Throughout modern economic cycles, the Federal Reserve’s (Fed) interest rate policy has always been at the center of shaping global capital flows. For crypto—a young but highly volatile asset class—Fed rate policy matters just as much as it does for stocks or gold. However, crypto’s reaction to rate cuts is not as simple as “cheaper money → higher prices.” It depends on many factors: the macro backdrop, inflation expectations, institutional positioning, as well as crypto’s own cyclical dynamics.

1.Why do rate hikes/cuts affect crypto?

1.1. Cost of capital, borrowing, and leverage

When the Fed cuts rates, margin borrowing costs fall, encouraging investors to use higher leverage and push capital into risk assets such as equities, commodities, and crypto. Conversely, higher rates make capital more cautious. The impact also depends on market structure: highly levered markets are prone to cascading liquidations, while weaker capital inflows limit the reaction.

1.2. Flows between risk assets and safe havens

High rates make bonds and deposits more attractive, drawing capital out of crypto. When the Fed cuts, safe yields decline, improving the relative competitiveness of risk assets. The opportunity cost of holding crypto (which provides no fixed yield) also falls, boosting its appeal.

1.3. FX channel: USD and global capital flows

Rate cuts often weaken the dollar. This creates two effects:

- Non-US investors: Crypto is priced in USD, so a weaker dollar makes it cheaper in local currencies, increasing international demand.

- US investors: A weaker dollar is often linked with domestic economic risk, making US institutions—which provide most crypto liquidity—more cautious with risk assets.

1.4. Psychology and expectations

Sentiment plays a major role. Expectations of further cuts can attract flows into crypto even before official announcements. The “Fed Put” also reinforces the belief that downside risks are capped, encouraging risk appetite. Since crypto often correlates with equities—especially tech stocks—positive equity reactions usually spill over to crypto.

1.5. Market structure & technicals

Given crypto’s heavy reliance on futures, funding rates, and open interest, changes in rates can trigger position rebalancing, stop-loss cascades, or mass liquidations—causing sharp volatility. Additionally, crypto markets often follow a “sell the news” pattern if cuts were already priced in.

1.6. Indirect impact via venture capital

Lower rates create abundant liquidity, encouraging retail and funds to invest in crypto/DeFi/Web3 startups. This strengthens ecosystems and provides long-term growth momentum. Higher rates, in contrast, constrain VC inflows and slow innovation.

2.Three types of rate cuts in history – Three very different scenarios

The Fed has never cut rates “just because it felt like it.” Each cut reflects a very specific context: sometimes acting like a booster shot that fuels strong rallies, and sometimes as a distress signal that precedes market crashes. For crypto—a liquidity-sensitive, emerging asset—the reactions differ across cycles.

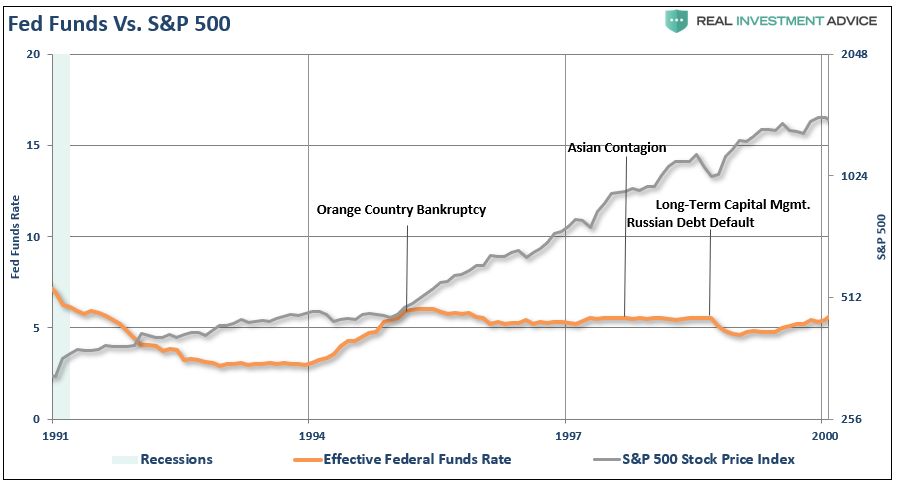

2.1 1995 – “Preventive” cuts, a soft landing

In 1995, under Alan Greenspan, the US economy was growing but slowing. Instead of waiting for a downturn, the Fed preemptively cut rates from 6% to 5.25% (75bps). This was not a rescue but a preventive move to sustain growth.

