Summary: This article explains the basics of META stock (Meta Platforms, Inc.—Facebook’s parent company), its business and valuation drivers, and how to trade META-related contracts within MEXC’s US Stock Futures offering. It covers an introduction, key concepts, platform selection and onboarding, trading steps, risks and fees, and an FAQ to help both beginners and advanced traders. Educational content only, not investment advice.

TL;DR

- Meta Platforms, Inc. (NASDAQ: META)—parent company of Facebook, Instagram, and WhatsApp—is a major AI-driven social media and advertising giant. Its stock is highly volatile due to ad cycles, AI investment, and metaverse spending.

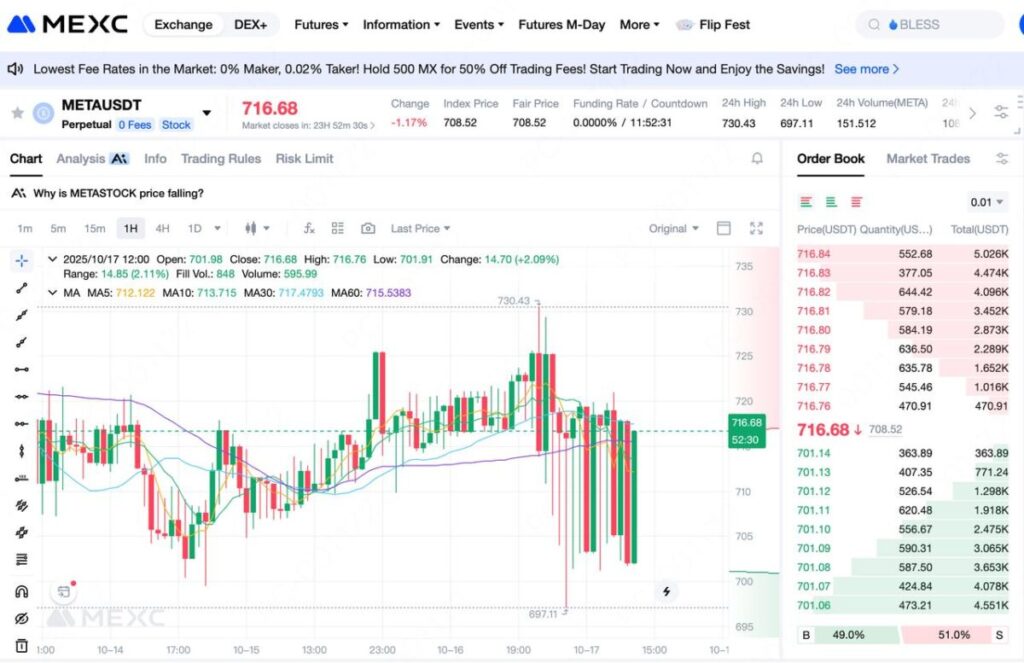

- MEXC periodically lists crypto-based “US Stock Futures” contracts linked to U.S. equities like META, allowing users to go long or short with leverage using USDT as margin.

- Users must complete KYC, fund their futures account, find the META contract (if listed), choose margin and leverage settings, and manage trades with stop-loss/take-profit controls.

- META-related futures differ from traditional equity products—expect leverage risks, tracking error, liquidity gaps, and funding payments. Always review contract specs and local compliance.

- META’s value hinges on ad revenue, AI efficiency, and regulatory factors. MEXC’s META-linked contracts (if available) offer flexible exposure but require disciplined risk management.

1.Introduction

Meta Platforms, Inc. (NASDAQ: META) is a global internet and social media giant operating Facebook, Instagram, WhatsApp, and Messenger, with heavy investment in AI and the metaverse (Reality Labs). As profitability improves and AI-powered ad engines strengthen, META’s share price remains highly volatile and closely watched. Many investors want to trade META more flexibly via derivatives in the crypto ecosystem. MEXC, a well-known digital asset exchange, offers diversified derivatives, including “US Stock Futures,” and at times lists contracts linked to US equities, covering popular tech names.

This article outlines META’s core information and uses MEXC as an example to illustrate the general process and considerations for participating in META-related US stock futures (if listed).

2.What Is META Stock?

- Full company name: Meta Platforms, Inc.

- Exchange and ticker: NASDAQ: META

- Business segments:

- Advertising: Monetized ads on Facebook and Instagram are the primary revenue and profit drivers.

- Social and messaging: Facebook, Instagram, WhatsApp, and Messenger form a massive user ecosystem.

- Metaverse and hardware: Reality Labs (Quest, AR/VR/MR devices) and related software platforms.

- AI investment: Ongoing spend on ad optimization, content recommendation, generative AI tools, and model infrastructure.

- Investor focus points:

- Impact of ad cycles and macro conditions on revenue.

- User growth and ARPU trends.

- AI-driven ad efficacy gains and cost optimization.

- Reality Labs investment intensity and loss-narrowing timeline.

- Regulation and privacy compliance (e.g., Apple privacy policies, antitrust scrutiny).

Note: Share prices are affected by earnings, interest rates, regulation, and competition—volatility can be significant.

3.Overview of “US Stock Futures/Contracts” on MEXC

- Product format: MEXC periodically lists US Stock Futures/contracts tied to US equity underlyings, typically USDT-margined, supporting long/short trades with leverage.

