Ethereum L2. These are metrics most crypto projects dream of achieving.

Yet CELO token trades as if the project is failing, not succeeding. This disconnect creates opportunity for patient investors who believe fundamentals eventually matter—but also risk for those who assume strong products automatically generate strong returns.

The lesson: in crypto, narrative and timing matter as much as fundamentals. Celo has the fundamentals. Whether it develops the narrative and timing to drive token appreciation remains the key question for 2026.

Disclaimer: This content is for educational and reference purposes only and does not constitute any investment advice. Digital asset investments carry high risk. Please evaluate carefully and assume full responsibility for your own decisions.

Join MEXC and Get up to $10,000 Bonus!