Result? US equities entered one of their strongest periods ever—Nasdaq rose 5x in the next five years. Lesson: When the Fed cuts while the economy is still strong, cheap money can spark massive bull runs. For crypto, this would be the dream scenario—ample liquidity without a crisis, risk capital flowing easily into digital assets.

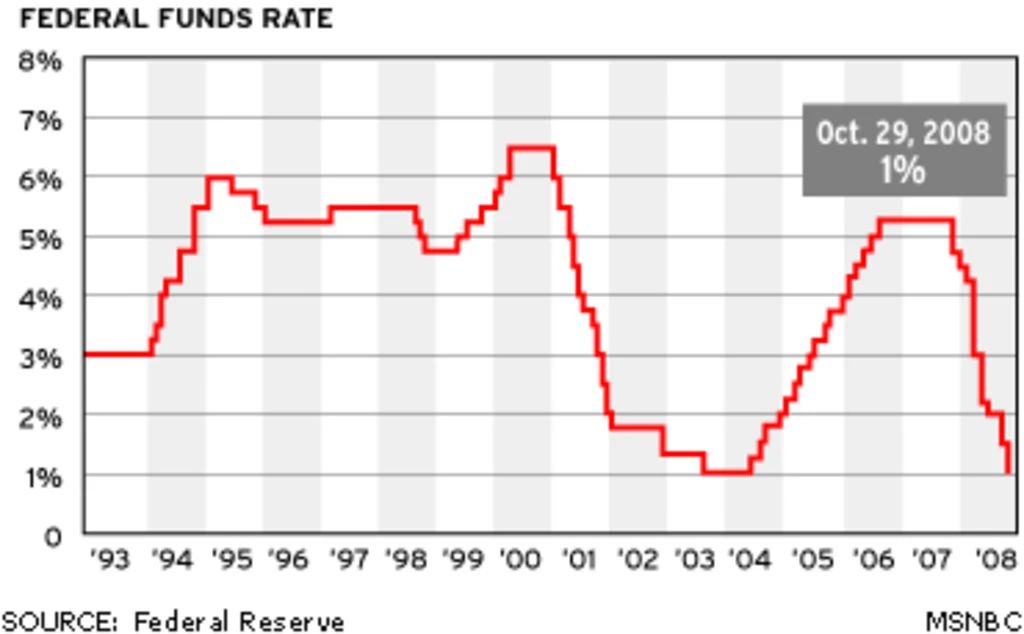

2.2. 2007–2008 – “Firefighting” cuts, but too late

In early 2007, the subprime bubble was brewing, but markets were euphoric with S&P 500 at record highs. The Fed began cutting in September 2007 (from 5.25%), but it was already a firefighting move. By 2008, Lehman collapsed, triggering a global financial crisis. The Fed slashed rates aggressively—from 5.25% to 0.25% in just 15 months (–500bps). But even historic cuts couldn’t prevent the worst recession since the Great Depression. For crypto, this kind of scenario usually means short-term pain: in a crisis, capital flees all risk assets. Only after massive QE injections did risk assets rebound.

