Since the start of Q3 2025, the crypto market has experienced a historic rally. Both $BTC and $ETH have reached new all-time highs, but the spotlight clearly falls on $ETH, driving growth across projects that stand to benefit from its surge.

1.Why Has Ethereum Outperformed the Market Recently?

- Spot ETH ETFs: The primary catalyst has been institutional adoption via Spot ETH ETFs. Major financial players have been accumulating $ETH at scale, sometimes trading volumes surpassing $BTC. Notably, top investment firms like BlackRock reportedly sold part of their $BTC holdings to buy $ETH.

- DeFi & RWAs: Ethereum remains the dominant chain for DeFi and Real-World Assets (RWAs). Total DeFi TVL across chains sits at $161B, with Ethereum maintaining ~60% market share. RWAs integrate easily thanks to robust DeFi liquidity and are preferred by institutional issuers (BlackRock, Franklin Templeton), while ETH staking secures these multi-billion-dollar assets, positioning Ethereum as a safe settlement layer.

- ETH Staking: Staking continues to reduce circulating supply, supporting price. ETH staking has reached a record high of ~35.7M $ETH, roughly 30% of total supply.

- Layer 2 & Rollups: Active L2 networks like Base, Arbitrum, and Optimism contribute to ETH demand, as growing user activity and DeFi adoption push transactions off-chain.

2.Projects Indirectly Benefiting from Ethereum’s Rally

2.1 Liquid Staking & LSDfi

Catalyst: Rising $ETH prices drive staking activity. As more ETH is staked, demand for Liquid Staking Derivatives (LSDs) explodes, fueling growth in LSD-focused DeFi (LSDfi).

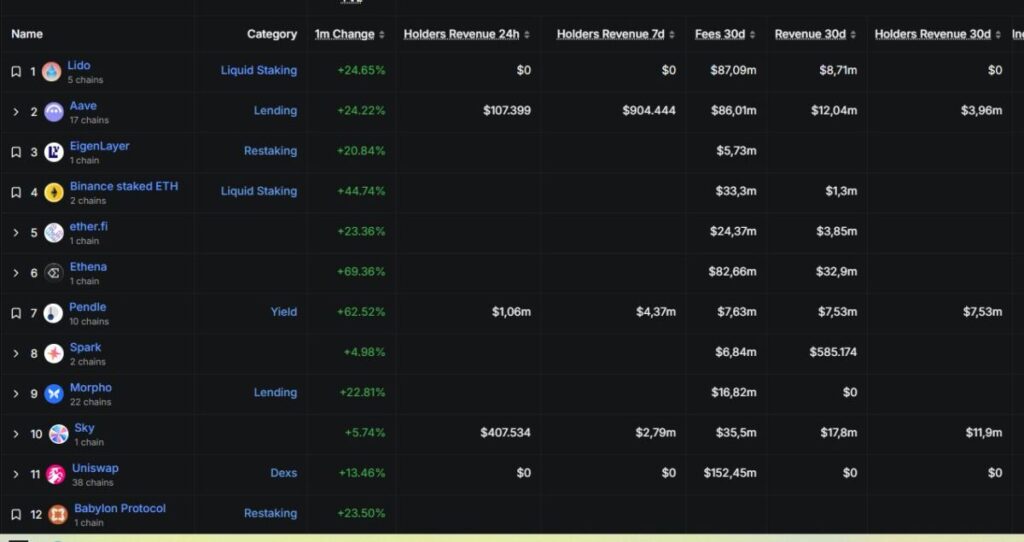

Key Projects:

- $LDO (Lido Finance): The LSD king, controlling >30% of staked ETH. Higher staking demand, especially fueled by Spot ETH ETFs, translates directly into protocol revenue. More staked ETH = higher fees captured.

- $RPL (Rocket Pool): A decentralized staking alternative. Amid concerns over Lido’s centralization, Rocket Pool attracts capital seeking true decentralization, even if on a smaller scale.

- $FXS (Frax Finance): Offers frxETH, a fast-growing LSD product. The LSD + stablecoin combo lets Frax capture staking yield while maintaining a stablecoin narrative in DeFi.

2.2 Layer-2 Scaling (Rollups)

Catalyst: ETH price surges → on-chain gas fees rise → users and developers migrate to L2s. L2s become growth proxies for the Ethereum ecosystem.

Key Projects:

- $ARB (Arbitrum): The largest L2 by TVL with a vibrant DeFi ecosystem. A testbed for new models and concentrated liquidity.

- $OP (Optimism): Backbone for Basechain (Coinbase’s L2), the largest onramp. Narrative: Superchain connecting multiple rollups. Favored by major projects like Worldcoin and Friend.tech.

- $MNT (Mantle): Strong backing from Bybit/BitDAO. Modular design (EigenDA) offers significant room for expansion. Positioned for the modular + L2 bull run narrative.

2.3 DeFi

Catalyst: ETH inflows into L1/L2 increase stablecoin demand, which serves as a liquidity gateway. RWAs provide real on-chain yield, and traders use derivatives for hedging/speculation, directly benefiting stablecoin and derivatives protocols in the DeFi revival.

Key Projects:

- $ENA (Ethena Protocol): Provides USDe (synthetic dollar) and yield-bearing sUSDe. Dubbed the “new MakerDAO.” Advantages: fiat-free, high yield attracting degens. Risk: delta-hedge dependent, reminiscent of LUNA-UST fragility.

- GMX: Largest perpetuals DEX on Arbitrum/Avalanche. Rising trader activity boosts volume, fees, and GLP/GM pool yields—a prime proxy for the on-chain perps revival.

- $AAVE: Top lending protocol, expanding with GHO stablecoin. Borrow/lend revenue rises as DeFi volumes recover. A blue-chip staple for many institutional portfolios.

2.4 Infrastructure / Restaking / Oracles

Catalyst: Ethereum scaling drives demand for oracle services, security, and restaking to ensure robust operations. These protocols form the ecosystem’s backbone, benefiting directly as ETH and L2s grow.

Key Projects:

- $LINK (Chainlink): Leading oracle infrastructure, providing off-chain data for most DeFi protocols. As RWAs grow, demand for off-chain data (T-bills, FX, commodities) rises, making Chainlink indispensable.

- $EIGEN (EigenLayer): The hottest narrative post-LSD, turning ETH restaking into a shared security layer for L2s, oracles, bridges, and DA. Potential to become a “second Lido” in security, as all services require it.

- $GRT (The Graph): Indexing and query layer for on-chain data. More on-chain apps (DeFi, SocialFi, GameFi) → higher indexing demand → The Graph becomes the “Google of blockchain.”

3.Conclusion

Ethereum’s recent growth is driven largely by institutional capital through ETFs and crypto-focused investment vehicles. Ecosystem projects have yet to fully mirror ETH’s surge, but sooner or later, these protocols are poised for explosive growth.

Disclaimer: This content does not provide investment, tax, legal, financial, or accounting advice. MEXC Learn shares information purely for educational purposes. Always DYOR, understand the risks, and invest responsibly.

Join MEXC and Get up to $10,000 Bonus!

Sign Up