In recent times, the concept of BuyBack and Burn (BnB) has become increasingly familiar to crypto investors, as tokens adopting this mechanism often experience strong growth. This article breaks down the mechanism and evaluates its effectiveness.

1.What is BuyBackandBurn?

At its core, BuyBack and Burn (BnB) means a project buys back its own tokens from the market and then permanently destroys them by sending them to “dead” wallets.

Projects usually fund this mechanism by allocating a portion of revenue or treasury reserves.

This isn’t a new invention—it’s an adaptation of traditional financial strategies.

- Buyback increases token liquidity and market activity.

- Burning helps control token supply, limit inflation from airdrops or unlocks, and creates a sense of safety for holders.

There are generally two types of BnB models:

- Buyback & Hold: Projects repurchase tokens and hold them for future use (e.g., grants, expenses, airdrops). This does not reduce long-term supply since the tokens may re-enter circulation.

- Buyback & Burn: Tokens are permanently destroyed, reducing total supply and creating scarcity—potentially pushing prices up if demand remains stable.

Examples:

- $BNB, $OKX, $MX — All have implemented BnB successfully, driving steady token growth.

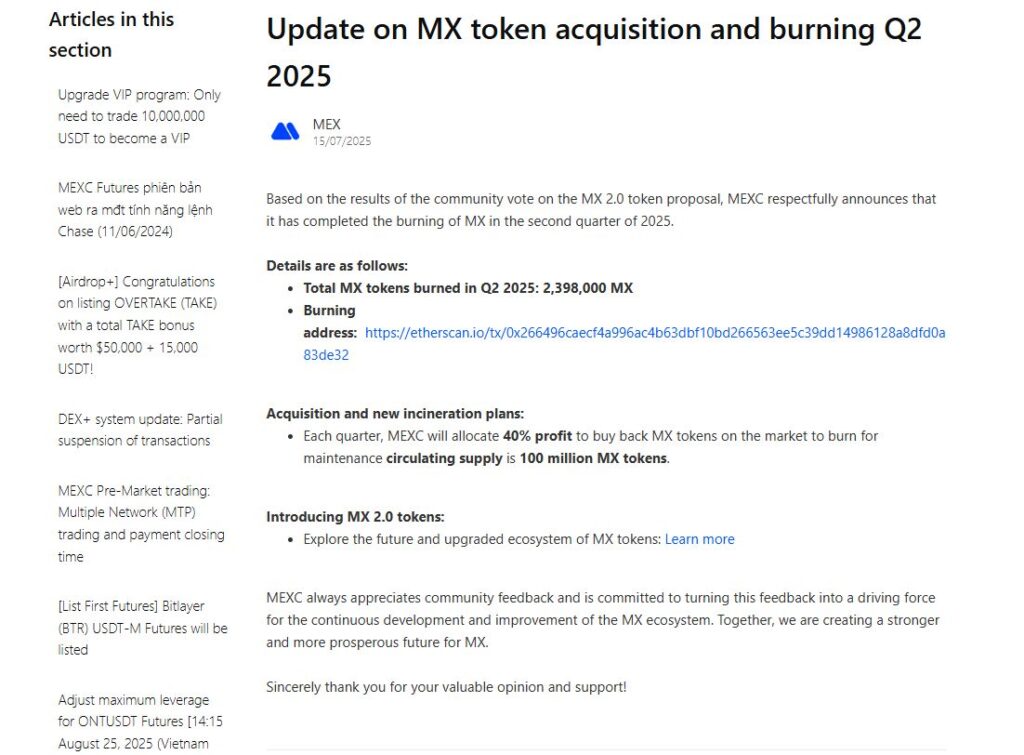

- MEXC allocates 40% of quarterly profits to buy back and burn $MX, keeping circulating supply capped at 100M tokens.

2.Does Buyback&Burn Really Help Token Price Increase?

Buybacks don’t always guarantee token price appreciation — it all comes down to the quality of cash flow behind them.

If a project generates real revenue and consistently uses profits to buy back and burn tokens (like $BNB or $MX), reducing circulating supply creates genuine scarcity pressure, supporting long-term value.

But if buybacks are just a short-term gimmick (funded by reserves or unstable inflows), any price boost tends to be temporary and fades quickly.

In reality, buybacks are only a tool. Whether a token’s price increases depends on three factors:

- The strength of the underlying business model,

- Market confidence,

- Actual demand for the token.

3.Case Studies

3.1 Success

Hyperliquid ($HYPE)

- Allocates 50–100% of trading fees (≈$600M/year) for buybacks.

- Unlike automatic systems, the team manually times buybacks to avoid buying at market tops.

- Result: $HYPE surged 300% in 2024, showcasing flexibility and strong market awareness.

MEXC Exchange ($MX)

- Through the MX Token 2.0 proposal, MEXC commits 40% of profits for quarterly buybacks and burns, maintaining a fixed supply of 100M $MX.

- Outcome: $MX price has remained on an upward trend, resilient even during bear markets.

3.2 Failures

Messari data highlights several failed cases:

- $RAY: Spent $175.8M on buybacks → Now worth $118.8M (−32%).

- $GMX: Spent $12.42M → Now $7.5M (−39%).

- $GNS: Spent $7.9M → Now $4.6M (−41%).

- $SNX: Worst case — Spent $562K → Now $234K (−58%).

3.3 Why did they fail?

- Automatic buybacks executed during revenue peaks (usually when token prices were high).

- When markets reversed, projects held overpriced bags.

- Buybacks represented only a small fraction of overall token value, so the effect was negligible.

4.Key Factors for Effective BuyBack and Burn

From both successful and failed cases, here’s what separates winners from losers:

4.1 Real Growth Fundamentals

- Success: $BNB and $MX grew because exchanges have sticky user bases and rising revenue. $HYPE boomed with the perpetual futures trend.

- Failure: GMX and SNX had weak revenue, poor narratives, and buybacks only amplified losses.

- Always check if the project has real revenue, active users, and solid demand drivers.

4.2 Smart Buybacks (Not Automated)

- Failures: $RAY and $GMX bought automatically at high prices.

- Success: $HYPE let the team decide timing, resulting in +300%.

- $MX burns from exchange profits; MakerDAO only buys back when surplus revenue is available → $MKR rose 29%.

4.3 Team & Community Trust

- Strong teams and supportive communities = positive signal (e.g., $BNB, $MX).

- Shady teams or skeptical communities → often just pump-and-dump tactics.

- Always gauge market sentiment (Crypto Twitter/X is useful for this).

4.4 Smart Value Distribution

Not every buyback must end in burns. Some projects innovate:

- veAERO, BananaGun buy stables/ETH with revenue and distribute to holders → more sustainable.

- PancakeSwap burned 7M CAKE ($15M) in 2023, yet price still fell due to weak revenue.

Bottom line: Sustainable growth, smart buybacks, trustworthy teams, and fair value distribution matter far more than flashy burn announcements.

5.Conclusion

While BuyBack and Burn can reduce supply and generate short-term hype, it is not a guaranteed strategy for long-term value creation. Investors should look beyond headlines and evaluate whether a project has real fundamentals before getting excited by a “burn” announcement.

Disclaimer:This content is for informational purposes only and does not constitute investment, tax, legal, financial, or accounting advice. It should not be taken as a recommendation to buy, sell, or hold any asset. MEXC provides information solely for reference and is not responsible for any investment decisions made by users. Please ensure you fully understand the risks involved before investing.

Join MEXC and Get up to $10,000 Bonus!