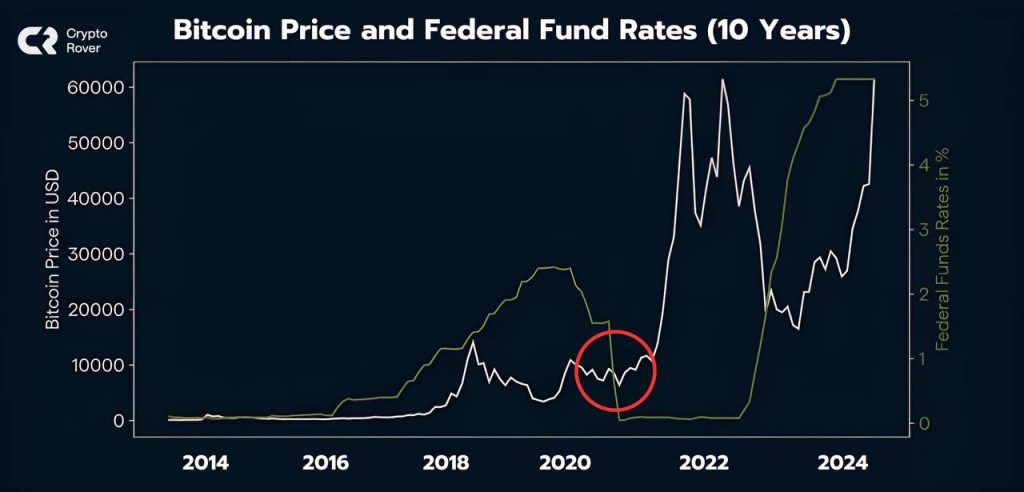

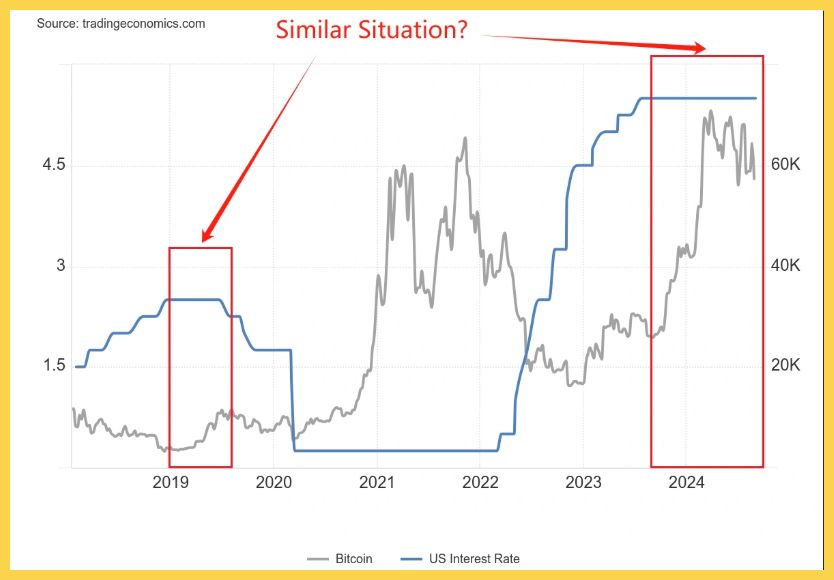

2.3. 2019–2020 – Two extremes: “new cycle” cuts vs. “panic” cuts

- 2019 – New cycle cuts: On July 31, 2019, after 10 years of unchanged policy, the Fed cut 25bps, eventually totaling 75bps. Bitcoin front-ran the news, rallying from $9k to $13k, but later cooled back to $7k by year-end. Stocks absorbed most of the liquidity (S&P 500 +10%), while crypto—just emerging from the 2018 bear market—lacked strong confidence. → A “new cycle” cut: modestly positive, but not enough to trigger a full bull run.

- 2020 – Panic cuts (COVID): When the pandemic hit, the Fed slashed rates from 1.75% to 0.25% in just 10 days, paired with unlimited QE. Initially, the liquidity shock wiped everything out—Bitcoin crashed from $8k to $3.8k in 24h (“Black Thursday”). But after $5T in stimulus, the tide turned: Bitcoin surged from $3.8k to $69k in 20 months (+17x). → A textbook “panic cut”: brutal short-term pain, but the biggest bull catalyst long-term.

2.4. 2025 – Will history rhyme?

As of September 2025, the Fed has cut 25bps, bringing rates to 4.00%–4.25%. Projections suggest more cuts ahead in October, potentially down to 3.50%–3.75% by year-end. That’s deeper than 2019’s cycle (–75bps), but not as extreme as 2020’s crash-to-zero.

