Key Takeaways

- Non-custodial cross-chain:Portal adopts atomic swaps without centralized bridging or custodians.

- BitScaler Technology:Supports multi-party channels and Taproot scripts to improve transaction efficiency and reduce costs.

- Token Economic Model:Total supply of 8.4 billion PTB, with a deflationary mechanism and staking incentives running in parallel.

- Ecosystem Modules:Includes Liquidity Router, Swap SDK, Portal Wallet, RAFA AI investment assistant.

- Application Scenarios:Cross-chain DeFi, DEX/CEX smart routing, developer tools, AI-driven investment.

- What is Portal To Bitcoin (PTB)?

Portal To Bitcoin is adecentralized cross-chain infrastructure based on the Bitcoin networkthat aims to expand Bitcoin from ‘digital gold’ to aprogrammableDeFisettlement layer. It achieves non-custodial atomic swaps with multiple chains like Ethereum and Solana through self-developed BitScaler technology, completely eliminating the security risks associated with traditional cross-chain bridges.

The core concept of Portal isuser funds are never entrusted to third parties, every cross-chain operation is a peer-to-peer, verifiable on-chain contract execution.

- The technical highlights and underlying logic of Portal

- BitScaler and PortalOS

- BitScaler:The pioneering permissionless atomic contract channel system that does not rely on new Bitcoin opcodes or centralized trusted parties.

- PortalOS:A modular operating layer that supports Bitcoin mainnet, Lightning Network (LN) and various Layer-2 access, inherently free from bridging risks.

- Core Functional Modules

- Liquidity Router:A non-bridging asset routing center for efficient liquidity distribution.

- Swap SDK:A cross-chain liquidity access toolkit for developers.

- Portal Wallet:A multi-currency cross-chain wallet with built-in DEX trading capabilities.

- RAFA AI:A generative AI investment assistant that intelligently optimizes trading and asset allocation.

- Security and Architecture

Adoptsa Hub-and-Spoke verifier network与 Portal Attestation Chain (PAC)to ensure that cross-chain transactions are verifiable and traceable.

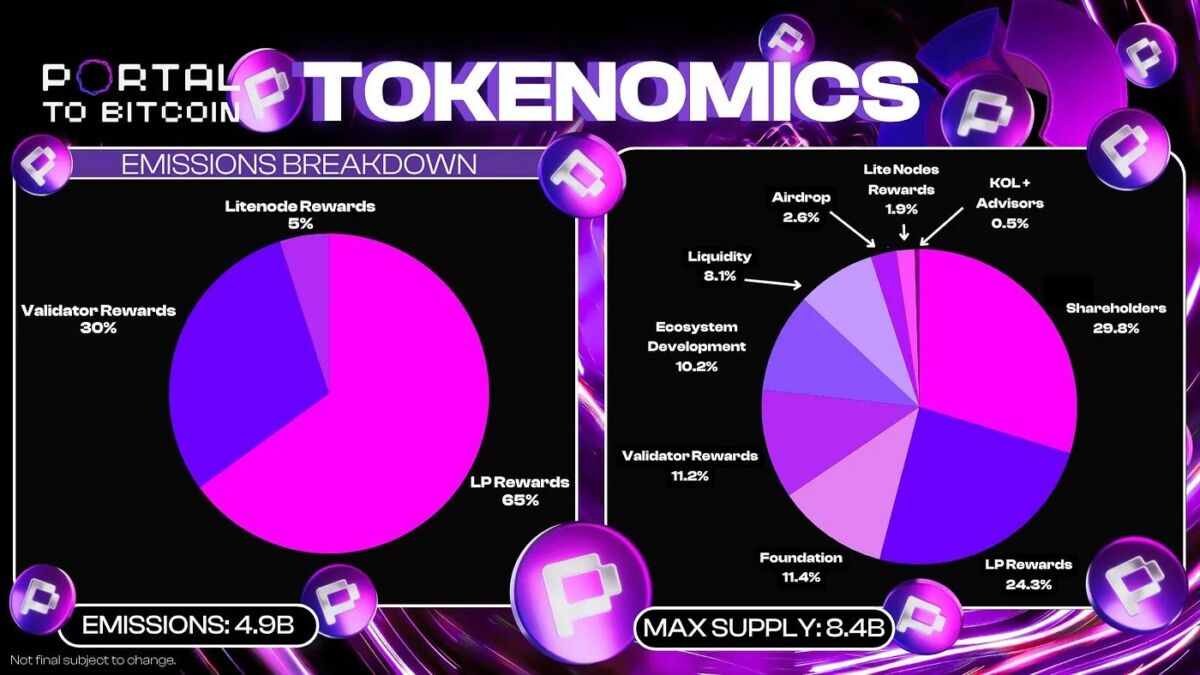

- The token economics of PTB

- Token Roles

- Validator Staking:Compete for 42 monthly validator node positions to earn transaction fees and block rewards.