- Contract types:

- Perpetual: No fixed expiry; uses funding rates to anchor prices.

- Delivery/Quarterly: With set expiry and settlement dates (if offered).

- Underlying and price reference: Contract prices generally track the corresponding equity spot or an index-based reference; see MEXC’s published index and mark price rules.

- Funding and depth: Volatility clusters around US market hours; monitor liquidity and funding announcements.

- Eligibility and compliance: Availability varies by region and time. Refer to the live product page in MEXC’s web/app.

Important: MEXC’s “US Stock Futures/contracts” differ from regulated CME futures or broker-dealer margin products offering direct US equity exposure. They are platform-provided crypto derivatives. Read risk disclosures and contract specs before trading.

4.How to Trade META-Related US Stock Futures on MEXC

The following is a general workflow; always follow the live MEXC interface:

4.1 Account setup

- Register and complete KYC per your jurisdiction.

- Deposit and transfer assets: Fund USDT or other stablecoins, then move to your futures account.

- Enable derivatives: Read and accept risk disclosures to unlock contract trading.

4.2 Find the instrument

- In Derivatives/Futures, search “META” or browse “US Stock Futures.”

- If listed, enter the META-related contract page (e.g., “META/USDT Perpetual” or “US Stock: META”).

- If not listed, monitor announcements or consider other listed US equity contracts.

4.3 Margin and leverage

- Margin mode: Isolated or cross.

- Leverage: Choose conservatively; high leverage is not recommended for beginners.

4.4 Order placement and position management

- Order types: Limit, market, and conditional (TP/SL).

- Direction: Long for bullish, short for bearish.

- Risk controls: Set stop-loss and scale-out targets on entry; use conditional orders to reduce emotional trading.

4.5 Funding and costs

- Perpetuals have periodic funding payments; note intervals and rates.

- Trading fees: Maker/taker differ; check VIP tiers or promos.

- Other costs: Slippage, liquidation penalties, and rebalancing between positions.

4.6 Trading hours and volatility

- Volatility concentrates around the US market open (typically 9:30 ET) and earnings windows.

- Around major events (earnings, policy, macro data) spreads and swings may widen—reduce leverage accordingly.

4.7 Exit and settlement

- Closing: Manually close or use TP/SL triggers.

- Fund management: Withdraw profits or transfer back to spot to keep risk in check.

5.Risk Warnings and Compliance Notes

- Leverage risk: Sharp moves can trigger rapid liquidations.

- Tracking error: Contract prices may deviate from US equity spot, leading to basis and short-term dislocations.

- Liquidity and slippage: Can be pronounced in extreme markets or off-peak hours.

- Platform and regional limits: Some regions cannot access US-equity-related contracts; follow local laws.

- Information asymmetry: Earnings, policy, and industry news can have outsized impacts; follow official and trusted sources.

Disclaimer: This article is not investment or legal advice. Do your own research and assess risks before trading.

6.Key Watchpoints for Investing and Trading META

- Earnings cadence: Revenue, net margin, ad ARPU, active users, and Reality Labs losses.

- Capex and AI: Datacenters, GPU capacity, and model R&D as medium/long-term moats.

- Regulatory dynamics: Privacy, antitrust, and content compliance.

- Peer comps: Competitive landscape and ad share shifts vs. GOOGL, AMZN, SNAP, and TikTok ecosystem.

7.Frequently Asked Questions (FAQ)

Q1: Are META stock and MEXC’s “META contracts” the same thing?

A: No. META stock is the actual equity of Meta Platforms listed on Nasdaq. MEXC’s “META contract” (if available) is a platform-issued crypto derivative, usually USDT-settled, that does not confer equity rights, dividends, or voting.

Q2: How can I confirm whether MEXC has listed META-related US stock futures?

A: In MEXC’s web/app Derivatives section, search “META” or “US Stock Futures,” and check the live tradable instruments and announcements.

Q3: How much capital is needed to trade META-related contracts?

A: It depends on contract size, leverage, and margin mode. Size positions according to your risk tolerance, and keep a margin buffer to avoid liquidation.

Q4: What is the funding rate in perpetual futures? A: It’s a periodic payment exchanged between longs and shorts to keep the contract price anchored to the index. See the platform for real-time rates and intervals.

Q5: Can I receive dividends or shareholder rights on MEXC?

A: No. Derivatives do not grant dividends or governance rights; PnL comes solely from price movements.

Q6: How should beginners control risk?

A: Start with low leverage and small sizes; set stop-losses and scale-out targets; avoid oversized positions around major data and earnings; review your strategy execution regularly.

Q7: How are MEXC’s fees calculated?

A: Fees include maker/taker trading fees, funding payments on perpetuals, potential liquidation fees, and slippage costs. Refer to the fee schedule or instrument details.

8.Conclusion

As a top global internet company, META’s price action is driven by AI and the ad cycle—opportunities come with volatility. MEXC’s US Stock Futures (if a META-linked contract is listed) allow flexible long/short exposure and hedging. But derivatives carry leverage and basis risks. Participate cautiously, fully understand the rules, and ensure they fit your risk tolerance.

Join MEXC and Get up to $10,000 Bonus!