The backdrop is unique: Bitcoin sits around $115k—much higher than 2019’s $7k or 2020’s $3.8k. Markets aren’t in despair needing a rescue, but they’re not in euphoric mania either. This sets up a “blended” scenario: cuts supportive but not explosive like 2020.

=> Historical parallels:

- 1995 – Preventive cuts → strong bull run, soft landing.

- 2007 – Firefighting cuts → collapse first, recovery later.

- 2019–2020 – New cycle & panic cuts → volatility, but a monster bull run thanks to QE.

The big 2025 question: Which path will the Fed take?

- If cuts remain mild like 1995 → crypto may benefit immediately.

- If conditions worsen → the Fed may be forced into firefighting or panic mode, potentially repeating 2020’s script: short-term pain, then explosive upside.

3.How will crypto react to the current Fed cuts?

As of September 2025, the Fed has started a new easing cycle. Bitcoin trades around $112k, in a “greedy” phase but not yet 2021-style mania.

The positives:

- Bitcoin ETFs are live, making institutional inflows as easy as buying equities.

- Economic data resembles 1995’s “perfect soft landing”: unemployment ~4.1%, GDP growth steady, inflation cooling from 9% peak to 3%.

- The Fed has room for another 100–150bps of cuts over the next 12–18 months.

History suggests the best part often comes later:

- 1995’s rally really took off after the last two cuts.

- 2020’s bull run started six months after the panic cuts. If similar, the next 6–12 months could be a golden window.

The risks:

- US equities are at record highs—a setup similar to 2007, which ended poorly. When stocks front-run rate cuts, it often signals they’ve gone too far.

- US government debt is 123% of GDP—double 2007—leaving little fiscal room for future stimulus.

- Institutions are also savvier now, less likely to FOMO blindly.

So, the next 6–12 months may be the most exciting phase of the cycle—but history only rhymes, it doesn’t repeat. 2025 brings unique factors—from AI to massive debt to geopolitical and trade complexities—that no past cycle can fully map out.

4.Strategies for crypto investors/traders during Fed cuts

4.1. By investment horizon

- Long-term investors (months/years): Focus on foundational coins with sustainable growth, not just pump/dump narratives. Prioritize projects with real-world adoption and growing ecosystems—since post-rate-cut liquidity prefers risk assets but still needs “credible stories.”

- Short-term traders: Target volatility around FOMC announcements—often sharp pump/dump moves on release. Suitable for swing trades or breakout setups around key support/resistance.

4.2. Risk & leverage management

- Avoid high leverage: News-driven whipsaws can trigger instant liquidations. Lower leverage = survival.

- Diversify:

4.3. Track Fed & macro signals

- FOMC meetings, minutes, speeches: Often the Fed’s “tone” (hawkish vs. dovish) matters more than the cut itself.

- Key economic indicators:

- CPI, PPI → inflation trends.

- GDP, employment → economic health.

- Credit & consumption → drivers of future rate decisions.

- Bond market: An inverted yield curve or surging long yields can drain flows from crypto—even during cuts.

4.4. Patience & expectation management

- Don’t expect “rate cuts = instant pump.” Often, the first reaction is chaotic—or even bearish.

- Follow step-by-step signals:

- If trend is clear after 1–2 weeks, scale positions.

- If weak, take short-term profits, preserve capital, and wait.

- Long-term mindset: Crypto is cyclical. Fed cuts are catalysts—not structural game-changers.

5.Conclusion

Fed rate cuts generally create conditions for risk capital to flow into crypto, but opportunity always comes with risk. Long-term investors should focus on fundamentals and adoption trends, while short-term traders can exploit volatility around FOMC events. Regardless of strategy, risk management and patience remain the keys to maximizing returns in an ever-changing macro landscape.

Disclaimer: This content does not constitute investment, tax, legal, financial, or accounting advice. MEXC provides this information for educational purposes only. Always DYOR, understand the risks, and invest responsibly.

Join MEXC and Get up to $10,000 Bonus!