- Lite Node Incentives:Provides additional network security, receiving PTB rewards.

- Liquidity Provider (LP) Dividends:Earn 100% native asset transaction fees + 66% PTB token issuance rewards.

- Deflationary and Issuance Mechanism

- Total Supply:8.4 billion PTB.

- Issuance:Based on the Bitcoin halving model, decreasing periodically.

- Deflation:A 0.3% protocol fee is charged on each Swap, of which 50% is used for repurchasing and destroying PTB.

- Distribution andLock-up

Detailed Distribution Plan

| Distribution Categories | Proportion | Unlocking Mechanism | Strategic Significance |

| Shareholder Distribution | 29.80% | 12 months lock-up + 36 months linear unlocking | Ensures long-term commitment from early supporters |

| Foundation Treasury | 11.40% | 1 month lock-up + 60 months linear unlocking | Supports long-term strategic execution |

| Ecosystem Development | 10.20% | 6 months lock-up + 48 months linear unlocking | Drives ecosystem growth |

| Liquidity Supply | 8.10% | 6 months linear unlocking | Ensures healthy trading conditions |

| Airdrop Rewards | 2.60% | TGE 33% + 33% after 3/6 months each | Rewards loyal community members |

| Release Plan | 37.40% | 10 years of continuous release | Network Incentive Core |

Monthly release allocation (26.18 million $PTB)

- 65% allocated to liquidity providers

- 30% allocated to validators

- 5% allocated to lite nodes

- Application Scenarios of Portal To Bitcoin

- Cross-chain DeFi

Supports real-time cross-chain asset exchange without trusting third parties or minting pegged assets (such asWBTC).

- Smart Liquidity Routing

Uses AI algorithms to find the optimal price and lowest slippage path betweenDEX/CEX.

- Developer Ecosystem

The Swap SDK and PortalOS modular support provide a secure and scalable cross-chain solution for DApp developers.

- AI investment advisory and asset management

RAFA AIHelping users make data-driven investment decisions and asset rebalancing.

- Market prospects and investment value

Portal has attracted on the testnet over 1 million wallet downloads, and has established partnerships with over 80% of Bitcoin Layer-2 projects. As the demand for decentralized cross-chain solutions grows, Portal has the potential to becomethe core infrastructure of Bitcoin DeFi。

- Conclusion: Infrastructure leading a new era of Bitcoin finance

Portal to Bitcoin is more than just another cross-chain protocol; it represents the next evolutionary step for Bitcoin in the broader cryptocurrency ecosystem. By addressing the fundamental challenges of Bitcoin interoperability without compromising on security or decentralization, Portal creates the infrastructure necessary for Bitcoin to realize its potential as a global settlement layer.

The launch of Portal marks the beginning of a new architecture for Bitcoin finance, with its carefully designed tokenomics, innovative technical architecture, and strong institutional support, enabling Portal to capture significant value as the Bitcoin ecosystem continues to mature and expand.

For investors and users looking to engage with Bitcoin’s growth, moving beyond simple price appreciation, Portal offers an attractive opportunity to participate in building the infrastructure that will drive Bitcoin’s integration with the broader DeFi ecosystem.

As the protocol launches and begins processing real cross-chain transaction volumes, the built-in deflationary mechanism of the $PTB token is designed to capture this value and redistribute it to network participants. This utility-driven tokenomics approach, combined with Portal’s unique technical capabilities, provides the project with sustainable long-term growth potential in the rapidly evolving cross-chain infrastructure space.

Frequently Asked Questions (FAQ)

How is Portal different from other cross-chain protocols?

Portal is the only custodial-free cross-chain protocol focused on Bitcoin, enabling true trustless exchanges through BitScaler technology, while other protocols typically require wrapped assets or centralized bridging.

What is the main use case for the $PTB token?

$PTB is used for validator staking, network governance, paying transaction fees, and capturing protocol value through a buyback and burn mechanism.

How can I participate in the Portal ecosystem?

Users can participate by becoming validators, light nodes, or liquidity providers, each with their corresponding $PTB rewards mechanism.

How is the security of Portal ensured?

Security is ensured through a custodial-free design, atomic swap mechanisms, multi-party verification, and comprehensive security audits to guarantee the safety of funds.

Recommended reading:

Best exchanges to buy and sell Bitcoin (BTC) in 2025

What is Ethereum, and how does it work? A complete guide to ETH prices and investments

Disclaimer: This material does not provide advice regarding investment, tax, legal, financial, accounting, consulting, or any other related services, nor is it an endorsement of the purchase, sale, or holding of any assets. The MEXC Newbie Academy provides information for reference only and does not constitute any investment advice. Please make sure to understand the risks involved and invest cautiously. Users’ investment activities are not related to this site.

Join MEXC and Get up to $10,000 Bonus!

Sign Up